Are you ready to dive into the world of market sentiment analysis? In this ultimate guide, we will explore the definition, types, indicators, and trading strategies that revolve around Market Sentiment. Understanding how economic factors, political events, and psychological biases influence Market Sentiment is crucial for making informed investment decisions. Let’s unravel the intricate web of market dynamics and learn how to leverage sentiment analysis for strategic investment moves.

Navigating Market Sentiment Analysis: Deciphering Trends and Signals

Understanding Market Sentiment: A Comprehensive Guide

Market sentiment refers to the overall emotional tone or attitude of market participants towards a particular asset or the market as a whole. It plays a pivotal role in shaping market trends and affecting investment decisions, showcasing the collective mood and beliefs of investors and traders.

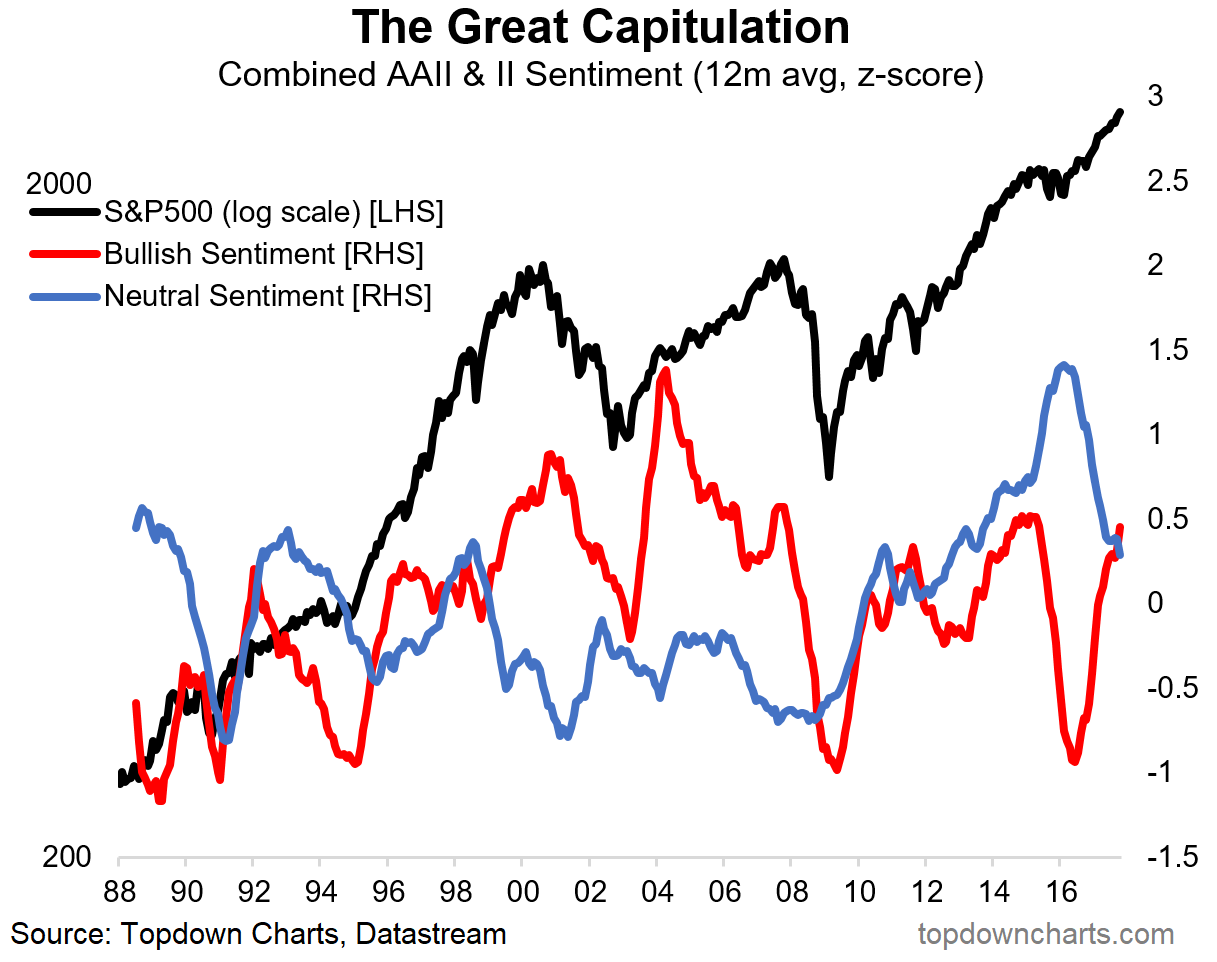

In the realm of market sentiment, there are two main types: bullish sentiment, characterized by optimism and confidence leading to rising asset prices, and bearish sentiment, marked by pessimism and fear resulting in falling prices. Understanding these sentiments enables investors to anticipate market movements and adjust their strategies accordingly.

To assess market sentiment accurately, investors rely on various indicators and tools such as investor surveys, social media sentiment analysis, volume analysis, volatility measures, and put/call ratios. These tools help in gauging the prevailing sentiment and market mood, aiding in making well-informed investment decisions.

While market sentiment analysis provides valuable insights, it also comes with challenges and limitations. Relying solely on sentiment can lead to herd mentality, false signals, and inaccuracies. It’s essential to complement sentiment analysis with fundamental and technical analysis for a comprehensive investment approach, mitigating the risks associated with sentiment-driven decisions.

Understanding Bullish and Bearish Market Sentiment

Characteristics of Bullish Market Sentiment

Bullish market sentiment reflects optimism and confidence among investors, leading to rising asset prices. Key indicators include increasing stock prices, high trading volumes, and positive economic news. Investor sentiment surveys, such as the Investors Intelligence Index, can also signal bullish trends. However, excessive bullishness may indicate market overheating.

Signs and Risks of Bearish Market Sentiment

Bearish sentiment signifies pessimism and fear, resulting in falling prices and a general negative outlook. Signs include declining stock values, rising volatility, and negative economic reports. Bear markets can pose risks like prolonged downturns, increased selling pressure, and potential capital erosion if not managed carefully.

Investment Strategies for Different Sentiments

During bullish periods, investors may focus on growth stocks, momentum trading, and expanding their portfolio. Contrarily, in bearish markets, strategies like short selling, defensive stock investments, and diversification can help mitigate losses. Adapting to changing sentiment is essential for long-term investment success.

Historical Examples of Extreme Market Sentiment

Historical instances of extreme sentiment include the Dotcom Bubble of the early 2000s, characterized by widespread euphoria and overvaluation of tech stocks, leading to a subsequent crash. The 2008 financial crisis showcased intense bearish sentiment with widespread panic selling and a significant market downturn. Learning from such events helps in navigating volatile market sentiment.

Factors Influencing Market Sentiment

Economic Factors: The market sentiment analysis is significantly impacted by economic variables such as GDP growth, inflation rates, and interest rates. For instance, a robust GDP growth typically boosts investor confidence, leading to bullish sentiment. Conversely, rising inflation or interest rates may trigger bearish sentiment as investors fear economic slowdown.

Political Events and Geopolitical Uncertainty: Political events and geopolitical tensions have a profound influence on market sentiment. Uncertainty stemming from elections, trade wars, or diplomatic conflicts can lead to volatility and bearish sentiment. Investors closely monitor political developments to assess the associated risks and adjust their investment strategies accordingly.

Social Media and News Headlines: In today’s digital age, social media platforms and news headlines play a pivotal role in shaping market sentiment. Trending topics, rumors, and breaking news can quickly sway investor sentiment, leading to rapid market reactions. Traders keen on market sentiment analysis need to stay vigilant and discern the credibility of information sources to make informed decisions.

Psychological and Behavioral Biases of Investors: Market sentiment is heavily influenced by psychological factors and behavioral biases exhibited by investors. Concepts like herd mentality, fear of missing out (FOMO), and confirmation bias can amplify market sentiment swings. Understanding these tendencies is crucial for investors to avoid making emotional decisions and instead rely on data-driven analysis for sound investment choices.

Incorporating these diverse influences into market sentiment analysis enables investors to navigate volatile markets with more confidence and informed decision-making. By staying attuned to economic indicators, political landscapes, media trends, and investor behaviors, individuals can better interpret market sentiment and adjust their investment strategies accordingly for optimal returns.

Techniques for Market Sentiment Analysis

Technical Analysis:

Technical analysis involves studying historical price charts and using various technical indicators to predict future price movements. By analyzing patterns and trends in market data, investors can gauge the sentiment of market participants towards a particular asset or market as a whole. This technique helps traders make informed decisions based on price movements and chart patterns.

Fundamental Analysis:

Fundamental analysis focuses on evaluating financial statements, economic indicators, and external factors that could impact an asset’s value. By examining factors like earnings reports, economic growth, and industry trends, investors can assess the intrinsic value of an asset. This analysis helps in understanding market sentiment by looking beyond price fluctuations to the underlying financial health of a security.

Sentiment Analysis Tools:

Sentiment analysis tools utilize advanced algorithms to monitor social media platforms, news articles, and other sources for mentions, sentiments, and trends related to specific assets or markets. By analyzing the collective sentiment of market participants expressed through these channels, investors can gauge the overall market sentiment and make well-informed decisions based on the prevailing mood in the market.

Combining Different Techniques:

To gain a comprehensive understanding of market sentiment, investors often combine multiple analysis techniques. By blending technical, fundamental, and sentiment analyses, investors can form a more holistic view of market conditions. This integrated approach allows investors to leverage the strengths of each technique to make strategic investment decisions that consider both quantitative data and qualitative market sentiment.

Sentiment-Based Trading Strategies

Unlocking the Power of Market Sentiment in Trading

Embracing momentum trading involves riding the waves of prevailing market sentiment, capitalizing on upward or downward trends. Contrarian investing, on the other hand, thrives on going against the crowd sentiment, seeking lucrative opportunities when the market sentiment is overly optimistic or pessimistic. Sentiment-driven asset allocation strategies empower investors to adjust their portfolios based on prevailing market sentiment, optimizing returns.

Mitigating Risks through Strategic Risk Management

Effective risk management strategies are paramount during periods of negative market sentiment. Implementing stop-loss orders, diversifying investments, and setting risk tolerance levels are essential to safeguarding against potential losses when market sentiment turns bearish. Proactive risk mitigation measures ensure resilience in the face of fluctuating market sentiments, preserving capital and optimizing long-term investment outcomes.

Understanding Limitations and Ethical Considerations in Market Sentiment Analysis

Market Sentiment Volatility

Market sentiment analysis comes with inherent volatility and unpredictability. Emotions drive market movements, leading to rapid shifts that can catch investors off guard. Understanding this aspect is vital for managing risk and making well-informed decisions in a dynamic market environment. Reacting impulsively to sentiment fluctuations can lead to undesirable outcomes, emphasizing the need for a disciplined approach.

Discipline in Sentiment-Based Trading

Successful sentiment-based trading demands discipline and emotional control. Emotions like fear and greed can cloud judgment, prompting impulsive actions that may not align with a well-thought-out strategy. Practicing patience and adherence to a predefined plan are crucial for navigating the nuances of market sentiment analysis effectively, avoiding hasty decisions that could compromise investment outcomes.

Ethical Dilemmas in Market Sentiment Analysis

Ethical considerations arise in manipulating market sentiment or disseminating false information to sway market perceptions. Maintaining integrity in analyzing and interpreting sentiment data is paramount for fostering trust and transparency in financial markets. Upholding ethical standards helps preserve market integrity, ensures fair play, and safeguards the interests of all participants, reinforcing the importance of ethical conduct in sentiment analysis practices.

Balanced Decision-Making Beyond Sentiment

While market sentiment offers valuable insights, relying solely on sentiment analysis for investment decisions may pose risks. It is essential to integrate sentiment data with a comprehensive analysis of fundamental and technical indicators, economic trends, and geopolitical factors. By considering a holistic view of the market landscape, investors can mitigate risks associated with sentiment-driven fluctuations and make well-rounded investment choices aligned with their financial goals.

By addressing the limitations and ethical considerations associated with market sentiment analysis, investors can navigate the complexities of sentiment-driven markets more effectively. Upholding ethical standards, practicing discipline, and incorporating a diverse set of factors into decision-making processes can enhance the robustness of investment strategies, empowering investors to navigate market sentiment fluctuations with resilience and foresight.