Discover the ultimate guide to mastering price action trading strategies, techniques, and tools. Dive into the world of price action analysis and explore how this method can revolutionize your trading decisions. With a focus on key concepts, strategies, and benefits, this guide will equip you with the necessary knowledge to navigate the complexities of the market with confidence. Whether you are a beginner or an experienced trader, understanding price action is essential for success in today’s dynamic financial landscape.

Delving into Price Action Analysis

Price action trading guide illuminates the intricate study of price movements within financial markets. It unravels trends and sentiments, unlocking a plethora of trading prospects. By scrutinizing price charts, traders decipher patterns and irregularities that shape informed decisions. This versatile method transcends markets, from stocks to forex, commodities, and cryptocurrencies, emphasizing its broad suitability. Mastery demands technical prowess, psychological acumen, and adept pattern analysis.

Understanding Key Concepts in Price Action Trading

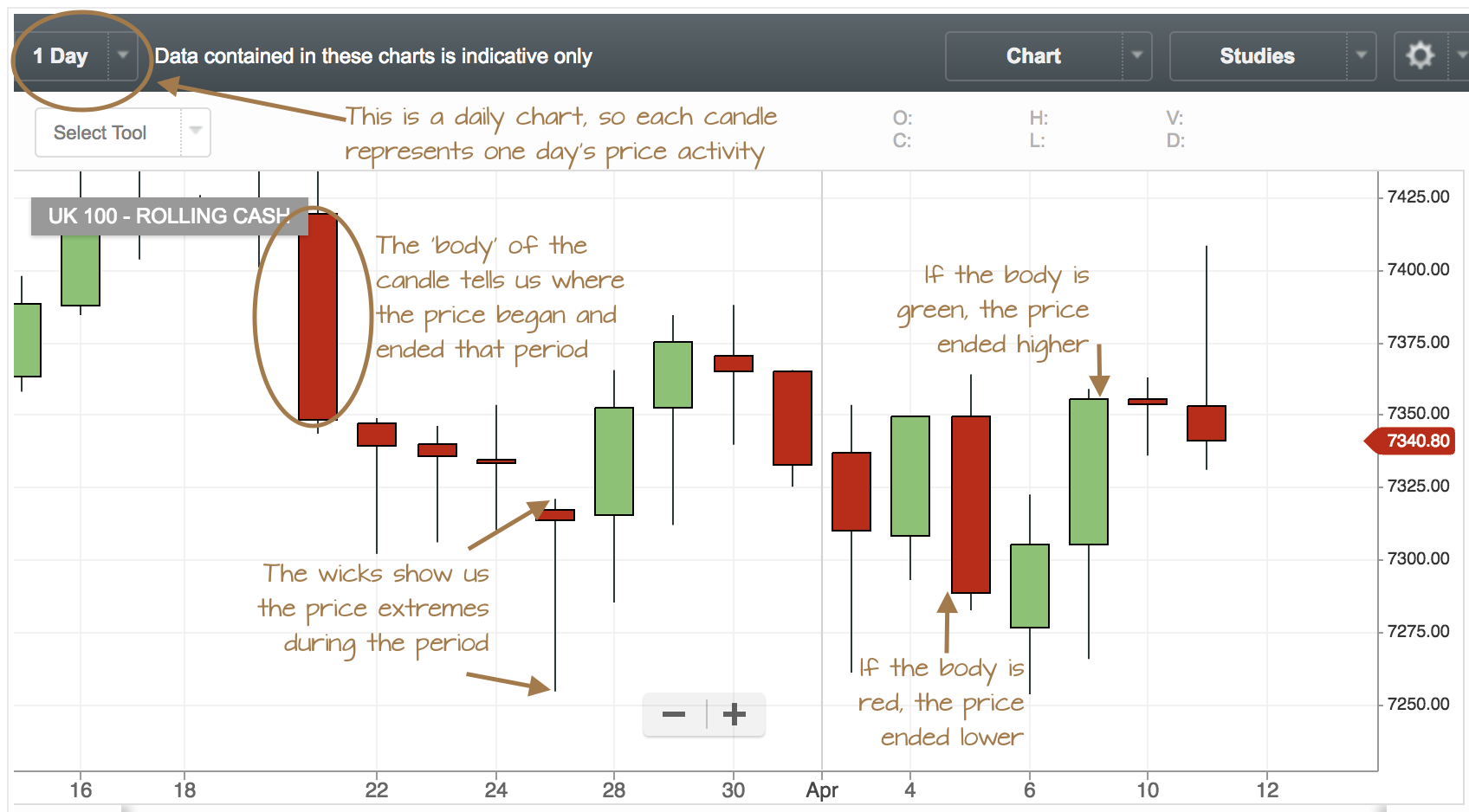

In the realm of price action trading, candlesticks serve as fundamental tools, capturing price movements visually to reveal market sentiment and momentum shifts. These graphical representations paint a vivid picture of buyer and seller dynamics, crucial for informed trading decisions.

Support and resistance levels act as pivotal zones on price charts, highlighting areas where the price typically reacts, either bouncing off or reversing. Recognizing these levels is key to identifying potential entry and exit points, assisting traders in crafting prudent strategies.

Trendlines, drawn to connect price highs or lows, provide valuable insights into the market’s prevailing direction and potential shifts. Understanding the dynamics of trendlines empowers traders to spot trend continuations or reversals, aiding in making well-informed trading choices.

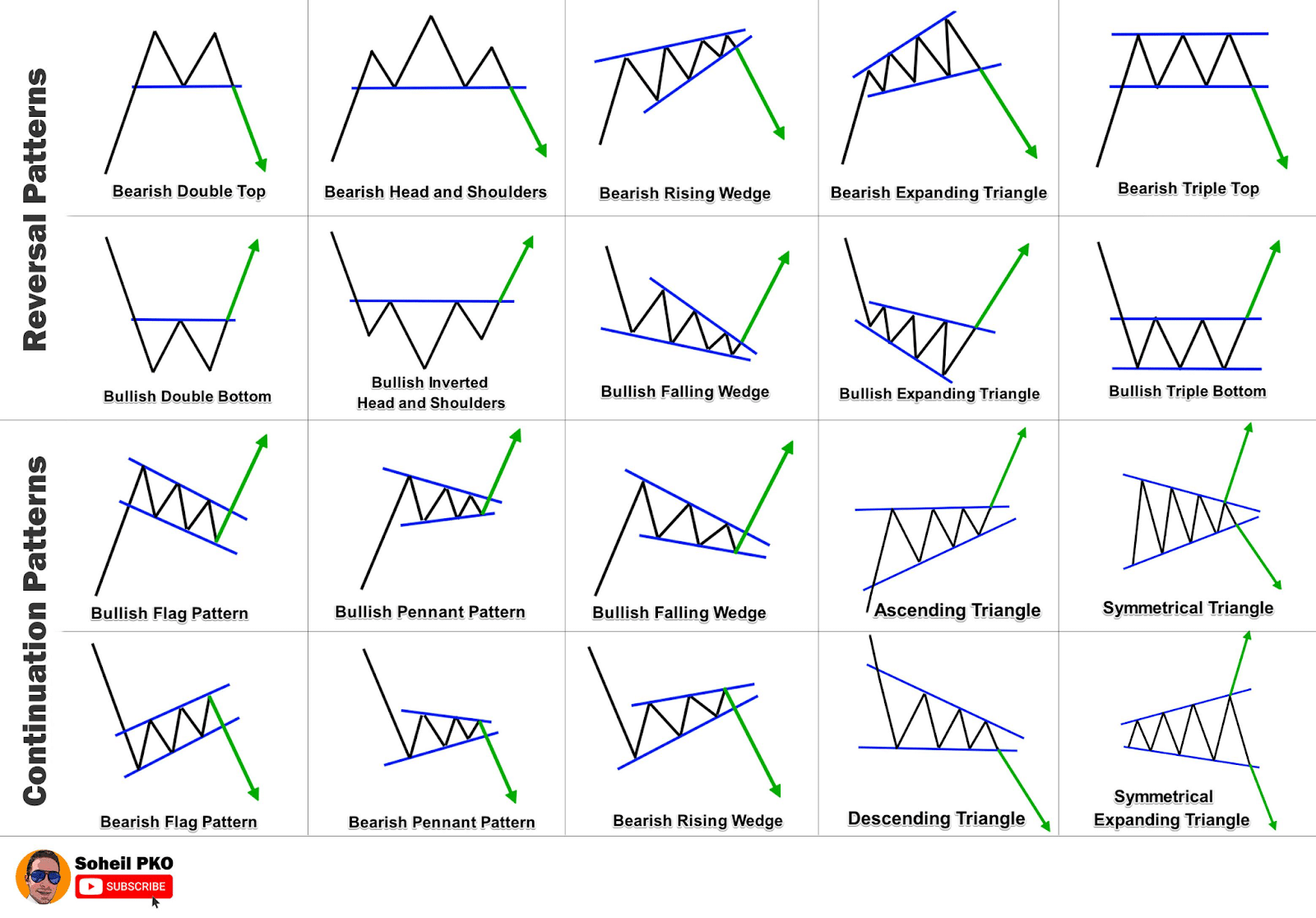

Chart patterns, such as triangles, flags, and head-and-shoulders formations, offer visual cues on potential market outcomes. Traders skilled in pattern recognition can anticipate price movements based on these formations, enhancing their ability to predict and capitalize on market trends effectively.

Common Price Action Trading Strategies

Trend Following

Trend following is a foundational strategy in price action trading, emphasizing the importance of identifying and aligning trades with the prevailing market trend. By riding the momentum of the trend, traders aim to capitalize on sustained price movements, increasing the probability of profitable trades. This strategy requires patience and discipline to ascertain and follow established trends effectively.

Range Trading

Range trading involves profiting from price fluctuations within established support and resistance levels. Traders employing this strategy seek to buy at support levels and sell at resistance levels, aiming to exploit repetitive price patterns within the price range. Effective range trading demands keen observation of price behavior at these key levels and the ability to recognize potential breakout or reversal signals.

Breakout Trading

Breakout trading revolves around identifying and capitalizing on price movements beyond significant support or resistance levels. Traders using this strategy anticipate potential trend shifts following a breakout, aiming to enter trades early to capture substantial price movements. Successful breakout trading requires prompt action, risk management, and confirmation of breakout validity to avoid false signals.

Reversal Trading

Reversal trading involves identifying potential trend reversals and profiting from price movements in the opposite direction of the prevailing trend. Traders utilizing this strategy strive to enter trades at pivotal points where trends are likely to change, seeking to benefit from the subsequent price reversal. Reversal trading demands precise timing, thorough analysis of market conditions, and confirmation of reversal signals for effective decision-making.

Advanced Price Action Techniques

Unlocking the Power of Advanced Price Action Techniques

Delve into the intricacies of advanced price action techniques to elevate your trading game. Volume analysis offers a window into market sentiment, supplementing price action signals for informed decisions. Seasonality unveils patterns like holiday effects, enriching your understanding of market dynamics. Correlation analysis unveils interconnectedness, aiding in predicting price movements across assets. Effective risk management strategies, like employing stop-loss orders, safeguard your capital while optimizing trade potential.

Advantages of Price Action Trading

Embracing Simplified Analysis

Price Action Trading Guide offers a streamlined approach through direct chart analysis, minimizing the dependency on intricate technical indicators. By focusing on raw price movements, traders can develop a clearer and more efficient trading strategy.

Unveiling Market Dynamics

Engaging in price action analysis unravels the intricate tapestry of market dynamics. Traders harness a profound comprehension of market behavior, enhancing their ability to predict trends and make well-informed trading decisions with confidence.

Cultivating Stronger Discipline

Price action trading fosters rigorous trading discipline by grounding decisions in objective chart patterns. This approach reduces emotional bias, promoting consistency and ensuring that trades are executed based on concrete data.

Capitalizing on Profit Opportunities

Proficient price action traders leverage their skills to detect and capitalize on market inefficiencies swiftly. This proactive approach potentially leads to higher returns as traders adeptly navigate price fluctuations and exploit profitable trading opportunities.

Understanding the Limitations of Price Action Trading

Subjectivity in Price Action Analysis

Price action trading’s subjectivity stems from traders’ interpretations of chart patterns, leading to varied trading decisions. This diversity may result in inconsistency across traders, making it essential to supplement with other analytical tools for validation.

Dealing with False Signals

One major drawback of price action trading is the occurrence of false signals. Traders must exercise caution and combine price action analysis with other indicators to filter out unreliable signals and reduce the risk of making incorrect trading choices.

Experience and Expertise Requirement

Mastering price action trading demands a significant investment of time and hands-on experience. Traders need to hone their skills in pattern recognition and market understanding to effectively leverage price action strategies for profitable trading outcomes.

Navigating Through Market Noise

In volatile markets, characterized by heightened unpredictability and erratic price movements, interpreting price action becomes even more challenging. Traders must exercise patience, adaptability, and possibly combine price action signals with other technical tools to navigate through market noise effectively.