Position sizing is a crucial aspect of successful trading strategies. Understanding how to appropriately allocate capital based on the size of a trading position can significantly impact trading outcomes. Factors influencing position sizing include risk tolerance, market volatility, and account size. By implementing effective position sizing techniques, traders can optimize returns and manage risks more effectively. In this comprehensive guide on position sizing, we will delve into the importance of position sizing, common techniques used, risk management strategies, and advanced techniques to enhance trading performance. Mastering position sizing is key to navigating the ups and downs of the financial markets with confidence and precision.

Delving into the Essence of Position Sizing

Position sizing in trading serves as the cornerstone that dictates the risk and reward balance for every trade. By intricately determining the quantity of shares or contracts to transact, traders align their actions with available capital and risk boundaries. This precision not only mitigates risk and fosters optimal returns but also shields traders against formidable financial downturns. Failure to uphold prudent position sizing practices can culminate in overtrading, margin calls, and profound financial ramifications.

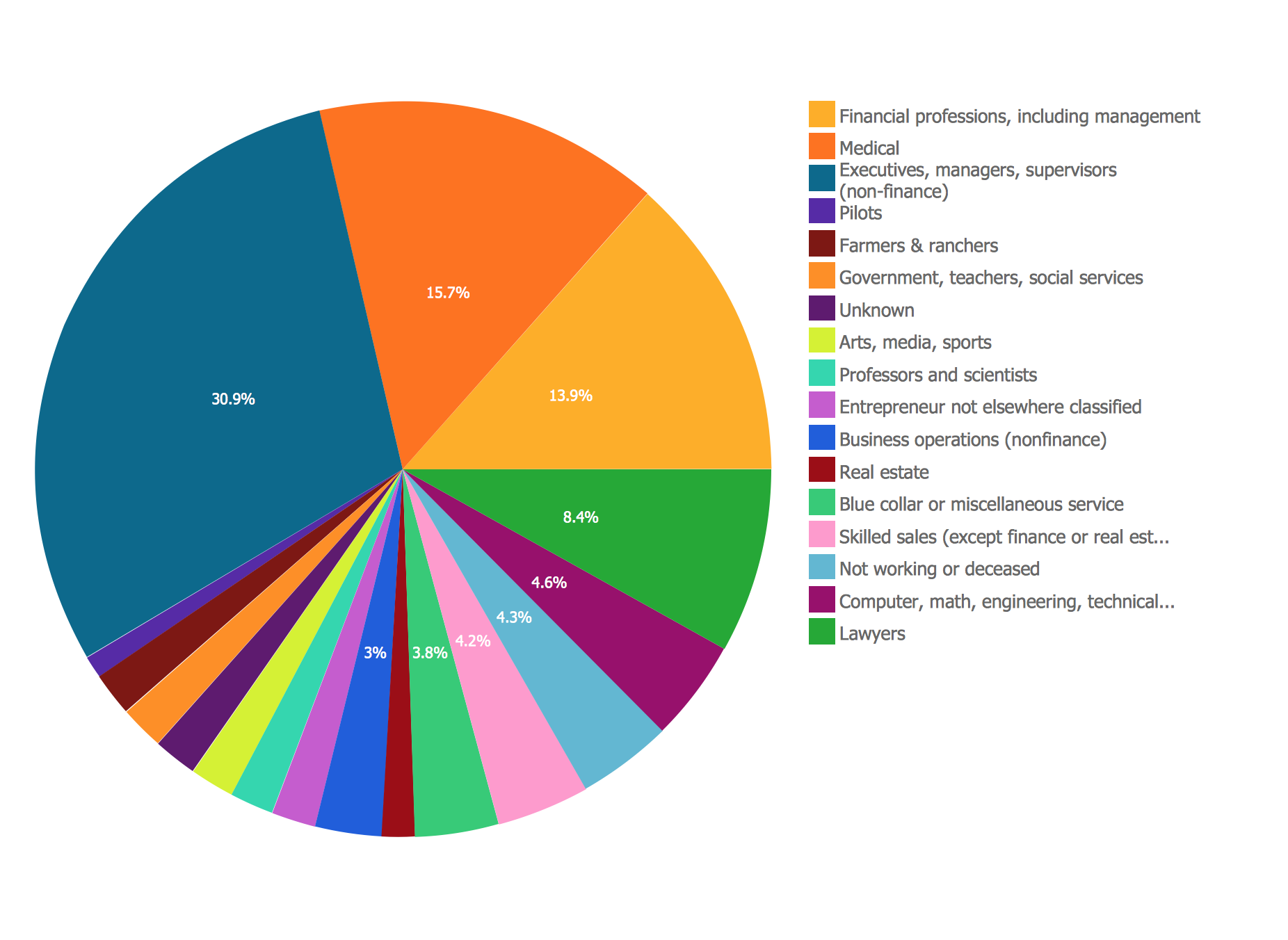

Factors Influencing Position Sizing

When considering position sizing in trading, available capital plays a pivotal role. Traders must assess the amount of capital allocated for trading, as it sets the upper limit for position size. Adequately managing available capital is essential to ensure prudent risk allocation for each trade, thereby safeguarding overall trading portfolio health.

Risk tolerance stands as a cornerstone in determining position sizing in trading. It reflects the level of risk a trader is comfortable with and willing to undertake. Risk tolerance influences the percentage of capital risked per trade, shaping the size of trading positions taken. Aligning position sizing with individual risk tolerance levels aids in maintaining emotional discipline and rational decision-making during volatile market conditions.

Market volatility serves as a critical factor influencing position sizing in trading. The expected price fluctuations of the underlying asset impact the potential risk and reward of a trade. Traders adjusting position sizes based on market volatility can mitigate potential losses during turbulent market phases and capitalize on profit opportunities during calmer periods, thus optimizing risk-adjusted returns.

The trading strategy employed significantly affects position sizing decisions in trading. Different trading strategies may necessitate varying position sizing techniques. For instance, a day trader employing high-frequency trading approaches may opt for smaller position sizes to manage rapid price changes effectively. Conversely, a swing trader with a longer-term perspective might utilize larger position sizes to capture broader market trends, highlighting the importance of tailoring position sizing to specific trading styles.

By comprehensively considering available capital, risk tolerance, market volatility, and trading strategy, traders can fine-tune their position sizing approach to align with their risk management objectives and trading preferences effectively. Mastering the art of position sizing in trading is essential for optimizing trading performance and achieving long-term success in the financial markets.

Maximizing Returns through Strategic Position Sizing

Optimizing Potential:

Position sizing in trading serves as a strategic tool to boost returns by enabling traders to assign more capital to high-potential trades. This approach enhances profit opportunities by aligning investment proportionately with trade potential, thereby maximizing returns on successful trades.

Portfolio Enhancement:

Effective position sizing plays a pivotal role in elevating overall portfolio returns. By judiciously adjusting the size of positions, traders can amplify gains across their entire investment portfolio, culminating in improved profitability and performance.

Compounding Growth:

A well-calibrated position sizing strategy facilitates the compounding of returns over time. Successful trades that are appropriately sized generate more capital for subsequent trades, fostering an exponential growth trajectory and long-term wealth accumulation.

Risk Mitigation:

Proper position sizing acts as a shield against overleveraging, averting the potential loss of significant capital. By carefully determining the size of each position in accordance with risk tolerance and market conditions, traders can safeguard their investments and preserve capital integrity.

Position Sizing for Different Market Conditions

Tailoring Your Position Size to Market Environments

In trading, adapting position sizes to different market conditions is vital. In bullish markets, where gains are ripe, traders often adopt a more aggressive approach to capitalize on the upward momentum. Conversely, in bearish markets, characterized by heightened risks, a more conservative position sizing strategy is prudent to safeguard against potential losses. Ranging markets call for position size adjustments to align with the expected volatility and breakout possibilities, ensuring flexibility and risk management. When trending markets prevail, leveraging larger position sizes can be beneficial, leveraging the higher probability of success provided by the prevailing trend dynamics. By tailoring position sizing strategies to specific market scenarios, traders can navigate varying conditions with precision and optimize returns effectively, enhancing their overall trading performance.

Advanced Position Sizing Techniques

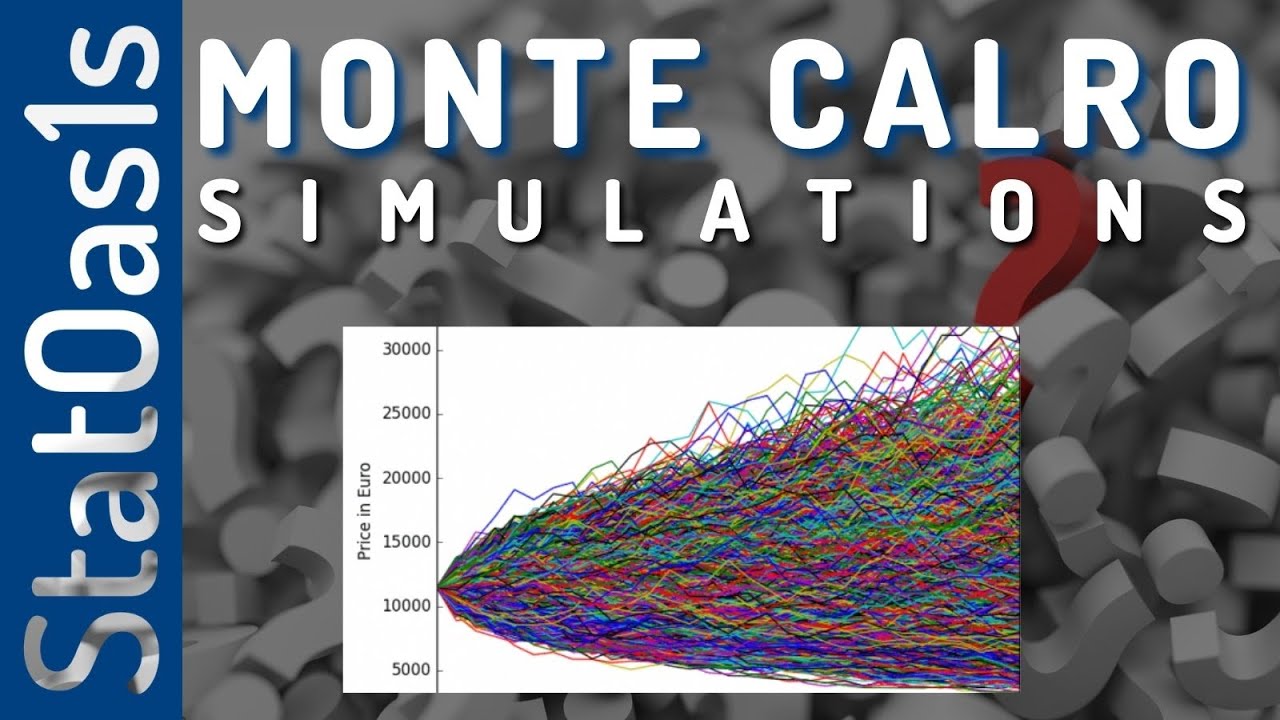

Monte Carlo Simulations

In the realm of advanced position sizing techniques, Monte Carlo simulations stand out. By utilizing sophisticated computer simulations, traders can model a wide range of possible trade outcomes. This empowers them to fine-tune position sizes to maximize potential gains while effectively managing risks, offering a data-driven approach crucial for strategic decision-making in trading.

Machine Learning Algorithms

The integration of machine learning algorithms revolutionizes position sizing strategies. Through the power of artificial intelligence, traders can analyze vast amounts of data to predict market trends accurately. By leveraging these advanced algorithms, traders can optimize position sizing based on predictive insights, enhancing precision and adaptability in their trading approaches for better risk management.

Dynamic Position Sizing

Dynamic position sizing technique involves adjusting trade sizes as market conditions evolve. By continuously assessing the changing landscape, traders can scale their positions accordingly, optimizing their exposure to risk and reward. This technique requires vigilance and adaptability to navigate fluctuating market dynamics effectively, ensuring that position sizes align with the current market environment.

Hedging Strategies

Incorporating hedging strategies into position sizing practices adds another layer of risk management sophistication. By strategically utilizing multiple positions that offset each other’s risk exposure, traders can safeguard their capital in volatile markets. This technique not only helps in managing risk effectively but also allows for greater flexibility in adjusting position sizes based on market conditions for enhanced trading outcomes.