Are you looking to enhance your trading skills with trend following strategies? In this ultimate guide to trend following, we will delve into the benefits, challenges, and types of these strategies. Discover how to spot market trends, effectively manage risks, and navigate the intricate psychology involved in trend following. Whether you are a novice or seasoned trader, understanding the ins and outs of trend following can significantly contribute to your trading success. Stay tuned to explore this fascinating world of strategy and analysis.

In the realm of financial markets, Trend Following remains a cornerstone approach for traders seeking consistent profits. By adopting trend following strategies, traders can capitalize on the momentum of market trends to secure profitable outcomes. This guide aims to unravel the nuances of trend following, encompassing its benefits, challenges, and various types available. Dive into the depths of market trend identification, risk management principles, and the psychology behind successful trend following practices. Join us in this journey to unlock the secrets of Trend Following and elevate your trading game.

Delving into Trend Following Strategies

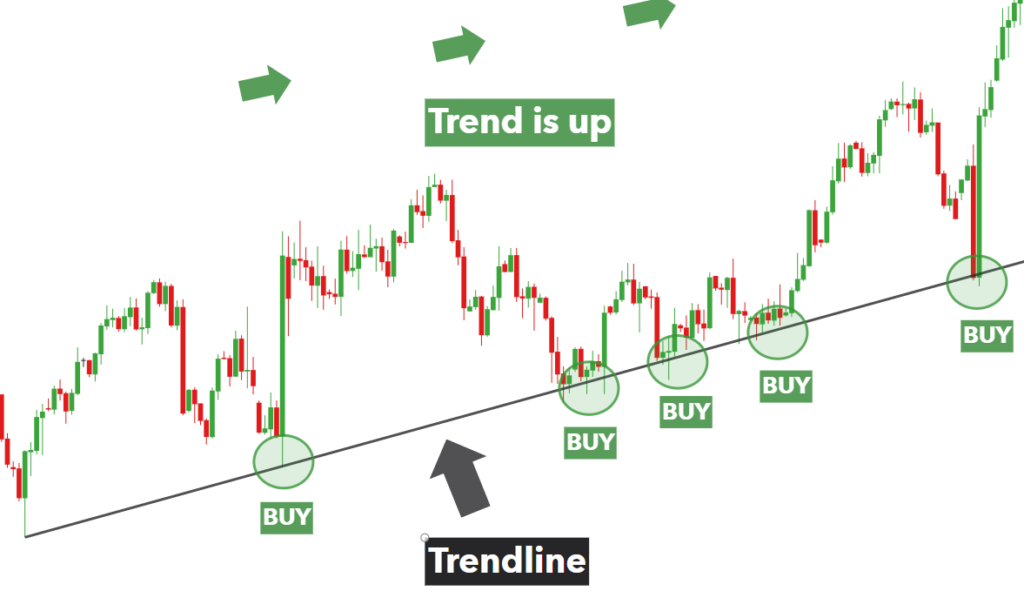

Trend Following Strategies represent a trading approach centered on recognizing and trailing current market trends. Traders employing this strategy seek to harness profits by leveraging the momentum of trending assets. This method entails extensive scrutiny of price movements, technical indicators, and overall market sentiment. It appeals to traders inclined towards tracking established trends instead of attempting to forecast market reversals. Trend Following Strategies act as a guiding principle for traders in navigating the dynamic landscape of financial markets.

Unveiling the Advantages of Trend Following Strategies

Embrace Lucrative Opportunities

Trend following strategies open doors to substantial returns during trending markets. By riding the momentum of established trends, traders can capitalize on profitable opportunities, maximizing their financial gains effectively. This approach allows traders to align with market movements and harness the potential for significant returns, making it a valuable tool in a trader’s arsenal.

Mitigate Risk Effectively

Compared to other trading methodologies, trend following strategies exhibit relatively lower risk levels. By focusing on market trends rather than predictions, traders can reduce the impact of sudden market fluctuations. This risk mitigation aspect provides a more stable trading approach, offering a cushion against volatile market conditions, thus safeguarding investments and enhancing overall portfolio stability.

Effortless Trading Operations

One of the notable advantages of trend following strategies is the reduced need for constant monitoring and active trading involvement. Traders can implement these strategies with minimal intervention, allowing them to engage in other activities without compromising trading performance. This hands-off approach streamlines trading operations, providing convenience and flexibility to traders looking to optimize their time and resources effectively.

Diversification Across Markets

Trend following strategies are versatile and adaptable, making them suitable for various financial markets such as stocks, forex, and commodities. This flexibility enables traders to diversify their portfolios across multiple asset classes, spreading risk and enhancing potential returns. By applying trend following principles across different markets, traders can capitalize on diverse opportunities and optimize their overall trading approach for long-term success.

The Challenges of Trend Following

Navigating Choppy Markets

Trend Following Strategies can face challenges in choppy or range-bound markets, where trends lack direction, leading to potential underperformance. Traders must adapt their approach, possibly reducing position sizes or utilizing additional indicators to navigate these volatile environments effectively.

Patience and Discipline

Success in Trend Following Strategies hinges on patience and discipline. Sticking with a trend amidst fluctuations requires a steadfast mindset and the ability to avoid emotional reactions to short-term market movements. Traders need to trust their strategy and exercise restraint in reacting to noise.

Dealing with False Signals

False signals or sudden trend reversals pose significant risks to trend followers. These unexpected market movements can trigger losses if traders fail to employ robust risk management practices. It is crucial to discern genuine trend changes from temporary fluctuations to safeguard investment capital.

Managing Emotional Biases

Emotional biases, such as fear and greed, can cloud judgment and hinder the objective analysis necessary for successful trend following. Traders must cultivate emotional resilience, maintain a clear focus on the strategy’s rules, and avoid impulsive decisions driven by sentiments. Embracing a disciplined and rational mindset is key to overcoming emotional barriers in trend following.

Exploring Various Types of Trend Following Strategies

When delving into the realm of trend following strategies, traders often encounter a diverse array of approaches tailored to capture market trends effectively. One prominent type is breakout strategies, where traders initiate positions as prices breach significant levels, aiming to ride the subsequent momentum. These strategies capitalize on the concept that price breakouts often lead to sustained trends, offering traders ample profit potential.

Another prevalent category is momentum strategies, focusing on assets exhibiting robust price momentum. By riding the coattails of assets with compelling upward or downward momentum, traders seek to capitalize on the continuation of established trends. Momentum strategies emphasize the adage “the trend is your friend,” advocating for aligning with market momentum to secure profitable trades.

Moving average strategies represent a popular trend following approach that leverages moving averages to identify prevailing trends and determine optimal entry and exit points. By analyzing the interaction between different moving averages, traders gain insights into the direction of trends and make informed trading decisions. This methodology aims to smooth out price fluctuations, aiding in trend identification and confirmation.

In the realm of trend following, channel strategies offer a structured framework for trading within well-defined price channels. Traders utilizing channel strategies aim to identify and exploit trends within these established boundaries, seeking to capture significant price movements while effectively managing risks. The key principle of channel strategies lies in capitalizing on the periodic nature of price oscillations within defined ranges.

Incorporating a diverse mix of trend following strategies can provide traders with a versatile toolkit to navigate the dynamic landscape of financial markets. By understanding the nuances of breakout, momentum, moving average, and channel strategies, traders can adapt their approach to varying market conditions and capitalize on emerging trends effectively. Embracing a multifaceted strategy arsenal empowers traders to optimize their trend following endeavors and enhance their overall trading performance.

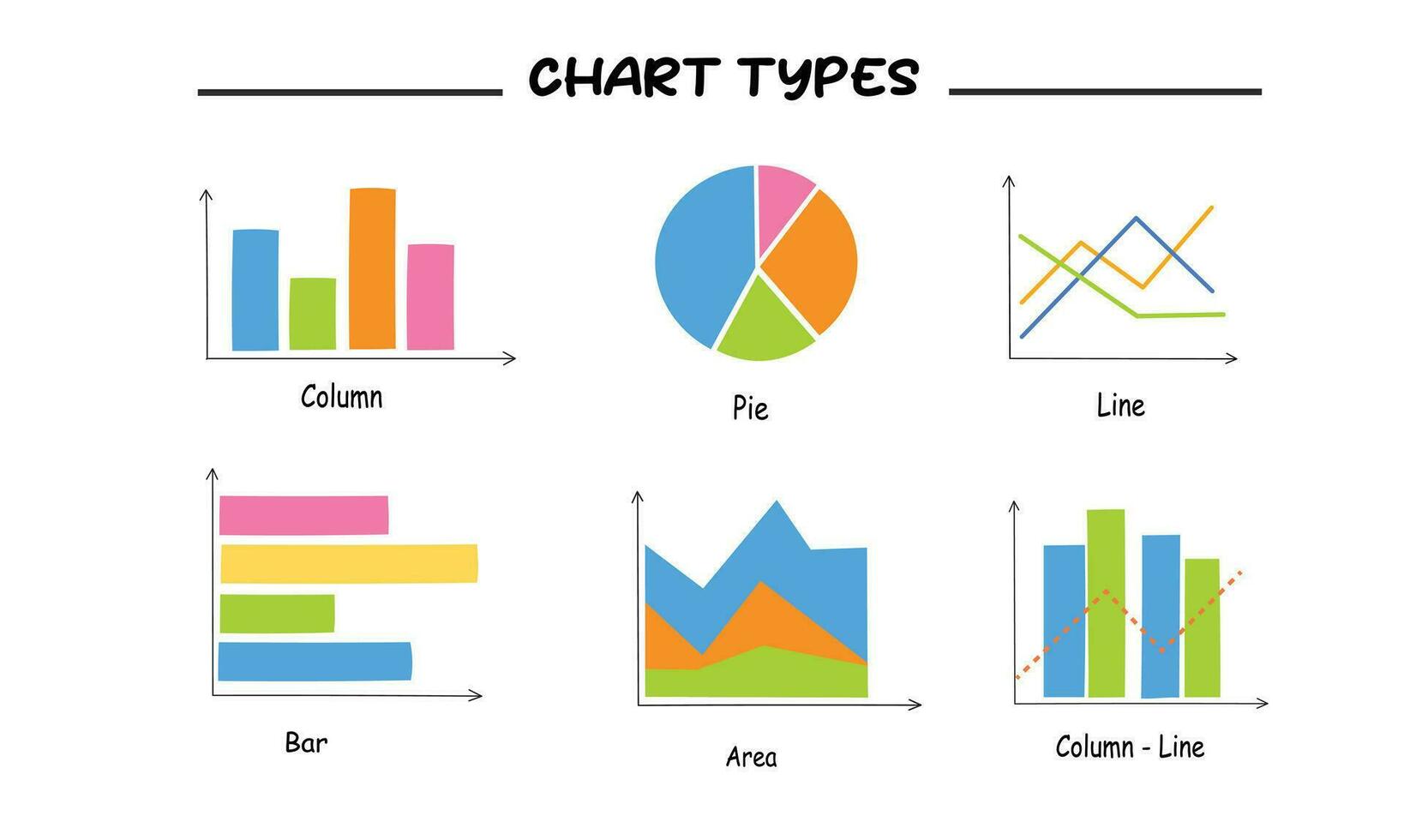

Unveiling Market Trends Through Strategic Analysis

In the realm of Trend Following Strategies, identifying market trends is a pivotal step towards successful trading endeavors. Utilizing technical analysis imbued with price charts, indicators, and patterns empowers traders to discern the direction of trends with precision. It forms the bedrock for informed decision-making and strategic market entries, ensuring the alignment of trades with prevalent market momentum.

Market sentiment plays a crucial role in deciphering market trends. By vigilantly monitoring news, social media platforms, and sentiment indicators, traders gain valuable insights into market participants’ emotions and inclinations. Understanding the sentiment prevailing in the market facilitates the identification of potential trend reversals or continuations, enabling traders to position themselves advantageously.

Economic data and events exert profound impacts on market dynamics, often catalyzing significant trend shifts. Traders employing Trend Following Strategies diligently assess macroeconomic factors such as interest rates, employment data, and geopolitical events to anticipate and capitalize on emerging trends. Acknowledging the influence of economic indicators equips traders to ride the waves of evolving market trends successfully.

Recognizing seasonality and historical patterns forms a cornerstone of market trend identification. Through meticulous analysis of historical data, traders unveil recurring trends and patterns across different time frames. By dissecting seasonal trends and historical price movements, traders can glean valuable insights to anticipate potential future market trends, enhancing their ability to execute well-informed trading decisions.

Mastering Risk Management in Trend Following Strategies

In the realm of trend following strategies, success hinges on defining precise entry and exit points grounded in technical analysis. These strategic decisions help traders navigate market fluctuations effectively, seizing profitable opportunities while minimizing risks. Implementing stop-loss orders serves as a vital tool to cap potential losses, safeguarding capital in volatile scenarios. Diversification across various assets or markets further fortifies portfolios, mitigating the impact of unexpected market movements.

Integrating advanced risk-management techniques like position sizing and correlation analysis enhances the robustness of trend following strategies. By appropriately allocating position sizes based on risk tolerance and market conditions, traders can optimize returns while managing exposure levels prudently. Correlation analysis aids in identifying asset relationships, allowing for a diversified portfolio that is less susceptible to simultaneous market shifts. Embracing these risk-management tools empowers traders to navigate the uncertainties of trend following with confidence and precision, paving the way for sustainable trading success.

The Psychology Behind Successful Trend Following Strategies

Embracing Patience and Discipline

Effective trend following strategies demand a high level of patience and discipline to resist the urge of emotional trading. By staying focused on the predefined trading rules and not succumbing to impulsive decisions, traders can avoid detrimental deviations from the strategy, ensuring a systematic approach to trading success.

Managing Biases and Emotions

To excel in trend following, traders must control biases, such as overconfidence or fear, which can lead to irrational trading decisions. By maintaining emotional stability and objectivity, traders can navigate market fluctuations with rationality, resulting in consistent adherence to their strategy and improved trading outcomes.

Objective Decision Making and Adherence to the Plan

Successful trend followers prioritize objectivity in decision-making processes, adhering strictly to their trading plan. By removing emotional influences and following a predetermined strategy, traders increase their chances of executing trades based on calculated analysis rather than impulsive reactions to market movements.

Continuous Evaluation and Adaptation

Adaptability is key in trend following as market trends evolve. Traders need to continuously evaluate their strategies and adjust them according to changing market conditions. This proactive approach ensures that the trend following strategy remains relevant and effective, maximizing potential profits while minimizing risks in dynamic market environments.