Mastering the art of scalping trading strategies is crucial for those looking to excel in the fast-paced world of trading. In this comprehensive guide, we will delve into the diverse range of scalping strategies, the essential skills required for success, how to choose the right market for your trades, the tools and platforms that can enhance your scalping game, effective risk management techniques, and the common pitfalls to avoid in scalping. Whether you are a seasoned trader or just starting out, understanding the intricacies of scalping can significantly elevate your trading prowess. Let’s dive deep into the world of scalping and unlock its potential for your trading success.

Unveiling the Essence of Scalping Trading Strategies

Scalping trading strategies stand out as agile methods that revolve around swiftly capitalizing on minor price changes in the market. This approach involves rapid buying and selling of assets, often within minutes or even seconds to harness swift market variations. To excel in scalping, traders must possess refined skills, make prompt decisions, and grasp intricate market intricacies. While automated systems aid in scalping, manual trading remains prevalent due to its flexibility and precision.

:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-05-437d981a36724a8c9892a7806d2315ec.jpg)

Key Skills for Successful Scalping

Technical Analysis Proficiency

Mastering technical analysis is paramount in scalping trading strategies. Proficiency in interpreting price charts, recognizing key indicators, and identifying patterns is crucial. By understanding market dynamics through technical analysis, traders can make well-informed decisions swiftly, optimizing entry and exit points for profitable scalping opportunities.

Market Sentiment Analysis

Analyzing market sentiment is a vital skill for successful scalping. Traders need to gauge the overall sentiment in the market to anticipate price movements accurately. By staying attuned to market sentiment, traders can capitalize on fluctuations, identify trends, and execute precise trades aligning with the prevailing market sentiment.

Risk Management

Effective risk management is non-negotiable in scalping trading strategies. Traders must implement stringent risk management practices, including setting stop-loss orders and determining appropriate position sizes. By managing risk diligently, traders can protect their capital and ensure longevity in their scalping endeavors.

Emotional Control

Emotional control plays a pivotal role in successful scalping. Traders must maintain discipline, avoid succumbing to emotional impulses, and stick to their trading plan rigorously. By cultivating emotional stability, traders can make rational decisions, minimize the impact of psychological biases, and enhance overall trading performance.

Benefits and Drawbacks of Scalping

Benefits of Scalping Trading Strategies

Scalping trading strategies offer the potential for high profits due to the frequent trades executed within short time frames. This approach allows traders to capitalize on small price movements, cumulatively leading to significant gains. Moreover, scalping provides flexibility in trading hours, enabling individuals to participate in the market even with limited time availability. The scalability of scalping allows traders to adjust positions swiftly in response to changing market conditions, enhancing adaptability.

Drawbacks of Scalping Trading Strategies

Despite its appeal, successful scalping requires significant skill and experience. Traders must make quick decisions, accurately predict market movements, and manage positions effectively within seconds. The fast-paced nature of scalping can induce stress and pressure, demanding a disciplined mindset and emotional control. Additionally, due to the high frequency of trades, transaction costs can accumulate rapidly, impacting overall profitability.

Selecting the Optimal Market for Scalping

Liquidity:

In the realm of scalping trading strategies, liquidity plays a pivotal role. Opting for markets characterized by high trading volumes and tight spreads is paramount for executing swift and seamless trades. Liquidity ensures that there is ample activity for quick entries and exits, minimizing slippage risks and enhancing profitability.

Volatility:

For scalping to thrive, volatility is a crucial component. Traders gravitate towards markets that exhibit significant price movements within short timeframes. Volatile markets offer ample trading opportunities for scalpers to capitalize on rapid price changes, enabling them to swiftly enter and exit positions for profit maximization.

Correlation:

Understanding the correlation between different markets is a strategic advantage for scalping traders. By identifying how various assets move in relation to each other, traders can leverage correlations to predict potential price movements. This insight aids in recognizing interconnected opportunities across different markets, allowing traders to optimize their scalping strategies for maximum returns.

Leveraging Advanced Tools and Platforms for Scalping Trading Strategies

Trading Platforms

Selecting a robust trading platform for scalping trading strategies is paramount. Look for platforms offering advanced charting tools for precise analysis, rapid order execution capabilities to capitalize on quick market movements, and integrated risk management features to safeguard your trades effectively. These elements are essential for swift decision-making and maximizing profitability in scalping trades.

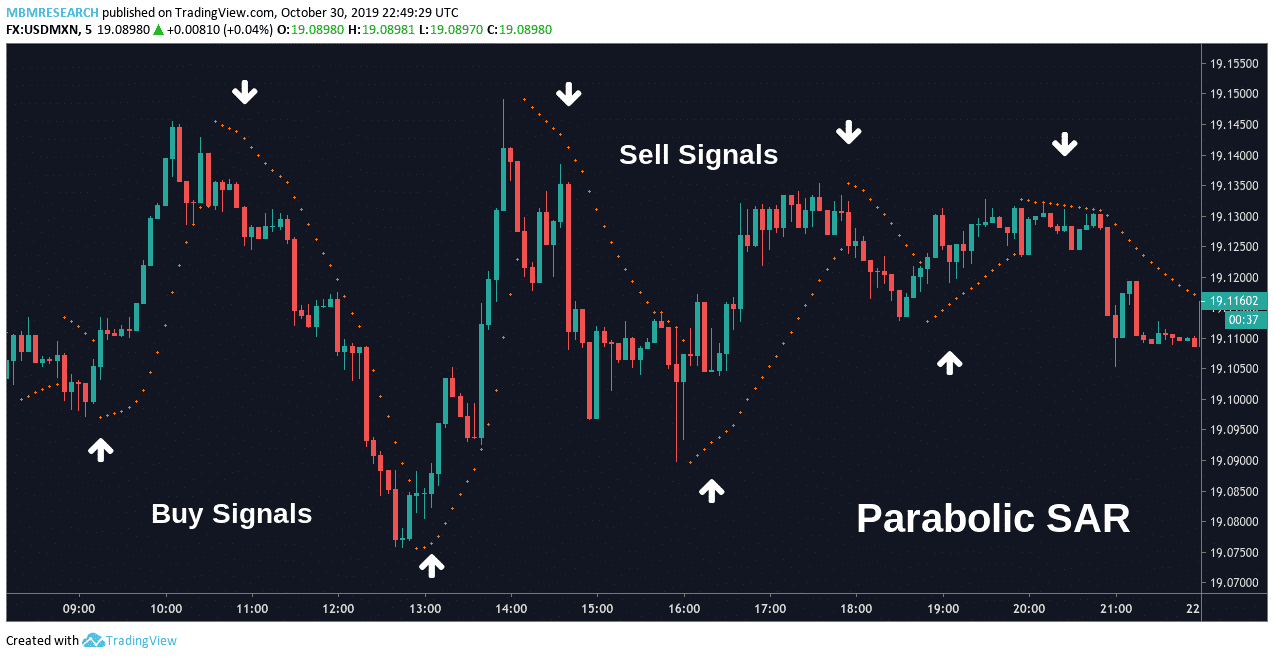

Technical Indicators

In scalping trading strategies, technical indicators play a vital role in identifying potential entry and exit points. By leveraging indicators like Moving Averages, Relative Strength Index (RSI), and Bollinger Bands, traders can effectively pinpoint trading signals and validate market trends. Integrating these indicators into your strategy enhances the precision and accuracy of your trades.

Automated Trading Systems

Embracing automated trading systems can streamline the execution process for scalping trades. These systems operate based on predefined parameters, allowing for swift and efficient trade execution without the need for manual intervention. Automated systems help traders capitalize on fleeting opportunities in the market by executing trades promptly, enhancing overall efficiency and reducing emotional decision-making.

Incorporating cutting-edge tools and platforms like advanced trading software, technical indicators, and automated trading systems can significantly elevate your scalping trading strategies. By integrating these tools into your trading arsenal, you can enhance precision, efficiency, and decision-making speed, ultimately boosting your success in the fast-paced world of scalping.

:max_bytes(150000):strip_icc()/stop-lossorder.asp-final-69b233d1e15d4628920c9568408d2648.png)

Effective Risk Management Strategies for Scalping

Stop-loss Orders

Implementing stop-loss orders is crucial in scalping trading strategies. By defining the maximum loss acceptable for each trade, traders can safeguard their capital from significant downturns due to sudden market fluctuations. Setting stop-loss orders strategically helps mitigate risks and ensures disciplined trading, aligning with the goal of preserving capital and optimizing profitability in scalping endeavors.

Position Sizing

Calculating the right position size is imperative for successful scalping. Traders must assess their risk tolerance and overall account balance to determine the appropriate position size for each trade. This tailored approach ensures that potential losses remain within manageable limits while capitalizing on profitable opportunities, creating a balanced risk-reward scenario essential for sustained success in scalping trading strategies.

Risk-Reward Ratio

Maintaining a favorable risk-reward ratio is a fundamental aspect of effective risk management in scalping. By aiming to achieve a ratio where potential profits significantly exceed potential losses, traders increase their chances of sustainable profitability. Balancing risk and reward in each trade through meticulous analysis and adherence to predefined ratios enhances the overall viability and success of scalping trading strategies.

Common Mistakes to Avoid in Scalping

Overtrading:

One of the common mistakes in scalping trading strategies is overtrading. This occurs when traders execute trades excessively, often out of an urge to be constantly in the market. Overtrading can dilute focus, increase transaction costs, and lead to emotional burnout, impacting overall profitability and sustainability.

Revenge Trading:

Another pitfall to steer clear of is revenge trading. After facing losses, some traders engage in revenge trading to recoup lost funds quickly. This approach is often emotional, impulsive, and disregards proper analysis, leading to further losses and a vicious cycle of chasing previous deficits.

Ignoring Risk Management:

Effective risk management is paramount in scalping trading strategies. Neglecting risk management principles, such as setting stop-loss orders and proper position sizing, can expose traders to significant financial risks. By overlooking risk management, traders undermine the foundation of their trading endeavors, jeopardizing long-term success and sustainability.