Are you interested in diving into the world of arbitrage trading strategy? In this comprehensive guide, we will explore the ins and outs of this low-risk investment approach. From understanding the types of arbitrage to its benefits, risks, implementation, and real-world applications, this article will equip you with the knowledge to make informed decisions. Discover how arbitrage, a key player in the financial market, can potentially yield consistent profits over time.

Would you like to learn how to leverage arbitrage trading strategy for financial gains? Look no further! This guide is designed to provide you with valuable insights into the world of arbitrage. By delving into the nuances of this strategy, you will gain a deeper understanding of how it works and its potential impact on your investment portfolio. Stay tuned to explore how arbitrage can play a vital role in optimizing your financial performance.

:max_bytes(150000):strip_icc()/GettyImages-1195603075-7e8dc700af47458e9b4f03a91c1397d8.jpg)

Unveiling the World of Arbitrage Trading Strategy

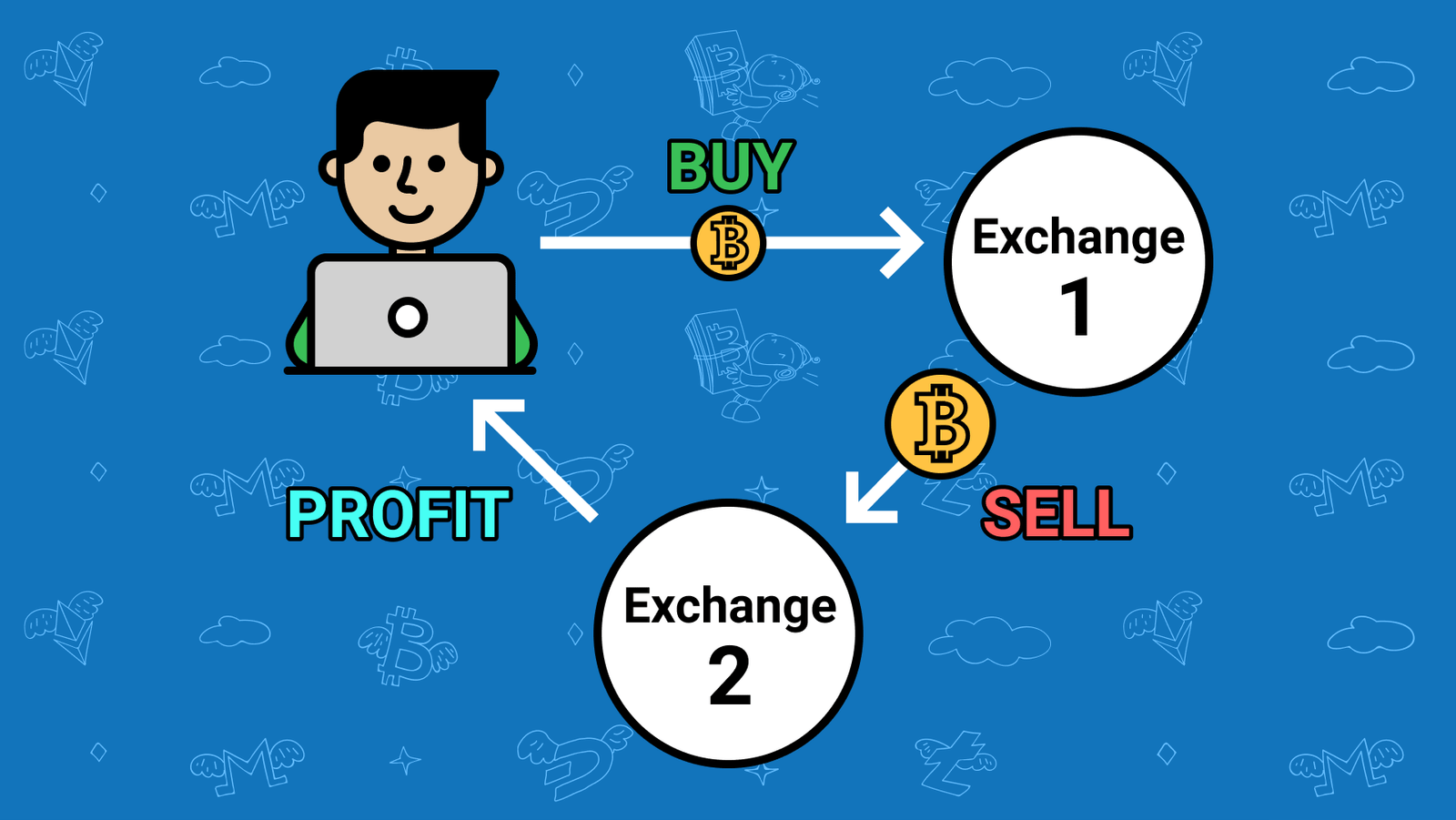

Arbitrage trading strategy, a sophisticated investment approach, revolves around exploiting price variations by simultaneously buying and selling the same asset in different markets. This method is renowned for its low-risk nature, offering the potential for steady and reliable profits. Whether in stocks, bonds, commodities, or currencies, arbitrage presents opportunities across various markets for astute investors.

Mastering the art of arbitrage hinges on the ability to pinpoint price divergences swiftly and execute trades with precision. The essence of successful arbitrage lies in skillfully navigating market inefficiencies and capitalizing on fleeting pricing differentials. By adeptly leveraging these opportunities, investors can harness the power of arbitrage trading strategy to enhance their investment portfolios and attain consistent returns over time.

Exploring the Various Types of Arbitrage

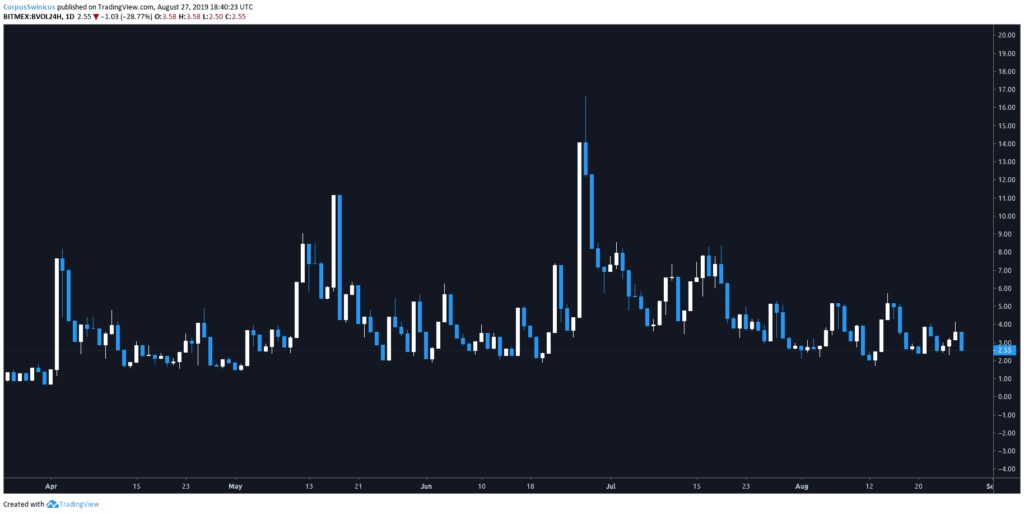

Arbitrage trading strategy offers a plethora of avenues for profit, with spatial, temporal, and statistical arbitrage standing out as key players in the financial landscape. Spatial arbitrage capitalizes on price variations across diverse locations. Temporal arbitrage, on the other hand, exploits price differences over time. Statistical arbitrage harnesses the power of data models to pinpoint and leverage pricing inconsistencies effectively. These distinct types of arbitrage open up diverse opportunities for traders to capitalize on market inefficiencies and generate profits.

In the realm of arbitrage trading strategy, spatial arbitrage presents a unique approach by capitalizing on geographical price differentials. Traders identify opportunities where the same asset is priced differently in various locations, swiftly buying at the lower price and selling at the higher, pocketing the price discrepancy. This type of arbitrage requires keen observation and quick execution to lock in profits before market forces align prices.

Temporal arbitrage shines a spotlight on the element of time in trading. Traders leveraging this strategy focus on exploiting price differences that emerge over distinct time periods. By closely monitoring market trends and timing their transactions strategically, investors can yield profits by purchasing an asset at a lower price and selling it when the price appreciates. This type of arbitrage necessitates a deep understanding of market dynamics and the ability to anticipate price movements accurately.

Statistical arbitrage revolutionizes the landscape of arbitrage trading by integrating complex statistical models into decision-making processes. This type of arbitrage relies on quantitative analysis and mathematical algorithms to identify pricing inconsistencies. Traders using statistical arbitrage analyze vast sets of data to pinpoint patterns and anomalies, enabling them to make informed trading decisions based on statistically significant information. By harnessing the power of data analytics, traders can capitalize on nuanced pricing differentials, enhancing profitability and mitigating risks effectively.

Maximizing Your Returns: Benefits of Arbitrage Trading Strategy

Unlocking the Potential:

Arbitrage trading strategy offers a myriad of advantages, encompassing low risk, steady returns, and portfolio diversification. The beauty of arbitrage lies in its low-risk nature, involving simultaneous buying and selling of the same asset. By exploiting market inefficiencies, this strategy unlocks consistent returns, amplifying your investment performance over time while adding a layer of diversification to your portfolio, mitigating risks effectively. Arbitrage trading strategy emerges as a powerful tool in the arsenal of savvy investors aiming for stability and growth in the financial markets.

Understanding the Risks of Arbitrage Trading Strategy

Engage with caution as Arbitrage trading strategy entails risks that demand careful consideration. The primary peril lies in price instability; the price gap pivotal to your trade may vanish before you act, leading to potential losses if prices shift unfavorably. Furthermore, challenges like execution risk, liquidity challenges, and regulatory uncertainties add layers of complexity, necessitating diligent risk management strategies. Stay cautious, informed, and adaptable in navigating these inherent risks.

Mastering the Implementation of Arbitrage Trading Strategy

Implementing an arbitrage trading strategy requires meticulous planning and swift execution. The process involves various imperative steps, starting with identifying a price inconsistency in the market. This initial step serves as the foundation for exploiting the price gap and realizing profit potential efficiently. The key to successful arbitrage lies in swift and effective trade execution to capitalize on the fleeting market inefficiencies.

Upon pinpointing a price disparity, the next crucial action is to execute your trades promptly and seamlessly. Time is of the essence in arbitrage, as prices can adjust rapidly, eroding potential profits. Efficiency in trade execution is paramount to maximizing gains while the market presents favorable arbitrage opportunities. By acting swiftly and decisively upon identifying price variances, traders can secure profitable outcomes.

Additionally, managing risk is integral to a sound arbitrage trading strategy. Implementing stop-loss orders helps mitigate potential losses by automatically closing positions if the market moves unfavorably. Constant monitoring of trades is vital to ensure that any unexpected fluctuations are promptly addressed. Rigorous risk management practices safeguard investments and help sustain profitability over the long term in the dynamic landscape of arbitrage trading strategy.

By following a structured approach, from identifying price inconsistencies to executing trades promptly and managing risks effectively, traders can enhance their proficiency in implementing arbitrage trading strategies. Strategic decision-making, coupled with agile trading practices and risk management protocols, empowers traders to capitalize on market inefficiencies and optimize their financial performance through arbitrage trading strategies.

Mastering Arbitrage Trading Strategy: Real-world Insights

Arbitrage trading strategy is a common tool among diverse traders, from hedge funds to individual investors, seeking low-risk profits. Renowned arbitrageurs like George Soros, John Meriwether, and David Einhorn have showcased its power. The history of arbitrage is rich with tales of billions in profits, making it a compelling strategy for those looking to optimize their financial gains.

Mastering the Art of Arbitrage Trading Strategy

Arbitrage trading strategy emerges as a potent method, promising sustained profits in the financial realm. Despite its potential for lucrative gains, navigating the associated risks is paramount. Understanding the intricacies of arbitrage equips traders with a versatile tool to enhance their portfolio. By integrating meticulous planning and precise execution, arbitrage can elevate trading practices and financial outcomes, making it an indispensable asset for any trader seeking to optimize their strategies and returns.