Are you looking to enhance your trading skills and optimize your investment strategies? In the world of trading, utilizing take profit orders can be a game-changer. Whether you are a novice or experienced trader, understanding the types, benefits, and potential pitfalls of take profit orders is crucial for maximizing your profits. In this comprehensive guide on take profit orders, we will delve into the various strategies and tips to help you navigate the complexities of the market effectively. Let’s explore the key aspects of setting the right take profit level and unlocking advanced tactics to elevate your trading experience.

Unlocking the Power of Take Profit Orders in Trading

Take profit orders, a fundamental tool in trading, serve as preset commands directing platforms to sell assets once they hit specified price thresholds. These orders act as shields against market volatility, safeguarding profits and curtailing losses effectively. Traders strategically employ these orders to optimize gains and mitigate risks, ensuring a secure exit at desired price levels, either before or after initiating a trade.

Exploring the Variety of Take Profit Orders

Understanding the Diverse Types:

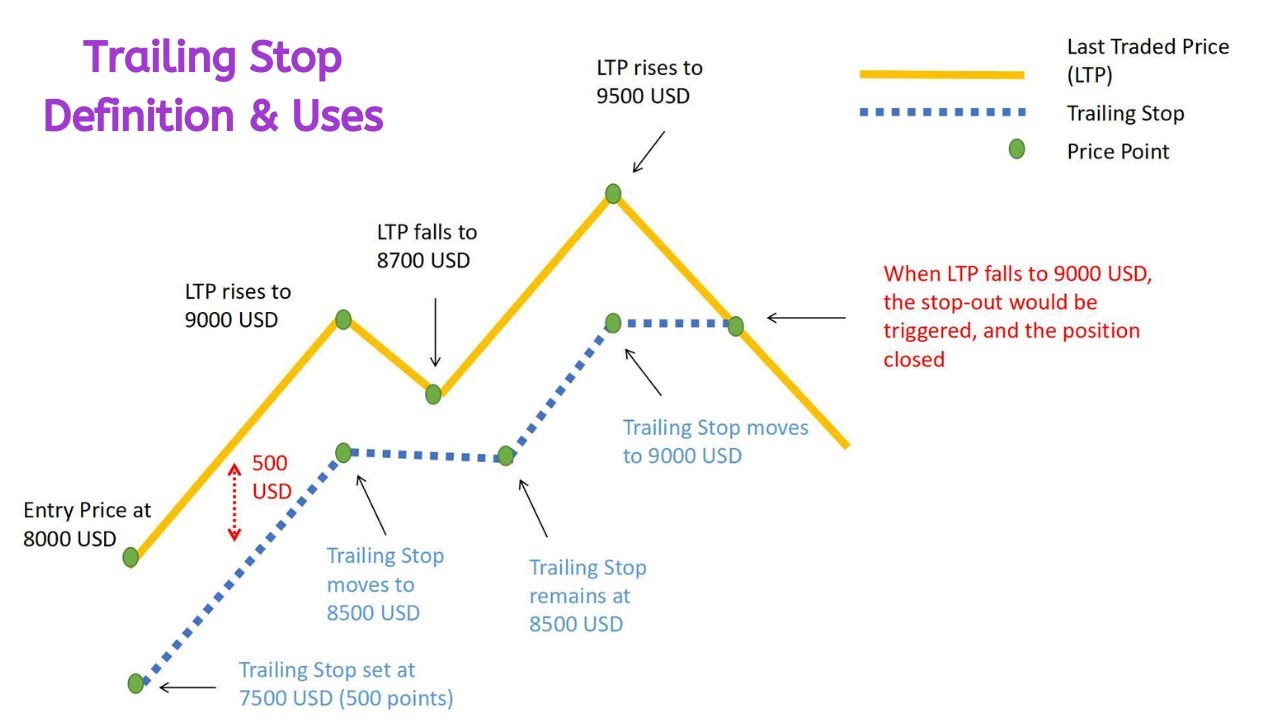

In trading, Limit Orders stand out as techniques where assets are sold at predefined prices. Contrarily, Stop Orders prompt selling an asset upon the price dipping below a set threshold. Additionally, Trailing Stop Orders are strategic by dynamically adjusting stop prices as asset prices favorably fluctuate. These variations empower traders with versatile tools for profit-taking precision.

Diving deeper into trading tactics, Limit Orders grant traders the ability to specify a preferred selling price, ensuring control over profit margins even in volatile markets. On the other hand, Stop Orders act as safeguards, automatically initiating sale when prices dip beyond a predetermined level, aiding in mitigating losses effectively. The dynamic nature of Trailing Stop Orders offers flexibility by adjusting stop prices in line with market fluctuations, securing profits during upward movements while limiting potential losses during downturns.

In the realm of trading strategies, Limit Orders and Stop Orders serve distinct purposes. Limit Orders allow traders to lock in profits at desired levels, while Stop Orders act as protective measures to limit losses. On the contrary, Trailing Stop Orders adapt to market changes, trailing behind the asset’s price movements to secure profits and optimize trade outcomes effectively. Understanding these types is fundamental in crafting a well-rounded trading approach for enhanced profitability.

By incorporating Limit Orders, traders set specific price points for profit-taking, ensuring a disciplined approach to securing gains. Simultaneously, Stop Orders provide an automated exit strategy when assets reach unfavorable price levels, safeguarding against excessive losses. The dynamic feature of Trailing Stop Orders complements trading strategies by dynamically adjusting stop prices in line with market movements, aligning with the trader’s profit objectives seamlessly. Leveraging these diverse types strategically is paramount in optimizing trading outcomes efficiently.

Conclusion:

Embracing the intricacies of Limit Orders, Stop Orders, and Trailing Stop Orders equips traders with a robust arsenal of tools to navigate the complexities of trading effectively. From setting precise profit targets with Limit Orders to protecting investments with Stop Orders and capturing profits during favorable market shifts with Trailing Stop Orders, understanding these types is pivotal for executing strategic trading decisions with confidence and precision. Mastering the nuances of each order type empowers traders to tailor their approach and optimize profits intelligently.

In the realm of trading, knowledge of Limit Orders, Stop Orders, and Trailing Stop Orders is fundamental in building a successful trading foundation. Each type presents unique opportunities for profit-taking and risk management, catering to different market scenarios and trader preferences. By harnessing the potential of these diverse order types, traders can navigate volatile markets, safeguard investments, and capitalize on profitable opportunities with finesse and expertise.

Maximizing Gains and Minimizing Risks with Take Profit Orders

Utilizing take profit orders in trading offers numerous benefits, empowering traders to secure profits effectively. By setting predetermined target prices, traders can automatically lock in gains when the asset reaches the specified level. This strategic approach allows for capitalizing on favorable market movements efficiently, contributing to overall portfolio growth.

Moreover, take profit orders play a pivotal role in risk management by enabling traders to establish predefined exit points to limit potential losses. In case the market turns unexpectedly, these orders act as a protective mechanism, helping traders avoid excessive losses and preserving their capital. This risk mitigation strategy enhances overall trading discipline and financial stability.

An often-overlooked advantage of employing take profit orders is the ability to eliminate emotions from the selling process. By setting clear profit-taking parameters in advance, traders can avoid impulsive decisions driven by fear or greed. This automated selling approach promotes rational and logical trading behavior, leading to consistent and well-thought-out trading decisions.

Additionally, integrating take profit orders into trading strategies allows traders to optimize their time management effectively. With the ability to pre-set their profit targets, traders can execute orders remotely and free themselves from constant monitoring. This automation not only streamlines the trading process but also provides traders with flexibility and the opportunity to engage in other productive activities while their trades are being executed.

In conclusion, the benefits of using take profit orders in trading cannot be overstated. From enhancing profit potential to managing risks, eliminating emotional biases, and saving time, incorporating these orders into your trading toolkit can significantly elevate your trading experience. By leveraging the power of take profit orders, traders can enhance their portfolio performance and achieve greater success in the dynamic world of trading.

Setting the Optimal Take Profit Level

In trading, considering risk tolerance is paramount when establishing a take profit level. Assessing your comfort level with risk aids in defining a suitable profit target aligned with your trading goals. Understanding your risk appetite guides the precision of your take profit strategy, balancing potential gains with acceptable risks.

Analyzing market conditions is a foundational aspect of determining the ideal take profit level. By delving into historical price data and current market trends, traders gain insights into potential price targets. This analysis empowers informed decision-making, allowing traders to tailor their take profit levels to market dynamics effectively.

To ensure the feasibility of your trading objectives, setting realistic targets for take profit orders is crucial. Striking a balance between ambitious profit aspirations and practical market conditions is key. Avoiding overly optimistic or pessimistic profit levels preserves the integrity of your strategy, enhancing the likelihood of achieving your desired outcomes.

Constant vigilance in monitoring market movements is essential for optimizing take profit levels. Regularly tracking the asset’s price fluctuations enables traders to adapt their profit targets in response to evolving market conditions. Dynamic adjustment of take profit levels based on real-time data enhances trading precision and maximizes profit potential.

Implementing Take Profit Orders in Various Trading Strategies

Incorporating take profit orders into diverse trading strategies can significantly impact your trading outcomes. In scalping, exploit quick market movements by strategically placing multiple take profit orders at short intervals, optimizing gains. For swing trading, capitalize on extended market movements by utilizing take profit orders to secure profits at predefined price levels over days or weeks. In trend trading, capitalize on market trends by strategically placing take profit orders at critical support or resistance levels to lock in gains effectively.

Scalping involves grabbing small but frequent profits by employing multiple take profit orders set close to the entry point, enabling traders to capitalize on rapid price fluctuations swiftly.

Swing traders aim for substantial profits over a more extended period by strategically employing take profit orders to capture gains at predetermined price points, aligning with their trading objectives.

Trend trading enthusiasts leverage take profit orders at strategic key levels, such as support and resistance, to ride the market trends effectively. By setting targets at crucial levels, traders can maximize gains and manage risks efficiently.

Common Mistakes to Avoid When Using Take Profit Orders

When it comes to using take profit orders in trading, avoiding common pitfalls is crucial. One significant mistake to steer clear of is not setting a take profit order at all. By skipping this step, traders risk missing out on potential profits or exposing themselves to unnecessary risks by letting emotions drive their decisions.

Another key mistake is setting unrealistic take profit levels. It’s essential to be realistic and avoid setting overly ambitious targets that may not be achievable. Setting achievable goals based on market analysis and understanding is vital for sustainable trading success.

Furthermore, not adjusting take profit levels can lead to missed opportunities or unwanted losses. Failing to monitor market conditions and adjust take profit levels accordingly based on updated information can hinder the effectiveness of your trading strategy.

Additionally, using take profit orders as a substitute for stop-loss orders is a critical error. Take profit orders are intended to secure profits at predefined levels, while stop-loss orders are meant to limit potential losses. Utilizing each order type correctly is essential to managing risk effectively.

Advanced Take Profit Strategies

Trailing Take Profit Orders

Implementing trailing take profit orders allows traders to adapt to market movements by automatically adjusting the take profit level as the asset’s price progresses positively. This strategy locks in profits while giving room for further growth, enhancing the potential returns on a trade. By dynamically trailing the take profit level, traders can optimize their gains in volatile market conditions.

Multiple Take Profit Orders

Diversifying take profit points through multiple orders at various price levels enables traders to capitalize on different stages of a trend. Setting targets at strategic levels helps secure profits incrementally and reduces the impact of sudden market reversals. By spreading take profit orders, traders have the flexibility to benefit from market fluctuations and secure gains more efficiently.

Partial Take Profit Orders

Opting for partial take profit orders involves selling a fraction of the position at predefined levels while keeping the remaining portion in play for additional profit potential. This approach allows traders to secure immediate gains while still participating in the asset’s upward movement. By scaling out of a position gradually, traders manage risk and optimize profit potential effectively.