Understanding Bollinger Bands: A Comprehensive Guide

Are you looking to enhance your trading skills and maximize your profit potential? Dive into the world of Bollinger Bands, a widely-used technical analysis tool in the financial markets. By learning about Bollinger Bands, traders can gain valuable insights into market volatility and crucial entry and exit points. Whether you’re a novice trader or a seasoned investor, understanding Bollinger Bands can be a game-changer in your trading journey.

Delving into Bollinger Bands: A Comprehensive Overview

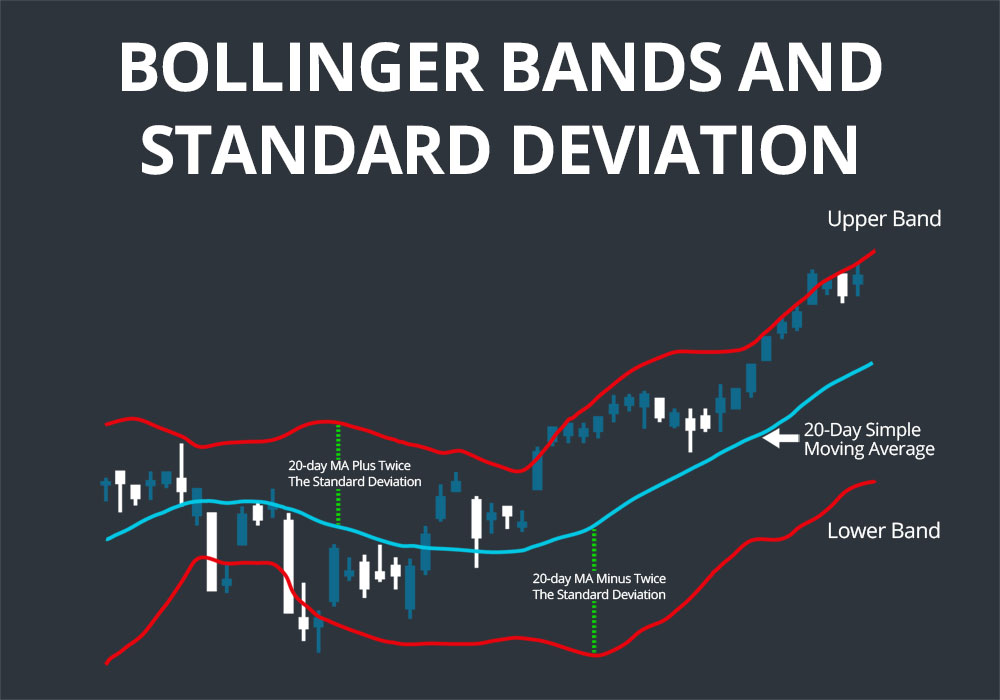

Bollinger Bands stand out as a fundamental technical analysis tool, offering traders a dynamic range linked to a moving average to gauge market volatility effectively. By leveraging the standard deviation of an asset’s price over a defined timeframe, Bollinger Bands delineate upper and lower thresholds, aiding in spotting trading prospects with precision. This unique calculation method, often multiplied by a factor of 2, grants traders key insights into potential price movements.

Understanding the Components of Bollinger Bands

Deciphering the Middle Band

The middle band of Bollinger Bands serves as the foundation, typically calculated as a simple moving average (SMA) or exponential moving average (EMA) of the security’s price. This pivotal component reflects the average price over a particular period, offering a baseline for market movement assessment.

Unveiling the Upper Band

Complementing the middle band is the upper band, derived by adding a specific multiple of the standard deviation to the middle band. This upper threshold indicates potential overbought conditions, signaling a probable reversal in the market trend, prompting traders to consider their positions and strategies diligently.

Revealing the Lower Band

Conversely, the lower band is constructed by subtracting a designated multiple of the standard deviation from the middle band. This lower boundary helps identify potential oversold scenarios, implying a potential market upturn, crucial for traders to make informed decisions on entries and exits.

Interpreting Bollinger Bands

Deciphering Trading Signals

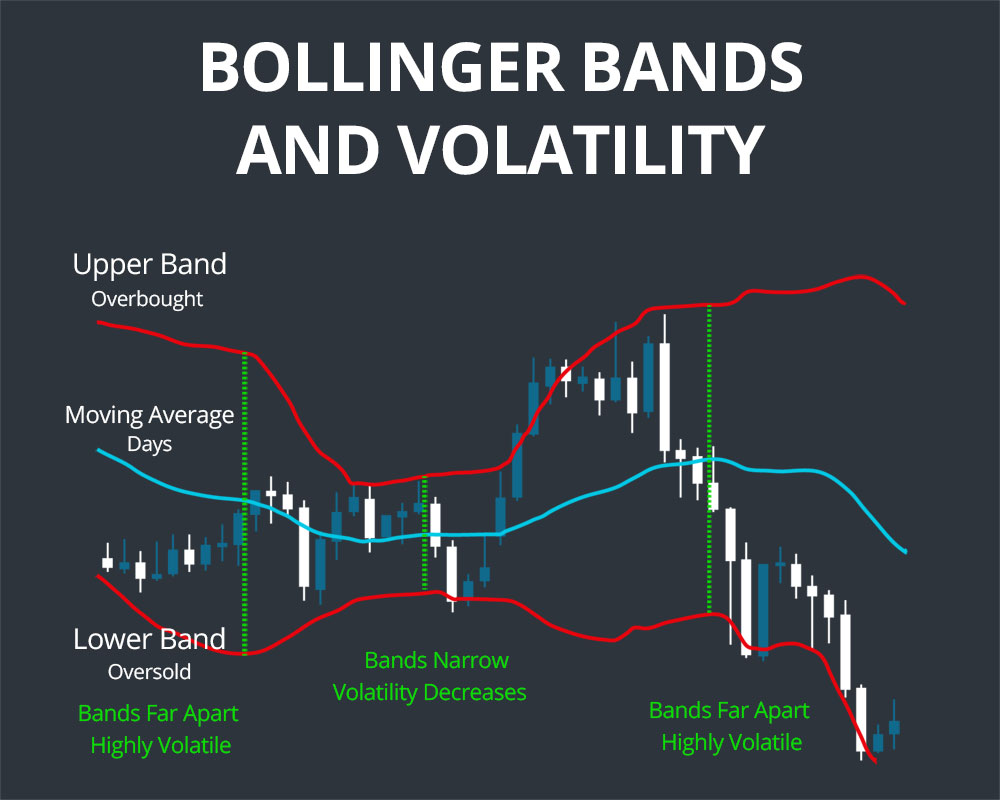

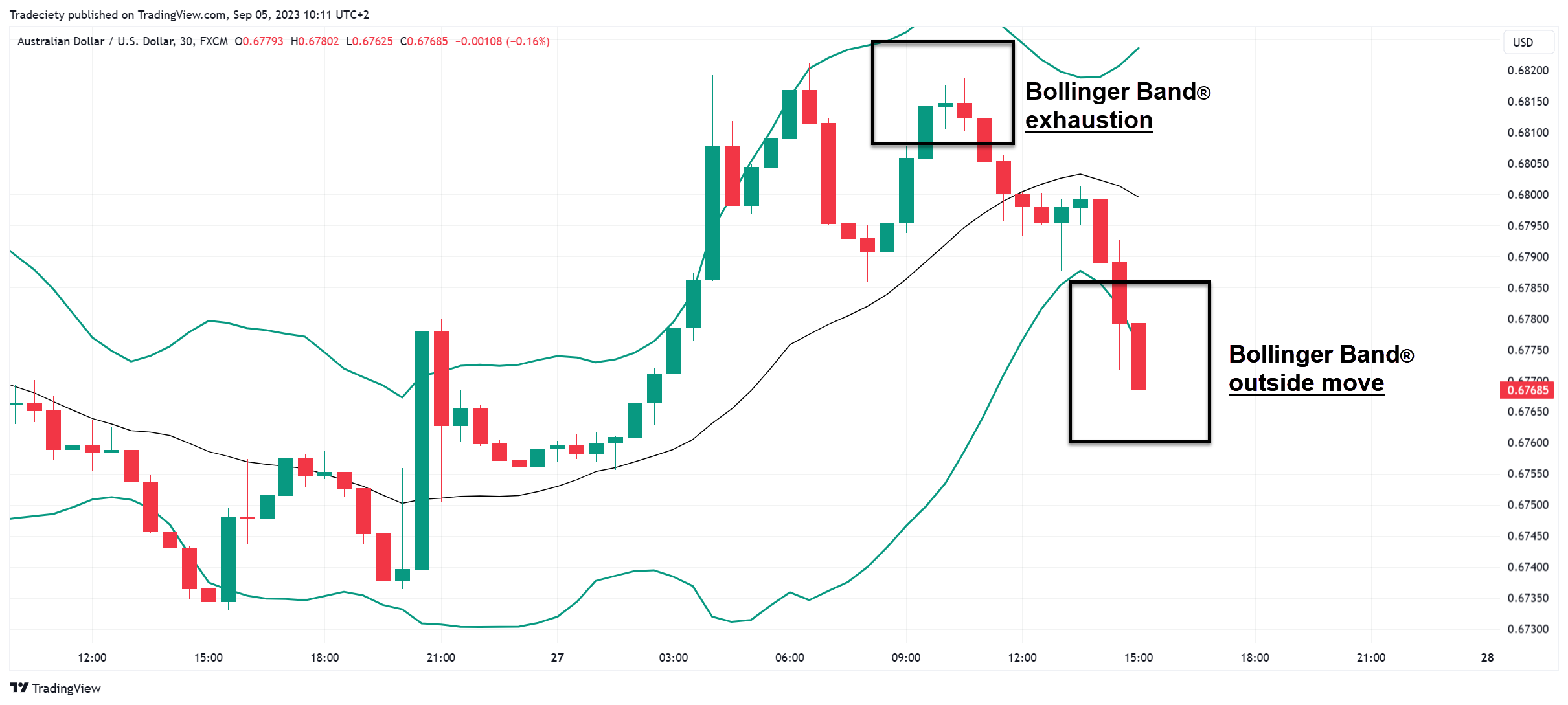

Interpreting Bollinger Bands involves recognizing crucial trading signals. When prices breach the upper band, indicating overbought conditions, traders might consider selling to capitalize on potential price corrections. Conversely, prices dipping below the lower band signal oversold conditions, suggesting buying opportunities. Staying within the bands hints at a neutral or range-bound market, highlighting stability in price movements.

By understanding the dynamics of Bollinger Bands, traders can discern valuable insights into market conditions and potential price movements. These signals provide a framework for making informed trading decisions, guiding traders on when to enter or exit positions effectively. Incorporating this analysis into trading strategies can enhance decision-making processes, ultimately leading to improved trading outcomes.

Leveraging Bollinger Bands for Trading Success

Identifying Trading Opportunities

Utilize Bollinger Bands to pinpoint potential trading prospects through breakout or pullback signals. When prices breach the bands, it signals volatility, aiding traders in spotting entry and exit points with precision. This dynamic tool enhances decision-making in ever-changing market conditions.

Recognizing Support and Resistance Levels

Bollinger Bands excel in highlighting crucial support and resistance levels. When prices hug the bands, it indicates strong support or resistance, guiding traders in making informed decisions. These levels act as key reference points for setting stop-loss and take-profit orders effectively.

Enhancing Trading Strategies

Integrating Bollinger Bands with other technical indicators elevates trading strategies. By combining indicators like Relative Strength Index (RSI) or Moving Averages, traders can validate signals and strengthen their positions. This synergy offers a comprehensive approach to market analysis, enhancing the probability of successful trades.

Understanding the Limitations of Bollinger Bands

Imperfect Nature of Bollinger Bands

Bollinger Bands, while powerful, are not flawless. Like any tool, they can produce false signals, leading traders astray. Being aware of this limitation is crucial to avoid misinterpretations that could impact trading outcomes significantly.

Complementary Indicator Usage

To mitigate the risks associated with false signals, it’s advisable to use Bollinger Bands in tandem with other technical indicators. This approach can provide a more comprehensive view of the market, enhancing decision-making accuracy.

Supplementary Decision Support

Relying solely on Bollinger Bands for trading decisions is not recommended. They should act as part of a broader toolkit, supplementing other analyses and insights to form a well-rounded strategy. Integrating various tools can help validate signals and improve overall trading precision.

Customizing Bollinger Bands

Enhancing Precision with Bollinger Bands Customization

Customizing Bollinger Bands allows traders to tailor settings to specific market conditions. Adjusting the moving average period refines the middle band’s sensitivity to price movements. Modifying the standard deviation count impacts the bands’ width, aiding in capturing price volatility accurately. This personalized approach enhances trading strategies, adapting Bollinger Bands to various securities like stocks, forex pairs, and commodities effectively.

Adapting Band Settings for Diverse Assets

Flexibility in customizing Bollinger Bands empowers traders to cater to the unique characteristics of different financial instruments. By fine-tuning the moving average period and standard deviation multiplier, traders can align the indicator with the volatility levels and trading patterns of specific assets. This adaptability enhances accuracy in identifying potential entry and exit points across a broad range of securities, contributing to more informed trading decisions.

Customization for Strategic Trading Insights

Tailoring Bollinger Bands parameters offers a strategic advantage by enabling traders to refine their analytical approach. Adjustments to the bands’ settings provide nuanced signals that align with specific trading styles and objectives. Whether seeking short-term opportunities in volatile markets or long-term trends in stable assets, customizing Bollinger Bands optimizes the tool’s effectiveness in generating relevant trading insights. This customization fosters a more precise and actionable trading strategy, enhancing overall performance and risk management.

Advanced Bollinger Band Techniques

Unveiling Breakout Opportunities with Bollinger Band Squeezes

Bollinger Bands unveil powerful signals through squeezes, indicating impending breakouts. When the bands contract, signaling low volatility, traders anticipate significant price movements. Recognizing these squeezes equips traders with vital information for potential breakout entry points, enhancing trading precision.

Gauge Market Volatility with Bollinger Band Width

The Bollinger Band width, calculated by the variance between the upper and lower bands, serves as a reliable indicator of market volatility. Wider bands denote heightened volatility, signaling increased price fluctuation and potential trading opportunities. Understanding and monitoring band width assists traders in adapting to changing market conditions effectively.

Identifying Overbought or Oversold Conditions with Bollinger Band Percentage

By configuring the Bollinger Band percentage, traders discern overbought or oversold scenarios, facilitating strategic decision-making. When prices extend beyond the bands, indicating extreme levels, traders can anticipate potential reversals. This insightful metric enhances traders’ ability to identify optimal entry and exit points with precision.