Learn about the importance of candlestick patterns in analyzing market behavior and making informed trading decisions. Dive into the world of Candlestick Patterns to understand how these visual representations can help identify trends, predict market movements, and maximize trading opportunities. Expanding your knowledge on bullish, bearish, reversal, and continuation patterns is crucial for any trader looking to enhance their analytical skills and achieve success in the financial markets.

Unveiling the Power of Candlestick Patterns in Market Analysis

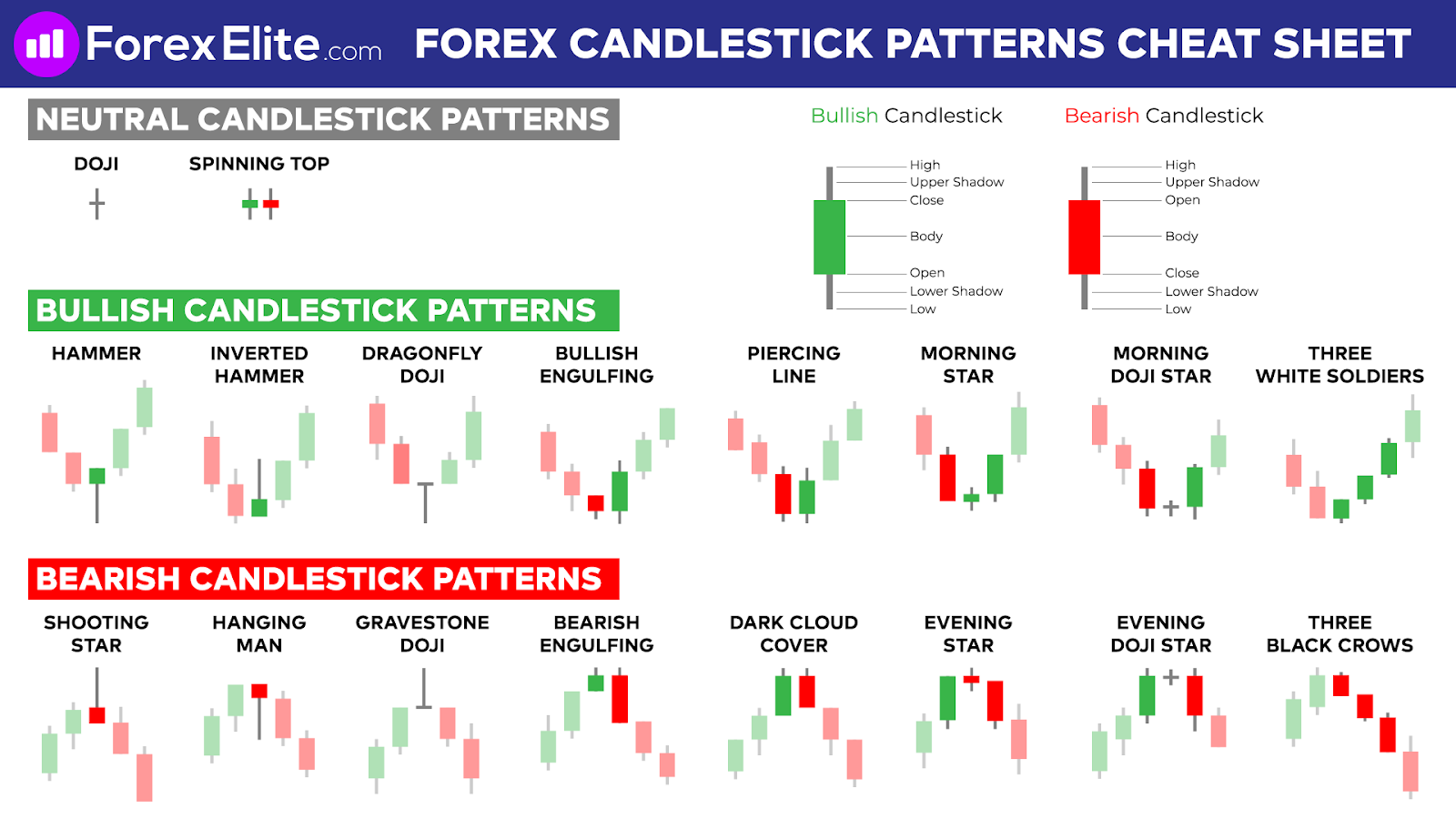

Candlestick patterns act as visual depictions of price movements within a defined timeframe. Through these patterns, traders gain valuable insights into market sentiment, momentum, and potential price directions. By mastering the art of analyzing candlestick formations, traders stand poised to spot lucrative trading prospects and execute well-informed decisions. These candlesticks include a body, either solid or hollow, accompanied by wicks extending from the top and bottom.

Understanding Bullish Candlestick Patterns: Signs of Market Strength

Bullish candlestick patterns serve as compelling signals of market strength, hinting at potential uptrends or reversals. Notable patterns like the Hammer, Bullish Engulfing, and Piercing Line exhibit buyer dominance and heightened buying pressure, signaling favorable market conditions. Traders keen on spotting these patterns leverage them to pinpoint entry opportunities or confirm existing upward trends, enhancing their decision-making process significantly.

Understanding Bearish Candlestick Patterns: Signals of Market Weakness

Exploring Market Weakness Indicators

Bearish candlestick patterns are crucial market signals indicating a potential downward trend or reversal. Traders keen on technical analysis recognize the significance of patterns like Hanging Man, Bearish Engulfing, and Dark Cloud Cover. These formations typically unveil seller dominance, showcasing heightened selling pressure in the market environment.

Significance of Seller Dominance

When bearish patterns emerge, they spotlight the prevailing influence of sellers, often portraying a sentiment shift towards negativity. Traders strategically leverage these patterns to pinpoint potential exit points or anticipate an impending trend reversal. The ability to interpret these signals equips traders with a tactical edge in navigating market uncertainties and optimizing trading decisions.

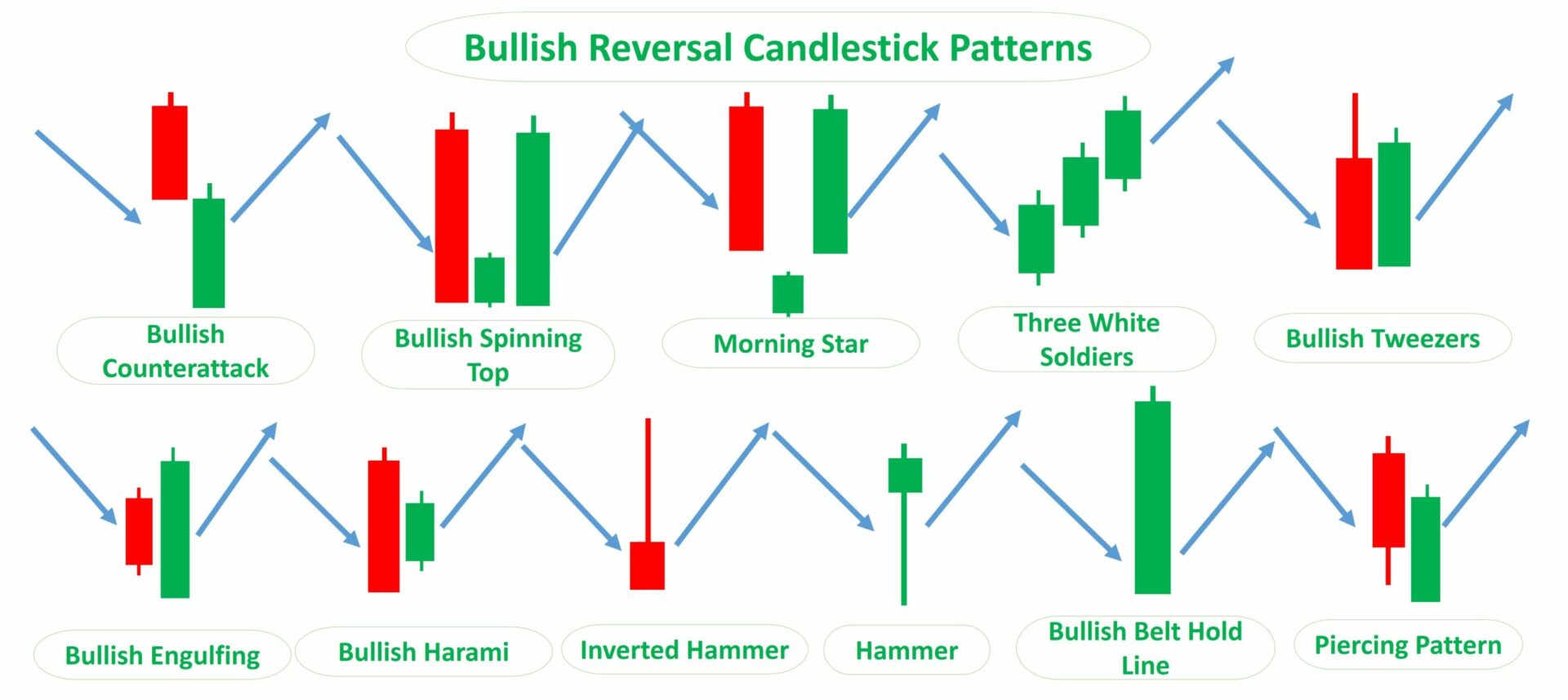

Unveiling Reversal Candlestick Patterns: Identifying Turning Points

Reversal candlestick patterns act as precursors of substantial market sentiment shifts. Major patterns like Doji, Three White Soldiers, and Three Black Crows hint at possible trend reversals, offering crucial insights for traders seeking to grasp market dynamics. By deploying these patterns, traders can anticipate and capitalize on potential trend changes, enhancing their decision-making process and trading strategies effectively.

Exploring Continuation Candlestick Patterns for Market Behavior Confirmation

Continuation candlestick patterns serve as vital indicators of sustaining the ongoing market trends. These patterns, such as the Three Inside Up/Down, Rising/Falling Three Methods, and Flag/Pennant, highlight the likelihood of the current trend persisting. They offer traders valuable confirmation, enabling them to fine-tune their trading strategies for optimal results. Identifying these patterns empowers traders to capitalize on trend continuation opportunities effectively.

Mastering Enhanced Analysis with Combined Candlestick Patterns

Enhance Market Insight with Multiple Candlestick Patterns

Integrating various candlestick patterns offers a holistic view of market sentiment, enhancing analysis accuracy. By combining patterns such as Doji, Hammer, and Engulfing, traders can gain deeper insights into potential market movements.

Identifying Reversal Zones Through Pattern Integration

When bullish patterns like Morning Star coincide with bearish signals like Hanging Man, traders can pinpoint potential reversal areas. This amalgamation aids in anticipating trend shifts and making well-timed trading decisions.

Confirming Trend Changes with Combined Patterns

Merging reversal patterns like Dark Cloud Cover with continuation signals like Rising Three Methods can validate trend reversals. Understanding how these patterns interact enables traders to validate trends accurately.

Informed Decision-Making Through Pattern Synergy

By grasping the interplay between various candlestick patterns, traders can navigate volatility and market uncertainties effectively. This comprehensive analysis approach empowers traders to execute well-informed decisions backed by robust market insights.

Understanding the Limitations and Cautions of Candlestick Patterns

While Candlestick Patterns Market Behavior offers valuable insights, reliance solely on them can be risky. Price movements are impacted by various external factors beyond patterns. To mitigate risks, traders should complement candlestick analysis with other indicators like Moving Averages or RSI. Relying solely on candlesticks may result in misleading signals, emphasizing the need for a well-rounded analytical approach.