As an experienced SEO writer, your task is to write the opening two paragraphs in English for an article titled “A Comprehensive Guide to Understanding Economic Calendars: Key Indicators & Strategies.” This article targets the keyword Economic Calendar. The meta description for this article is:

Explore the importance of economic calendars, key indicators, market reactions, trading strategies, customization options, reliability, and additional features in this comprehensive guide.

The opening paragraph should be designed to capture the reader’s attention and encourage them to continue reading the article. Use the meta description as a guide to determine what information should be included in the opening paragraph. Each paragraph should not exceed 200 characters.

When writing the opening paragraph, make sure to adhere to the following writing guidelines:

– Intent: To educate and inform traders and investors about the significance of economic calendars and how to leverage them for successful trading.

– Style: Informative and educational

– Tone: Professional and informative

Also, be sure to include the keyword Economic Calendar in one of the paragraphs. Additionally, provide some background or context about the article topic to help readers understand what they will be reading about.

Understanding Economic Calendars: A Comprehensive Guide

Economic calendars serve as vital tools offering a structured overview of forthcoming economic events and data publications. These events hold immense power to influence financial markets, currencies, and trading choices. Remaining abreast of these scheduled events enables traders and investors to proactively adapt strategies and make well-informed decisions promptly. These calendars feature essential details like event dates, timings, impacted currency or asset classes, and predicted market impacts, facilitating informed decision-making.

Key Economic Indicators and Their Importance

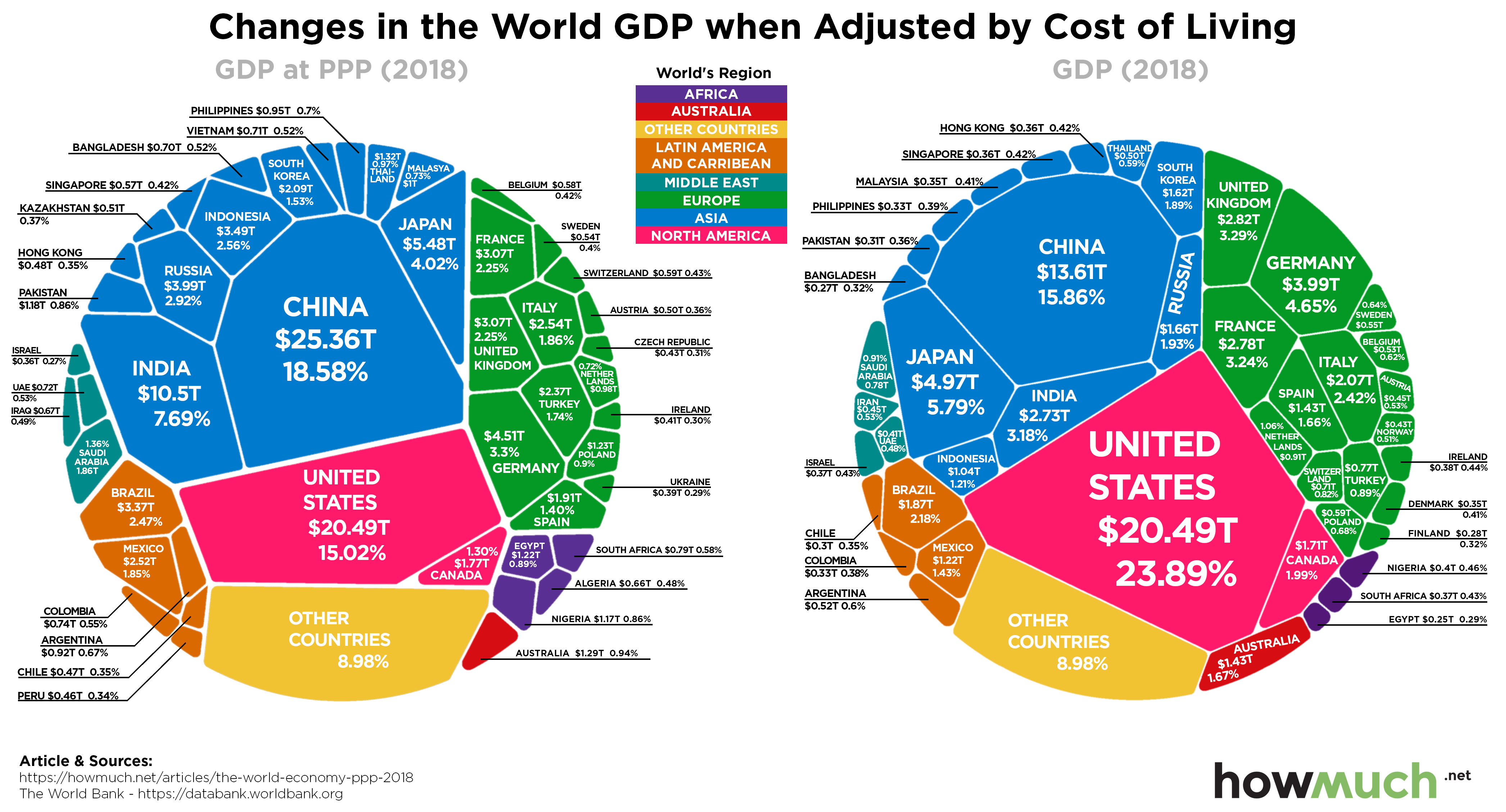

Economic calendars play a vital role in presenting essential economic indicators like GDP, inflation, unemployment rates, and interest rate decisions. These indicators serve as barometers for a nation’s economic well-being, shaping market sentiments significantly. By comprehending the implications of each indicator, traders can effectively gauge event importance and anticipate market reactions. For instance, robust GDP growth signifies economic upturn, whereas escalating inflation levels may foreshadow increased market turbulence.

Immersing oneself in the nuances of economic indicators on the calendar is akin to deciphering the language of the financial markets. GDP, the broadest measure of economic activity, acts as a pivotal indicator reflecting a country’s overall economic performance. Inflation, a measure of rising prices, impacts consumer purchasing power, affecting investment decisions. Unemployment rates signal labor market conditions, influencing consumer confidence and spending patterns. Lastly, interest rate decisions by central banks have far-reaching implications on borrowing costs and economic activity.

Diving deeper into the significance of economic indicators reveals a treasure trove of information for traders and investors. These indicators form the foundation for making informed decisions in the financial realm, guiding market participants in navigating through uncertainties. By leveraging economic calendars to monitor these key indicators, individuals can gain a competitive edge in anticipating market movements and adapting their strategies accordingly. Understanding the language of economic indicators is a critical skill for prospering in the dynamic landscape of financial markets.

Understanding Economic Data and Market Reactions

Economic data releases are pivotal as they can trigger market movements based on how the actual figures deviate from forecasts. Positive surprises, such as surpassing expectations, typically uplift currencies and drive stock market gains. Conversely, negative surprises, where data falls short of predictions, can instigate market downturns and devaluate currencies. It’s imperative for traders to meticulously follow economic data and comprehend market responses to diverse outcomes for informed decision-making.

Leveraging Economic Calendars for Enhanced Trading Strategies

Economic calendars are invaluable tools for traders, enabling them to pinpoint potential trading prospects. Anticipating market responses to critical events allows traders to strategically position themselves. For instance, a trader might opt to purchase a currency ahead of a favorable GDP disclosure or offload a stock before an adverse interest rate declaration. Nonetheless, traders must also factor in additional market variables and implement sound risk management approaches to optimize their trading decisions.

Customization and Filtering Options

Economic calendars provide vital customization tools empowering users to align information with their unique requirements. By enabling filters based on country, currency, asset class, or impact level, traders and investors can hone in on events crucial to their investment strategies. Furthermore, access to historical data and interactive charts equips individuals to conduct in-depth analyses, enhancing decision-making based on past market behaviors.

Ensuring Reliable and Accurate Economic Data

When it comes to economic calendars, reliability hinges on the credibility of information sources. Trustworthy calendars obtain data directly from official institutions like government agencies and central banks, ensuring accuracy. To bolster precision, cross-referencing data from various calendars is advisable, mitigating the chances of discrepancies. Traders must stay vigilant for possible delays or revisions in economic data releases to make informed decisions.

Additional Features and Resources

Economic calendars go beyond event schedules; they can be enriched with news feeds, market analysis, and expert commentary. These resources elevate trading by offering context and insights beyond raw data. Subscriptions to email or mobile alerts keep traders informed on crucial economic events, aiding in timely decision-making within volatile markets. Leveraging these features is key to staying ahead in dynamic trading environments.