Understanding Monetary Policy: The Basics

Are you curious about how governments manage their economies? Dive into the world of monetary policy, where central banks use various tools to control the supply of money, interest rates, and ultimately influence economic activity. In this article, we will explore the fundamentals of monetary policy, its impact on inflation, interest rates, and economic growth, as well as its intricate relationship with fiscal policy. Whether you’re a novice or an expert in economics, understanding the nuances of monetary policy is crucial in comprehending how countries navigate financial stability and growth. Let’s unravel the complexities of Monetary Policy together.

Unraveling the Essence of Monetary Policy Basics

Monetary policy serves as the cornerstone of economic management, orchestrated by central banks to wield influence over an economy’s money supply and interest rates. In essence, it’s the strategic orchestration of money and credit within a financial system, regulating their availability and cost. The ultimate aim? To ensure price stability, foster robust economic growth, and bolster employment opportunities. Monetary policy Basics, therefore, underpins the very fabric of a nation’s economic stability and prosperity.

Exploring the Central Bank’s Toolbox: Monetary Policy Tools

Central banks wield a diverse arsenal of tools to steer monetary policy, shaping economic landscapes with precision. Open market operations, a pivotal strategy, involve the strategic exchange of government securities to manipulate the money supply, thereby regulating economic activity. Furthermore, reserve requirements play a strategic role in determining the cash reserves banks must maintain, intricately molding the availability of credit for borrowers. This orchestration of tools showcases the finesse required in guiding monetary policy towards desired outcomes.

Open Market Operations: A Strategic Maneuver

Within the central bank’s toolkit lies the intricate mechanism of open market operations. By engaging in the buying and selling of government securities, central banks exert direct influence over the money supply. Purchases inject liquidity into the financial system, fostering economic growth, while sales curb excess money circulation to tame inflationary pressures. This delicate balancing act underscores the nuanced approach central banks adopt in sculpting economic trajectories.

Reserve Requirements: Shaping Financial Landscapes

Reserve requirements form another cornerstone of a central bank’s toolkit. By stipulating the proportion of deposits banks must maintain as cash reserves, central banks wield significant control over lending capacities. Adjustments in reserve requirements can either stimulate or dampen lending activities, modulating the overall availability of credit in the economy. This essential tool underscores the pivotal role central banks play in regulating financial stability and economic growth.

In summary, the array of tools at a central bank’s disposal underscores the meticulous planning and precision required to navigate the intricate realm of monetary policy. From open market operations to reserve requirements, each tool plays a crucial role in sculpting economic outcomes, reflecting the central bank’s pivotal mandate in fostering sustainable financial stability and growth.

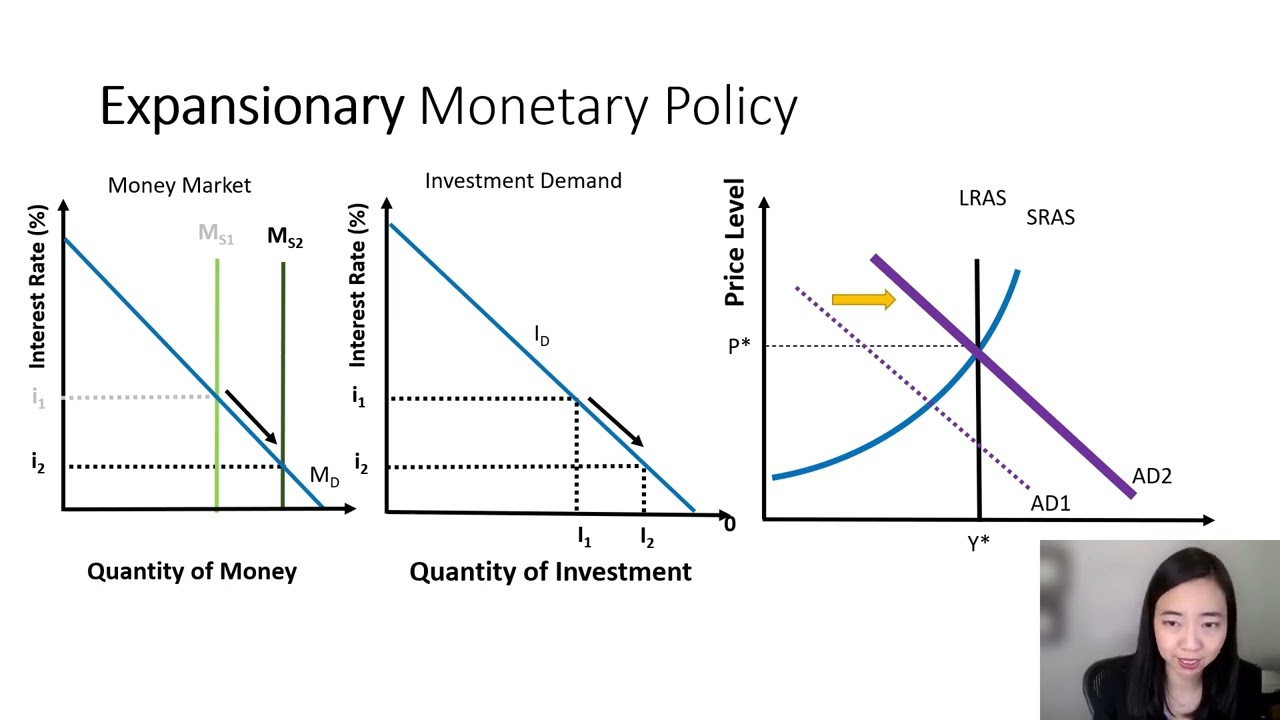

Balancing Act: Navigating Expansionary and Contractionary Monetary Policies

In the realm of monetary policy, two contradictory yet vital strategies emerge: Expansionary and Contractionary Monetary Policy. The former, characterized by an uptick in the money supply and a dip in interest rates, aims to invigorate economic growth and counteract downturns. Conversely, Contractionary Monetary Policy focuses on restraining inflation and mitigating overactive economic conditions by tightening the money supply and escalating interest rates. Striking a balance between these approaches is paramount in steering an economy towards stability and prosperity. By deftly employing Expansionary and Contractionary tools, central banks orchestrate a delicate dance to manage fluctuations and uphold economic equilibrium. Achieving this balance is akin to navigating a ship through turbulent waters, requiring precision, foresight, and adaptability. As the economic landscape evolves, the interplay between Expansionary and Contractionary Monetary Policies remains a cornerstone of economic governance, showcasing the nuanced art of managing financial cycles.

Evolution of Monetary Policy in the Digital Era

In the ever-evolving landscape of finance, cryptocurrencies and fintech present novel hurdles for traditional monetary policy frameworks. The decentralized nature of cryptocurrencies challenges the control over money supply and regulation. Central banks are adapting by exploring digital currencies, assessing their implications for policy execution. This shift towards digitalization demands innovative strategies to uphold financial stability and drive economic progress. The synergy of technology and monetary policy is shaping a new era of economic governance.

The Interplay of Fiscal and Monetary Policy: A Delicate Dance

Fiscal policy, encompassing government spending and taxation decisions, intertwines with monetary policy in shaping economic dynamics. This interaction influences inflation, interest rates, and overall economic health, illustrating the vital coordination required for sustainable growth.

Effective collaboration between fiscal and monetary authorities is imperative to prevent contradictory measures and enhance the impact of their strategies. Alignment in objectives and strategies facilitates a harmonized approach, fostering economic resilience.

A balanced blend of fiscal and monetary policies is essential for fostering economic stability and fostering growth. Through synchronized efforts, governments can mitigate economic fluctuations, stimulate investment, and create an environment conducive to sustainable development. This delicate dance is pivotal in steering economies towards prosperity and resilience.