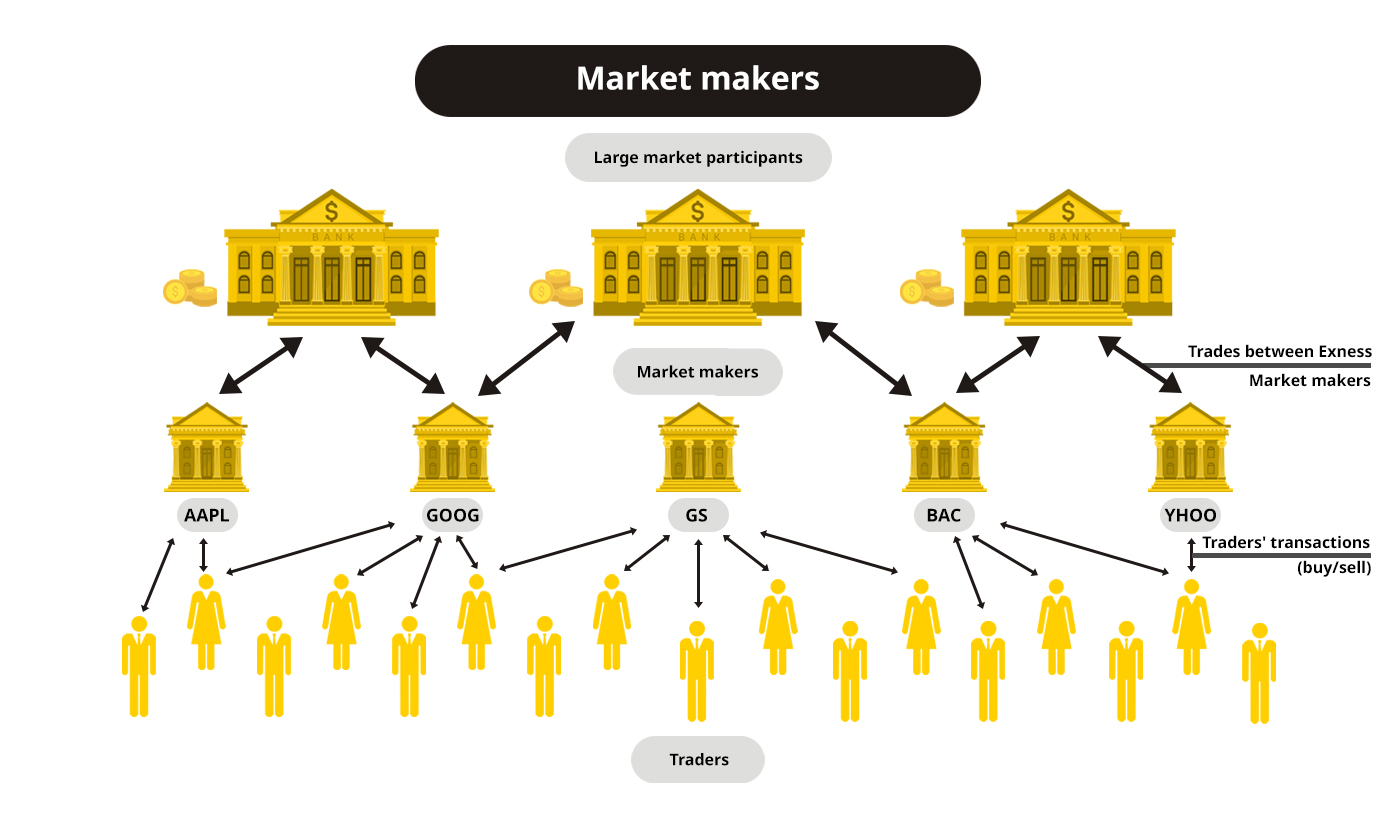

Market makers play a crucial role in the financial markets, yet their significance is often overlooked. These unsung heroes are responsible for maintaining liquidity and price stability by facilitating the buying and selling of financial instruments. Understanding Market Makers sheds light on the types, actions, benefits, and risks associated with these key players. By delving into their functions, readers can grasp how market makers contribute to the efficiency and reliability of trading processes, ultimately shaping the dynamics of the market.

Unveiling the Role of Market Makers in Financial Markets

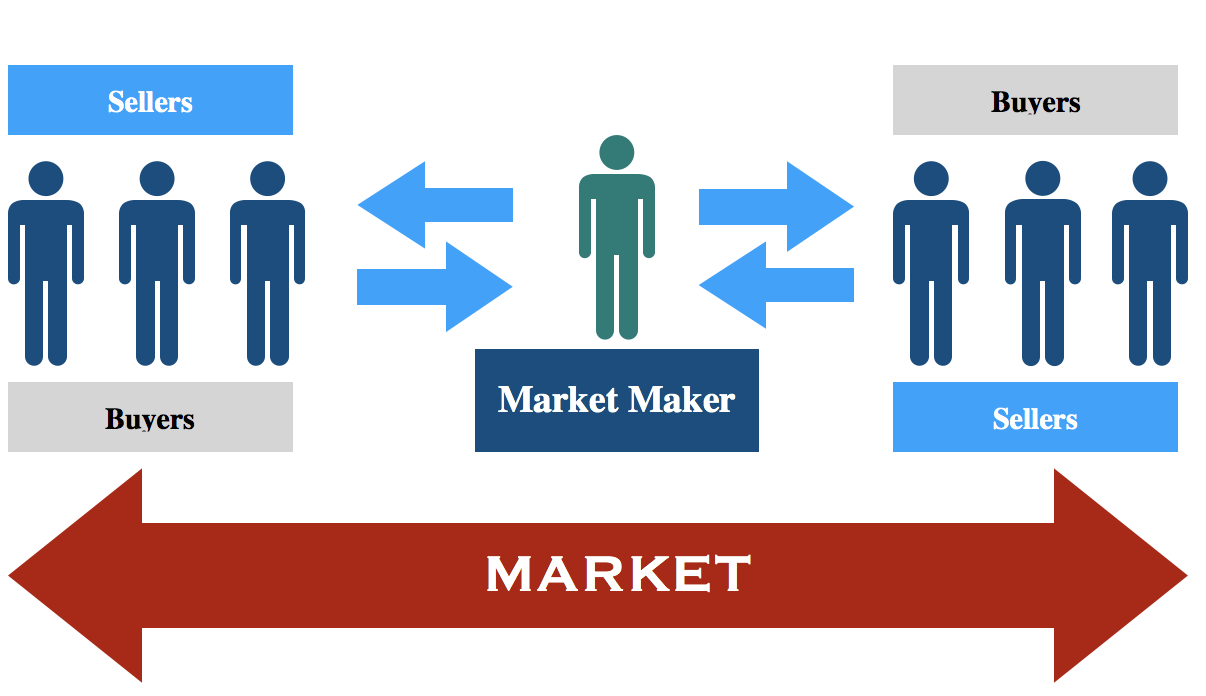

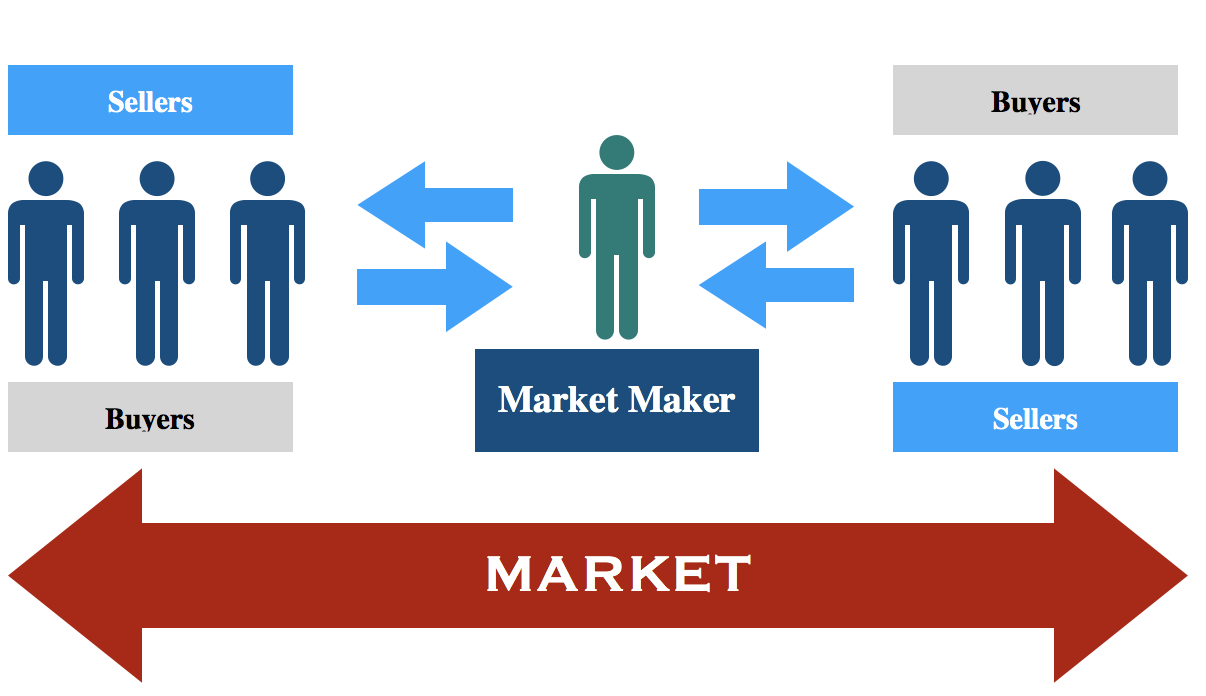

Market makers in financial markets are indeed the unsung heroes who form the backbone of trading activities. Their pivotal role lies in offering liquidity and enabling seamless transactions by providing continuous bid and ask prices for various securities. This proactive quoting mechanism ensures that buyers and sellers can execute trades swiftly and without significant price fluctuations.

Moreover, market makers play a crucial part in enhancing market stability by shouldering the risk of inventory holding. By committing to buy and sell securities, they mitigate volatility, fostering a more predictable trading environment. The compensation for this risk-taking comes from the bid-ask spread, the difference in prices at which they are willing to trade. This spread acts as their revenue stream, incentivizing them to maintain orderly markets.

In essence, market makers in financial markets are the cornerstone of efficiency and stability. Their dedication to liquidity provision, risk management, and price transparency elevates market functionality, making them indispensable entities that keep the financial ecosystem vibrant and orderly. Through their intricate operations, market makers subtly orchestrate the fluidity of trading, embodying the essence of reliability in the often turbulent world of finance.

-proprietary-trading-firms-Colorado.jpg)

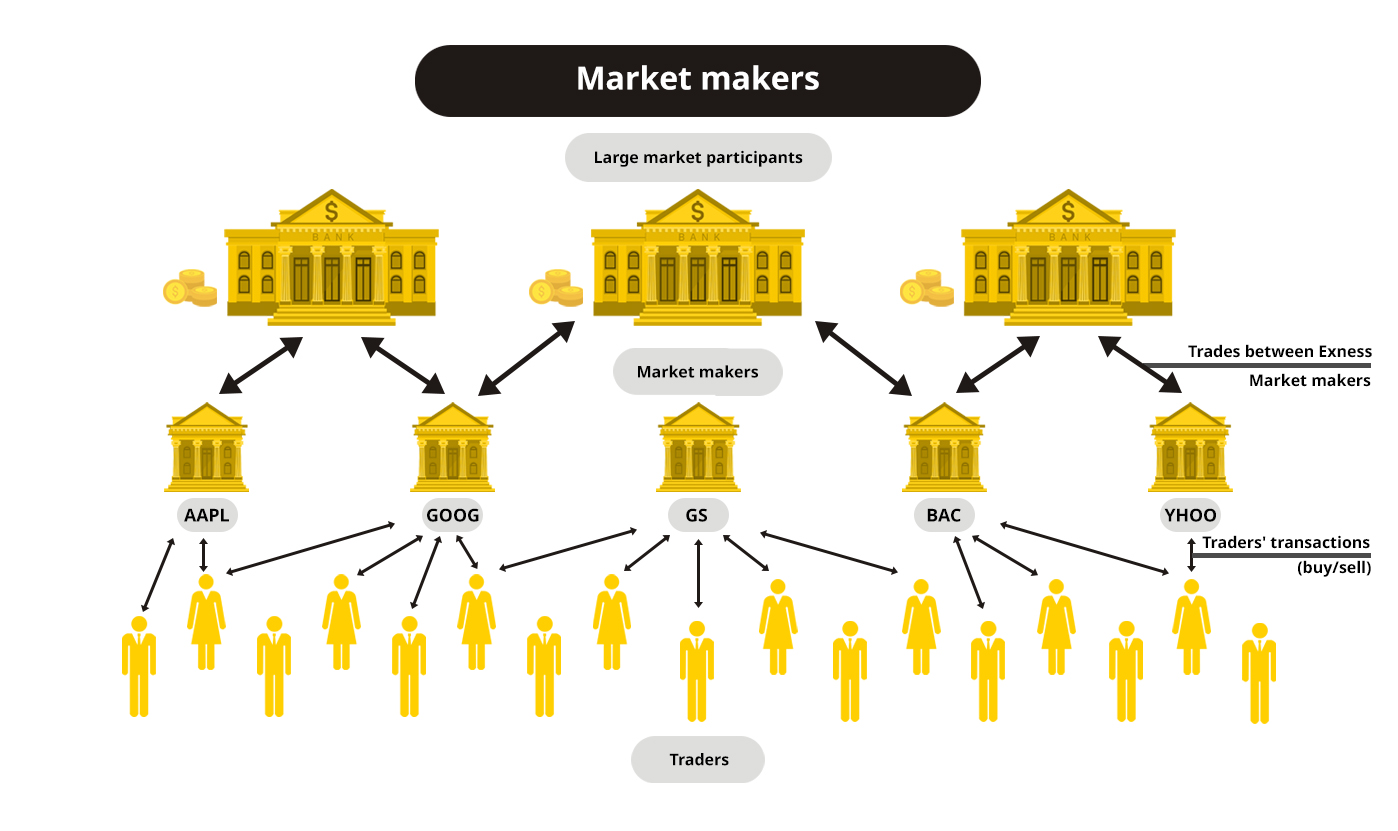

Exploring the Diverse Landscape of Market Makers

Proprietary Trading Firms: A World of Independence and Innovation

Proprietary trading firms stand out as independent market makers engaging in trading activities solely for their benefit. These firms heavily rely on cutting-edge algorithms and advanced technology to execute trades swiftly and capitalize on market inefficiencies. Their autonomy and strategic approach contribute significantly to market liquidity and efficiency.

Designated Market Makers (DMMs): Guardians of Regulatory Compliance

Designated market makers, appointed by exchanges, play a pivotal role in ensuring liquidity for specific securities. Subject to stringent regulatory oversight, DMMs operate within defined guidelines to maintain orderly markets and uphold investor confidence. Their presence fosters stability and confidence by providing continuous bid and ask prices.

Electronic Market Makers (EMMs): The Era of Automation and Precision

Emerging as key players in modern markets, Electronic Market Makers revolutionize trading with automated systems. Utilizing sophisticated algorithms, EMMs quote prices and execute trades swiftly, reducing human involvement. Their efficiency in price formation and order execution enhances market liquidity while minimizing transaction costs for participants.

High-Frequency Traders (HFTs): Pioneers of Speed and Precision

High-frequency traders are a specialized category of market makers known for their lightning-fast trading strategies. Leveraging ultra-fast algorithms and advanced infrastructure, HFTs capitalize on tiny price differentials across markets to generate profits. Despite controversy, their role in enhancing market liquidity and price efficiency cannot be overlooked.

Incorporating these distinct types of market makers into financial ecosystems brings depth and diversity, enriching market dynamics and ensuring robust liquidity for traders and investors alike.

The Crucial Role of Market Makers in Financial Markets

Enhancing Liquidity

Market Makers in Financial Markets play a pivotal role in enhancing liquidity by consistently participating in trading activities. Their continuous presence ensures a smooth flow of transactions by providing both buying and selling opportunities, thereby maintaining a vibrant and active market for various financial instruments. This constant availability of counterparties fosters market liquidity, benefiting traders and investors alike.

Improving Trading Efficiency

Market Makers streamline trading processes by offering prompt execution of trades at competitive prices. Through their market-making activities, they reduce the time and complexity required to match buyers with sellers, enhancing the overall efficiency of markets. This efficiency not only saves time for market participants but also facilitates quick and seamless transactions, contributing to a more dynamic trading landscape.

Ensuring Market Stability

One of the critical contributions of Market Makers in Financial Markets is their role in ensuring market stability. By absorbing order imbalances and stepping in to facilitate trades, they help prevent drastic price fluctuations and maintain market equilibrium. This stabilizing effect is essential in mitigating sudden shocks and maintaining a balanced market environment, instilling confidence in market participants and investors.

Fostering Competition and Transparency

Market Makers promote healthy competition and enhance market transparency by actively quoting prices and displaying their trading intentions. This practice creates a more competitive landscape where traders can make informed decisions based on real-time market data. The transparency offered by Market Makers encourages fair pricing mechanisms, reduces information asymmetry, and cultivates a trustworthy and efficient market ecosystem.

Mitigating Risks in Market Making: Handling Market Volatility and Regulatory Oversight

Market Makers in Financial Markets shoulder the burden of potential losses when market movements go awry. To navigate these turbulent waters, they meticulously orchestrate risk management strategies, employing sophisticated tools to monitor exposure levels. Constant vigilance and adaptability are key to maintaining stability amid unpredictable market fluctuations. Moreover, stringent regulatory oversight demands adherence to ethical practices to avert punitive actions like fines or license revocation.

The Future of Market Making: Technology and Innovation

Market Makers in Financial Markets are at the forefront of technological advancements reshaping the landscape. From algorithmic trading to artificial intelligence, innovations are revolutionizing how market makers operate. These advancements enable quicker decision-making and enhance liquidity provision, benefiting both market participants and overall market efficiency.

Moreover, emerging trading platforms offer diverse opportunities for Market Makers in Financial Markets to thrive. Alternative channels provide increased flexibility and accessibility, enabling market makers to adapt their strategies to different market conditions efficiently. This diversification enhances market resilience and further strengthens liquidity across various trading environments.

In response to technological evolution, Market Makers in Financial Markets are proactively integrating advanced technologies to refine their operations. By leveraging technology, market makers can streamline processes, minimize operational costs, and bolster risk management practices. This technological integration enhances market makers’ capabilities, enabling them to maintain liquidity levels consistently and mitigate potential market risks effectively.

The dynamism of financial markets necessitates continuous innovation from Market Makers in Financial Markets. Adapting to evolving market dynamics through innovative technologies and strategies is imperative for market makers to stay competitive and relevant. Prioritizing innovation ensures market makers can navigate changing market landscapes with agility, ensuring sustained liquidity provision and market stability for all participants.