Explore the fundamental aspects of Capital Markets in this comprehensive overview. From understanding the different types and regulations to analyzing their global impact and emerging trends, this article delves into the intricacies of the financial world. Discover how key participants navigate through various market types and the pivotal role Capital Markets play in driving economic growth. Get ready to dive deep into the dynamic landscape of Capital Markets and broaden your knowledge in this essential financial domain.

Unveiling the Dynamics of Capital Markets: An In-Depth Exploration

In the realm of finance, Capital Markets serve as the pivotal arena where long-term debt and equity securities are exchanged. These markets act as conduits, fostering the movement of capital from investors to diverse entities like corporations and governments.

The fundamental function of Capital Markets lies in nurturing economic expansion. By pooling savings and directing them towards ventures with growth potential, these markets ignite progress and innovation.

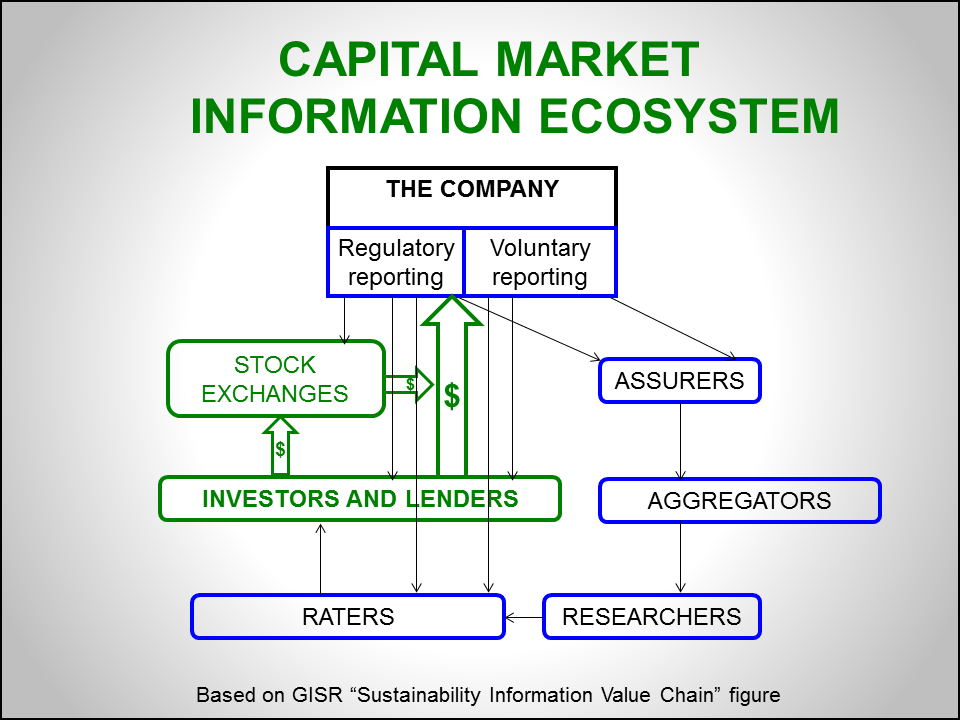

Essential actors in Capital Markets comprise institutional investors, individual investors, investment banks, and regulatory authorities. Together, they orchestrate the harmonious operation of these financial ecosystems.

:max_bytes(150000):strip_icc()/derivative.finalJPEG-5c8982d646e0fb00010f11c9.jpg)

Exploring the Diversity of Capital Markets

Equity Markets

Equity markets, a cornerstone of capital markets, facilitate the trading of stocks and shares representing ownership in companies. Investors engage in buying and selling these securities to benefit from capital appreciation and dividends, reflecting the dynamic nature of company ownership.

Bond Markets

Diving into the realm of debt securities, bond markets provide a platform for trading instruments issued by governments and corporations. These markets offer investors the opportunity to invest in fixed-income securities with varying maturity periods and interest rates, catering to diverse risk appetites.

Money Markets

Delving into short-term financing, money markets play a vital role in managing liquidity through lending and borrowing for periods typically under a year. With a focus on high liquidity and low-risk securities, money markets provide essential avenues for short-term funding needs for various entities.

Derivative Markets

Nestled in the realm of sophisticated financial instruments, derivative markets deal with contracts whose value is derived from the underlying assets. These markets enable investors to hedge risks, speculate on price movements, and enhance portfolio diversification through a wide array of options, futures, swaps, and other complex instruments.

Overview of Capital Markets Regulation

Safeguarding Market Integrity and Transparency

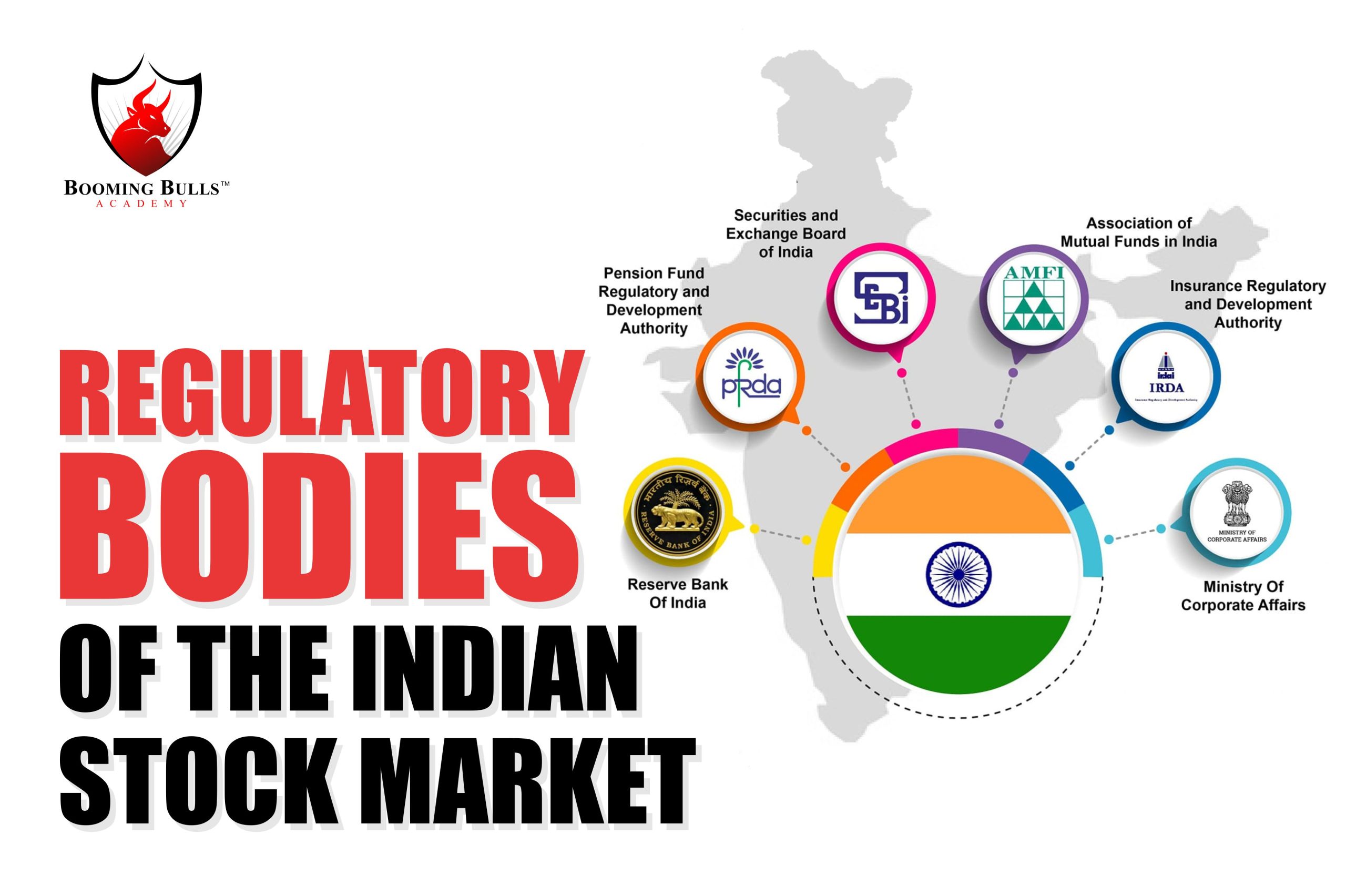

Regulatory bodies diligently supervise capital markets, safeguarding investors and upholding market integrity. These bodies enforce regulations encompassing disclosure mandates, prevention of insider trading, and deterring market manipulation. Through stringent oversight, regulations nurture trust and stability within capital markets, fostering a conducive environment for all participants. Furthermore, international organizations facilitate harmonizing regulations globally, ensuring consistency and transparency across borders.

Global Capital Markets: Interconnected and Interdependent

Interconnected Global Investment Flows

Capital markets serve as a conduit for international investment flows, linking investors worldwide. This interconnectedness allows capital to move seamlessly across borders, driving economic growth and fostering global financial stability. Understanding these linkages is crucial for investors navigating the complex web of global markets.

Impact of Economic Events and Policies

The ripple effects of economic events and policy decisions in one market reverberate throughout the interconnected global capital markets. A change in interest rates or a regulatory update can trigger a chain reaction, influencing asset prices and investor sentiment across various regions. This interconnected nature highlights the importance of staying informed and adaptable in the dynamic financial landscape.

Globalization’s Influence on Market Dynamics

The advent of globalization has transformed capital markets into a tightly interwoven network, characterized by increased interdependence and heightened complexity. Investors now face a landscape where developments in distant markets can swiftly impact their portfolios. Navigating this intricate web demands a thorough comprehension of global trends and the ability to adapt swiftly to changing market conditions.

Diversification Benefits and Risks

Cross-border investments offer diversification benefits, allowing investors to spread risk across different markets and asset classes. While diversification can mitigate portfolio volatility, it also exposes investors to foreign exchange fluctuations and geopolitical risks. Balancing these factors is essential for optimizing risk-adjusted returns in the interconnected global capital markets ecosystem.

In conclusion, the global capital markets operate as a unified entity where events in one corner of the world can resonate across financial markets worldwide. Understanding the intricate web of interconnectedness and interdependence is paramount for investors and financial professionals seeking to navigate the complexities of the global financial landscape effectively. Embracing this interconnected nature offers opportunities for growth and diversification while necessitating a vigilant approach to managing risks in this dynamic environment.

The Evolution of Capital Markets: Embracing Innovation for Future Growth

Technological Advancements Reshaping Capital Markets

Technological advancements like electronic trading platforms and blockchain solutions are revolutionizing the efficiency and transparency of capital markets. With real-time trading and smart contracts becoming the norm, the landscape is evolving rapidly, enhancing accessibility and speed of transactions.

Sustainable Investing: A Paradigm Shift in Capital Markets

The trend towards sustainable investing is reshaping capital markets, with investors prioritizing ESG factors. Aligning investments with environmental and social values is gaining momentum, influencing decision-making processes and driving positive change in businesses.

Fintech Disruption: Redefining Investment Opportunities

The surge of fintech companies is disrupting traditional financial institutions by offering innovative solutions and democratizing investment access. From robo-advisors to peer-to-peer lending platforms, fintech is reshaping how investments are made, challenging established norms.

Regulatory Dynamics and Global Events: Navigating Uncertainties

Regulatory changes and geopolitical events play a critical role in shaping the future of capital markets. Adapting to evolving regulations and geopolitical landscapes is essential for market participants to navigate uncertainties and seize opportunities amidst changing market dynamics.

In conclusion, the emerging trends in capital markets are paving the way for a more efficient, sustainable, and technologically advanced financial environment. As market participants embrace innovation and adapt to regulatory shifts, the future holds promising opportunities for growth and development in the ever-evolving landscape of capital markets.