Are you curious about how economic indicators impact the global economy? In this comprehensive guide, we will delve into the intricate world of Economic Indicators. From GDP and labor market indicators to inflation, trade, and consumer confidence, understanding these key metrics is essential for making informed decisions in today’s ever-changing economic landscape. Let’s explore the significance of Economic Indicators and how they play a crucial role in analyzing economic performance.

Exploring the Significance of Economic Indicators

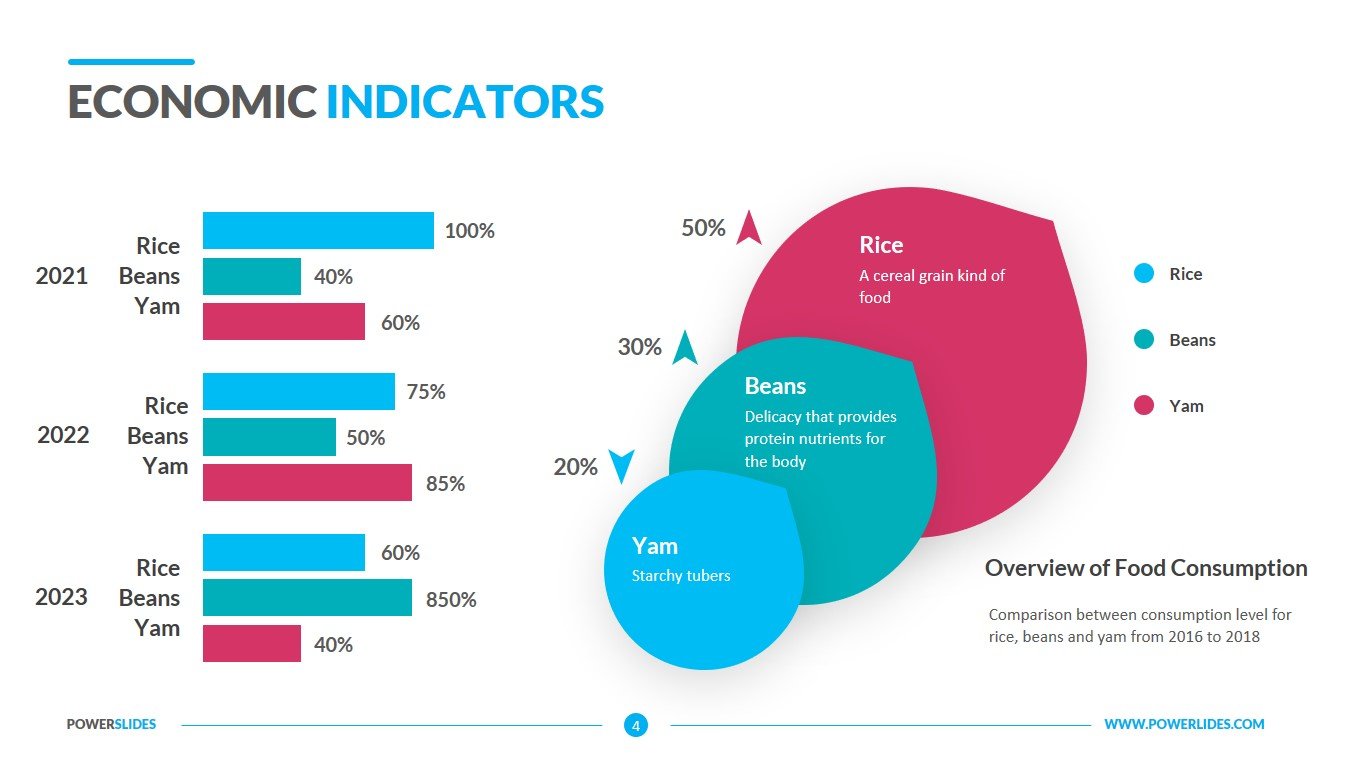

Economic indicators serve as vital statistical tools offering profound insights into the vitality and functionality of economies worldwide. They empower stakeholders like businesses, investors, and policymakers to navigate the economic landscape with informed decision-making capabilities. Categorized into key domains such as employment, inflation, production, and trade, these metrics provide a comprehensive snapshot of economic performance. Leveraging these indicators over time unveils trends, enabling the anticipation of future economic trajectories.

Exploring Key Types of Economic Indicators

Understanding the Dynamics of Economic Performance Metrics

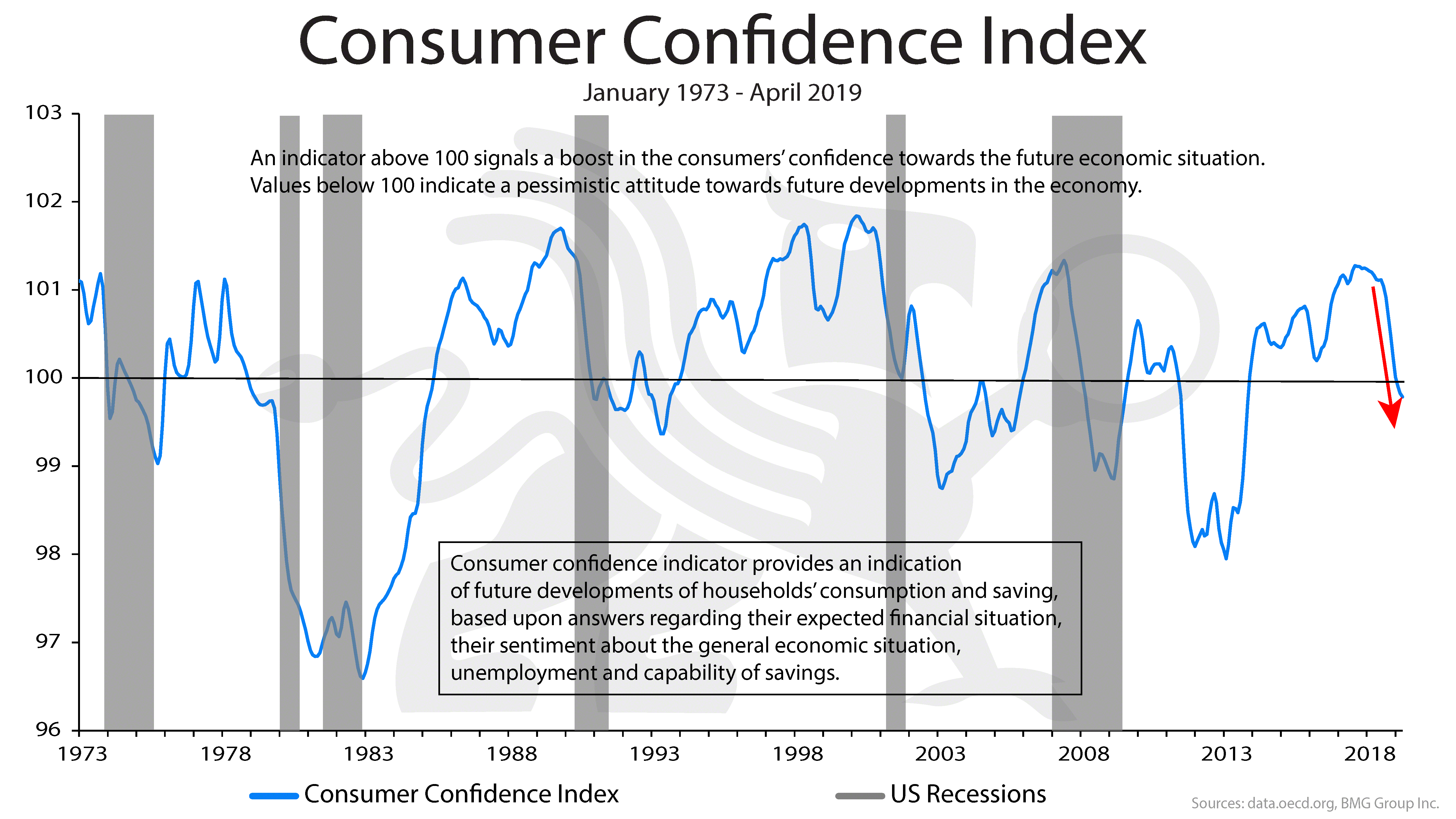

Economic indicators come in various forms, each offering unique insights into the economic landscape. Leading indicators like the consumer confidence index and stock market performance give foresight into future economic trends, guiding decisions. On the other hand, lagging indicators such as the unemployment and inflation rates validate and confirm prevailing economic patterns, highlighting past performance.

Diving deeper, coincident indicators such as GDP and retail sales provide real-time snapshots of ongoing economic activity, offering a pulse on the current state of the economy. Additionally, composite indicators amalgamate multiple metrics to present a holistic overview, exemplified by the leading economic index which encapsulates various indicators for a comprehensive economic assessment.

Understanding the nuances of these key types is pivotal in deciphering economic shifts and making informed decisions in a rapidly evolving financial landscape. By grasping the implications of leading, lagging, coincident, and composite indicators, stakeholders can strategize effectively while navigating the complexities of the economic realm.

Unveiling the Power of GDP in Economic Analysis

Gross Domestic Product (GDP) serves as a crucial measure, encompassing the total worth of all goods and services produced within a country during a specified timeframe. As the cornerstone of economic measurement, GDP offers a comprehensive snapshot of a nation’s economic output and vitality.

GDP growth rate is a pivotal metric, indicating the rate at which a country’s economy is expanding or contracting. Policymakers closely track this metric to gauge the overall health and trajectory of the economy, making informed decisions to spur growth or address economic challenges promptly.

Delving deeper, GDP per capita emerges as a vital tool for assessing the average income levels within a nation, providing insights into the standard of living and economic well-being of its citizens. By comparing GDP per capita across countries, analysts can evaluate disparities in prosperity and quality of life.

The components of GDP, namely consumer spending, government expenditure, private investments, and net exports, offer a nuanced perspective on the various drivers of economic activity. By scrutinizing these components, economists can discern patterns, strengths, and weaknesses within an economy, paving the way for targeted policy interventions.

Labor Market Indicators: Employment and Unemployment

Understanding the Dynamics of Labor Market Indicators

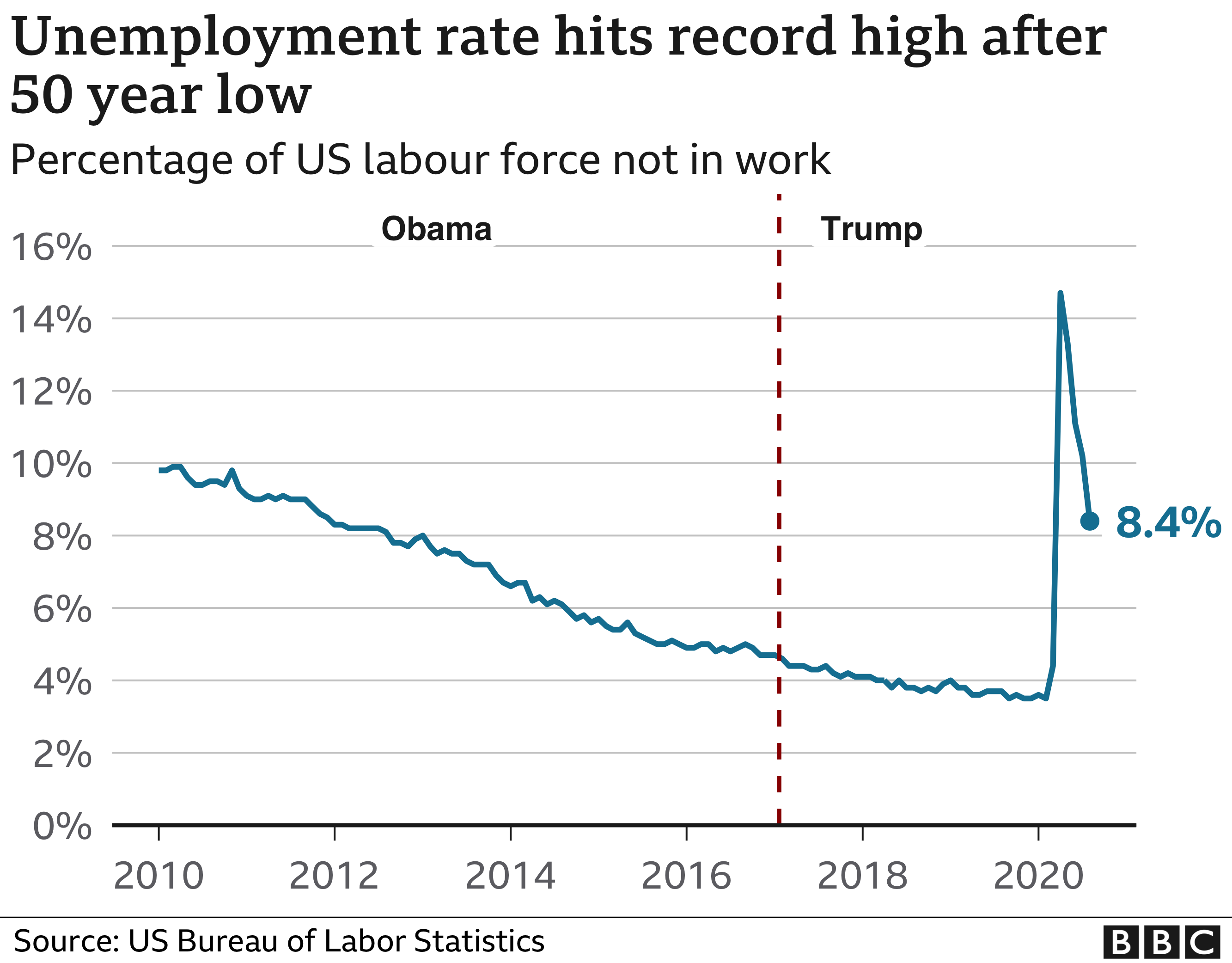

In the realm of economic indicators, Employment rate stands as a pivotal gauge, reflecting the proportion of the populace currently employed. Conversely, the Unemployment rate tracks the segment of the workforce actively pursuing jobs without success. These metrics play a vital role in assessing the health of an economy through the lens of workforce engagement and job availability.

Significance of Labor Participation Rate

The Labor Participation Rate unveils the proportion of the potential workforce, whether employed or actively job-hunting. This metric signifies the involvement of individuals in the labor market, shedding light on the degree of economic activity. A high participation rate often indicates a robust economy with ample job opportunities, while a low rate may signal underlying challenges in employment prospects.

Wage Growth: A Vital Economic Indicator

Wage growth serves as a crucial measure intertwined with inflation and consumer purchasing power. A steady increase in wages signifies a healthy labor market, boosting consumer spending capacity and driving economic growth. Monitoring wage growth trends aids in understanding shifts in consumer behavior, inflationary pressures, and overall economic performance, making it an essential aspect of interpreting economic indicators.

The Impact of Inflation on Economic Stability

Understanding Inflation Dynamics

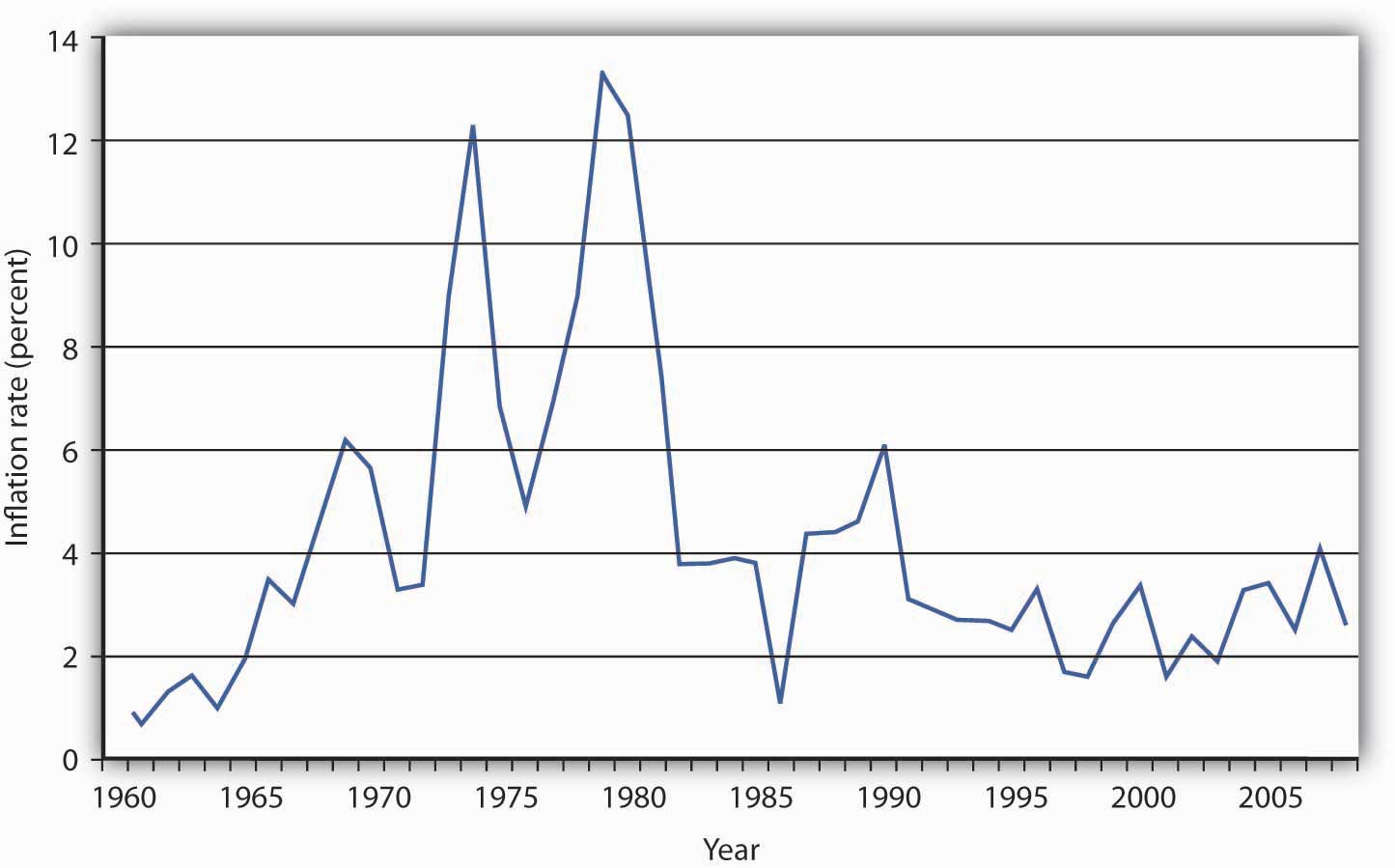

Inflation, a key economic indicator, gauges the speed at which prices for goods and services escalate over time. It provides insights into the economy’s purchasing power and overall price levels.

Key Inflation Measures

The Consumer Price Index (CPI) and the Producer Price Index (PPI) are fundamental metrics used to track inflation variations. CPI reflects retail prices, while PPI focuses on wholesale costs.

Implications of High Inflation

Elevated inflation can significantly diminish the value of savings and constrain individuals’ purchasing capacity. It can disrupt economic stability and influence consumer behavior.

Role of Central Banks

Central banks strategically adjust interest rates to curb inflation and maintain stable prices. These monetary policy tools are crucial in managing inflationary pressures, fostering economic growth, and preserving financial equilibrium.

By comprehending the intricate relationship between inflation and economic performance, individuals and businesses can navigate market fluctuations with informed decision-making processes. Understanding economic indicators like inflation is pivotal in assessing economic health and planning for a sustainable financial future.

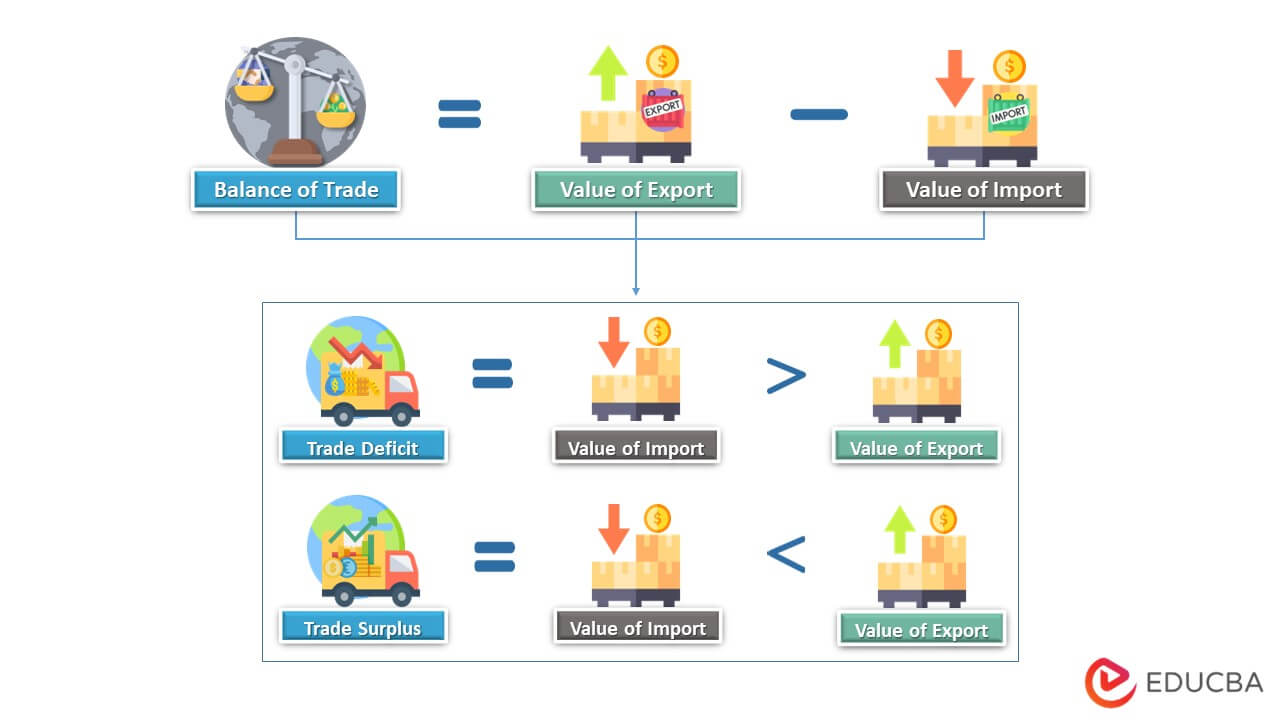

Trade and Balance of Payments in Understanding Economic Indicators

In the realm of economic indicators, trade and balance of payments play a pivotal role in understanding a nation’s economic health. Exports and imports serve as vital metrics, showcasing the exchange of goods and services across borders. When a country imports exceed its exports, a trade deficit emerges, impacting its economic stability. Moreover, the balance of payments encapsulates a comprehensive view of all economic transactions between a country and the global economy, shedding light on financial flows and international trade relationships. The fluctuation of exchange rates significantly influences a country’s export and import competitiveness, directly impacting its trade balance and economic performance. Understanding these dynamics offers valuable insights into a country’s economic standing and global trade dynamics.

Unveiling the Pulse of Consumer Confidence and Economic Sentiment

Consumer confidence surveys are vital tools that gauge the optimism level among consumers regarding the economy. When confidence is high, consumers are more likely to increase spending, thereby stimulating economic growth. Conversely, low confidence can lead to reduced consumer spending, impacting overall economic performance significantly.

Economic sentiment surveys offer profound insights into the expectations of businesses and investors concerning the future economic landscape. By assessing sentiment indicators, analysts can anticipate potential economic trends, enabling stakeholders to make informed decisions and strategize effectively for potential shifts in the market. Understanding these sentiment indicators is crucial in navigating the dynamic economic environment and mitigating risks.