As an experienced SEO writer, your task is to write two opening paragraphs in English for an article titled The Power of Market Psychology in Trading. The article targets the keyword Market Psychology. The meta description for this article is:

Explore the impact of market psychology on financial decision-making, common biases in trading, controlling emotions, leveraging market psychology for trading advantage, risk management, news impact, and traits of successful traders.

The opening paragraphs should be designed to grab the reader’s attention and encourage them to continue reading the article. Use the meta description as a guide to determine what information to include in the opening paragraphs. Each paragraph should not exceed 200 characters.

In writing the opening paragraphs, make sure to adhere to the following writing guidelines:

– Intent: To educate and inform readers about the role of market psychology in trading and provide strategies to harness it effectively for better trading outcomes.

– Style: Informative and educational

– Tone: Professional and authoritative

Make sure to include the keyword Market Psychology in one of the paragraphs. Additionally, provide some background or context about the article topic to help readers understand what they will be reading.

Unveiling the Impact of Market Psychology in Trading

Market psychology delves into the intricate realm of how emotions and cognitive biases sway financial decision-making processes. By grasping market psychology, traders can enhance decision-making skills, steering clear of detrimental blunders. Leveraging market psychology unveils trading prospects and aids in predicting market shifts. Ultimately, comprehending market psychology equips traders with a competitive advantage, paving the way for success in the markets.

Understanding Common Psychological Biases in Trading

In the world of trading, market psychology plays a significant role, heavily influenced by common biases that traders often fall victim to. Confirmation bias, where individuals seek information validating their preconceptions, can lead to overlooking critical data that contradicts their views. Overconfidence bias poses a risk as traders tend to overrate their skills, potentially leading to risky decisions.

Fear of missing out (FOMO) is another prevalent bias that drives traders to make impulsive decisions based on the fear of missing lucrative opportunities, often clouding rational judgment. Additionally, the herd mentality, a psychological phenomenon where traders follow the crowd without critical analysis, can create volatile market conditions and lead to herd-driven trading patterns devoid of sound reasoning. Recognizing and mitigating these biases is crucial in navigating the stock market effectively.

Strategies to Control Emotions in Trading

Understanding and Managing Emotions

To master market psychology in trading, start by recognizing your emotions. Acknowledging feelings like fear or greed helps prevent impulsive decisions. Embrace emotional awareness as a tool for rational trading.

Creating a Solid Trading Plan

Craft a well-defined trading strategy aligned with your goals and risk tolerance. A robust plan acts as a compass during turbulent market times, guiding decisions and mitigating emotional reactions.

Implementing Stop-Loss Orders

Utilize stop-loss orders to protect your investments and prevent substantial losses. These orders automatically sell assets at a predetermined price, ensuring disciplined risk management and emotional control.

Knowing When to Take Breaks

Recognize the signs of emotional fatigue or stress. Stepping away from trading allows for mental clarity and prevents hasty decisions driven by heightened emotions. Recharge to trade effectively with a clear mindset.

Leveraging Market Psychology for Trading Success

Utilizing Contrarian Indicators

Contrarian indicators can highlight potential shifts in market sentiment, offering unique trading opportunities when the crowd behavior deviates from the norm. By being contrarian, traders can capitalize on market overreactions or underreactions, strategically entering or exiting trades at opportune moments based on psychological factors rather than following the herd.

Identifying Price and Sentiment Divergences

Tracking inconsistencies between price movements and prevailing sentiment can provide insightful signals for traders. Divergences often indicate potential market reversals or significant price movements. Recognizing these disparities allows traders to adjust their strategies accordingly, anticipating changes in market sentiment before they translate into widespread price shifts.

Utilizing Technical Analysis for Strategic Entry and Exit Points

Technical analysis helps traders identify crucial support and resistance levels based on historical price data and market psychology. By analyzing price charts, trend indicators, and volume patterns, traders can make informed decisions about entry and exit points, optimizing their risk-to-reward ratios and enhancing overall trading performance.

Balancing Trend Following and Reversal Strategies

While acknowledging market trends is essential for successful trading, being mindful of potential trend reversals is equally critical. By understanding market psychology and investor behavior, traders can navigate market dynamics effectively, identifying when trends are losing momentum or when sentiment is shifting, enabling them to adjust their strategies promptly and profitably.

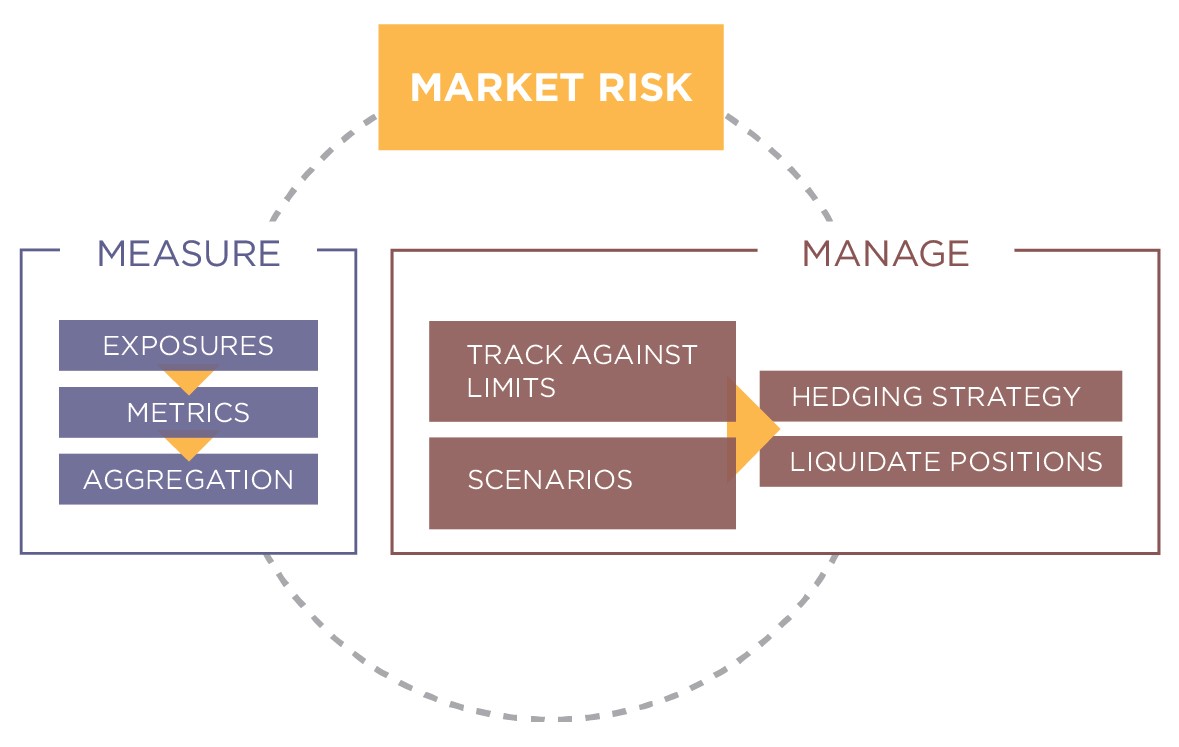

Understanding the Impact of Market Psychology on Risk Management

Market psychology is a powerful tool for traders to identify and manage risks effectively. By understanding market sentiment and crowd behavior, traders can anticipate potential risks and adjust their strategies accordingly to protect their investments. It’s crucial for traders to assess their risk tolerance levels to make informed decisions aligning with their comfort levels. Implementing risk management tools like stop-loss orders and position sizing is essential to mitigate potential losses and protect capital. Additionally, having a well-defined plan to handle losses can help traders navigate through challenging market scenarios confidently.

Understanding Market Psychology: Navigating News and Events

In trading, news and events play a vital role in shaping market sentiment. Being cognizant of upcoming news and events enables traders to anticipate market movements. However, it’s crucial not to overreact impulsively to news but rather to approach them with a strategic mindset. By analyzing news and events effectively, traders can uncover hidden opportunities and make informed trading decisions based on market psychology.

Understanding the Psychology Behind Successful Traders

Successful traders possess a profound comprehension of market psychology, enabling them to anticipate market movements and make informed decisions. By understanding the emotions and behaviors of market participants, they can navigate through volatility with confidence, making calculated moves that align with market sentiments. This deep understanding gives them an edge in interpreting market dynamics and staying ahead of the curve.

Emotional intelligence is a hallmark of successful traders, allowing them to remain calm and collected even in turbulent market conditions. By controlling their emotions, they can avoid impulsive decisions driven by fear or greed, leading to more rational and strategic trading choices. This emotional discipline helps them stay focused on their trading plan and long-term goals, fostering consistency and stability in their trading journey.

Discipline is a key trait among successful traders, guiding their actions and decision-making processes. Their adherence to trading rules and risk management principles minimizes impulsive and reckless behavior, promoting a structured approach to trading. This disciplined mindset instills patience, resilience, and a systematic methodology that underpins their trading strategies, ultimately contributing to their success in the markets.

Successful traders embrace a culture of continuous learning and adaptation, recognizing the dynamic nature of financial markets. By staying informed, updating their skills, and evolving their strategies, they can adjust to changing market conditions and seize new opportunities. This proactive approach to education and growth empowers them to refine their trading techniques, optimize performance, and stay competitive in the ever-evolving landscape of trading.