High-risk auto insurance is a crucial topic for drivers to understand, especially when facing factors like DUI that can significantly impact insurance premiums. Drivers should be aware of how these high-risk factors can affect their coverage options and costs. Finding suitable high-risk auto insurance companies for DUI can be challenging but is essential for maintaining legal driving status. In this article, we will delve into the impact of DUI on auto insurance premiums, explore options for SR-22 insurance, and provide valuable tips to reduce high-risk auto insurance premiums, including key insights on how to find reputable high-risk auto insurance companies for DUI.

Understanding High-Risk Auto Insurance

High-risk auto insurance caters to drivers deemed riskier by insurers. This specialized coverage is pricier than standard policies because high-risk drivers are statistically more prone to accidents and claims. Being classified as high-risk can stem from various reasons like DUI convictions, speeding tickets, or at-fault accidents. Drivers with multiple violations might find it challenging to secure conventional auto insurance, pushing them towards high-risk auto insurance for coverage options.

Finding High-Risk Auto Insurance Companies for DUI

When searching for high-risk auto insurance companies after a DUI, it’s crucial to explore insurers specializing in such coverage. Despite elevated premiums, these insurers offer tailored solutions for drivers with serious violations. Comparing quotes from various companies is essential to secure the best coverage at competitive rates. It’s crucial to acknowledge that post-DUI, elevated premiums may persist for an extended period, emphasizing prudent financial planning.

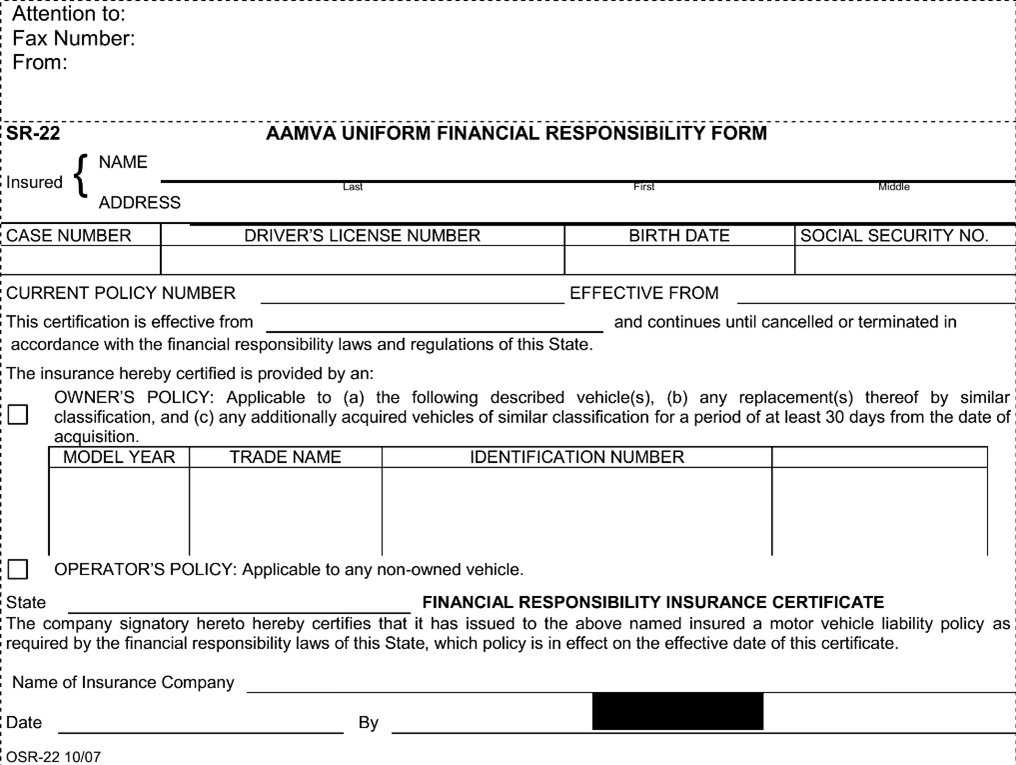

Understanding SR-22 Insurance for DUI

In certain states, individuals with a DUI must submit an SR-22 form to the DMV. This document serves as proof of financial responsibility, indicating that the driver carries at least the mandatory auto insurance coverage. Failure to uphold SR-22 insurance can lead to consequences such as license suspension. High-risk auto insurance providers specialize in offering SR-22 insurance for drivers in need of this certification, ensuring legal compliance and adequate coverage.

Tips for Reducing High-Risk Auto Insurance Premiums

Defensive Driving Courses and Clean Driving Record

Taking a defensive driving course not only enhances your driving skills but can also lead to lower high-risk auto insurance premiums. Additionally, maintaining a clean driving record for an extended period demonstrates responsible driving behavior, which insurance companies often reward with reduced rates, especially for drivers labeled as high-risk due to past incidents like DUI.

Vehicle Safety Features and Discounts

Installing anti-theft devices and other safety features in your car not only enhances security but can also make you eligible for discounts on high-risk auto insurance premiums. Insurance providers value proactive steps towards vehicle safety and may offer incentives for drivers who prioritize safeguarding their vehicles against potential risks.

Comparing Rates from Multiple Insurers

Despite being classified as high-risk drivers, shopping around for the best insurance rates is crucial. Different insurance companies assess risk differently, so exploring various options can help high-risk drivers find more competitive premiums. Comparing rates allows you to identify cost-effective coverage without compromising on quality, potentially reducing the financial burden of high-risk auto insurance.

By implementing these tips, drivers can take proactive steps to reduce high-risk auto insurance premiums, making insurance more affordable and ensuring financial security without compromising on coverage. Making informed decisions based on these strategies can significantly impact insurance costs, providing high-risk drivers with more manageable options for protecting themselves on the road.

Exploring Alternatives to High-Risk Auto Insurance

Qualifying for Non-Standard Auto Insurance Policies

Some drivers facing high-risk factors may qualify for non-standard auto insurance policies. While these policies are more expensive than standard ones, they can be a more affordable alternative to high-risk auto insurance, offering coverage to drivers in challenging situations.

Utilizing Usage-Based Insurance Programs

Considering a usage-based insurance program is another alternative. These programs monitor driving behaviors, such as speed and mileage, rewarding safe practices with discounted premiums. This option encourages responsible driving habits and can lead to cost savings for drivers.

Exploring Public Transportation and Ride-Sharing

For individuals struggling with high-risk auto insurance premiums, utilizing public transportation or ride-sharing services can be a cost-effective solution. Opting for these alternatives may prove more economical than traditional auto insurance, especially for those with limited insurance options.

Long-Term Consequences of DUI on Auto Insurance

Understand the Prolonged Impact

A DUI conviction can profoundly affect your auto insurance premiums for years to come. Unlike minor violations, DUIs carry long-term consequences, leading to substantially higher insurance rates even after several years. This sustained financial burden can significantly impact your overall budget and financial planning, emphasizing the importance of responsible driving behaviors.

Persistent Premium Disparity

Drivers with a DUI history might continue to face inflated insurance premiums compared to those with clean driving records. This persistent premium disparity highlights the severity of DUI-related convictions and urges drivers to prioritize safe driving practices to avoid long-lasting financial repercussions. Understanding the lasting effects of a DUI can empower drivers to make informed decisions to protect their finances and driving privileges.

Challenges for Repeat Offenders

Individuals with multiple DUIs or severe violations may encounter challenges in securing affordable auto insurance for an extended period. Insurance providers may consider repeated offenses as high-risk behaviors, leading to limited coverage options and substantially higher premiums for an extended duration. Being aware of the hurdles faced by repeat offenders reinforces the importance of making prudent decisions behind the wheel to safeguard against financial strain.

Enduring Financial Ramifications

The financial impacts of a DUI extend far beyond immediate penalties and fines, persisting for a decade or more in the form of elevated insurance costs. These enduring financial ramifications underscore the importance of responsible driving practices and the significant consequences that can follow a single instance of impaired driving. By understanding the long-lasting financial implications of a DUI, drivers can take proactive steps to mitigate potential risks and secure their financial well-being in the long run.