Protecting your assets is a crucial aspect of financial planning. One way to safeguard your belongings and investments is by understanding the Benefits of purchasing umbrella insurance policy. Umbrella insurance coverage offers an extra layer of protection that goes beyond your standard insurance policies, providing liability coverage and peace of mind in unforeseen circumstances. With the potential to shield your finances in the event of lawsuits and accidents, having umbrella insurance can offer a sense of security for you and your loved ones.

Mitigate Financial Risks with Umbrella Insurance Coverage

In today’s unpredictable world, accidents can strike unexpectedly, potentially leaving you exposed to significant financial risks. Whether a minor mishap or a major incident, the aftermath can lead to substantial medical and property expenses. Having umbrella insurance coverage benefits becomes vital in such scenarios. This additional coverage steps in when your existing policies reach their limits, ensuring you’re not left shouldering the excess liabilities alone.

Moreover, this extra layer of financial protection ensures that in cases where accidents push your liability costs beyond what your primary policies can cover, you won’t face the daunting prospect of financial ruin. By bridging the gap between your current coverage and the actual costs incurred, umbrella insurance safeguards your assets and shields you from potential bankruptcy, offering a safety net against unexpected financial burdens.

Additionally, the beauty of umbrella insurance coverage benefits lies in their versatility – they extend beyond the confines of your home borders. Whether you’re on a road trip, vacationing overseas, or merely out and about, this coverage travels with you, providing a safety cushion for accidents occurring anywhere in the world. Such comprehensive protection ensures that no matter where you are, you can navigate life’s uncertainties with peace of mind, knowing that you’re shielded from excessive liabilities that accidents may bring your way.

Comprehensive Protection Against Defamation Risks

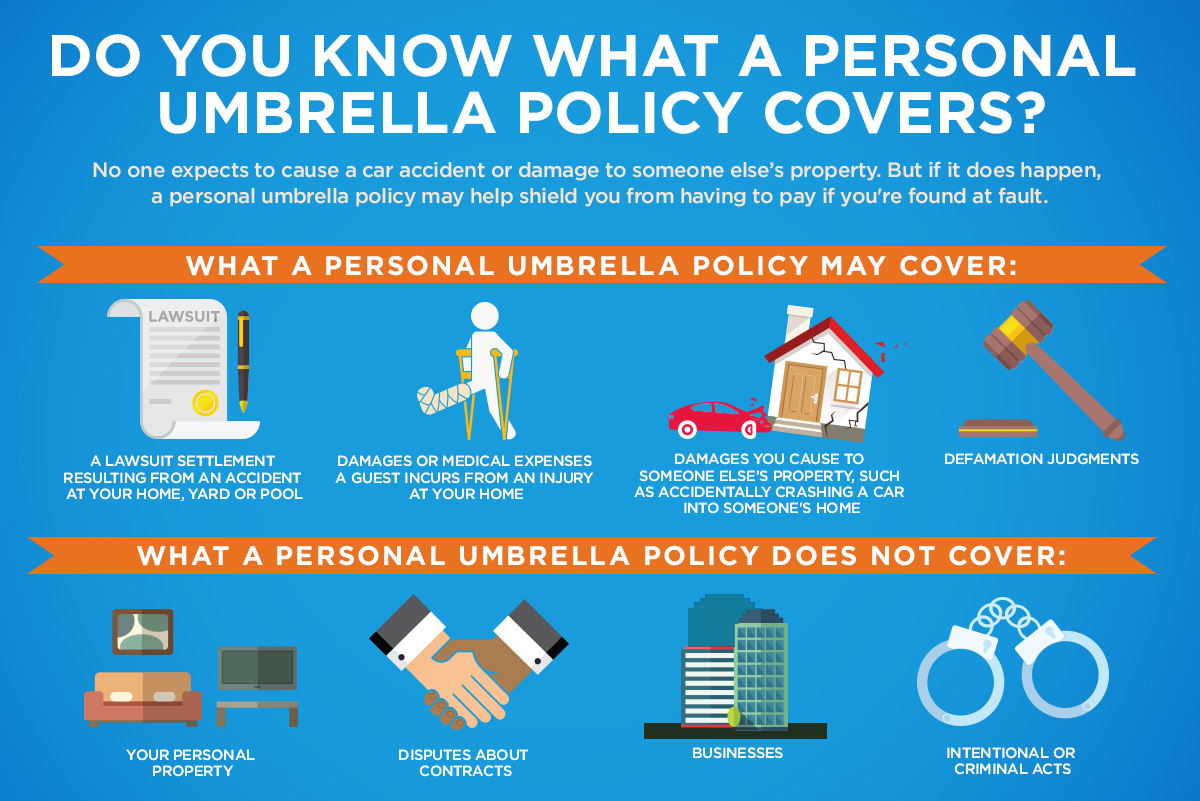

When it comes to safeguarding your reputation and finances, umbrella insurance coverage benefits extend to encompass protection against libel, slander, and defamation. These types of defamation claims can lead to substantial legal fees and damages. Umbrella insurance serves as a safety net, assisting in covering expenses related to defending against such allegations and potential compensation payouts. In today’s digital age, where online presence is significant, umbrella insurance can even shield you from cyberbullying and other forms of online defamation, ensuring a holistic approach to protecting your well-being.

Comprehensive Protection for Unintentional Acts of Negligence

Umbrella insurance coverage benefits extend to safeguarding you from inadvertent negligence. This coverage shields you in situations where you unintentionally cause harm or damage to others, be it bodily injury or property destruction. Whether accidents unfold at your premises, during travel, or while driving, umbrella insurance steps in to cover legal fees and compensatory payouts. Additionally, it fills gaps left by your primary insurance plans, ensuring holistic protection for unforeseen liabilities.

Safeguarding Your Business with Umbrella Insurance Coverage Benefits

Protect Your Business from Liability

Umbrella insurance coverage benefits extend to all sizes of businesses, offering a safety net against various lawsuits like negligence claims, contract breaches, and product liability issues. By shouldering legal expenses and damages, this coverage shields your business assets, ensuring financial stability during unforeseen legal challenges. Embracing umbrella insurance adds a critical layer of protection to your business operations.

Ensuring Peace of Mind with Umbrella Insurance Coverage Benefits

Umbrella insurance coverage benefits go beyond financial protection; they offer peace of mind. By knowing you are shielded in lawsuits, you can rest easier and focus on living fully without constant worry about asset vulnerability. The assurance of safeguarding your hard-earned assets from unforeseen events brings a sense of security and confidence to navigate life’s uncertainties with peace.