A Comprehensive Guide to Understanding Your Disability Insurance Needs is a detailed resource designed to help you navigate the complexities of choosing the right disability insurance coverage. In this article, we will delve into how to assess your needs, select the best provider, and comprehend the various coverage types available. Understanding the essential policy features, factors influencing premiums, common exclusions, and the process of filing a claim is crucial in ensuring you have the appropriate protection in place. Whether you are new to disability insurance or considering reviewing your current policy, this guide will equip you with the knowledge to make informed decisions on how to choose the right disability insurance coverage.

Understanding Your Disability Insurance Needs

When assessing your Disability Insurance Needs, it’s essential to meticulously evaluate your financial landscape, including income, expenses, and future earning potential. Understanding your current financial obligations, like mortgages and family expenses, is crucial for determining the right coverage amount. Furthermore, factoring in your health status, lifestyle choices, and the nature of your occupation helps identify potential risks that your disability insurance should adequately protect against. By considering these key aspects comprehensively, you can tailor your disability insurance to suit your specific needs and ensure robust financial protection.

Selecting the Best Disability Insurance Provider

When considering your Disability Insurance Needs, start by researching renowned insurance companies known for their expertise in disability insurance. Look for providers with a proven track record and solid financial stability. It’s crucial to compare various aspects such as coverage options, premium rates, and customer service ratings to ensure the best fit for your needs.

Customizability is key when choosing the right insurance provider for your disability coverage. Opt for insurers that offer policies tailored to your specific requirements. Having the flexibility to adjust coverage levels and benefits according to your unique circumstances can provide you with the most suitable protection, aligning with your Disability Insurance Needs.

To make an informed decision, seek guidance from financial advisors or industry experts. Their insights can be invaluable in selecting a reputable insurance provider that aligns with your Disability Insurance Needs. Professionals in the field can provide recommendations based on your individual circumstances, ensuring you make a well-informed choice for your disability insurance coverage.

:max_bytes(150000):strip_icc()/diinsurance_v3-bf77d05568264d77a7f79ec956ef3d82.png)

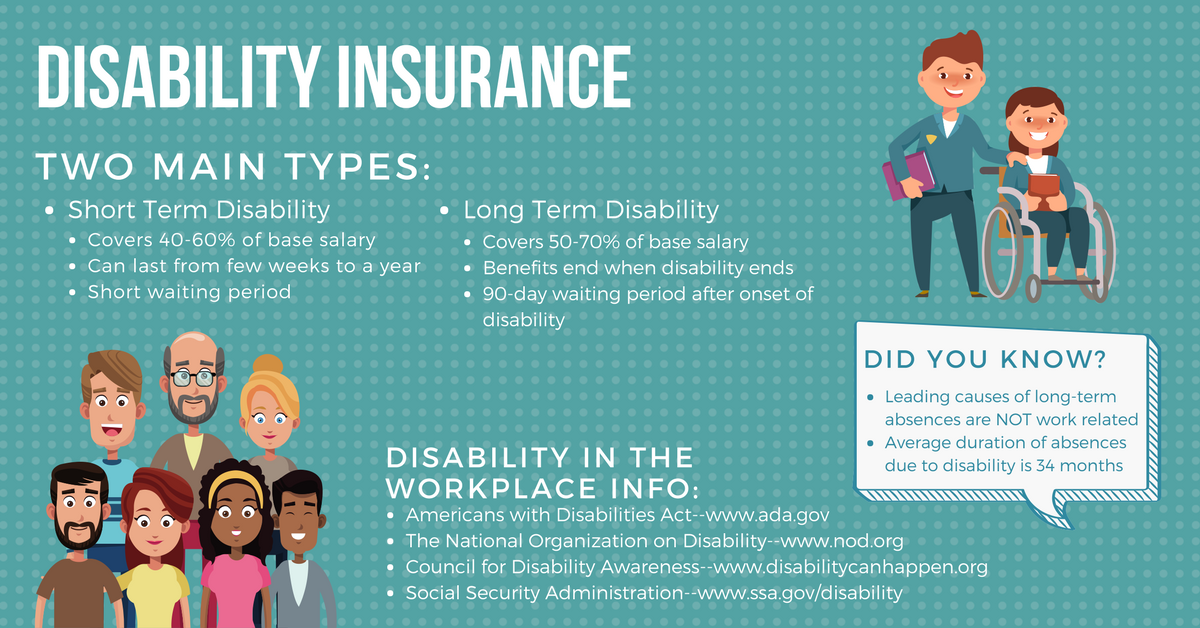

Understanding the Various Types of Disability Insurance Coverage

When considering your Disability Insurance Needs, it’s essential to understand the distinct types of coverage available. Short-term disability insurance is crucial for temporary disabilities, offering support for typically up to 2 years. On the other hand, long-term disability insurance provides peace of mind for more prolonged disabilities that extend beyond the 2-year mark, ensuring financial stability during extended periods of inability to work.

For individuals seeking targeted protection tailored to their specific job roles, Own-occupation disability insurance is key. This coverage guarantees financial support if you’re unable to fulfill the duties of your current profession due to a disability, focusing on your particular occupation’s requirements and demands.

In contrast, Any-occupation disability insurance steps in when you are incapable of performing any job due to a disability, irrespective of your current occupation. This broader coverage ensures financial protection in situations where transitioning to a different profession isn’t feasible, offering comprehensive support tailored to your overall ability to work.

Understanding Essential Policy Features for Your Disability Insurance Needs

Benefit Period

The benefit period is a critical aspect to consider in Disability Insurance Needs. It dictates how long you’ll receive benefits once disabled. Opt for a policy with a longer benefit period to secure financial stability during extended periods of disability, ensuring adequate coverage when you need it the most.

Elimination Period

The elimination period marks the duration you must wait before receiving benefits. Choosing a shorter elimination period means quicker access to financial support in your time of need. Consider your financial obligations and savings when selecting the optimal elimination period for your Disability Insurance Needs.

Benefit Amount

Determining the monthly benefit amount is vital in Disability Insurance Needs. Ensure the benefit aligns with your income to cover essential expenses during disability. Calculating your monthly financial requirements can guide you in selecting an appropriate benefit amount for comprehensive coverage.

Cost of Living Adjustments (COLA)

In Disability Insurance Needs, including cost of living adjustments (COLA) in your policy is prudent. COLA helps protect the value of your benefits against inflation, ensuring your coverage remains relevant over time. Opting for COLA can safeguard your financial security by ensuring your benefits keep pace with the rising cost of living.

Understanding the Factors Influencing Disability Insurance Premiums

Age Impact on Premiums

As individuals age, disability insurance premiums typically rise due to the increased likelihood of health issues. Younger individuals may secure lower premiums, making it essential to consider locking in rates early to manage Disability Insurance Needs effectively.

Occupation’s Premium Influence

Occupations with higher risk levels often translate to higher disability insurance premiums. Jobs with increased physical demands or hazardous work environments may significantly impact premium rates, reflecting the risk associated with the occupation.

Health History’s Premium Implications

Personal health history plays a pivotal role in determining disability insurance premiums. Pre-existing conditions can lead to higher premium costs as insurers assess the potential risks associated with existing health conditions when calculating premiums.

Coverage Amount and Duration Dynamics

The amount of coverage and the duration of benefits directly impact disability insurance premiums. Opting for higher coverage limits and longer benefit periods increases the level of financial protection but also results in higher premiums, aligning the cost with the extended coverage benefits.

Incorporated strategically into the content, the phrase “Disability Insurance Needs” reinforces the relevance and importance of considering these factors to address individual insurance requirements effectively. By weaving this key term naturally into the discussion, the content maintains its SEO focus while engaging readers on the nuances of disability insurance premium determinants.