Exchange rates play a crucial role in the global economy, impacting businesses, international trade, and financial markets. Understanding Exchange Rates: A Fundamental Overview delves deep into the key concepts, types, and factors influencing exchange rate fluctuations. From the basics of exchange rate mechanisms to the challenges of forecasting in a dynamic market environment, this article provides a comprehensive insight into how exchange rates shape the economy. Dive into the complexities of Exchange Rates and discover their profound implications on businesses and the global landscape.

Exploring the Essence of Exchange Rates

Exchange rates serve as the bedrock of global financial interactions, depicting the value of one currency in comparison to another. Vital for international trade, tourism, and investments, they wield significant influence across economies. Economic conditions, interest rates, and political stability are prime movers of exchange rate shifts. Grasping these intricacies is paramount for entities involved in cross-border transactions, underlining the essence of understanding exchange rates.

Understanding Exchange Rates: Fixed vs. Floating

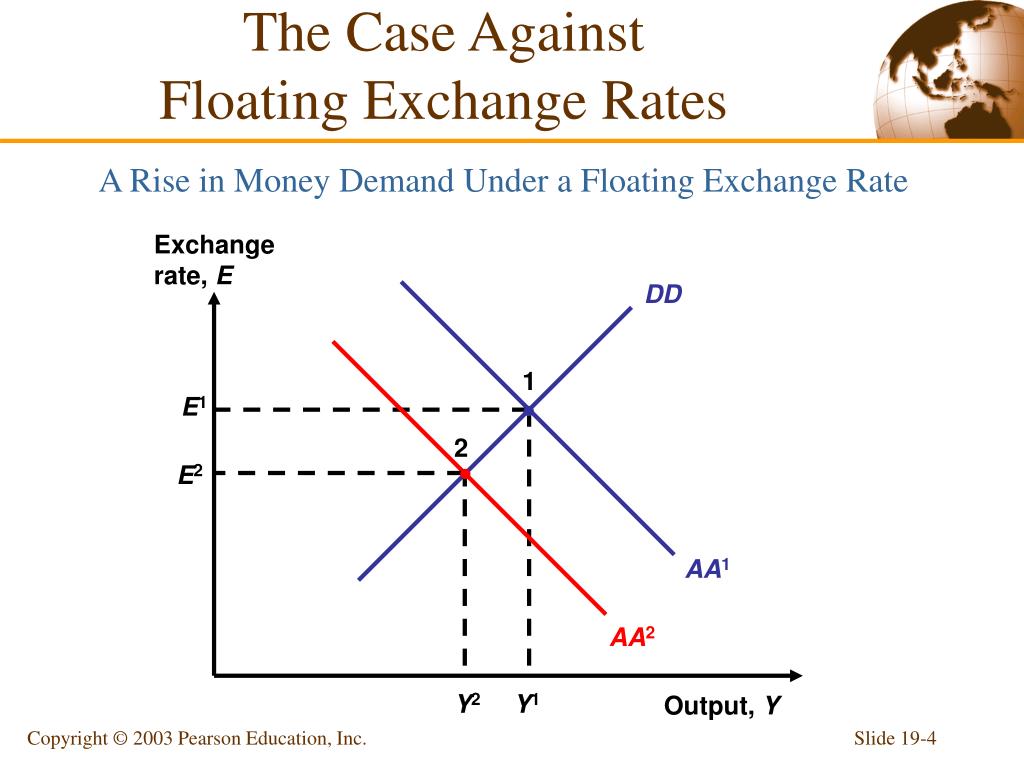

When delving into the realm of exchange rates, it’s crucial to grasp the dichotomy between fixed and floating exchange rates. Fixed rates are tethered to a specific currency or a mix of currencies, offering stability but potentially limiting economic flexibility. Conversely, floating rates dance freely in the market’s winds, responding to supply and demand dynamics with fluidity and adaptability.

Countries face a momentous decision when selecting between fixed and floating exchange rates. This choice is intricately linked to a nation’s economic robustness and its monetary policy objectives. Stable economies may opt for fixed rates to establish predictability, while those seeking agility might embrace the volatility of floating rates to navigate market fluctuations dynamically.

In the grand tapestry of global finance, major currencies predominantly operate under the mantle of floating exchange rates. This approach allows these currencies to adjust organically to market conditions, fostering a more responsive and market-driven valuation that reflects the intricate dance of international trade, investment flows, and economic indicators. By embracing floating rates, these currencies embrace adaptability and responsiveness in the ever-evolving landscape of global finance.

Factors Affecting Exchange Rate Fluctuations

Economic Growth and Inflation Rates

Economic growth and inflation play pivotal roles in exchange rate movements. When a country shows strong economic performance, there is typically an increased demand for its currency, driving its value up. Likewise, higher inflation rates can erode a currency’s purchasing power, leading to depreciation.

Interest Rate Differentials

Interest rate differentials influence capital flows as investors seek higher returns on their investments. A higher interest rate in a country can attract foreign capital, strengthening its currency. Conversely, lower rates may lead to capital outflows, putting pressure on the exchange rate.

Political and Economic Stability

Political stability and a robust economic environment instill confidence in investors, promoting currency stability and appreciation. Uncertainty or unrest, on the other hand, can deter foreign investments, weakening a currency due to heightened risk perceptions.

Speculation and Market Sentiment

Speculation and market sentiment can introduce volatility to exchange rates. Investor perceptions, news, and market psychology can drive rapid fluctuations in currency values, often leading to short-term distortions in exchange rates.

In analyzing exchange rate fluctuations, a comprehensive understanding of these factors is crucial to navigate the complexities of the foreign exchange market effectively. By monitoring and interpreting the interplay of economic indicators, interest rate movements, geopolitical events, and market sentiments, businesses and investors can make informed decisions to mitigate risks and capitalize on opportunities in the ever-evolving currency markets.

The Impact of Exchange Rates on Businesses

Exchange rate fluctuations affecting the cost of imported goods and services

Exchange rate movements directly influence the prices of imported products and services. A stronger domestic currency can lower the cost of imports, benefiting businesses reliant on foreign goods. Conversely, a weaker currency can increase import expenses, impacting profit margins and pricing strategies for businesses dependent on overseas supplies.

Managing currency risk for businesses with international operations

For companies engaging in global trade, exchange rate fluctuations pose significant currency risk. Fluctuations in exchange rates can lead to unpredictable revenue and cost differentials, affecting profitability. Businesses must implement risk management strategies like forward contracts or currency options to safeguard against adverse currency movements and ensure financial stability.

Impact on competitiveness of exports and imports

Exchange rate fluctuations play a crucial role in determining the competitiveness of a country’s exports and imports. A depreciating home currency can make exports more attractive in foreign markets by lowering prices, boosting demand for local products. Conversely, a strengthening currency can make imports more affordable, potentially impacting the competitiveness of domestic industries reliant on imported goods.

Using hedging strategies to mitigate exchange rate risks

To shield businesses from the volatility of exchange rates, hedging strategies offer a valuable tool. By using financial instruments like futures contracts or options, companies can lock in exchange rates to protect against adverse movements. These hedging techniques provide a level of certainty in cash flows, enabling businesses to navigate currency fluctuations and maintain financial stability.

Forecasting Exchange Rates: Challenges and Techniques

Delving into the Intrinsic Complexity of Exchange Rate Forecasting

Forecasting exchange rates presents a multifaceted challenge due to the convergence of various factors. These encompass economic indicators, geopolitical events, market psychology, and governmental policies, collectively impacting currency valuations. The intricate interplay of these elements contributes to the intricate nature of predicting exchange rate movements accurately.

Harnessing Technical Analysis and Economic Models for Insightful Projections

To navigate the labyrinth of exchange rate forecasting, analysts frequently employ technical analysis and economic models. Technical analysis scrutinizes historical price data to identify trends and patterns, aiding in predicting future currency movements. Conversely, economic models rely on fundamental economic principles to gauge currency valuation, providing a macroeconomic perspective crucial for forecasting accuracy.

Empowering Decision-Making with Precise Exchange Rate Forecasts

For businesses and investors, precise exchange rate forecasts serve as a cornerstone for strategic decision-making. By anticipating currency fluctuations, stakeholders can optimize their international transactions, pricing strategies, and investment portfolios. Reliable forecasts enable proactive risk management and capitalize on market opportunities, fostering financial growth and stability.

Navigating the Unpredictability: The Inherent Challenges of Exchange Rate Forecasting

Despite the advancements in forecasting techniques, exchange rate prediction remains susceptible to inherent uncertainties and external shocks. Factors like unexpected political events, economic upheavals, or global crises can swiftly alter currency dynamics, challenging the accuracy of forecasts. The dynamic and volatile nature of the foreign exchange market underscores the perpetual challenge of crafting precise and reliable forecasts.

The Impact of Exchange Rates on the Global Economy

Exchange rates serve as a cornerstone in the global economy, influencing trade, investment decisions, and overall economic health. The fluctuations in currency values wield immense power, affecting cross-border transactions, foreign investments, and the profitability of businesses operating globally. Ensuring stability in exchange rates is vital for fostering a secure international financial environment where countries can engage in trade with confidence and predictability.

The dynamic nature of exchange rates necessitates close monitoring and management. International entities such as the International Monetary Fund (IMF) play a pivotal role in overseeing exchange rate movements and offering guidance on policies that can mitigate risks and enhance economic stability. Their involvement underscores the significance of exchange rates as a fundamental element in shaping the interconnected global economic landscape, highlighting the need for strategic decision-making to navigate the complexities of international finance.