Market depth analysis is a crucial tool for traders and investors looking to gain valuable insights into the dynamics of the market. By understanding market depth, one can unravel the layers of supply and demand, identify key factors influencing price movements, and make informed decisions. In this comprehensive guide to market depth analysis, we will delve into the intricacies of interpreting market depth data, exploring various types, effective trading strategies, limitations to be aware of, and advanced analysis techniques. Whether you are a seasoned trader or a novice investor, mastering market depth can significantly enhance your trading skills and improve your performance in the market.

Factors Influencing Market Depth

Liquidity

Liquidity plays a vital role in market depth analysis. It refers to the volume of orders available at different price levels. Higher liquidity signifies a more active market with tight bid-ask spreads, indicating easier order execution. Traders often prefer liquid markets as they offer more opportunities for swift transactions and reduced price slippage, enhancing overall trading efficiency.

Volatility

Volatility, the measure of price fluctuations, heavily influences market depth. Increased volatility tends to widen the bid-ask spread, reflecting uncertainty and risk in the market. Traders must assess volatility levels to gauge potential price movements accurately. Understanding how volatility impacts market depth is essential for implementing effective risk management strategies and adjusting trading approaches accordingly.

Market Sentiment

Market sentiment, reflecting the collective mood of traders, greatly impacts market depth. A bullish sentiment leads to increased buying pressure, potentially creating higher demand and raising price levels. Conversely, a bearish sentiment triggers more selling activity, affecting market depth by altering the balance between supply and demand. Monitoring market sentiment allows traders to anticipate market shifts and make informed trading decisions.

News and Events

External factors such as major news releases and significant events can swiftly alter market depth dynamics. News can trigger rapid changes in supply and demand levels, causing price fluctuations and impacting market depth. Traders need to stay informed about economic announcements, corporate developments, and geopolitical events to anticipate market reactions accurately. Incorporating news analysis into market depth assessment enhances decision-making processes and risk management strategies.

Understanding Market Depth Data in Trading

Interpreting market depth data is crucial for traders. A deep market depth, showcasing a substantial number of orders at various price levels, signifies high liquidity and often lower price volatility. Conversely, a shallow market depth indicates limited liquidity, potentially leading to higher volatility due to fewer orders to absorb significant trades. Moreover, sudden spikes in market depth can hint at potential imminent price shifts, prompting traders to stay vigilant.

To enhance decision-making accuracy, traders should integrate market depth analysis with other technical indicators for a comprehensive market overview. Combining market depth data with other tools provides a broader perspective, allowing traders to make informed decisions based on a more holistic understanding of market dynamics. This holistic approach contributes to more precise entry and exit points, mitigating risks and maximizing trading opportunities effectively.

By effectively interpreting market depth data, traders can navigate the financial markets with greater precision and confidence. Understanding the implications of market depth, whether deep or shallow, empowers traders to anticipate potential price movements and volatility trends. Integrating market depth analysis with other technical indicators strengthens analytical capabilities, enabling traders to execute well-informed trading strategies. This comprehensive approach enhances decision-making processes, leading to more favorable trading outcomes and improved overall performance in the market.

Types of Market Depth

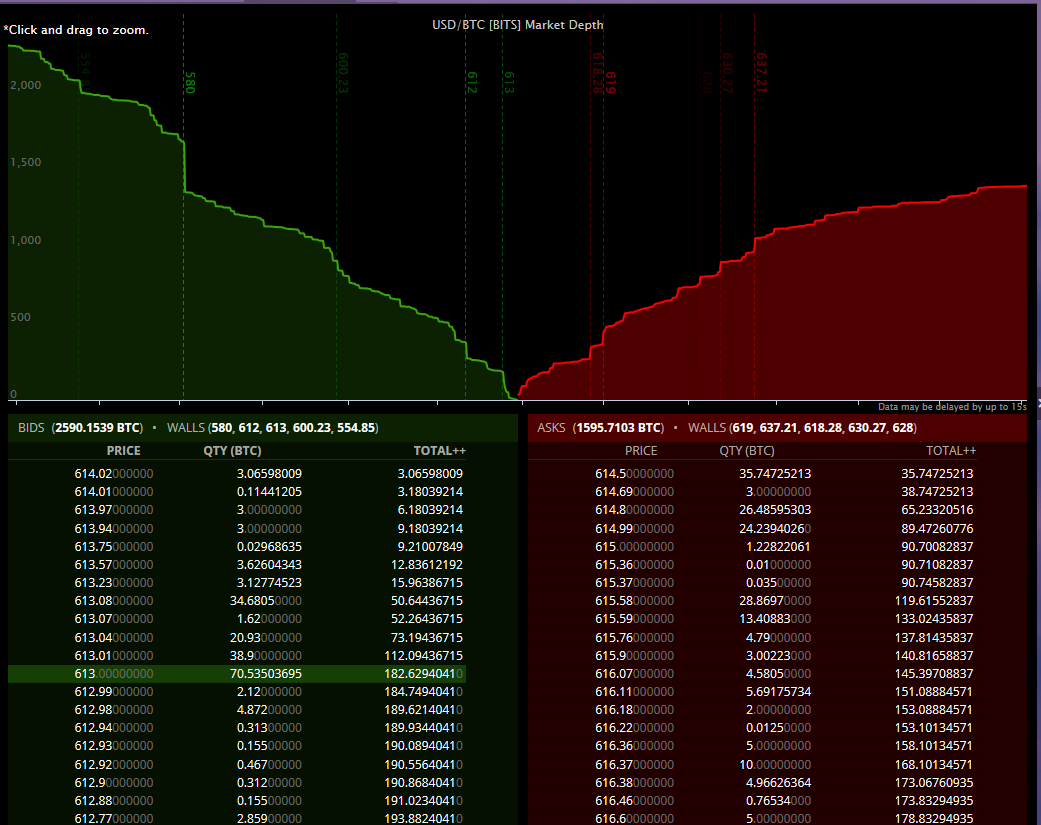

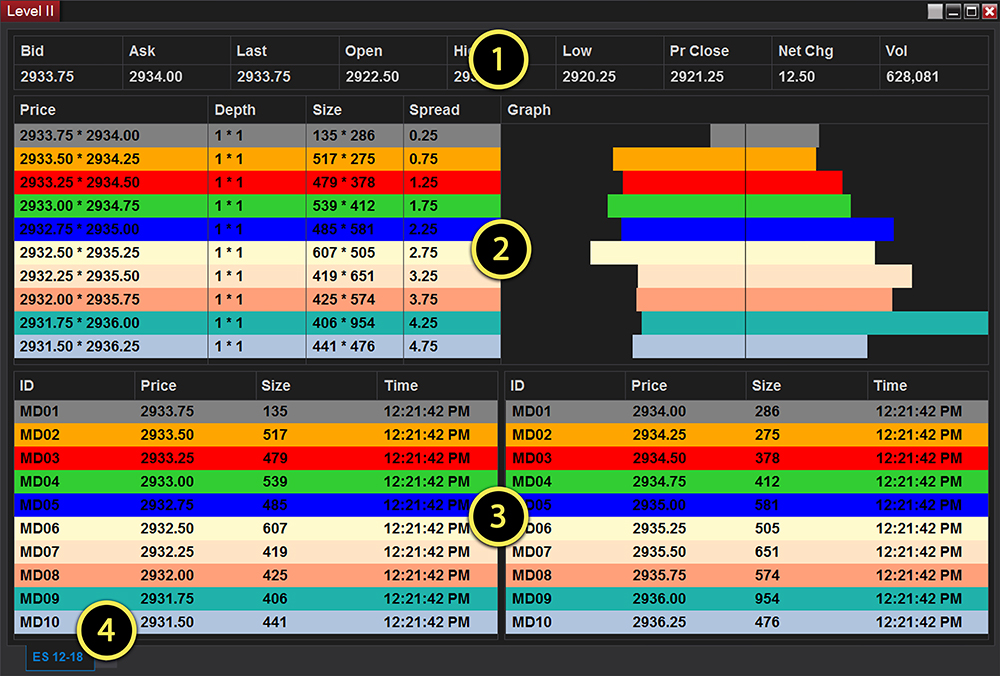

In the realm of market depth analysis, various types offer unique insights for traders and investors. Level II Market Depth provides granular details on individual orders, unveiling sizes and prices. Contrarily, Level I Market Depth focuses on top bid and ask prices and their volumes. Time and Sales track recent trades with price, volume, and time stamps, while DOM (Depth of Market) visually depicts order distribution across price levels. Each type equips market participants with valuable data for informed decision-making in trading.

Level II Market Depth provides traders with a comprehensive view of order book details, enabling them to gauge market sentiment and potential price movements based on various order sizes and prices. On the other hand, Level I Market Depth offers a more simplified snapshot, displaying the best bid and ask prices along with their corresponding volumes, making it easier for quick decision-making by showing the most competitive prices in the market.

Time and Sales, also known as a transaction tape, give traders a historical view of trades executed, showing the price, volume, and timestamp of each trade. This information is vital for understanding the trend of trades and the momentum in the market. By analyzing the Time and Sales data, traders can identify patterns and make informed decisions based on recent trade activities.

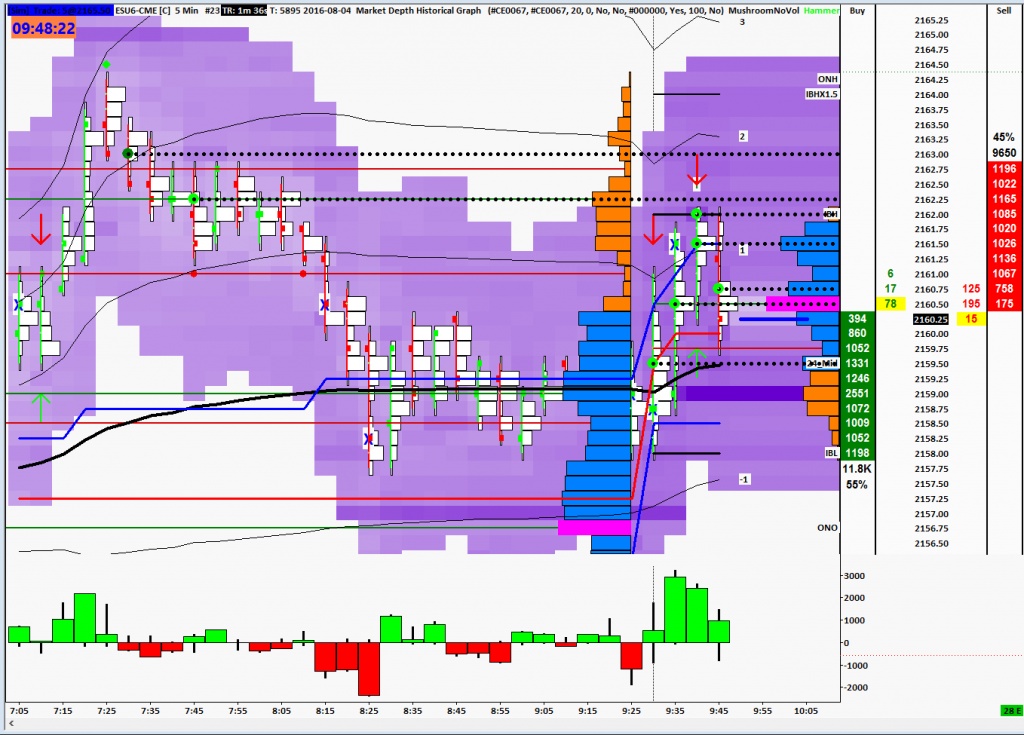

Depth of Market (DOM) presents traders with a visual representation of the order book, depicting the distribution of buy and sell orders at different price levels. This graphical tool allows traders to visualize market liquidity and potential support and resistance levels. Analyzing the DOM can help traders anticipate price movements and determine optimal entry and exit points in the market, enhancing their overall trading strategies.

Leveraging Market Depth for Enhanced Trading Strategies

Market depth analysis offers traders various strategies for optimized decision-making. Scalping involves capitalizing on minor price fluctuations by swiftly acting on market depth cues. This technique relies heavily on interpreting real-time supply and demand dynamics to secure profits efficiently.

Contrarian Trading, on the other hand, entails going against popular market sentiments. Market depth data plays a pivotal role in identifying potential market reversals, allowing traders to capitalize on such opportunities.

In Market Making, traders contribute to market liquidity by placing simultaneous buy and sell orders at different price points. This strategy relies on market depth to gauge optimal entry and exit points for profitable transactions.

Hedging is a risk management strategy that utilizes market depth to offset potential losses by opening positions that act as insurance against adverse market movements. By strategically analyzing market depth, traders can safeguard their portfolios against unexpected volatility and mitigate risks effectively.

:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-05-a19b59070c434400988fca7fa83898dd.jpg)

Analyzing the Limitations of Market Depth Analysis

Understanding the Challenges

Market depth analysis, while fundamental, has limitations that traders must acknowledge. Viewing only current orders, it may not forecast future market trends accurately. Moreover, the tool lacks insights into the intentions driving participants’ actions, limiting predictive capabilities.

Potential Manipulation

Large traders or sophisticated algorithms can influence market depth, distorting the true supply-and-demand dynamics. Users must exercise caution and combine market depth with diverse analytical methods for a comprehensive view.

Integration with Other Analytical Tools

To mitigate the limitations, traders should integrate market depth analysis with diverse technical and fundamental tools. Utilizing multiple sources enhances decision-making accuracy and minimizes risk in the volatile market environment.

By understanding these restrains, traders can navigate the complexities of market depth analysis more effectively, elevating their trading strategies and improving decision-making processes.