In today’s dynamic financial landscape, understanding forward contracts is essential for managing risks and optimizing financial strategies. This comprehensive guide delves into the key aspects of forward contracts, shedding light on their features, benefits, risks, pricing, and applications. Whether you are a seasoned investor or a business owner looking to hedge against market fluctuations, grasping the intricacies of forward contracts can be a game-changer in your financial toolkit. Let’s delve into the world of forward contracts to unlock their potential for risk management and exposure mitigation.

Are you curious about how Forward Contracts can help you navigate the uncertainties of the financial markets? In this extensive guide, we will unravel the complexities surrounding Forward Contracts, providing insights into their mechanisms, uses, and alternatives. From understanding the fundamentals to exploring real-world applications, this guide will equip you with the knowledge needed to make informed decisions in the realm of financial risk management. Join us on this journey to gain a deeper understanding of Forward Contracts and their pivotal role in shaping strategic financial outcomes.

Exploring the World of Forward Contracts

Forward contracts serve as vital tools in financial risk management, allowing parties to lock in prices for future transactions. These agreements, not traded on exchanges and customizable to specific needs, enable precision in managing price uncertainties. Whether safeguarding against price fluctuations or capitalizing on anticipated changes, forward contracts offer a versatile approach tailored to commodities, currencies, and interest rates, enhancing strategic decision-making.

Key Features of Forward Contracts

Forward contracts offer a bespoke solution tailored to the exact requirements of the parties engaged, adding a layer of customization unmatched by standardized futures contracts. Unlike futures, forward contracts allow negotiable terms, adapting to unique circumstances and preferences, enhancing flexibility in risk management strategies.

In the realm of forward contracts, a noteworthy distinction lies in their non-standardized nature, allowing for versatile contract terms that can differ significantly from one agreement to another. This variability enables parties to fine-tune contract specifics, aligning with their specific risk exposure, asset preferences, and financial objectives.

Settlement of forward contracts typically involves the physical delivery of the underlying asset at the contract’s maturity date. This aspect distinguishes them from cash-settled instruments like futures, providing a tangible exchange of goods or securities as per the agreement’s terms, adding a tangible element to the contract execution process.

The unique feature of daily mark-to-market valuation sets forward contracts apart by reflecting real-time fluctuations in market prices. This adjustment mechanism ensures that the contract’s value is continuously updated based on prevailing market conditions, enabling parties to monitor and manage their positions effectively in response to price changes.

Unlocking the Benefits of Using Forward Contracts

Price Lock-In for Future Transactions

Forward contracts empower businesses to secure fixed prices for future transactions, shielding them from unpredictable market fluctuations. This stability fosters confidence in financial planning and budgeting, ensuring predictability in costs and revenue streams.

Price Volatility Mitigation

By hedging against adverse price shifts, forward contracts serve as a shield against sudden market changes. This risk management tool offers peace of mind by stabilizing prices, safeguarding businesses from unforeseen financial turbulence.

Speculation and Profit Opportunities

Beyond risk mitigation, forward contracts provide a platform for strategic speculation on future price movements. Savvy investors can leverage these contracts to capitalize on anticipated market trends, potentially yielding lucrative returns.

Flexible Risk Management

One of the key advantages of forward contracts is their versatility in tailoring risk management strategies. Whether hedging against price fluctuations or optimizing profit margins, these contracts offer customizable solutions to suit varying risk appetites and objectives.

By harnessing the benefits of forward contracts, businesses and investors can navigate volatile markets with confidence, optimize financial outcomes, and strategically position themselves for success in an ever-evolving economic landscape. Understanding forward contracts’ advantages unlocks a powerful tool for enhancing financial resilience and capitalizing on market opportunities.

Pricing Forward Contracts

Understanding How Forward Prices are Determined

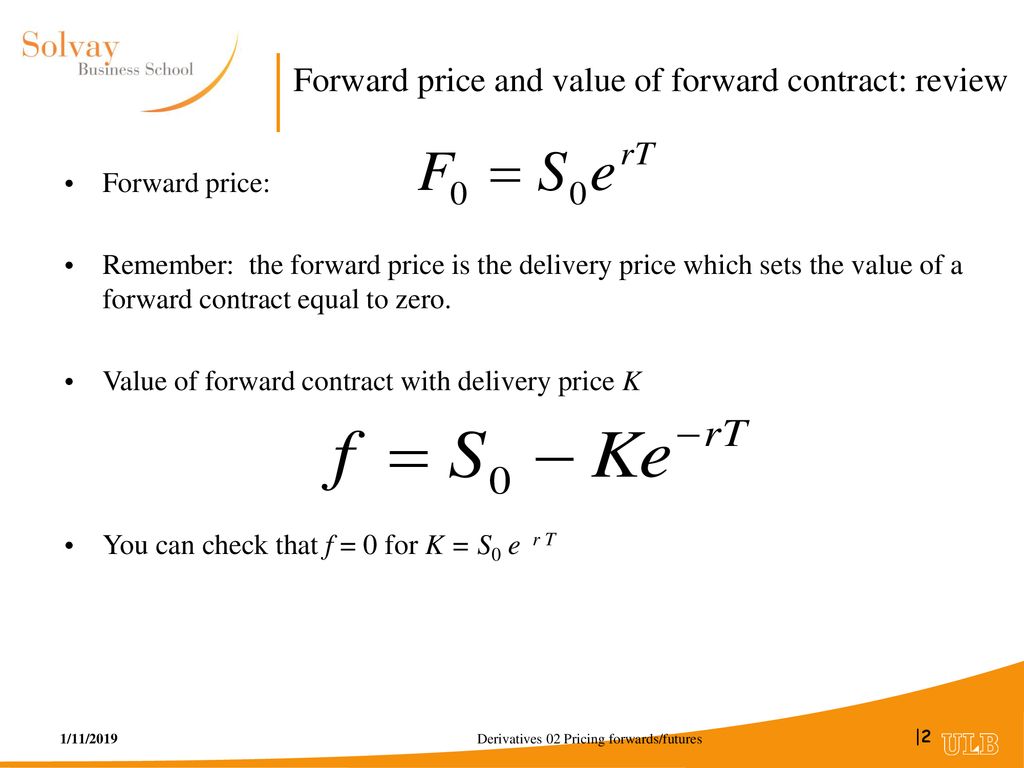

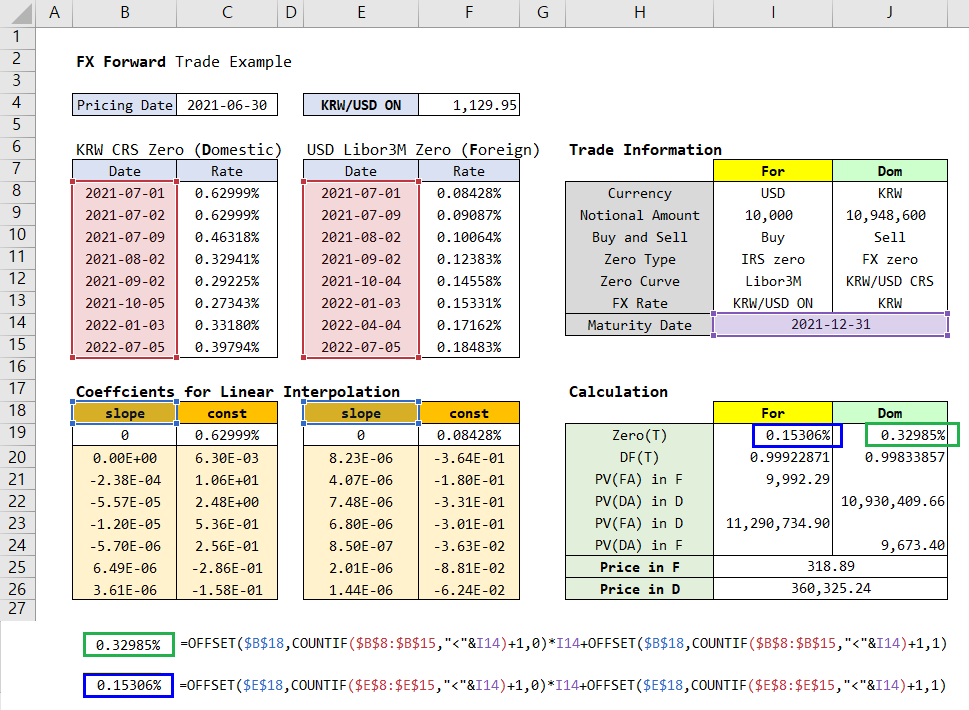

Forward contract pricing hinges on two core factors: the current spot price of the asset and prevailing interest rates. The payout at contract maturity is based on the difference between the agreed-upon forward price and the spot price at that future date. Interest rates play a significant role, impacting the cost of carry and thereby influencing forward pricing dynamics.

Calculating Forward Prices with Precision

The intricate nature of forward pricing involves the application of mathematical models like the forward pricing formula. This formula incorporates variables such as the spot price, time to maturity, risk-free rate, and storage costs. By utilizing these components, financial professionals derive accurate forward prices, crucial for effective risk management and strategic decision-making in the derivatives market.

Unveiling the Premium or Discount Dynamics

When discussing forward contracts, it’s common to encounter prices quoted as either a premium or a discount concerning the spot price. This margin variation signifies the market’s forecasted direction of the asset’s spot price movement until contract expiration. A premium suggests an anticipated rise, while a discount indicates an expected decrease in the asset’s value, shedding light on market sentiments and risk perceptions.

Reflecting Expected Changes in Spot Prices

The premium or discount attached to forward prices acts as a reflection of the projected alterations in the underlying asset’s spot price over the contract’s duration. This differential accounts for market expectations and participants’ anticipations regarding future price movements. Understanding these pricing dynamics aids investors and businesses in gauging potential risks, making informed hedging decisions, and aligning their financial strategies accordingly.

Evaluating the Risks in Forward Contracts

Forward contracts come with inherent risks that demand a prudent approach for effective risk management. One critical risk is counterparty risk, where there’s the looming possibility of the other party failing to meet their end of the agreement. This risk underscores the need for thorough due diligence in selecting reliable counterparties to mitigate potential default scenarios.

Moreover, the directional nature of forward contracts exposes traders to market fluctuations. Should the price of the underlying asset move unfavorably against initial expectations, significant losses can incur, highlighting the importance of meticulous market analysis and risk assessment.

The intricate nature of forward contracts can pose challenges for inexperienced individuals due to their complexity. Seeking guidance from financial experts or professionals becomes imperative to navigate the intricacies of these contracts effectively. This step ensures that all parties involved grasp the terms, conditions, and implications before committing to a forward contract.

It is crucial to recognize that forward contracts might not align with the risk tolerance and investment objectives of all investors. Due to their nature, these contracts may not suit investors seeking low-risk or quick liquidity options. Therefore, understanding individual risk profiles and consulting with financial advisors are crucial steps in determining the suitability of forward contracts in a portfolio.

By comprehensively understanding and evaluating the risks associated with forward contracts, investors and businesses can make informed decisions tailored to their risk appetite and financial objectives. Mitigating these risks through diligent research, expert guidance, and a clear understanding of market dynamics can enhance the effectiveness of forward contracts as risk management tools.

Applications of Forward Contracts

Forward contracts serve as indispensable tools across various financial landscapes with diverse applications. They find prominent use in international trade, enabling businesses to effectively manage currency risk fluctuations. By locking in exchange rates through forward contracts, companies can mitigate potential losses arising from adverse currency movements, ensuring stable and predictable financial outcomes in cross-border transactions.

Businesses across industries leverage forward contracts to shield themselves from price volatility concerning commodities and essential raw materials. By entering into forward agreements, companies can secure prices for future deliveries, safeguarding profit margins and budget projections from the impacts of fluctuating raw material costs. This strategic use of forward contracts empowers businesses with stability in cost management and enhances overall financial resilience.

Additionally, forward contracts present an avenue for market participants to engage in speculation on future price movements. Investors can capitalize on their market insights by utilizing forward contracts to take positions based on anticipated price trends, potentially yielding profits from accurate market predictions. This speculative aspect of forward contracts offers a platform for sophisticated risk management strategies and financial gains through astute forecasting and decision-making.

Moreover, investors actively employ forward contracts to manage risks associated with interest rate fluctuations. By entering into interest rate forward contracts, investors can hedge against adverse interest rate changes, safeguarding their portfolios from potential losses. This proactive approach to risk management using forward contracts allows investors to optimize their investment strategies, ensuring a balanced exposure to interest rate variations while preserving capital and maximizing returns in dynamic financial environments.

In conclusion, the multifaceted applications of forward contracts underscore their versatility and significance in risk management, speculation, and financial optimization. Whether used to mitigate currency risk in international trade, hedge against commodity price fluctuations, speculate on market movements, or hedge interest rate exposure, forward contracts offer a robust mechanism for businesses and investors to proactively navigate uncertainties and capitalize on market opportunities. Understanding forward contracts is key to leveraging their potential effectively in diverse financial scenarios.