Are you looking to expand your knowledge on market orders? In this comprehensive guide, we will delve into the definition, advantages, and disadvantages of market orders. Whether you’re a seasoned trader or new to the market, understanding when to use or avoid market orders can be crucial for your trading strategy. Let’s explore the ins and outs of market orders and equip you with the information you need to make informed trading decisions.

Advantages of Using Market Orders

Leveraging Speed and Execution Certainty

Market orders stand out as the quickest method to initiate or close a position swiftly. Unlike limit orders that might not trigger, market orders guarantee execution. This rapid execution can be beneficial when immediate action is required, especially in fast-paced market conditions. Utilizing market orders ensures timely and efficient trade placements, capitalizing on time-sensitive opportunities without delay.

Seizing Instant Market Opportunities and Risk Mitigation

Embracing market orders enables traders to capitalize on abrupt market fluctuations promptly. By swiftly executing market orders, traders can swiftly react to emerging trends or news, making the most of sudden price movements. Additionally, market orders can serve as a risk management tool, allowing investors to swiftly hedge against potential losses by promptly entering or exiting a position at the prevailing market price. This proactive approach aids in safeguarding investments against unforeseen market volatility.

Incorporating market orders into trading strategies provides traders with unparalleled speed in execution and the certainty of trade completion, empowering them to act swiftly in taking advantage of market developments and safeguarding against potential risks. This tactical approach enhances traders’ ability to navigate market dynamics effectively and capitalize on profitable trading opportunities efficiently.

When to Avoid Using Market Orders

Lack of Market Confidence

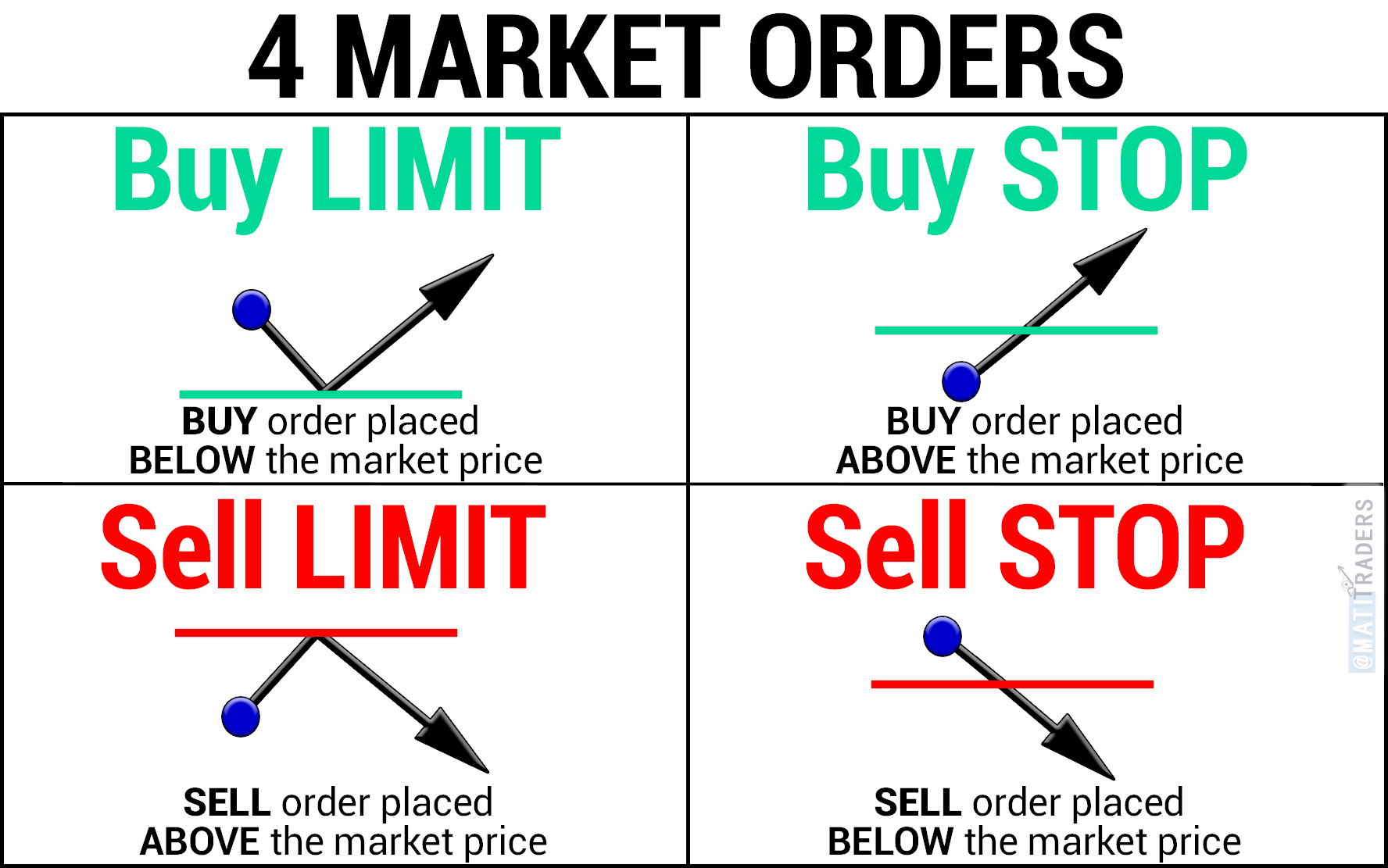

Market orders should be bypassed when traders lack confidence in predicting market trends. Uncertainty can lead to unfavorable executions, impacting profits. Utilize limit orders to set specific price levels for trade entry, mitigating risks associated with uncertain market directions.

Reluctance Towards Risk

Avoid market orders if unwilling to embrace sudden losses. Market volatility can trigger unexpected price shifts, jeopardizing investments. Employing stop-loss orders aligns with risk management strategies, offering protection against substantial financial downturns.

High Volatility Circumstances

During market frenzy, refrain from employing market orders due to heightened price fluctuations. Opt for advanced trading techniques such as using trailing stops or conditional orders to navigate turbulent market conditions effectively. This allows for better control over trade executions amidst erratic price movements.

Executing Large Orders

When dealing with significant trade volumes, market orders may not be ideal, especially in thin markets. Thinly traded assets can suffer from wide bid-ask spreads, impacting order execution at unfavorable prices. Employing alternative order types such as iceberg orders or dark pools ensures discreet execution of large trades without market disruption.

By discerning when to steer clear of market orders based on market sentiment, risk appetite, volatility levels, and trade size considerations, traders can enhance their strategic approach to trading, ultimately fortifying their portfolio performance and overall trading success.