Are you intrigued by the world of financial markets and the unpredictable nature of market volatility? In this comprehensive guide, we delve into the intricate details of market volatility – from its various types and underlying causes to its profound impact on investors. Understanding market volatility is crucial for individuals navigating the dynamic landscape of finance, as it can dictate investment decisions and risk management strategies. Join us as we explore the nuances of market volatility and equip you with essential insights to navigate through turbulent market conditions.

In today’s fast-paced financial environment, mastering the art of managing market volatility is paramount for investors seeking to safeguard their portfolios and optimize their returns. Market Volatility is a key concept that influences market trends and shapes investment behaviors. By unraveling the mysteries surrounding market volatility, investors gain a competitive edge in anticipating market movements and implementing effective risk management strategies. Stay tuned as we uncover the strategies for managing market volatility and delve into the realm of forecasting and risk management in financial markets.

Understanding Market Volatility: A Comprehensive Overview

Market volatility encapsulates the variability in financial asset prices, reflecting the market’s fluctuation intensity over time. It serves as a critical risk gauge, signaling the likelihood of substantial price swings in investments. Factors like economic shifts, political unrest, and unforeseen calamities can trigger volatility, underscoring the importance of comprehending this concept for making informed investment choices and implementing robust risk management strategies.

Exploring the Depths of Market Volatility: Types and Measurement

Understanding Different Forms of Market Volatility

Market volatility manifests through various lenses, with historical and implied measures being prominent. Historical volatility, a retrospective analysis tool, scrutinizes an asset’s past price actions to gauge its volatility tendencies. Conversely, implied volatility, derived from options pricing, anticipates future asset volatility, aiding investors in strategic decision-making.

Diverse Units to Quantify Volatility

The quantification of market volatility resonates through diverse units like standard deviation, variance, and beta. While standard deviation delves into the dispersion of an asset’s returns, variance amplifies this notion by squaring standard deviation values. In contrast, beta scrutinizes how closely an asset mirrors the market’s movements, offering valuable insights for risk evaluation.

Varied Levels Across Asset Classes

Volatility transcends uniformity, showcasing distinct behavior across asset classes and markets. Equities might pulsate with higher volatility compared to fixed income securities, whereas commodities could exhibit sporadic price swings of their own. Understanding these variations is pivotal for investors in crafting diversified portfolios attuned to distinct volatility profiles.

Unraveling the Causes and Drivers of Market Volatility

Economic Factors:

Understanding Market Volatility is crucial in grasping how economic factors like interest rate fluctuations, GDP growth variations, and inflation rates directly influence market volatility. For investors, monitoring these indicators closely is essential for anticipating market swings and making informed decisions amidst economic uncertainties.

Political Events Impact:

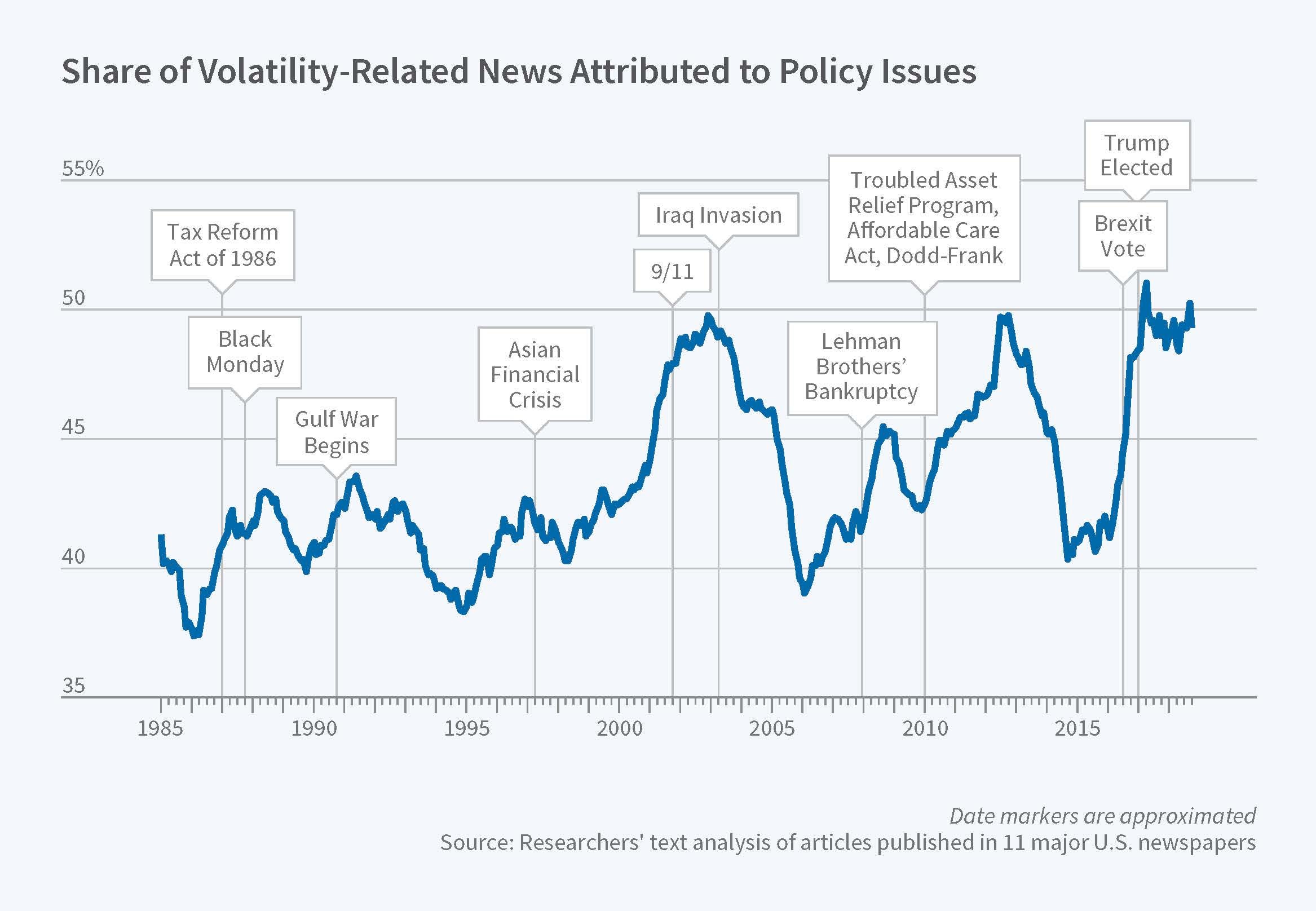

Political events, from elections to policy alterations and geopolitical tensions, play a pivotal role in driving market volatility. The uncertainty surrounding political changes can create ripples in financial markets, causing fluctuations in asset prices and investor confidence. Acknowledging these factors is key to navigating volatile market conditions effectively.

Disruptions from Natural Calamities:

Natural disasters like hurricanes and earthquakes can wreak havoc on supply chains, infrastructure, and economic stability, leading to heightened market uncertainty. The aftermath of such events can disrupt businesses, impact investor sentiment, and trigger significant market turbulence, emphasizing the need for risk management strategies in unpredictable situations.

Investor Sentiment and Herd Behavior:

Investor sentiment, coupled with herd behavior, can exacerbate market volatility by amplifying price movements based on collective emotions rather than fundamental factors. Understanding how psychological biases influence market dynamics is crucial for investors to avoid succumbing to herd mentality and strategically manage risks in volatile market environments.

The Impact of Market Volatility on Investors

Market Volatility’s Influence on Investment Returns and Portfolio Performance

Understanding Market Volatility is crucial as it directly impacts investment returns and portfolio performance. Sudden market fluctuations can either amplify gains or trigger losses, emphasizing the need for proactive risk management approaches to navigate turbulent market conditions effectively.

Managing Investments in High Volatility Environments

High levels of volatility pose significant risks. Without proper management, investors may face unexpected losses. Strategic portfolio diversification and disciplined investment strategies are vital to mitigate risks and safeguard portfolios against market uncertainties.

Embracing Opportunities Amidst Volatility

Market volatility, though daunting, can present lucrative opportunities for investors with a higher risk tolerance. By understanding Market Volatility and adopting a calculated approach, investors can capitalize on undervalued assets and potentially reap substantial returns during market fluctuations.

Informed Decision-Making through Volatility Awareness

A profound understanding of Market Volatility empowers investors to make well-informed decisions regarding asset allocation and risk management. By dissecting the nuances of market fluctuations, investors can adjust their investment strategies to align with their risk appetite and financial goals effectively.

Strategies for Managing Market Volatility

Diversification: Mitigating Risk

Diversifying your portfolio across various asset classes and markets is a fundamental strategy for mitigating volatility risk. By spreading investments, you reduce exposure to the fluctuations of a single asset, enhancing stability and protecting against severe downturns in any specific market.

Hedging with Options and Futures

Implementing hedging strategies, such as options or futures contracts, can safeguard your investments against price fluctuations. These financial instruments allow you to offset potential losses from market volatility, providing a level of protection and stability in your portfolio amidst unpredictable market movements.

Regular Portfolio Rebalancing

Consistently monitoring and rebalancing your portfolio ensures alignment with your risk tolerance and investment objectives. During volatile periods, adjustments to asset allocations help maintain the desired risk exposure. Rebalancing enables you to stay on track with your financial goals despite the market’s erratic behavior.

Dollar-Cost Averaging: Smoothing Volatility

Utilizing the dollar-cost averaging method involves regularly investing fixed amounts of money over time, regardless of market conditions. This strategy helps average out the impact of market volatility on your investments, reducing the influence of short-term price fluctuations and potentially enhancing long-term returns.

Forecasting and Predicting Market Volatility

Historical Data and Statistical Models:

Utilizing historical data and advanced statistical models is a fundamental approach to predict future market volatility trends. By analyzing past market behaviors, investors can identify patterns and trends to anticipate potential fluctuations, aiding in making informed investment decisions and managing risks proactively.

Volatility Indices like the VIX:

Volatility indices such as the widely monitored VIX offer valuable insights into market sentiment and the expected level of volatility. Investors use these indices as indicators to gauge market uncertainty and adjust their strategies accordingly, helping them navigate through volatile market conditions with more clarity and confidence.

Economic Indicators and Geopolitical Events:

Economic indicators and geopolitical events play a pivotal role in forecasting market volatility. Monitoring factors like GDP growth, interest rates, inflation, and global geopolitical tensions enables investors to assess potential sources of volatility. Being aware of these external influences empowers investors to prepare for unforeseen market movements and adjust their portfolios strategically.

The Challenge and Benefits of Forecasting:

Forecasting market volatility presents challenges due to the dynamic nature of financial markets. However, despite the complexities, accurate forecasts can equip investors with the foresight to anticipate and mitigate risks effectively. By incorporating forecasting techniques into their investment strategies, individuals can align their portfolios to withstand market fluctuations and optimize returns in the long run.

Navigating Market Volatility: A Crucial Element in Risk Management

In the realm of investment portfolios, market volatility stands as a fundamental aspect of risk management. Understanding Market Volatility and its intricate dynamics is vital for investors to thrive in the financial markets. Before venturing into the realm of volatile markets, investors must meticulously evaluate their risk appetite and align their investment objectives to mitigate uncertainties effectively.

Effective risk management serves as a shield against potential losses in turbulent market environments. By implementing robust risk management strategies, investors can navigate through periods of heightened volatility while safeguarding their investments from significant downturns. It is imperative to stay vigilant, continuously monitoring market trends, and adjusting investment strategies proactively to maintain resilience in the face of market fluctuations.