Breakout trading strategies are essential tools for traders looking to capitalize on market momentum and volatility. By effectively identifying key levels of support and resistance, traders can execute timely trades to capture potential profits. In this comprehensive guide on breakout trading, we will delve into various strategies, execution tips, risk management techniques, and the advantages and limitations of this approach in the financial markets. Whether you are a novice trader looking to enhance your skills or an experienced investor seeking to refine your trading strategy, understanding breakout trading is crucial for navigating the dynamic world of finance.

In the realm of financial markets, Breakout Trading stands out as a popular and effective strategy employed by traders worldwide. By recognizing and acting upon significant price movements, traders can exploit opportunities for substantial profits. In this guide, we will explore the intricacies of Breakout Trading, providing valuable insights into effective strategies, risk management, and tips for successful execution. Whether you are a day trader, swing trader, or long-term investor, mastering the art of Breakout Trading can significantly enhance your trading arsenal and elevate your performance in the markets.

Strategies for Identifying Breakout Opportunities

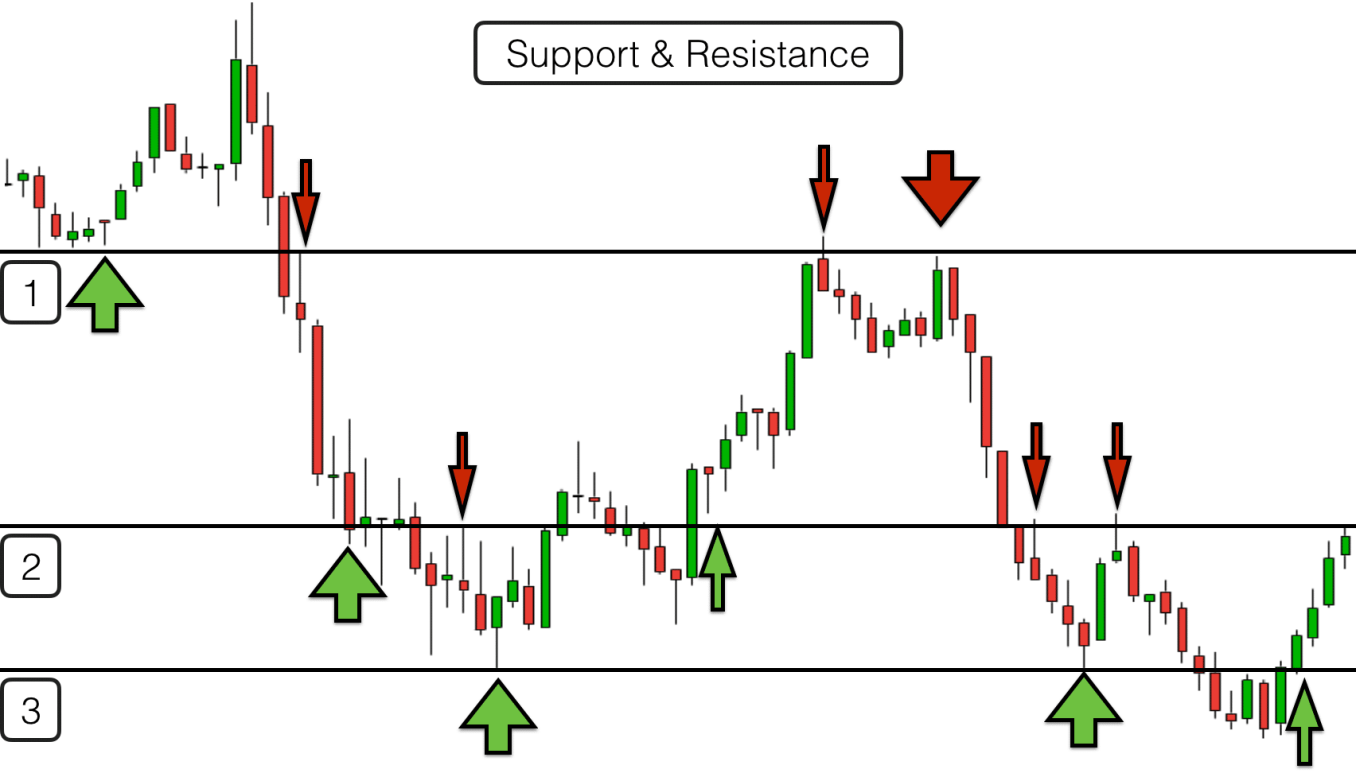

Identifying Support and Resistance Levels

When scouring for breakout opportunities, pay close attention to price action forming distinct support and resistance levels. These levels act as critical entry and exit points, guiding traders on potential breakout positions. Clear and well-defined levels offer a roadmap for anticipating breakout movements effectively.

Leveraging Technical Indicators

Utilize technical tools like moving averages, Bollinger Bands, and Fibonacci retracements to validate breakout signals. These indicators provide additional confirmation of potential breakout points, enhancing the precision of your trading decisions. By combining technical analysis with price action, traders can strengthen their breakout strategies and improve trade accuracy.

Monitoring Market Influences

In addition to technical analysis, consider external factors such as market sentiment, news events, and economic data when identifying breakout opportunities. These catalysts can significantly impact price movements, triggering breakouts or false signals. Understanding the broader market context is essential for making informed decisions and maximizing profit potential in breakout trading.

Mastering the Art of Executing Breakout Trades

Executing Breakout Trades with Precision

Executing breakout trades effectively requires precision and strategy. Begin by identifying a suitable entry point based on the breakout pattern and your risk tolerance. Analyze the market conditions to determine the optimal moment to enter a trade and capitalize on price momentum.

Risk Management in Breakout Trading

Implement a robust risk management strategy by setting a stop-loss order below the support level for long trades or above the resistance level for short trades. This precautionary measure helps limit potential losses and protect your trading capital, enhancing overall trade sustainability.

Smart Position Sizing and Adjustments

Manage risk prudently through strategic position sizing based on your account balance and risk appetite. Adjust your trade size accordingly to align with the evolving market conditions and ensure that your risk exposure remains within manageable limits throughout the trade duration.

Monitoring and Adaptation for Success

Constantly monitor your breakout trade, keeping a watchful eye on market developments. Adjust the stop-loss or take-profit levels as necessary to optimize profits and mitigate risks effectively. Flexibility and vigilance are key to maximizing the potential returns from breakout trades.

Incorporating these execution strategies into your breakout trading approach can significantly enhance your trading performance by improving precision, minimizing risks, and maximizing profit potential. Embrace these practices to navigate the challenges of breakout trading with confidence and finesse, ensuring that each trade is executed with precision and skill.

Effective Management of Breakout Trades

Monitoring and Adjustment

Successful management of breakout trades involves vigilant monitoring of the trade’s progress. Regularly assess the market dynamics and adjust stop-loss or take-profit levels accordingly to align with the evolving price action. This proactive approach helps in maximizing profits and minimizing potential losses by adapting to changing market conditions swiftly.

Trailing Stop-Loss Orders

Implementing trailing stop-loss orders can be a prudent strategy in managing breakout trades. This technique allows traders to secure profits by automatically adjusting the stop-loss level as the trade progresses favorably. By locking in gains while keeping the trade open for further upside potential, traders can optimize their risk-reward ratio and capitalize on extended price movements.

Exiting on Breakout Failure

Preparation for trade exit is vital in breakout trading. If the breakout fails to sustain momentum or if there are substantial shifts in market conditions, traders should be ready to exit the trade promptly. Exiting strategically in such scenarios helps limit losses and preserves capital for future opportunities, ensuring a disciplined approach to managing breakout trades effectively.

Advantages of Breakout Trading

Seizing High Returns:

Breakout Trading Strategies present traders with the enticing potential for substantial returns following a successful breakout. By accurately identifying breakouts and effectively executing trades, traders can capitalize on price movements that often lead to significant profit opportunities, making it a preferred strategy for those seeking lucrative gains in the financial markets.

Versatility Across Markets and Timeframes:

One of the key advantages of Breakout Trading Strategies lies in their adaptability, allowing traders to apply this approach across diverse markets and time frames. Whether in stocks, forex, or commodities, and whether as a day trader, swing trader, or long-term investor, breakout trading’s versatility empowers traders to capture opportunities in various financial instruments and trading scenarios.

Harnessing Market Dynamics:

Breakout Trading enables traders to leverage market volatility and momentum to their advantage. The strategy thrives on identifying key breakout levels where prices surge or plummet, providing traders with opportunities to jump in at the right moment. By harnessing market dynamics effectively, traders can ride the waves of momentum for profitable outcomes.

In conclusion, the Advantages of Breakout Trading Strategies encompass the potential for high returns, adaptability across different markets and timeframes, and the ability to capitalize on market momentum and volatility. By mastering this strategy, traders can enhance their trading capabilities, seize profitable opportunities, and navigate the dynamic landscape of financial markets with confidence and precision.

Challenges and Risks in Breakout Trading Strategies

Breakout Trading Strategies: Navigating Limitations

Breakout trading, while rewarding, is not without its shortcomings. One key issue is the potential for breakouts to fail, resulting in losses for traders. This risk underscores the importance of thorough analysis and risk assessment before entering trades in the volatile breakout market.

Discipline and Risk Management in Breakout Trades

Successfully executing breakout trading strategies demands a high level of discipline and risk management. Traders must set clear stop-loss levels and adhere to strict trade plans to mitigate the impact of potential adverse market movements. Without proper risk management, traders risk substantial losses in volatile breakout scenarios.

Identifying False Breakouts and Trapping Scenarios

Distinguishing between genuine breakouts and false signals presents a significant challenge for traders. False breakouts can deceive traders into entering positions prematurely, leading to getting trapped in losing trades. To combat this, traders must employ technical analysis tools and indicators to confirm breakout validity before committing to trades.

In the realm of breakout trading strategies, understanding and addressing the limitations is pivotal for achieving sustainable success in the financial markets. By acknowledging the risks of failed breakouts, emphasizing discipline in execution, and honing the skills to identify false signals, traders can navigate the complexities of breakout trading with more confidence and precision.