Are you a senior looking for the best whole life insurance policies? In this comprehensive guide, we will delve into the benefits, factors to consider, top companies, application process, and alternatives for seniors. Understanding the importance of securing the right whole life insurance policy is crucial for financial stability and peace of mind in your senior years. Whether you are a retiree or planning for the future, choosing the best whole life insurance can provide you with the necessary coverage and protection.

With a myriad of options available, selecting the best whole life insurance policies for seniors can be a daunting task. Our guide is designed to help you navigate through this process effortlessly, ensuring that you make an informed decision. Whether you are interested in exploring top companies, understanding the application process, or considering alternatives, this guide has got you covered. Stay tuned to discover the most suitable whole life insurance policy that meets your needs and secures your financial future.

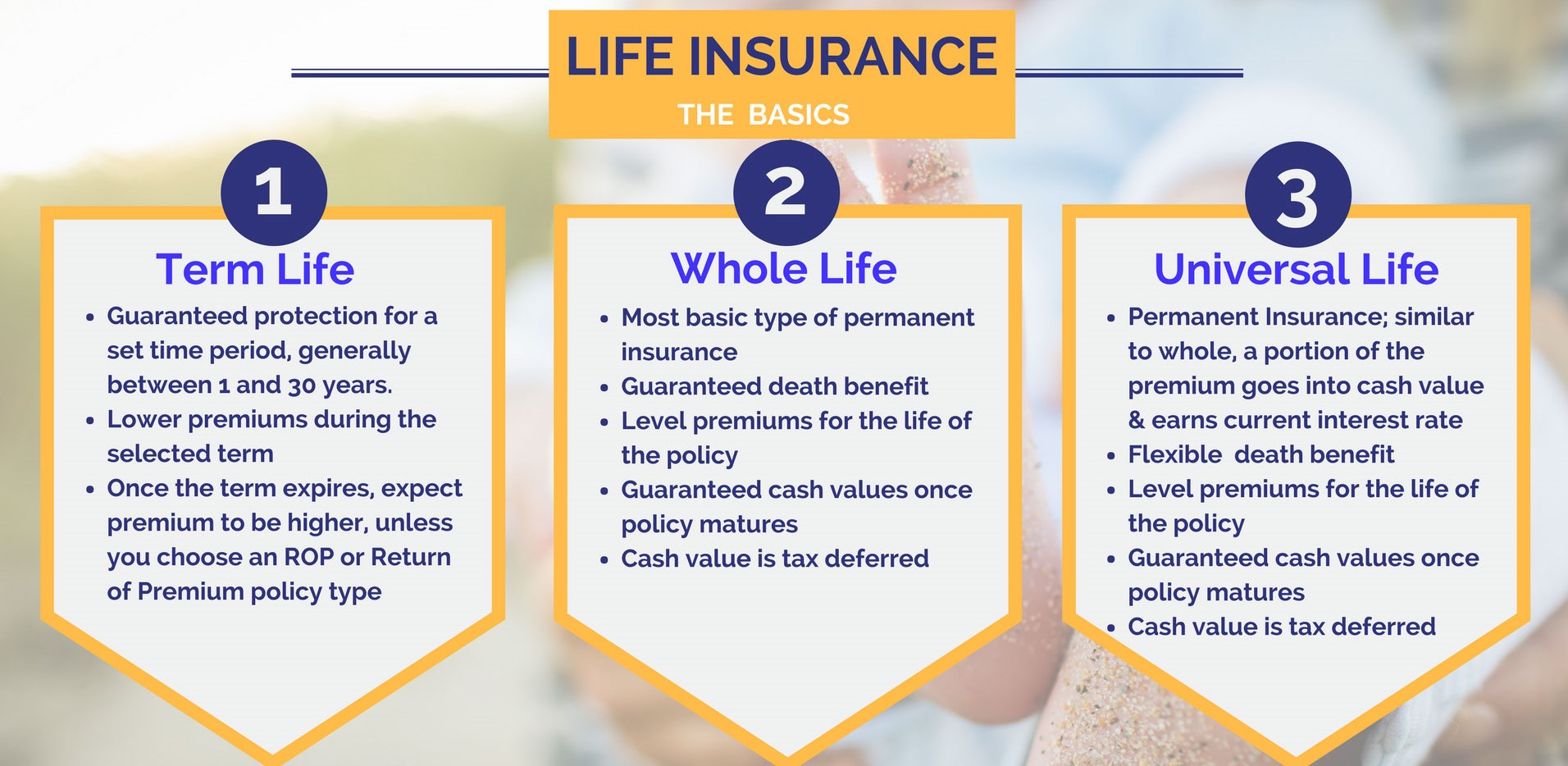

Understanding Whole Life Insurance for Seniors

Whole life insurance offers seniors lifelong coverage, ensuring a death benefit for their beneficiaries, providing financial security and peace of mind. The fixed premiums offer predictability, safeguarding against potential cost hikes as seniors age. Additionally, the cash value within the policy accrues tax-deferred, serving as a valuable asset that grows over time, catering to various financial planning needs like covering final expenses, estate planning, and facilitating wealth transfer strategies. This comprehensive coverage ensures seniors have a reliable financial safety net throughout their later years.

Benefits of Whole Life Insurance for Seniors

Ensuring Lifetime Coverage and Financial Security

Whole Life Insurance for Seniors offers guaranteed lifetime coverage, providing peace of mind knowing that loved ones will be financially secure. This permanence eliminates concerns about outliving the policy, offering stability during retirement and beyond.

Protection Against Rising Costs with Fixed Premiums

Fixed premiums in Whole Life Insurance shield seniors from escalating insurance expenses in the future. This financial predictability ensures that the policy remains affordable and accessible, even as seniors advance in age.

Cash Value Benefits for Retirement Planning

The cash value feature in Whole Life Insurance serves as a strategic asset for seniors. It can function as a tax-free income stream during retirement, supplementing other income sources, or as a source for loans when financial needs arise, providing flexibility and security.

Asset Preservation and Estate Tax Mitigation

Whole Life Insurance plays a significant role in asset preservation and estate planning for seniors. By leveraging this coverage, seniors can protect their assets and reduce potential estate taxes, ensuring a smoother wealth transition to beneficiaries while securing their financial legacy.

Factors to Consider When Choosing a Whole Life Insurance Policy

Age and Health Status Impact

When selecting a whole life insurance policy as a senior, your age and health status become pivotal factors. Typically, premiums are influenced by these aspects, meaning that the younger and healthier you are, the more affordable your premiums are likely to be. It’s essential to consider how these factors interplay when assessing different policy options to secure the best coverage tailored to your circumstances.

Determining the Right Coverage Amount

Deciding on the appropriate coverage amount is crucial when choosing a whole life insurance policy for seniors. Evaluate your financial obligations and the needs of your beneficiaries to establish a suitable death benefit. Understanding your coverage needs ensures that your loved ones are adequately protected in the event of your passing, offering peace of mind during your senior years.

Ensuring Premium Affordability

As a senior exploring whole life insurance options, it’s imperative to analyze the affordability of premiums. Assess your budget carefully to ensure that the premiums are sustainable in the long term. While whole life policies provide permanent coverage, it’s essential to select a policy with premiums that align with your financial capacity to maintain the policy effectively without straining your finances.

Aligning with Financial Goals

When considering whole life insurance for seniors, aligning the cash value component with your financial goals is paramount. Analyze how the cash value accumulation can contribute to your overall financial planning objectives. Understanding how the policy’s cash value can grow over time and potentially supplement your retirement income or fund other financial goals is crucial in making an informed decision.

Applying for Whole Life Insurance as a Senior

Engaging an Experienced Insurance Agent

To kickstart your whole life insurance application process, it’s pivotal to connect with a seasoned insurance agent specializing in senior insurance. This expert can navigate the complexities of policies tailored to seniors, ensuring you secure the most suitable coverage for your needs. Their expertise will guide you through the selection process, making it seamless and personalized.

Furnishing Personal & Health Information

Be prepared to share personal and health details during the application process for underwriting assessments. These evaluations help determine the risk associated with insuring you. Providing accurate information is crucial for tailoring a policy that aligns with your specific requirements and guarantees adequate coverage to safeguard your financial well-being.

Determining Coverage & Payment Options

When applying for whole life insurance as a senior, you will need to make decisions on the coverage amount and premium payment options. Assess your financial situation and future needs carefully to select an appropriate coverage level. Moreover, explore various payment plans to choose one that suits your budget and financial goals effectively.

Reviewing Policy Details Thoroughly

Before finalizing your whole life insurance application, meticulously review the policy terms and conditions. Pay close attention to coverage benefits, premium amounts, payout details, and any exclusions. Understanding the policy comprehensively empowers you to make an informed decision, ensuring that the chosen coverage meets your expectations and aligns with your long-term financial objectives.

Expert Tips for Securing the Best Whole Life Insurance Policy for Seniors

Shopping Around for the Right Fit

When seeking the best whole life insurance policy for seniors, it’s crucial to shop around and compare quotes from various insurance companies. This step allows you to evaluate different coverage options, premiums, and benefits to make an informed decision tailored to your specific needs.

Collaboration with Experienced Agents

Partnering with a seasoned insurance agent specializing in senior policies can streamline the process of finding the most suitable whole life insurance. An experienced agent will grasp your unique requirements, offering personalized guidance to navigate the complexities of policy selection effectively.

Health and Family History Assessment

Considering your health status and family history is paramount when selecting a whole life insurance policy. These factors influence premiums and coverage options, ensuring that your policy aligns with your current health situation and potential hereditary risks.

Aligning Policies with Financial Objectives

Ensure that the chosen whole life insurance policy aligns harmoniously with your financial goals and estate planning objectives. Understanding how the policy fits into your overall financial strategy guarantees that it provides the desired protection and benefits for you and your loved ones effectively.