Day trading is a popular trading strategy that involves buying and selling financial instruments within the same trading day to capitalize on small price movements. In this comprehensive guide on day trading strategies, you will learn essential skills, asset selection, risk management, strategy development, psychology, and technology required for successful day trading. Whether you are a novice or experienced trader, mastering the art of day trading can enhance your trading performance and profitability in the financial markets.

Delving into Day Trading Strategies

Day trading, at its core, revolves around swift transactions, buying, and selling financial instruments within a single trading day. It hinges on exploiting fleeting price changes for profit. Day traders meticulously analyze technical patterns and prevailing market sentiments to navigate the intricate landscape of day trading. By refraining from overnight positions, day traders mitigate risks linked with prolonged market exposure. Success in day trading relies heavily on adept skills, deep know-how, and unwavering discipline to maneuver rapid choices in a high-octane atmosphere.

Mastering Essential Skills for Successful Day Trading

Developing Strong Analytical Skills

Successful day trading demands sharp analytical abilities to interpret market data promptly, spotting profitable trading windows. Analyzing trends, volume, and price action is critical for making informed decisions. A thorough grasp of technical indicators aids in recognizing potential entry and exit points, crucial for maximizing profits. Effective analysis equips traders with an edge in the dynamic day trading landscape.

Managing Risk and Emotions

Mastering risk management is key to longevity in day trading. Alongside this, controlling emotions like fear and greed is vital to avoid impulsive actions that can lead to losses. Adhering to preset risk-reward ratios and setting stop-loss orders are tactics that help mitigate risks and maintain composure in high-pressure scenarios.

Understanding Technical Analysis

A deep understanding of technical analysis is indispensable for day traders. Proficiency in reading and interpreting chart patterns, support, and resistance levels enhances the ability to predict price movements accurately. This knowledge serves as a cornerstone for devising effective trading strategies based on statistical probabilities.

Upholding Discipline and Trading Plan

Discipline is non-negotiable in day trading. Adhering to a well-thought-out trading plan is crucial to stay focused and avoid emotional decision-making. Consistency in following set rules and strategies, even in turbulent market conditions, fosters a disciplined approach that can lead to long-term success in day trading.

Utilizing Trading Platforms and Tools

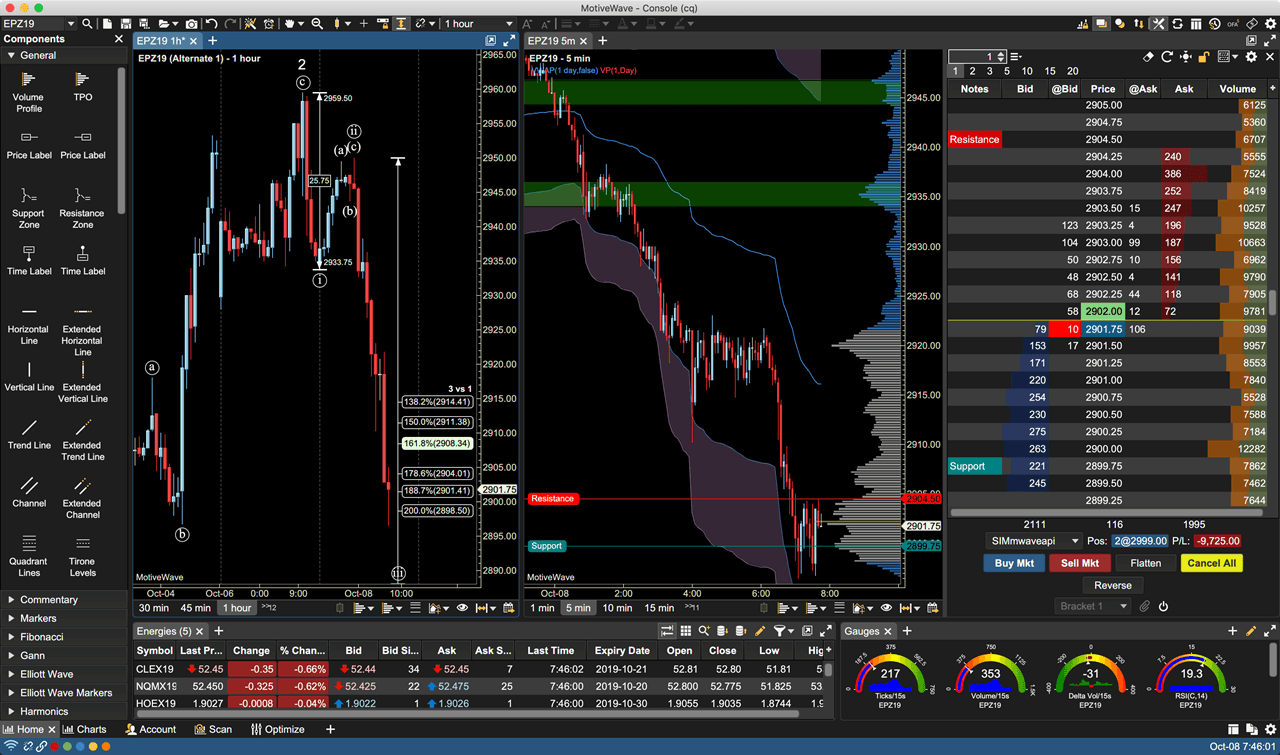

Efficient execution of trades hinges on familiarity with trading platforms and tools. Proficiency in using order types, charting software, and real-time data feeds streamlines the trading process. Being well-versed in the functionalities of these tools empowers traders to act swiftly on opportunities, maximizing their efficiency and effectiveness in day trading.

Choosing the Right Assets for Day Trading

When selecting assets for day trading strategies, opt for liquid instruments like stocks, currencies, or futures due to their high trading volume. These assets facilitate quick order execution and tighter spreads, crucial for intraday trading efficiency. Additionally, focus on assets exhibiting high volatility and predictable price movements. This combination offers opportunities for capturing short-term price fluctuations, essential for day trading success.

Diversifying your asset selection requires researching various asset classes to align with your trading style and risk appetite effectively. Whether you prefer equities, forex, or commodities, understanding the unique characteristics of each asset class helps in selecting the most suitable options for your day trading strategies. Matching assets to your strategy enhances your ability to capitalize on market movements efficiently.

Staying informed about market dynamics is vital in choosing the right assets for day trading. Regularly monitor market conditions, economic indicators, and significant news events that can impact the prices of your selected assets. By keeping abreast of relevant information, you can anticipate price movements and make informed decisions, a critical aspect of successful day trading. Consistent analysis and awareness of market drivers contribute to better asset selection strategies.

Crafting a Solid Day Trading Strategy

When developing your day trading strategy, start by defining clear trading goals aligned with your risk tolerance and time horizon. Understanding these aspects helps tailor your approach to match your objectives effectively. Identifying specific trading setups or patterns that signal entry and exit points is crucial for consistent decision-making in the fast-paced trading environment.

Position sizing and risk management are integral components of a successful day trading strategy. Establishing parameters for these factors helps control potential losses and optimize profit potential. Backtesting your strategy using historical data is a critical step in evaluating its effectiveness. This process enables you to identify strengths, weaknesses, and areas for improvement.

To stay competitive, continuously refine and adapt your strategy based on evolving market conditions and personal trading experiences. Flexibility and willingness to adjust your approach can enhance your adaptability to changing market dynamics. By monitoring performance metrics and making data-driven adjustments, you can optimize your day trading strategy for better outcomes in the long run.

Mitigating Risk in Day Trading

In day trading, employing stop-loss orders is crucial to cap losses per trade efficiently. By setting predetermined stop levels, traders can manage risk effectively, safeguarding their capital in volatile markets. This risk management tool helps traders stay disciplined and avoid emotional decision-making.

Diversification plays a vital role in risk management for day traders. Spreading trades across various assets or markets can help lessen the impact of adverse price movements in a single position. By diversifying, traders can potentially offset losses incurred in one area with gains in another, balancing their overall risk exposure.

Establishing clear risk-to-reward ratios is a strategic approach for successful day trading. By defining the potential profit against the acceptable loss for each trade, traders can assess trade viability and make informed decisions. Maintaining a favorable risk-to-reward ratio enhances the potential for profitability by focusing on trades with higher reward opportunities.

Vigilant trade monitoring is imperative in day trading to adapt to changing market conditions promptly. Continuously evaluating trades and market dynamics enables traders to adjust their strategies dynamically, mitigating risks effectively. Staying alert and responsive to market movements is key to reducing exposure to unforeseen risks and optimizing trade outcomes.

Understanding the intricacies of margin trading is essential for day traders to manage risk prudently. While margin trading offers leverage to amplify gains, it also magnifies potential losses. Traders need to grasp the risks associated with margin requirements, margin calls, and leverage levels to navigate this aspect of day trading safely. Clear comprehension and careful execution are vital in leveraging margin effectively.

Mastering Trading Psychology and Discipline

Developing a positive and resilient mindset is crucial in day trading. Handling emotional challenges effectively can prevent hasty decisions influenced by fear or greed. By focusing on a disciplined approach, traders can maintain composure amidst market fluctuations.

Avoid impulsive trading by adhering to a well-defined trading plan. Impulsivity can lead to deviating from strategic decisions, resulting in unnecessary risks. Stay committed to your plan to enhance consistency and minimize emotional trading.

Mistakes are inevitable in day trading. Embrace them as learning opportunities rather than failures. Analyzing past errors helps refine strategies and improve decision-making processes, fostering continuous growth and skill development in day trading.

Taking breaks during trading sessions is essential for mental clarity and sustained focus. Stepping away from screens periodically can prevent decision fatigue and improve overall performance. Refreshing your mind enables better decision-making and reduces the chances of making rash choices.

Engage with mentors or participate in trading communities to gain valuable insights and support. Surrounding yourself with experienced traders fosters a learning environment and provides motivation and accountability. Seeking guidance from mentors or peers can enhance trading discipline and encourage continuous improvement in day trading practices.

Leveraging Technology in Day Trading

In the realm of day trading strategies, technology plays a pivotal role in maximizing trading efficiency and profitability. Leveraging advanced charting tools and technical indicators within trading platforms empowers traders to make informed decisions swiftly. Automated trading systems, driven by preset criteria, execute trades seamlessly, eliminating emotional bias. Real-time data feeds for market news and analysis aid in timely decision-making. Social trading platforms foster collaboration, allowing traders to exchange insights and strategies. Embracing ongoing technological advancements is key to refining trading skills and staying competitive in the dynamic trading landscape.