Discover practical tips to reduce your insurance premiums and save money effortlessly. By implementing strategies such as increasing your deductible and negotiating your premium, you can learn how to effectively lower your insurance costs. This complete guide will provide you with valuable insights on how to find cheap renters insurance quotes and make informed decisions to maximize your savings. Start optimizing your insurance expenses today with these expert tips!

Uncover Hidden Savings: Ask for Discounts

When looking to trim your insurance costs, don’t overlook the potential savings from discounts. Insurers often reward policyholders for factors like being a non-smoker, using security devices, or upholding a strong credit score. Reach out to your insurer to explore these available discounts and determine if you meet the eligibility criteria. By actively seeking discounts, you can significantly reduce your insurance premiums and enhance your savings effortlessly. Remember, a simple inquiry can lead to substantial savings on your insurance premiums.

Master the Art of Negotiating Your Premium

Negotiating Expertly with Insurers

When aiming to reduce your insurance costs, mastering the art of negotiation can be a game-changer. Politely approach your insurer, highlighting your excellent claims history or customer loyalty. Engage in a constructive dialogue showcasing your responsible behavior as a policyholder, which can persuade the insurance company to offer you a lower premium.

Provide Evidence of Responsibility

During your negotiation, present tangible evidence that supports your case for a reduced premium. This might include documents proving your safe driving record, evidence of security features at your home, or any other responsible actions that mitigate the insurer’s risk. Demonstrating your commitment to safe practices can be a compelling argument for securing a more favorable insurance rate.

The Benefits of Usage-Based Insurance Programs

Understanding Usage-Based Insurance

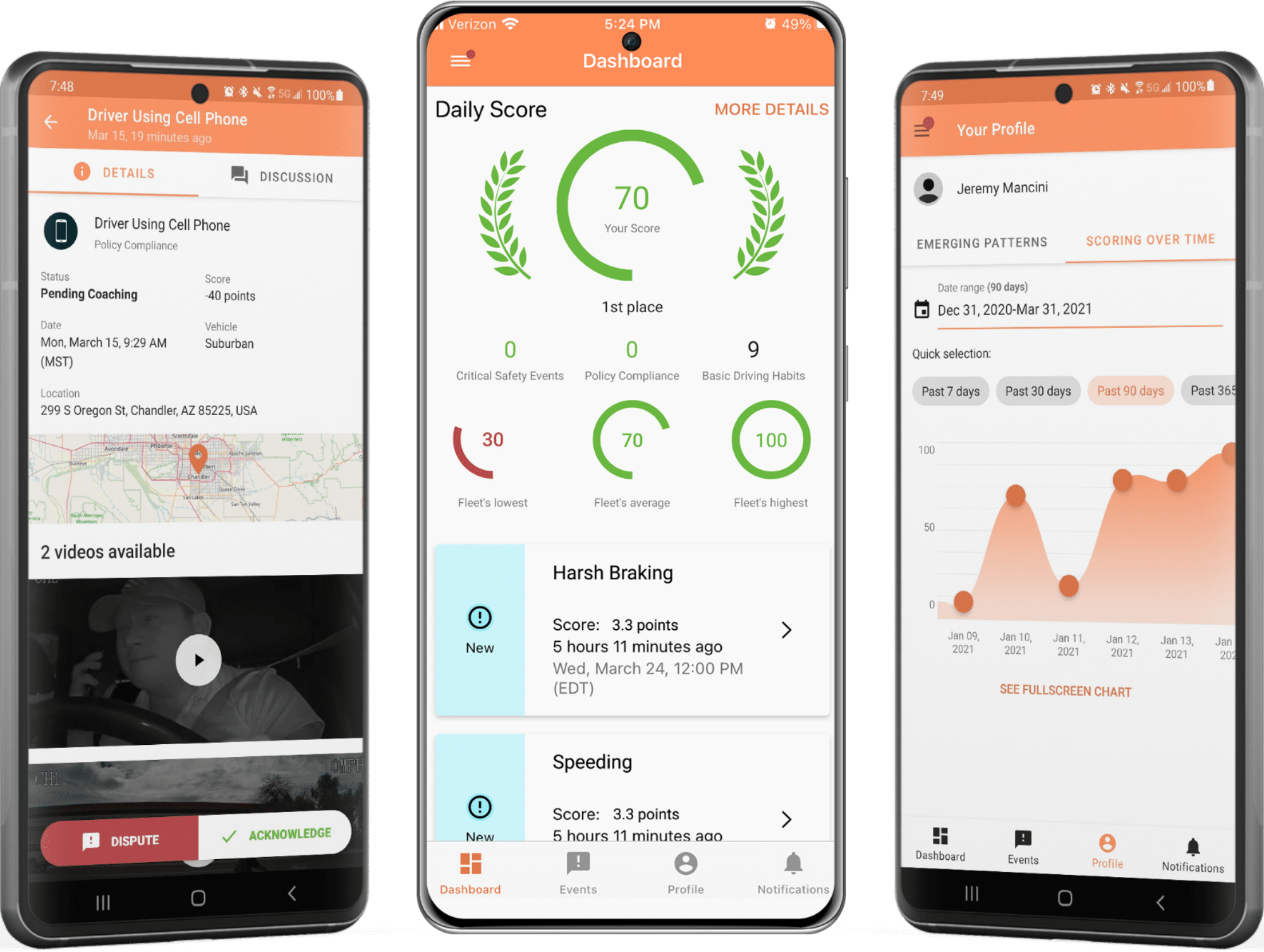

Usage-based insurance programs revolutionize the traditional insurance model by monitoring your driving behavior. By tracking factors like speed, braking, and mileage, these programs reward safe driving habits. This data-driven approach allows insurers to offer personalized premiums based on your actual driving patterns, potentially leading to significant savings in the long run.

Cost Savings Through Safe Driving

With usage-based insurance, the safer you drive, the more you can save on your insurance premiums. By demonstrating responsible driving behaviors such as obeying speed limits and avoiding harsh braking, you can qualify for lower rates. This incentivizes policyholders to adopt and maintain safe driving practices, ultimately benefiting both insurers and drivers in the form of reduced premiums.

Tailored Premiums Based on Behavior

Usage-based insurance tailors premiums to individual driving behaviors, offering a fairer and more customized approach to pricing. Rather than relying solely on generalized risk factors, such as age or location, insurers assess your specific driving habits to determine your premium. This personalized pricing strategy ensures that you pay a rate that accurately reflects your level of risk, potentially resulting in lower overall costs.

Continuous Monitoring for Adjustments

One of the key advantages of usage-based insurance is the ongoing monitoring of your driving behaviors. Insurers continuously collect data on your driving habits, allowing for adjustments to your premium based on your evolving behavior. This real-time feedback mechanism not only encourages safe driving but also provides opportunities for further premium reductions as you improve your driving skills and habits.

Rewards for Safe Driving Habits

Usage-based insurance programs offer incentives for maintaining safe driving habits. By consistently practicing careful and defensive driving techniques, you can earn rewards, such as discounts or cashback, on your premiums. This system not only encourages safer driving practices but also motivates policyholders to actively engage in behaviors that lead to reduced insurance costs over time.