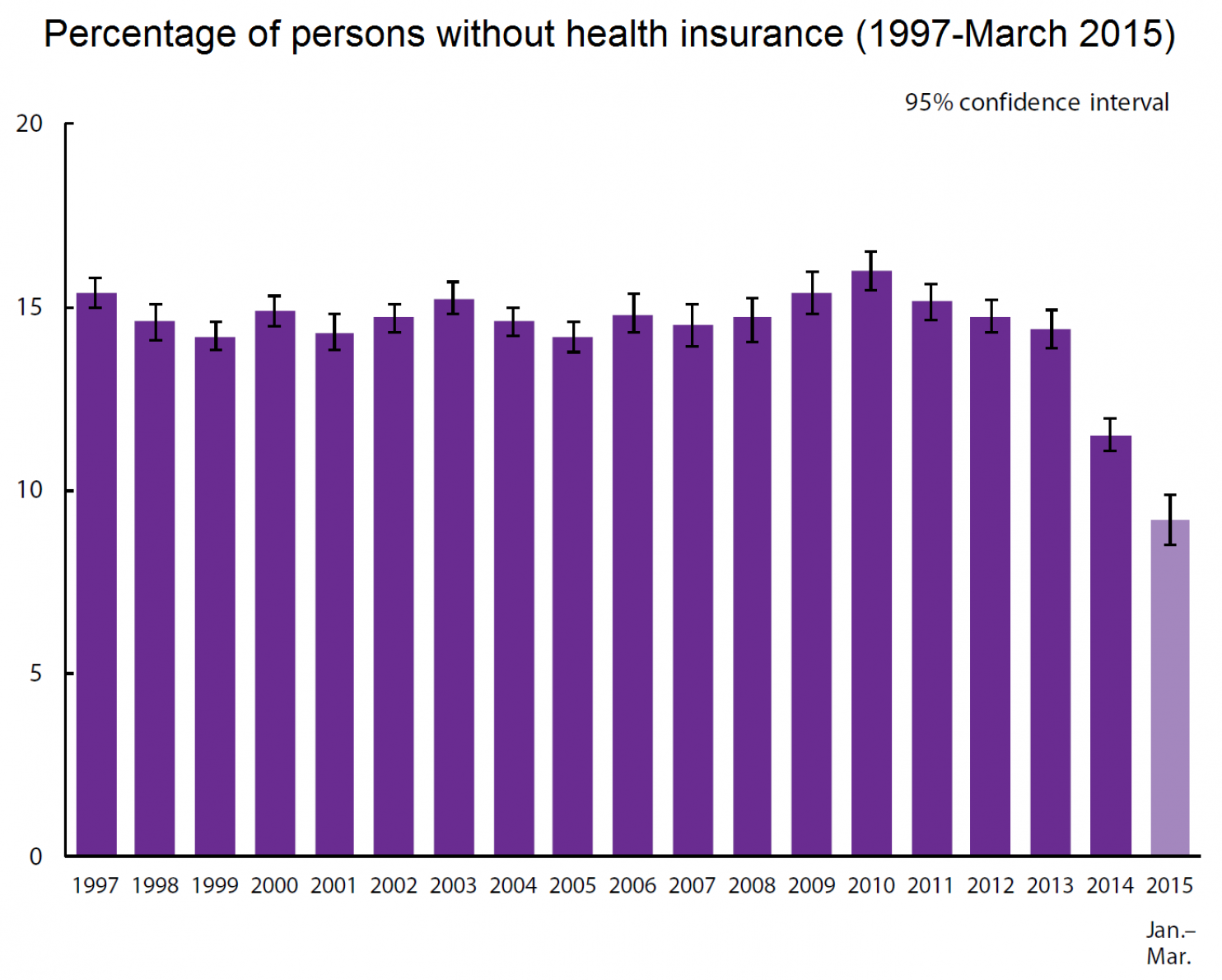

Are you a small business owner looking for affordable health insurance options for your employees? In this comprehensive guide to health insurance for small businesses, we will explore different plans, cost-saving strategies, compliance requirements, and the role of technology in managing healthcare expenses. Understanding the complexities of health insurance can be daunting, but with the right information and strategies, you can provide quality healthcare benefits while managing costs effectively. Stay tuned to discover actionable insights tailored to small business audiences, including tips on optimizing employee benefits and navigating the ever-changing landscape of healthcare insurance.

Navigating Health Insurance Plans for Small Businesses

Understanding Different Health Insurance Plan Options

When delving into health insurance for small businesses, it’s essential to explore various plan types like HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and POS (Point of Service) plans. Each plan has its unique features, from network restrictions to flexibility in choosing healthcare providers.

Balancing Coverage Options and Premiums

Small business owners need to strike a balance between the coverage offered by a health insurance plan and its associated premiums. Assessing the needs of your employees and understanding the cost implications helps in selecting a plan that provides adequate coverage without overburdening the budget.

Tailoring Plans to Workforce Size and Demographics

The size and demographics of your workforce play a significant role in determining the most suitable health insurance plan. Understanding the health needs and preferences of your employees can guide you in choosing a plan that aligns with their requirements, promoting employee satisfaction and well-being.

Researching Insurance Providers for Comprehensive Comparisons

Conducting thorough research on reputable insurance providers is crucial. By comparing the offerings, services, and pricing structures of different insurers, small business owners can make informed decisions when selecting a health insurance plan that best meets their employees’ healthcare needs and the company’s budget constraints.

Cost-Saving Strategies for Small Business Health Insurance

Negotiation for Lower Premiums and Employee Contributions

Negotiating lower premiums through group plans or having employees contribute a portion can significantly reduce overall costs, making health insurance more affordable for small businesses. By pooling resources or sharing the financial burden with employees, you can access better rates while providing essential coverage. This approach fosters a win-win situation for both employers and employees, ensuring comprehensive health insurance options for small businesses.

Implementing Wellness Programs for Health Promotion

Investing in wellness programs not only boosts employee health and productivity but also leads to reduced healthcare claims over time. By promoting healthy lifestyles and preventive care, small businesses can lower insurance costs associated with chronic illnesses and high medical expenses. Encouraging regular exercise, healthy eating habits, and preventive screenings can result in substantial long-term savings on health insurance premiums.

Leveraging Tax Deductions and Credits

Small businesses offering health insurance can take advantage of tax deductions and credits available for employers. By understanding and utilizing tax incentives, businesses can offset some of the costs associated with providing health coverage to their employees. These tax benefits serve as valuable cost-saving strategies, making it more financially feasible for small businesses to offer competitive health insurance options without compromising quality.

Exploring Alternative Coverage Options like HRAs and Self-Funding

Exploring alternative coverage options, such as Health Reimbursement Arrangements (HRAs) or self-funding arrangements, can provide cost-effective alternatives to traditional health insurance plans. HRAs allow employers to reimburse employees for medical expenses, offering flexibility in coverage while controlling costs. Similarly, self-funding empowers businesses to directly fund employee healthcare claims, tailoring coverage to specific needs and potentially reducing overall expenses. By diversifying coverage options, small businesses can tailor health insurance to their budget while ensuring comprehensive benefits for their workforce.

Enhancing Employee Benefits with Comprehensive Health Insurance Coverage

Understanding Essential Health Benefits under ACA

Small businesses must provide health insurance plans that cover essential health benefits mandated by the Affordable Care Act (ACA), including preventive services, prescription drugs, maternity care, mental health services, and more. Complying with these requirements ensures your employees receive comprehensive coverage that meets national healthcare standards.

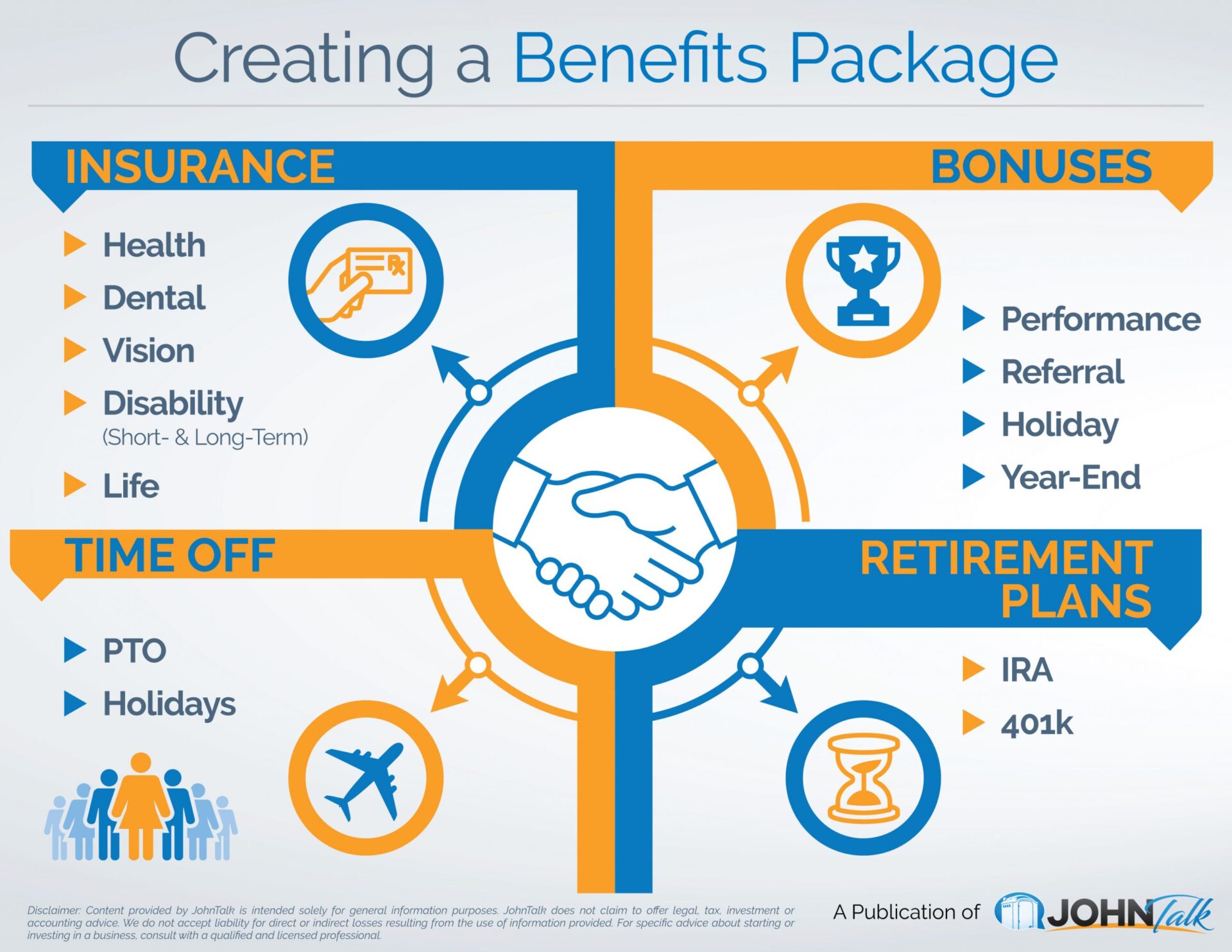

Building Competitive Benefits Packages

Attract and retain top talent by offering robust health insurance coverage as part of a competitive benefits package. Providing extensive medical coverage, wellness programs, and additional perks can set your small business apart, showcasing a commitment to employee well-being and security.

Exploring Voluntary Benefits for Enhanced Satisfaction

Incorporating voluntary benefits like dental and vision insurance alongside your primary health coverage can significantly boost employee satisfaction. These additional coverages address specific healthcare needs beyond basic medical services, contributing to a holistic employee benefits package valued by your workforce.

Facilitating Employee Understanding and Enrollment

Empower your employees by facilitating clear communication on coverage options and enrollment processes. Conduct regular educational sessions, provide easy-to-understand guides, and offer dedicated support to ensure that staff members make informed decisions when selecting health insurance plans. Transparent communication fosters trust and encourages active participation in benefits programs.

Navigating Legal Compliance in Health Insurance for Small Businesses

When it comes to health insurance, small businesses must adhere to ACA regulations, ensuring compliance with employer mandates and coverage requirements. Understanding and implementing these rules guarantee that employees receive adequate health benefits, contributing to overall well-being and satisfaction. Compliance with ACA regulations is essential to avoid penalties and provide a comprehensive healthcare package.

It is crucial for small businesses to comprehend the Health Insurance Portability and Accountability Act (HIPAA) to safeguard employee health information. HIPAA establishes guidelines for data privacy and security, protecting sensitive medical details. By adhering to HIPAA regulations, businesses demonstrate a commitment to maintaining confidentiality and earning employees’ trust in handling their health data appropriately.

In the ever-evolving landscape of healthcare laws and regulations, staying informed is paramount for small businesses. Regularly monitoring changes and updates ensures that businesses remain compliant, avoiding costly penalties and legal repercussions. Engaging with industry resources, attending relevant seminars, and subscribing to updates from regulatory bodies help small business owners stay abreast of legal developments affecting health insurance.

Given the complexities of legal compliance in health insurance, seeking professional guidance from an insurance broker or attorney is highly advisable for small businesses. These experts offer valuable insights, assess business needs, and navigate the intricacies of health insurance regulations. By partnering with professionals, small businesses can streamline compliance efforts, mitigate risks, and optimize health insurance options to best suit their workforce’s needs.

Evaluating and Managing Health Insurance Costs

To effectively manage health insurance costs for small businesses, monitoring healthcare expenses is crucial. By analyzing claims data and usage patterns, you can identify areas where cost savings can be achieved, allowing for better budget allocation and financial management. Understanding the key drivers of expenses empowers you to make informed decisions that benefit both your employees and your bottom line.

Regular plan reviews are essential in ensuring that your health insurance coverage remains optimal and cost-effective. Evaluating your current plan against your business needs and industry standards helps in identifying redundancies or gaps in coverage. By staying proactive and responsive to changes in the healthcare landscape, you can align your benefits with the evolving needs of your workforce while maximizing cost efficiency.

Implementing cost-sharing strategies like deductibles and co-pays can help reduce health insurance expenses for your small business. These strategies involve employees sharing a portion of the healthcare costs, promoting responsible usage while controlling overall expenditure. It creates a balance between providing comprehensive coverage and mitigating financial burdens, striking a sustainable approach to managing health insurance costs effectively.

Exploring innovative solutions such as telemedicine and virtual care can revolutionize your approach to healthcare costs. Embracing technology-enabled services not only enhances access to healthcare for your employees but also minimizes expenses associated with traditional in-person visits. By incorporating these solutions into your health insurance plans, you can optimize costs while prioritizing employee wellness and convenience, fostering a healthy and productive workforce.

Leveraging Technology for Enhanced Small Business Health Insurance Management

In the realm of small business health insurance, technology plays a pivotal role in streamlining processes and optimizing healthcare benefits for employees. Online platforms offer a convenient means to compare various insurance plans, enroll employees seamlessly, and efficiently manage claims, saving time and ensuring comprehensive coverage.

Employing wearable devices and health tracking apps enables businesses to prioritize employee wellness actively. By encouraging the use of such tools, employers can empower their workforce to monitor and improve their health, leading to enhanced productivity and reduced healthcare costs in the long run.

Telemedicine services have emerged as a revolutionary solution for small businesses, offering employees convenient and cost-effective access to healthcare professionals remotely. By incorporating telemedicine into their health insurance plans, businesses can provide on-demand medical assistance, promoting quick diagnoses and treatments without geographical constraints.

To maintain a competitive edge in the realm of health insurance, small businesses must stay abreast of emerging technologies. From AI-driven healthcare analytics to blockchain for secure data management, keeping updated on technological advancements can streamline administrative tasks, improve decision-making processes, and enhance overall employee healthcare experiences.

Embracing Future Trends in Health Insurance for Small Businesses

Anticipating Regulatory Changes:

Stay ahead by anticipating shifts in healthcare regulations. Understanding and adapting to these changes can help small businesses navigate compliance challenges seamlessly, ensuring their health insurance plans remain optimized and legally sound.

Embracing Value-Based Care Models:

Monitor the rise of value-based care models. These models emphasize quality outcomes over quantity, potentially lowering costs for small businesses while enhancing employee healthcare experiences and overall satisfaction.

Innovative Insurance Solutions:

Explore tailored insurance products and services designed for small businesses. These innovative solutions can offer flexible coverage options, cost-effective alternatives, and personalized packages that meet the unique needs of small business owners and their workforce.

Utilizing Data and Analytics:

Prepare for the increasing integration of data and analytics in health insurance. Leveraging these tools can provide valuable insights, optimize plan designs, predict trends, and ultimately drive better decisions in managing health insurance options for small businesses.