Are you considering long-term care insurance for your elderly parents? In this comprehensive guide, we will explore the factors, costs, benefits, and alternatives of this insurance option. Understanding the Cost of long-term care insurance for elderly parents is crucial in making informed decisions for your family’s financial security. Whether you are planning for the future or currently facing decisions regarding elder care, this article will provide valuable insights to help you navigate the complexities of long-term care insurance.

As the cost of long-term care continues to rise, it is essential to be well-informed about the options available for your elderly parents. By delving into the factors influencing the cost, average costs, benefits, and alternatives of long-term care insurance, you can better prepare for the future. This guide aims to support you in making proactive and empowered decisions regarding the financial well-being and care of your elderly loved ones. Stay tuned to discover how long-term care insurance can provide you with peace of mind and security.

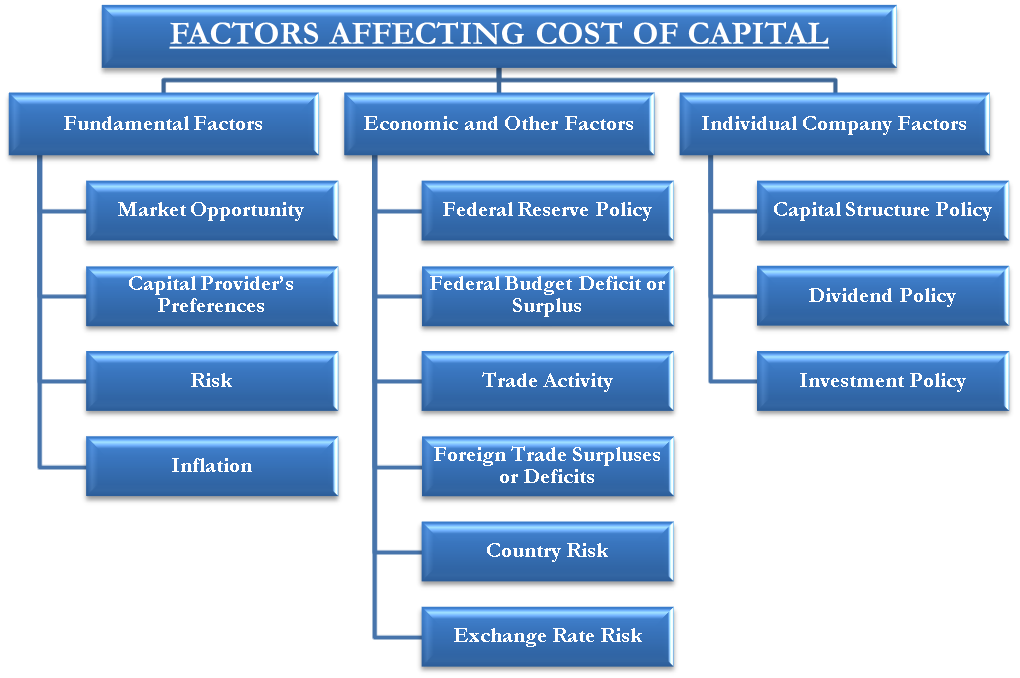

Factors Influencing the Cost of Long-Term Care Insurance

Age Influence on Premiums

Age significantly affects long-term care insurance costs. Generally, premiums are higher for older applicants due to an increased likelihood of needing care. Starting younger can result in lower premium rates, providing long-term savings.

Health Status Impact

Health status plays a crucial role in premium determination. Pre-existing medical conditions often lead to higher premiums or even disqualification. Maintaining good health can help lower insurance costs and ensure eligibility.

Coverage Amount Consideration

The coverage amount selected directly influences the cost of long-term care insurance. Opting for comprehensive coverage with a wide range of benefits will lead to higher premiums. Balancing coverage needs with affordability is key.

Benefit Period Length

The duration for which you want coverage significantly affects the insurance cost. Longer benefit periods, offering coverage for more years, typically result in higher premiums. Assessing the potential length of care needed is essential for cost-effective planning.

Elimination Period Impact

The elimination period, the waiting time before benefits commence, affects premium rates. Opting for a shorter elimination period leads to higher premiums but quicker access to benefits. Understanding and selecting the right elimination period is crucial for balancing cost and coverage.

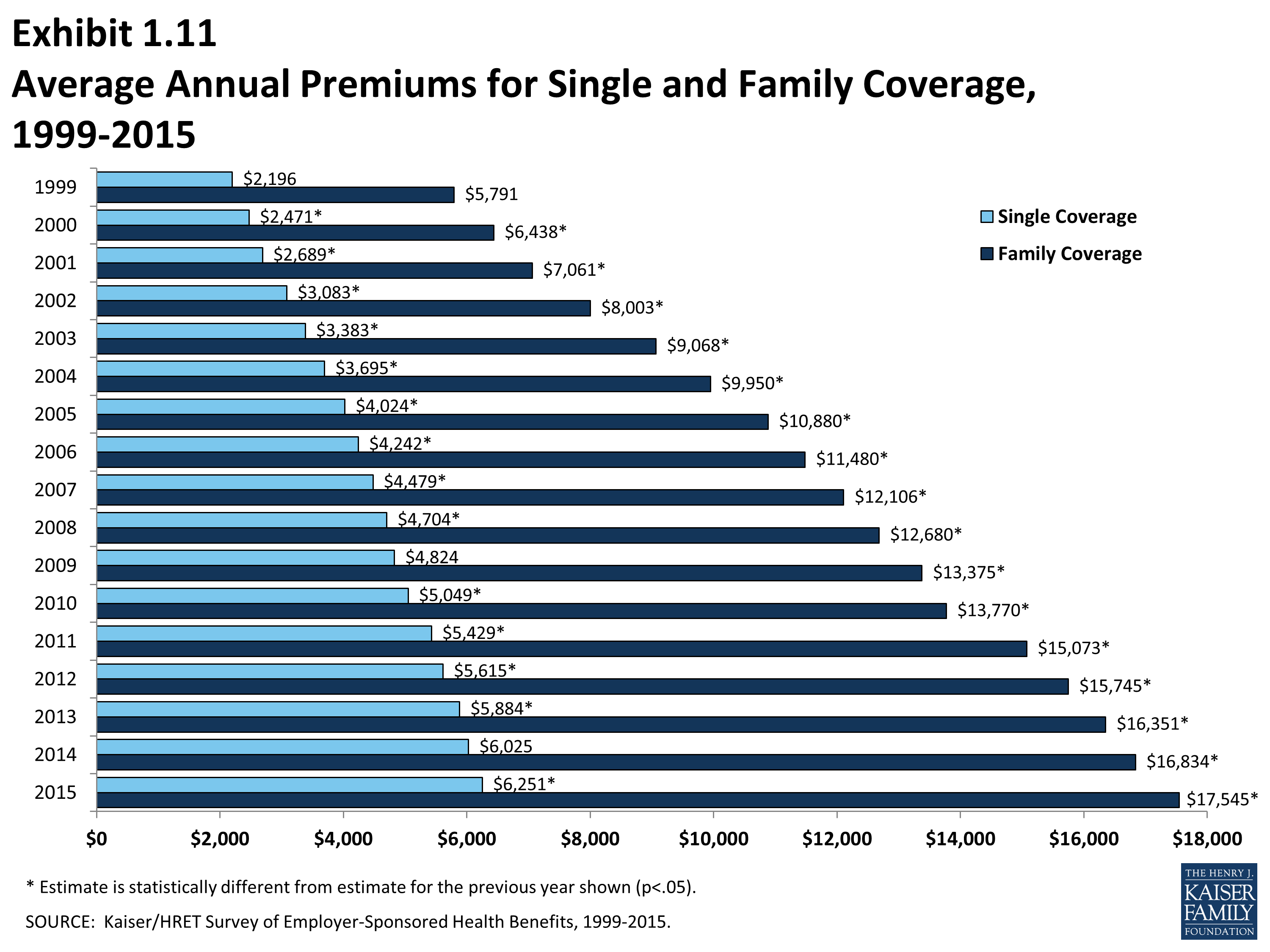

Understanding the Average Cost of Long-Term Care Insurance

When considering Long-Term Care Insurance for Elderly Parents, it’s essential to grasp the financial aspect. The American Association for Long-Term Care Insurance indicates an average annual premium of $3,600 for a 65-year-old couple. However, these costs can fluctuate significantly based on various factors. To secure the most competitive rates, it is advisable to seek quotes from several insurance providers. Comparing these quotes allows for a better understanding of the available options tailored to your specific needs and budget.

Benefits of Long-Term Care Insurance

Long-Term Care Insurance for Elderly Parents offers invaluable financial protection against the escalating costs of long-term care services. This insurance ensures that your parents can access quality care without depleting their life savings, providing peace of mind for the entire family. Additionally, the potential tax advantages, such as tax-deductible premiums, can offer significant savings in the long run, making it a wise financial investment for your loved ones’ future well-being.

Furthermore, having long-term care insurance reduces the burden on family members who may otherwise need to step in and provide unpaid care for elderly parents. This coverage allows your family to focus on providing emotional support rather than shouldering the financial and physical demands of caregiving, promoting a healthier and more balanced family dynamic. Choosing Long-Term Care Insurance for Elderly Parents not only secures their future care but also supports your family’s overall well-being.

Exploring Alternatives to Long-Term Care Insurance

Self-Funding for Long-Term Care Expenses

One alternative to long-term care insurance for elderly parents is self-funding. By saving and investing proactively, you can build a financial cushion to cover potential long-term care expenses. This approach gives you flexibility and control over your financial resources, providing a personalized solution tailored to your specific needs.

Government Programs like Medicaid

For low-income elderly parents, Medicaid can be a vital resource for covering long-term care costs. While criteria vary by state, Medicaid can help when long-term care insurance is unattainable. Understanding the eligibility requirements and coverage options under Medicaid can significantly impact long-term care planning for your loved ones.

Long-Term Care Riders on Life Insurance Policies

Consider life insurance policies with long-term care riders as a hybrid solution. These riders can offer long-term care benefits, providing financial support while maintaining a death benefit component. Exploring this option can offer a versatile way to address long-term care needs alongside traditional life insurance coverage.

Utilizing Annuities for Long-Term Care Needs

Annuities are another avenue to consider when planning for long-term care expenses. Certain types of annuities can generate income streams that can be allocated towards covering long-term care costs efficiently. Understanding the features and benefits of annuities can be instrumental in creating a comprehensive financial plan for your elderly parents.

Expert Tips for Choosing the Right Long-Term Care Insurance Policy

Determining Care Needs:

Understanding your parents’ current and potential future care requirements is vital. Evaluate their health, mobility, and any existing medical conditions. Consider factors like assistance with daily activities, medical treatments, and the type of care facilities that may be necessary. This assessment will help tailor the insurance policy to meet their specific needs effectively.

Researching Insurance Options:

Explore various insurance companies and policies to find the best match for your parents. Look into coverage details, premiums, benefit payouts, and any limitations or restrictions. Consider the reputation and financial stability of the insurance providers. Compare multiple options to ensure you select a policy that aligns with your parents’ care preferences and financial capabilities.

Budget and Long-Term Care Costs:

Factor in your budget and the potential expenses associated with long-term care when choosing a policy. Consider not just the premium costs but also the coverage extent, deductibles, co-pays, and inflation protection. Ensure the policy adequately covers the anticipated care needs without straining your financial resources excessively. Finding a balance between affordability and comprehensive coverage is key.

Seeking Professional Advice:

Consulting with a financial advisor or an insurance agent specializing in long-term care can provide personalized guidance. They can help you navigate through the complexities of insurance policies, clarify any doubts, and offer recommendations tailored to your parents’ specific situation. Their expertise can assist in making informed decisions that ensure your parents receive the necessary care without compromising their financial stability.

Ensuring Comprehensive Care and Financial Security for Your Loved Ones

Long-term care insurance for elderly parents serves as a crucial safeguard for their well-being and your financial stability. By meticulously evaluating costs, benefits, and alternatives, you pave the way for informed decisions. Strategic planning guarantees access to high-quality care for your parents, offering reassurance during challenging times. Embracing long-term care insurance empowers you to navigate elder care responsibilities with confidence and compassion.