Mastering Forex Trading Strategies: A Comprehensive Guide is a valuable resource for both novice and seasoned traders looking to enhance their skills in the dynamic world of forex trading. From understanding the foundational principles to implementing advanced techniques, this detailed guide covers a wide array of strategies to help you navigate the complexities of the forex market. Whether you are just starting out or seeking to refine your trading acumen, this article offers insights into the benefits, risks, and key considerations essential for successful Forex Trading. Explore the different types of forex trading strategies, essential skills, and advanced techniques to excel in the forex market. Learn the benefits, risks, and key considerations for successful trading.

Unraveling the World of Forex Trading

Forex trading strategies revolve around buying and selling currencies to capitalize on market shifts. With a colossal daily trading volume surpassing $5 trillion, the forex market stands as the largest financial entity worldwide. Traders engage in diverse markets like spot, forwards, and futures, each presenting unique opportunities. Currency pairs are quoted, showing the base currency’s value concerning the quote currency, defining the essence of forex trading dynamics.

Understanding the Benefits and Risks of Forex Trading

In the world of Forex Trading Strategies, one of the key attractions is the potential for high returns. The currency markets are known for their volatility, offering traders ample opportunities to profit from price fluctuations and capitalize on market movements swiftly. However, this volatility also poses a significant risk, making it crucial for traders to employ effective risk management strategies to safeguard their investments.

Trading Forex comes with the unique advantage of operating 24/7. This around-the-clock trading capability allows traders to respond promptly to global economic events and news that impact currency values. The flexibility to trade at any time of the day empowers traders to seize profitable opportunities whenever they arise, enhancing the potential for maximizing profits while managing risks effectively.

One of the appealing aspects of Forex Trading Strategies is the relatively low entry barrier compared to other financial markets. With minimal capital required to start trading, Forex offers accessibility to a wide range of traders, including beginners and those with limited investment funds. This accessibility encourages participation and opens doors for individuals to explore and benefit from the dynamic world of forex trading.

Despite the alluring prospects, it’s essential to acknowledge the high risks associated with forex trading. Market volatility, amplified by leverage, exposes traders to significant risks of substantial losses. It’s imperative for traders to exercise caution, conduct thorough research, and develop a robust trading plan to mitigate risks effectively. Understanding and managing these risks are crucial aspects of navigating the forex market successfully.

Exploring Different Types of Forex Trading Strategies

Scalping

Scalping involves making quick trades to profit from small price movements. Traders executing this strategy aim to capitalize on short-term opportunities, often within minutes. It requires intense focus, discipline, and rapid decision-making to generate profits efficiently.

Day Trading

Day trading, a popular strategy, involves opening and closing positions within the same trading day. Traders capitalize on intraday price fluctuations, avoiding overnight exposure. It demands strong analytical skills, risk management, and the ability to react swiftly to market changes.

Swing Trading

Swing trading focuses on capturing intermediate price movements that last several days to weeks. Traders aim to ride the market swings to their advantage, often using technical analysis and market trends. Patience, strategic entry/exit points, and trend identification are vital for successful swing trading.

Position Trading

Position trading involves holding positions for an extended period, ranging from weeks to months or even years. Traders following this strategy rely heavily on fundamental analysis, market research, and long-term market trends. It requires patience, in-depth market knowledge, and the ability to withstand market volatility.

Mastering Essential Forex Trading Skills

Technical Analysis

Mastering technical analysis involves decoding price charts and patterns to forecast market movements. By analyzing historical data, traders can identify trends, support, and resistance levels crucial for making informed trading decisions. Understanding key technical indicators such as moving averages and stochastic oscillators can aid in predicting potential price movements accurately.

Fundamental Analysis

Essential in forex trading, fundamental analysis entails evaluating economic indicators, geopolitical events, and central bank policies impacting currency values. Traders need to closely monitor inflation rates, interest rates, GDP growth, and geopolitical tensions to anticipate market shifts. Proficiency in fundamental analysis empowers traders to make well-informed trading choices aligned with economic trends.

Risk Management

Effective risk management is a fundamental skill for forex traders to safeguard their capital. Implementing risk management strategies like setting stop-loss orders and proper position sizing can mitigate potential losses. Traders must define risk tolerance levels and adhere to strict risk management protocols to protect their trading accounts amidst market volatility.

Emotional Control

Maintaining emotional control is paramount to successful forex trading. Emotional discipline helps traders avoid impulsive decisions driven by fear or greed, which can lead to significant losses. Developing a sound trading plan, sticking to predefined strategies, and managing emotions through mindfulness techniques can enhance decision-making abilities and promote consistent trading success.

Choosing a Forex Broker: Key Considerations

Regulation and Licensing

When selecting a forex broker, it is paramount to prioritize regulation and licensing. Verifying that the broker is compliant with regulatory authorities ensures a secure and ethical trading environment. Investors’ funds protection and transparency are crucial aspects to consider in fostering trust and reliability in the broker. By adhering to regulations, brokers demonstrate their commitment to maintaining industry standards, safeguarding traders’ interests.

Trading Platform Evaluation

A critical factor in choosing a forex broker is evaluating the trading platform. The platform’s user-friendliness, functionality, and speed of trade execution significantly impact your trading experience. A robust platform with advanced features, real-time data, and easy navigation is essential for seamless trade execution and analysis. Consider demo accounts to test the platform’s capabilities before committing to a broker for optimal trading performance.

Spreads and Commissions Comparison

Comparing spreads and commissions among different brokers is vital to minimize trading costs. Lower spreads reduce the cost of each trade, enhancing profitability. However, be cautious of brokers offering excessively low spreads, as this may indicate hidden charges elsewhere. Transparent fee structures and competitive pricing ensure cost-effective trading. Conduct thorough research to find a broker offering competitive spreads aligned with your trading strategy and preferences.

Customer Support Assessment

Effective customer support is a key consideration when selecting a forex broker. Prompt and reliable customer service enhances the overall trading experience, providing assistance when needed. Evaluate the availability of customer support channels, response times, and the quality of assistance offered. Responsive support ensures quick resolution of queries, technical issues, and helps in navigating the trading platform effectively. Opt for brokers with dedicated and knowledgeable support teams for a seamless trading journey.

Understanding Leverage in Forex Trading: Maximizing Gains while Minimizing Risks

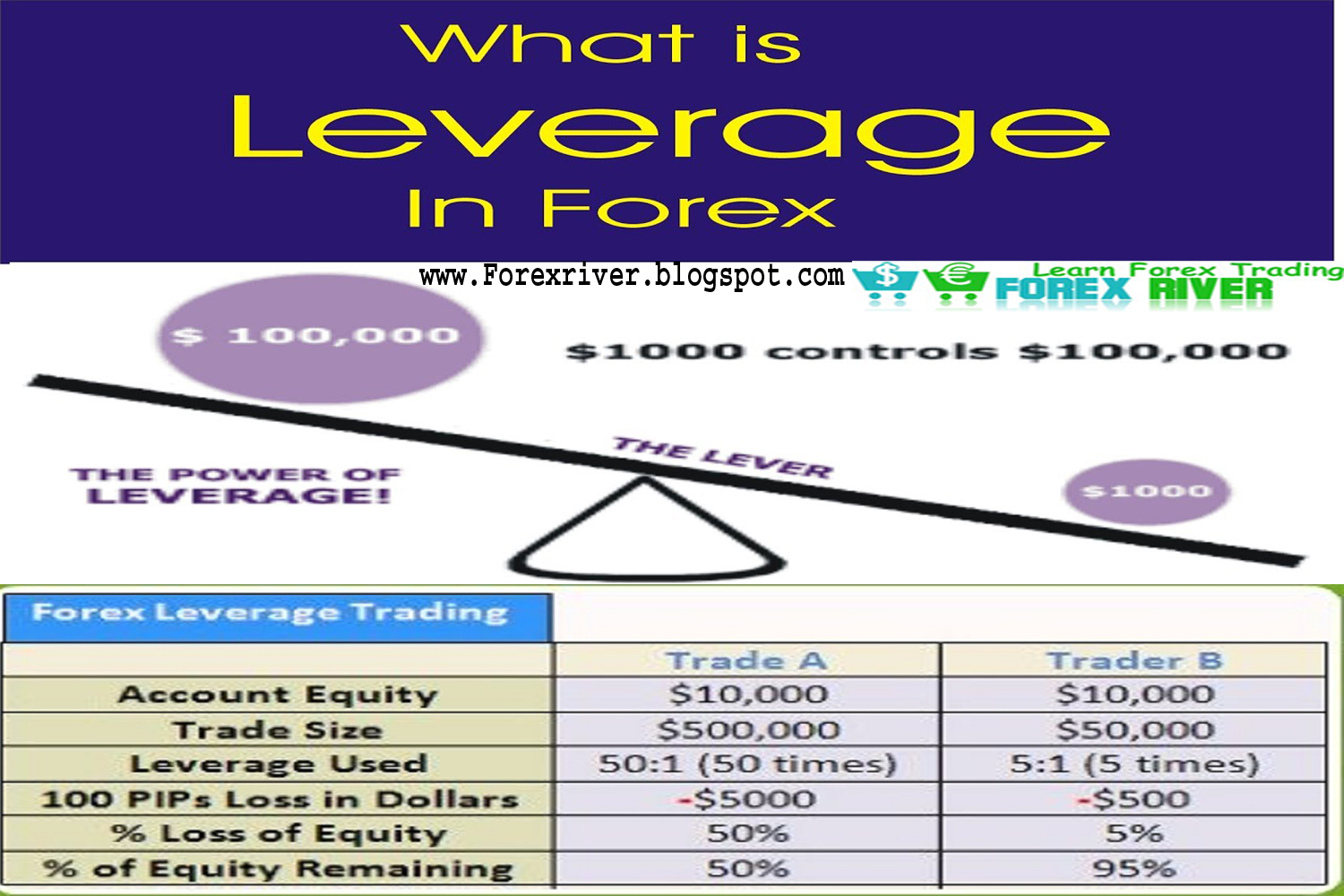

Leverage in Forex Trading is a double-edged sword, offering traders the opportunity to magnify gains by controlling larger positions with a smaller deposit. The allure of increased profits is appealing, yet it comes hand in hand with elevated risks. Traders must tread carefully as the possibility of margin calls looms if losses surpass the margin requirement, potentially wiping out accounts. Effectively managing leverage is paramount to safeguard against substantial losses and secure long-term success in Forex Trading Strategies.

Advanced Forex Trading Techniques

Exploring Advanced Strategies for Enhanced Trading

In the world of Forex trading, advanced techniques play a pivotal role in navigating the complexities of the market. One such technique is hedging, a strategy that involves opening multiple positions to offset risk and protect profits concurrently. By strategically balancing trades, traders can mitigate potential losses and secure gains in fluctuating market conditions.

Another powerful technique is arbitrage, where traders capitalize on price divergences across various markets. By swiftly exploiting these variations, traders can secure profits with minimal risk exposure. Arbitrage requires precision timing and a keen eye for market inefficiencies to leverage these lucrative opportunities effectively.

Algorithmic trading has revolutionized the Forex landscape by enabling traders to execute trades automatically based on predetermined criteria. These sophisticated systems analyze market data and execute trades at lightning speed, eliminating emotional biases and ensuring precise, timely transactions for optimal results.

For traders looking to leverage the expertise of seasoned professionals, social trading offers a unique avenue for success. By mirroring the trades of experienced traders, novice traders can learn from their strategies, improve their decision-making process, and potentially achieve profitable outcomes. Collaborating with successful traders can provide valuable insights and enhance trading acumen in the competitive Forex market.