Mastering Technical Analysis Strategies: A Comprehensive Guide is an essential resource for traders looking to enhance their market analysis skills. This article delves deep into the world of technical analysis, covering key concepts, chart patterns, technical indicators, risk management, and more. Whether you are a novice trader or an experienced investor, understanding technical analysis is crucial for making informed decisions in the financial markets. By incorporating these strategies, traders can gain valuable market insights and improve their profitability significantly.

Unveiling the Depths of Technical Analysis Strategies

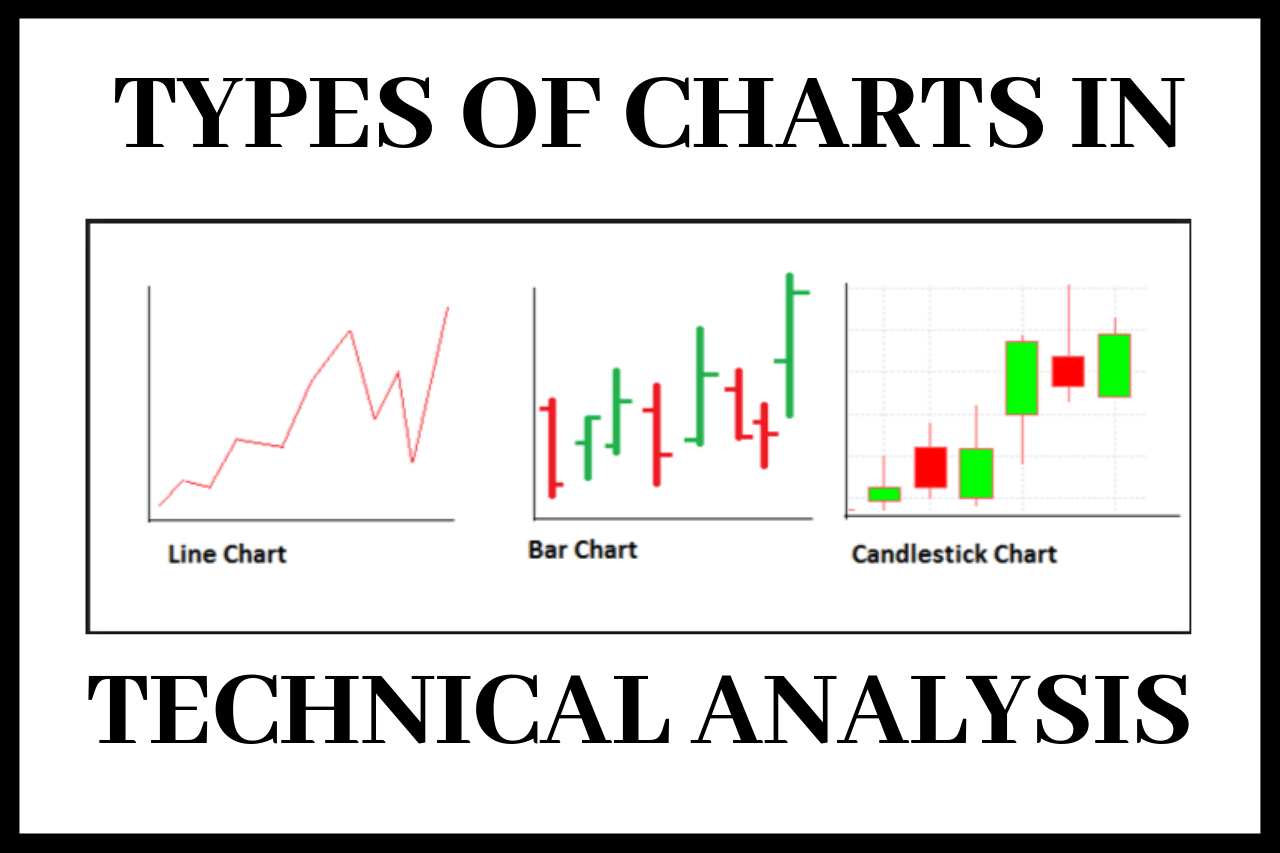

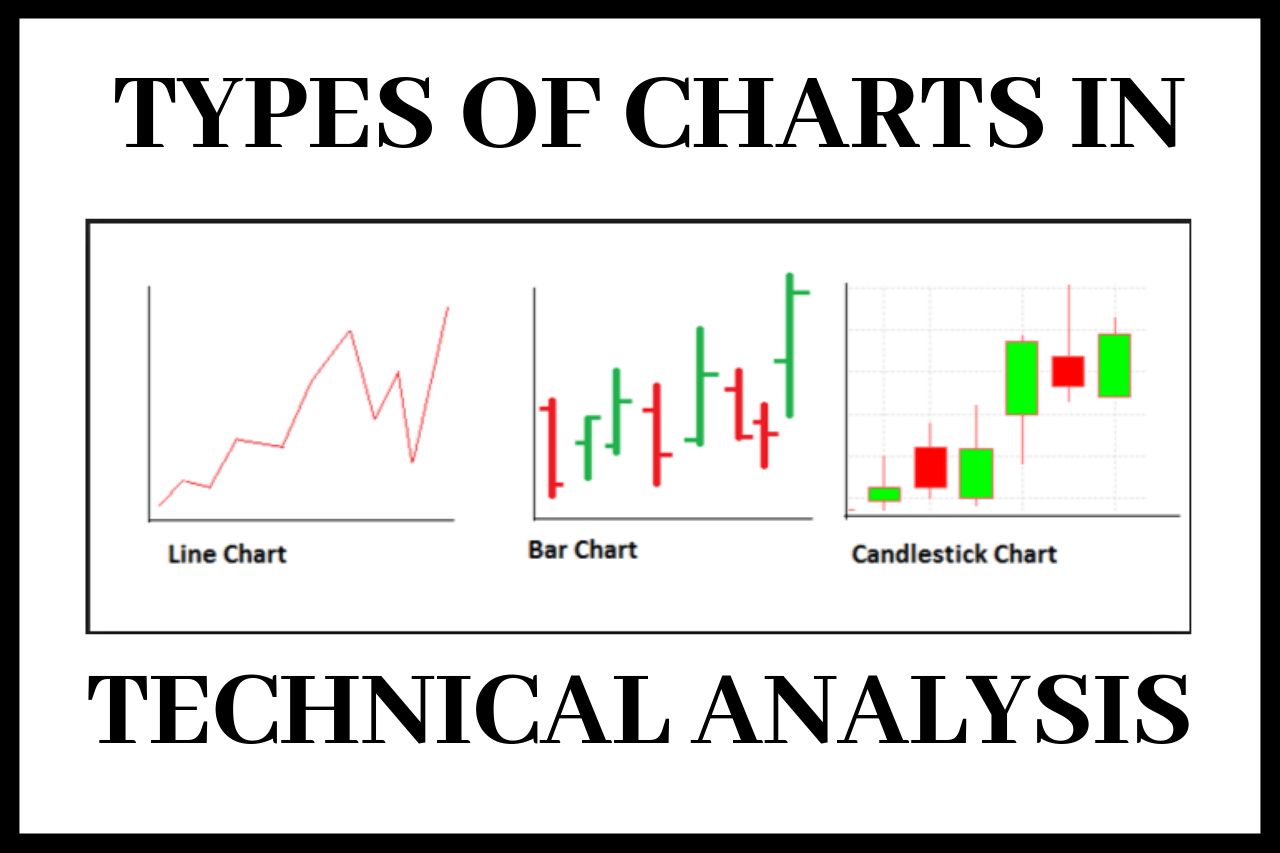

Technical Analysis is a profound tool in trading, scrutinizing past price actions to forecast future trends. By examining historical data like charts and indicators, traders make well-informed decisions. This approach assumes that price movements adhere to patterns, offering opportunities for gains. Unlike fundamental analysis centered on financial aspects, technical analysis emphasizes price behavior exclusively, guiding traders strategically. Understanding these principles is fundamental to traders navigating the intricate world of markets effectively.

:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-05-437d981a36724a8c9892a7806d2315ec.jpg)

Unveiling the Power of Chart Patterns in Technical Analysis Strategies

Chart patterns are like the footprints of market sentiment on price charts, offering traders a roadmap to potential price movements. These formations, such as double tops, double bottoms, head and shoulders, and triangles, serve as visual cues for traders to interpret market dynamics.

Understanding these chart patterns is akin to deciphering the language of the market. By recognizing and analyzing these patterns, traders can forecast potential price directions with greater accuracy, empowering them to make strategic trading decisions.

Traders leverage chart patterns to unveil hidden opportunities in the market. Whether it’s spotting breakouts signaling new trends, reversals indicating trend changes, or continuations confirming existing trends, mastering these patterns equips traders with a competitive edge in the dynamic world of trading.

Mastering Risk Management in Technical Analysis for Optimal Profitability

In the realm of Technical Analysis Strategies, mastering risk management is a fundamental pillar to safeguard capital and bolster profits. Implementing stop-loss orders is pivotal to curbing losses, while prudent position sizing ensures controlled risk exposure. It’s imperative for traders to align their strategies with their risk tolerance levels for optimal outcomes. By embracing effective risk management practices, traders fortify their capital preservation efforts, paving the way for sustained success in the long haul.

Risk management stands as the cornerstone of successful trading endeavors within Technical Analysis Strategies, serving as a shield for capital preservation and profit amplification. Through the strategic placement of stop-loss orders, traders shield themselves from excessive losses, instilling discipline in their trading approach. Furthermore, the art of position sizing unlocks the ability to regulate risk exposure, maintaining balance in the trading portfolio. This meticulous attention to risk fortifies traders against market uncertainties, fostering a resilient trading stance.

Tailoring trading strategies to individual risk tolerance levels is a strategic move that underpins effective risk management within the realm of Technical Analysis Strategies. Acknowledging personal risk thresholds allows traders to calibrate their approach, aligning trading decisions with their comfort levels. Adjusting strategies in accordance with risk tolerance not only fortifies capital protection but also cultivates a more sustainable trading journey. This tailored adjustment fosters a harmonious blend of risk mitigation and profit maximization, enhancing the overall trading experience.

In the intricate landscape of Technical Analysis Strategies, prudent risk management is the cornerstone that underpins trading longevity and success. Consistent application of sound risk management principles acts as a shield, shielding traders from potential pitfalls and fostering a resilient trading foundation. By meticulously adhering to risk management best practices, traders fortify their financial resilience, ensuring that capital preservation remains at the forefront of their trading ethos. Through this dedication to risk management, traders solidify their path towards sustained profitability and market resilience.

Unleashing the Power of Technical Analysis for Traders

Enhancing Market Understanding and Decision-Making

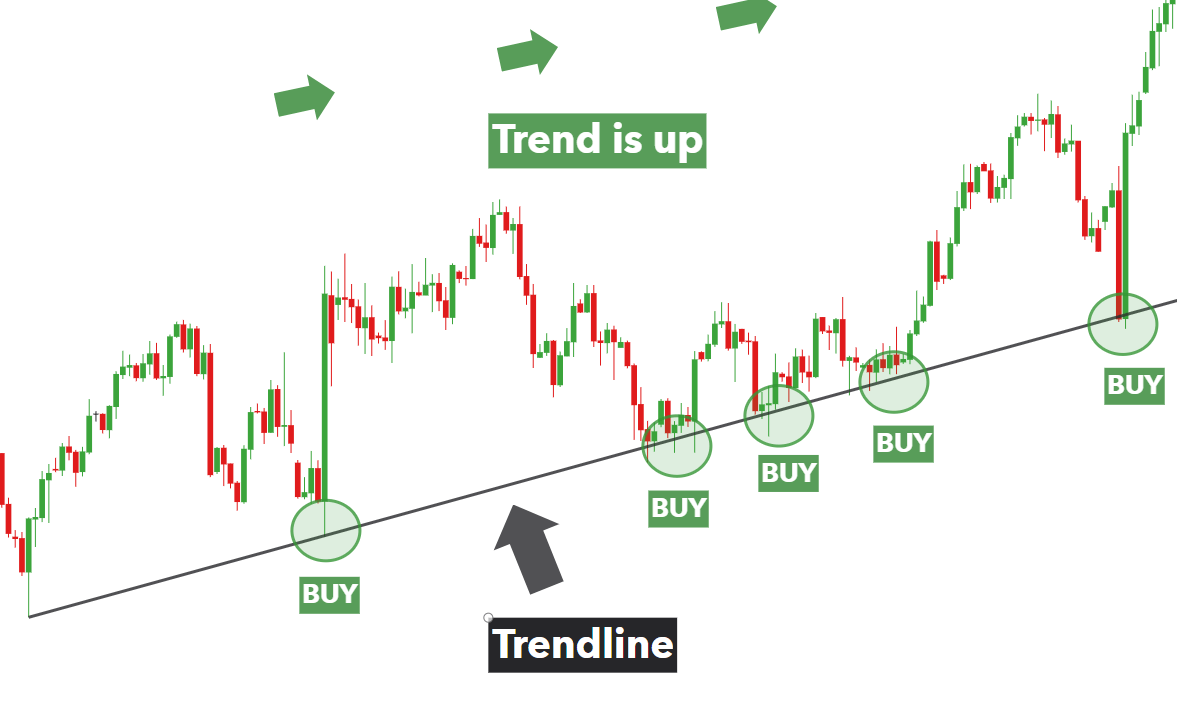

Technical analysis serves as a powerful tool, offering traders profound insights into market behavior and potential price shifts. By analyzing charts and patterns, traders can anticipate market trends, enabling them to make informed decisions based on data rather than speculation.

Spotting Opportunities, Managing Risk, and Making Informed Choices

With technical analysis, traders can efficiently spot potential trading opportunities while effectively managing risk. By identifying key support and resistance levels, traders can establish entry and exit points, helping optimize profits and minimize losses.

Accessibility and Applicability Across Markets

One of the beauties of technical analysis is its simplicity which makes it accessible to all traders. Its versatility allows its application in various financial markets such as stocks, forex, and commodities, providing a universal approach to analyzing market movements.

Gaining a Competitive Advantage and Boosting Profit Potential

Understanding technical analysis equips traders with a competitive edge in the ever-evolving markets. By interpreting price charts and indicators, traders can make data-driven decisions, enhancing their profitability potential and staying ahead of market trends.

The Boundaries of Technical Analysis Strategies

While technical analysis is a powerful tool, it’s imperative to acknowledge its constraints. This method isn’t foolproof; it’s based on historical data, which might not always foretell future market movements accurately. Moreover, interpretation can vary among traders, introducing subjectivity. To mitigate these limitations, combining technical analysis with fundamental analysis is essential for a more comprehensive market evaluation and informed decision-making.