Swing trading is a popular trading strategy that involves holding positions for a few days to weeks to capture short to medium-term market movements. In this comprehensive guide on swing trading strategies, we will delve into the benefits and opportunities it offers for traders looking to capitalize on market fluctuations. From effective strategies to risk management techniques, common pitfalls to avoid, and key tips for success, this guide will equip you with the tools and knowledge needed to excel in the world of swing trading.

Understanding Swing Trading: A Comprehensive Guide

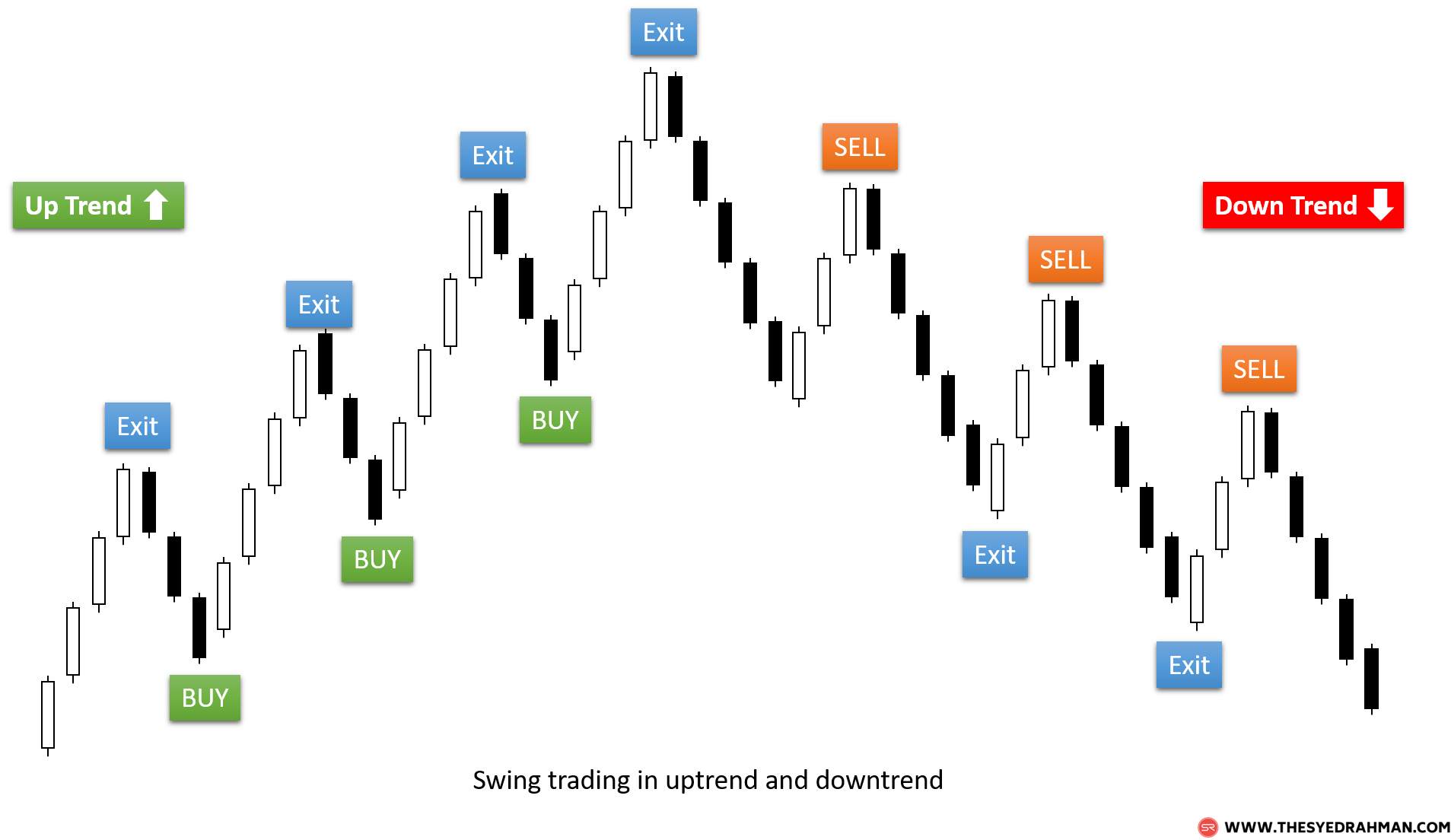

Swing trading harnesses the power of holding positions for days to weeks, capitalizing on short-term market fluctuations. Acting as a bridge between day trading’s rapid pace and long-term investing’s patience, swing trading provides a balanced approach to risk and reward, appealing to traders seeking a middle ground. Utilizing technical indicators and market trends, swing traders meticulously analyze data to pinpoint ripe trading opportunities for optimal decision-making.

Benefits of Swing Trading Strategies

Swing Trading Strategies offer the potential for higher returns than long-term investing by capitalizing on multiple price swings within a shorter timeframe. This approach leverages the advantage of reduced risk compared to day trading, as positions are held for days to weeks, allowing traders to navigate market fluctuations more effectively. Moreover, swing trading provides flexibility to adapt to changing market conditions swiftly, enabling traders to adjust their positions in line with evolving trends for enhanced profitability and risk management.

Unveiling Lucrative Opportunities in Swing Trading

Leveraging Technical Analysis for Success

Technical analysis serves as the backbone for pinpointing lucrative swing trading opportunities. By evaluating charts and patterns, traders can anticipate market movements. Utilizing tools like moving averages, support/resistance levels, and momentum oscillators aids in gauging trends and potential reversals effectively.

Integrating Market News and Economic Events

Beyond technical indicators, staying abreast of market news and economic events is pivotal. Swing traders must factor in external influences that can impact asset prices. Reacting to critical news releases promptly can help traders capitalize on shifts in market sentiment and price movements swiftly.

By blending technical analysis insights and fundamental knowledge, traders can adeptly spot and seize favorable swing trading opportunities, maximizing profit potential in dynamic market conditions.

Effective Swing Trading Strategies

Trend Following Strategies

Trend following strategies in swing trading are powerful tools for traders. By spotting market trends and aligning positions accordingly, traders ride the momentum for potential profits. This involves analyzing charts, identifying trend directions, and entering trades in line with the prevailing market movement, making it a key strategy for capitalizing on price shifts efficiently.

Range Trading Strategies

Range trading strategies are ideal for identifying and exploiting price movements within specific ranges. Traders using this strategy focus on buying at support levels and selling at resistance levels within the defined price boundaries. This method requires patience and meticulous analysis to capture profits from price fluctuations while minimizing risks associated with volatile market conditions.

Breakout Trading Strategies

Breakout trading strategies are designed to capitalize on significant price movements following a breakout from key support or resistance levels. Traders monitor price action near these levels and execute trades when the price breaks out decisively, aiming to profit from potential accelerated price movements. This strategy requires timely execution and risk management to maximize profit potential and minimize losses.

Risk Management in Swing Trading

Implementing Key Risk Management Strategies

In the realm of swing trading strategies, incorporating stop-loss orders is paramount. These orders serve as protective measures, limiting potential losses by automatically selling a position once it reaches a specified price level. By setting stop-loss orders strategically, traders can safeguard their capital and minimize downside risks effectively.

Position sizing stands as a fundamental pillar in managing risks within swing trading. This strategy involves determining the appropriate amount of capital to allocate to each trade based on the trader’s account size and risk tolerance. By carefully sizing positions, traders can maintain a balanced risk-reward ratio and prevent disproportionately large losses that could significantly impact their overall portfolio.

Optimal Risk Allocation through Diversification

Diversification is a powerful risk management tool that can mitigate the impact of individual losing trades. By spreading investments across multiple trades in different instruments or markets, traders can reduce the overall risk exposure of their portfolio. Diversification helps in minimizing the concentration risk associated with putting all capital into a single trade, thereby enhancing the overall stability of the trading strategy.

Common Mistakes to Avoid in Swing Trading

Overtrading Risks

Overtrading in swing trading, where traders take on excessive positions, can heighten risks and diminish profits. It’s crucial to maintain discipline, focus on quality over quantity, and avoid succumbing to the temptation of frequent trades for sustained success in swing trading strategies.

Neglecting a Trading Plan

One common pitfall is trading without a well-defined plan, leading to impulsive actions and subpar trade executions. By creating and following a detailed trading plan, traders can mitigate risks, stay objective, and make informed decisions aligned with their strategy in swing trading practices.

Emotional Decision-Making

Emotional trading triggered by fear or greed can distort rational thinking and prompt detrimental choices. To excel in swing trading strategies, traders must cultivate emotional discipline, adhere to predefined rules, and execute trades based on a calculated analysis rather than impulsive reactions to market fluctuations.

Mastering the Art of Successful Swing Trading

Crafting a Proven Trading Plan

To excel in swing trading, crafting a meticulous trading plan is paramount. Define your strategy, set clear risk management parameters, and establish strict trading rules. By outlining these crucial aspects, you provide yourself with a roadmap for making informed trading decisions, thereby increasing your chances of success in the volatile markets.

Embracing Discipline and Patience

Discipline and patience are virtues that can significantly impact your swing trading journey. Resist the urge for impulsive trades, adhere to your predefined trading plan, and exercise patience during market fluctuations. By staying disciplined and patient, you create a structured approach that mitigates unnecessary risks and cultivates long-term success.

Continuous Learning and Market Awareness

In the dynamic world of swing trading, knowledge is power. Commit to continuous learning by staying abreast of market trends, exploring new trading techniques, and enhancing your analytical skills. By being well-informed and adaptable, you position yourself to capitalize on emerging opportunities and navigate market challenges with confidence.