Learn all about the importance of stop loss orders in trading and how they can benefit your trading strategy. Stop loss orders are a vital risk management tool that every trader should utilize to protect their investments. By setting predefined levels to limit potential losses, traders can minimize risks and enhance their overall trading performance. Whether you are a novice or seasoned trader, understanding the fundamentals of stop loss orders is essential for long-term success in the financial markets. Let’s delve into the intricacies of stop loss orders and explore the various strategies and common pitfalls to avoid when implementing them in your trading routine.

Understanding Stop Loss Orders in Trading

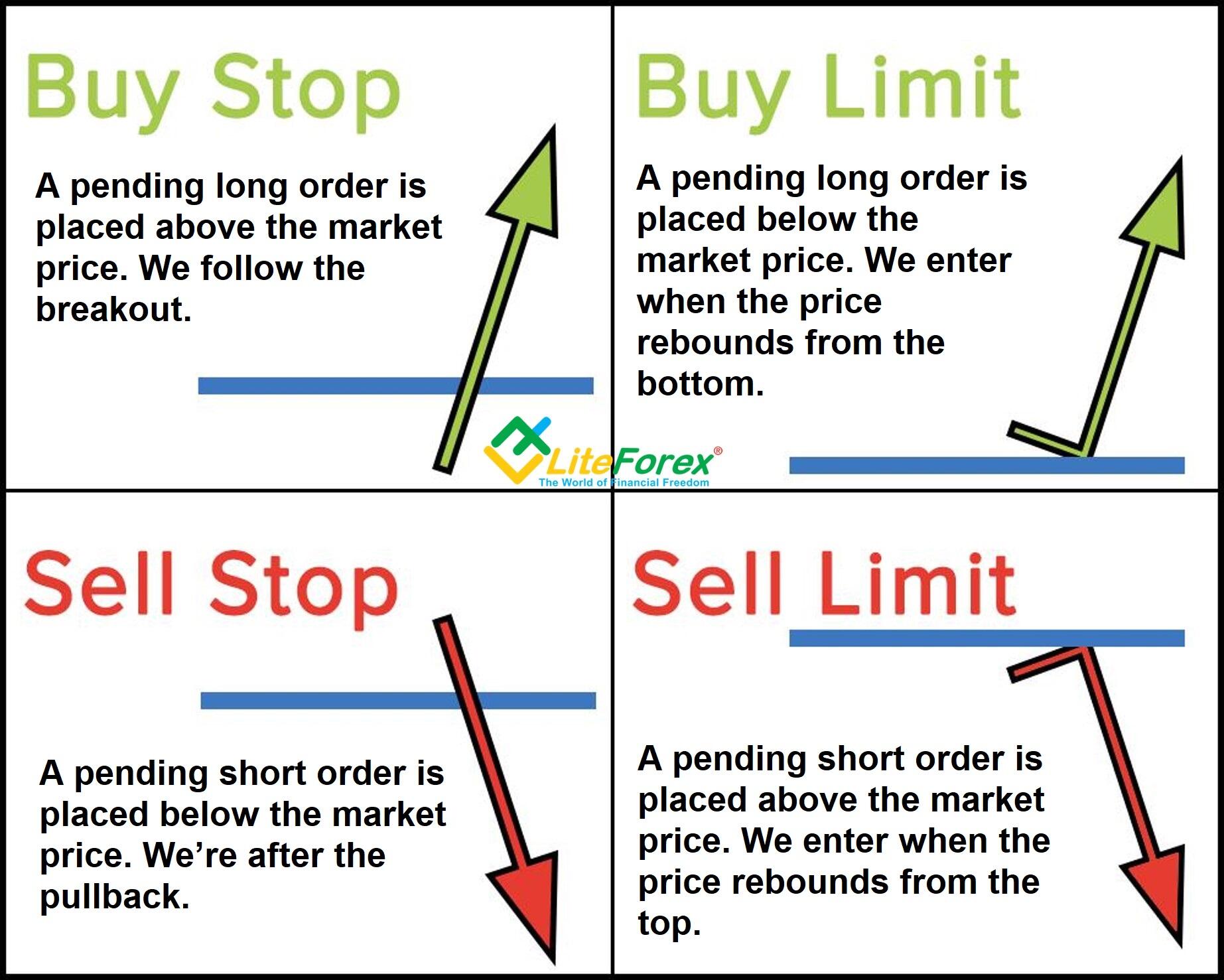

Stop loss orders serve as a safety net in trading, acting as predefined instructions to automatically sell an asset when it hits a particular price point. By setting these limits, traders shield themselves from excessive losses, thereby managing the capital at stake effectively. Whether placed above or below the current market price, these orders are indispensable risk management tools for traders at all levels of expertise in the financial markets.

Understanding Different Types of Stop Loss Orders for Effective Trading

Market Stop

A market stop order is an essential tool where your stop loss is triggered immediately at the prevailing market price when the preset level is reached. It ensures a swift exit from a losing position, protecting your investment from further downturns in volatile market conditions.

Limit Stop

With a limit stop order, your trade is executed only when the asset’s price reaches or surpasses the specified threshold. This order type gives you control over the price at which you exit a trade, minimizing slippage and potential losses.

Trailing Stop

By employing a trailing stop order, you can secure profits while safeguarding against unexpected market reversals. This dynamic order type moves with the asset’s price, maintaining a set distance, thereby locking in gains as the trade moves in your favor.

Bracket Stop

A bracket stop order is a versatile tool that combines a stop loss with a take profit order, creating a predefined range for trade management. This type of order automates both your trade exits, allowing you to capitalize on favorable price movements and protect your gains simultaneously.

Maximizing Returns and Mitigating Risks with Stop Loss Orders

Preserving Capital:

Implementing stop loss orders in trading acts as a safety net, preserving capital by preventing catastrophic losses. By setting predetermined exit points, traders shield their investments from significant downturns, ensuring long-term sustainability and financial security.

Enforcing Discipline:

Stop loss orders enforce discipline, a crucial aspect in trading. They deter emotional decision-making, prompting traders to adhere to predetermined strategies. This discipline minimizes impulsive actions driven by fear or greed, fostering a rational and systematic approach to trading.

Managing Risk-Reward Ratios:

Utilizing stop loss orders empowers traders to effectively manage risk-reward ratios. By setting stop levels based on trade setups, traders can identify optimal entry and exit points, enhancing profitability while containing potential losses within predefined thresholds.

Peace of Mind:

One significant benefit of stop loss orders is the peace of mind they offer, especially when traders are away from the trading desk. Knowing that their positions are protected by stop loss orders alleviates stress and allows traders to engage in other activities without constant monitoring, contributing to overall well-being and a healthy work-life balance.

Safeguarding Your Investments with Stop Loss Order Strategies

Avoiding Common Mistakes in Trading

Many traders overlook the critical aspect of implementing stop loss orders, leaving their trades vulnerable to substantial risks. By not utilizing stop loss orders, traders expose themselves to the potential of significant losses in volatile market conditions. This underscores the necessity of incorporating stop loss orders trading for effective risk management and capital protection.

Finding the Right Balance

Setting stop loss orders too tightly can trigger premature exits from trades, hindering the potential for profit. Conversely, placing stop loss orders too far away from the entry point diminishes their protective function and exposes investments to unnecessary risks. Striking the right balance is crucial to ensure optimal risk management and trade efficiency in the financial markets.

Dynamic Adaptation for Market Conditions

Failure to adjust stop loss levels as the market fluctuates can lead to missed opportunities or increased losses. Traders must actively monitor market dynamics and be prepared to modify their stop loss orders accordingly to align with evolving price movements. Flexibility and adaptive strategies are key to maximizing the effectiveness of stop loss orders and safeguarding investments effectively.

Advanced Stop Loss Strategies: Maximizing Trading Outcomes

Enhancing Risk Management Through Layered Stop Loss Orders

Implementing multiple stop loss orders can establish a layered risk management system. By setting different stop levels at various points of the trade, traders can safeguard their positions against sudden market volatility or unexpected price movements. This strategy helps in diversifying risk exposure and enhances overall portfolio protection, ensuring a more resilient trading approach.

Capturing Profits with Trailing Stop Loss Orders

Trailing stop loss orders are a dynamic tool that allows traders to protect their gains while allowing for potential profit maximization. As the price moves favorably, the stop loss order automatically adjusts, trailing behind the market price. This method enables traders to secure profits in volatile markets and lock in gains without the need for constant monitoring.

Synergizing Stop Loss Orders with Risk Management Tools

Integrating stop loss orders with other risk management techniques like position sizing and hedging can amplify risk mitigation efforts. By combining these strategies, traders can create a comprehensive risk management framework that not only limits potential losses but also optimizes profit potential. Strategic alignment of these tools enhances overall risk-adjusted returns and ensures a well-rounded trading strategy.

Adaptability and Customization in Stop Loss Strategies

Tailoring stop loss orders to fit specific trading styles and market conditions is paramount for sustained success. Depending on the trading strategy employed and the prevailing market dynamics, traders can adjust stop loss levels to align with their risk tolerance and profit targets. Customizing stop loss orders enhances flexibility, allowing for agile responses to changing market scenarios and optimizing trading outcomes.

Incorporating these advanced stop loss strategies empowers traders to navigate the complexities of the financial markets with precision and confidence. By embracing innovative risk management techniques and tailoring stop loss orders to their trading approach, individuals can maximize trading outcomes while effectively managing risk exposure. Strategically combining these advanced strategies enhances trading proficiency and paves the way for consistent success in the dynamic world of trading.

The Vital Role of Stop Loss Orders in Trading

Stop loss orders stand as critical instruments in the realm of trading, serving as the cornerstone for managing risk effectively and elevating trading performance. Armed with a comprehensive knowledge of the varied types, benefits, and strategies surrounding stop loss orders, traders can fine-tune their risk management approach, paving the way for improved trading results.

It is paramount for traders to regularly reassess and modify their stop loss orders to align with the ever-evolving dynamics of the market. The adaptability to swiftly adjust stop loss levels ensures their continued efficacy in safeguarding investments amidst changing market conditions, thereby bolstering trading success.

Integration of stop loss orders into trading blueprints is fundamental for traders aiming to fortify their financial positions and optimize returns. Diligent utilization of stop loss orders not only shields capital from unforeseen downturns but also fosters a conducive environment for generating enhanced trading gains, underscoring their irreplaceable value in the trading landscape.