In the vast world of forex trading, the role of Forex brokers is crucial for traders looking to navigate the financial markets successfully. In this comprehensive guide on Forex Brokers, we will delve into the essential features, types, and performance indicators that every trader should consider before choosing the right broker. Whether you are a novice or experienced trader, understanding the intricate details of Forex brokers is key to making informed decisions and maximizing your trading potential.

Understanding Forex Brokers: A Comprehensive Guide

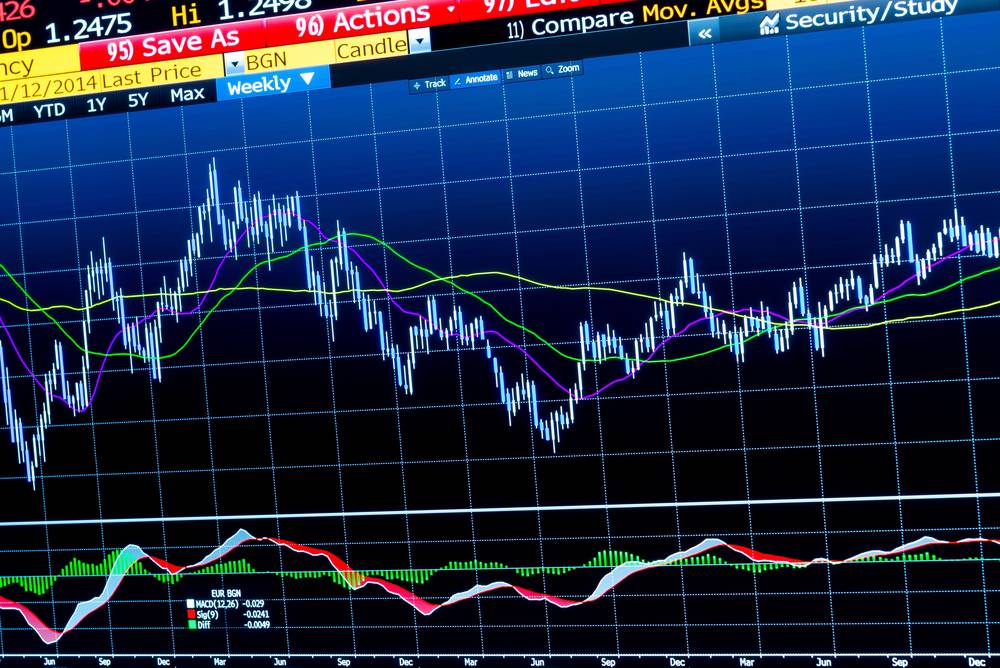

Forex brokers act as vital intermediaries linking traders to the dynamic foreign exchange market, where the buying and selling of currencies take place. These brokerages offer a trading platform, crucial for executing trades, providing real-time market data, and facilitating transactions efficiently. Selecting the appropriate Forex broker is paramount, influencing trading conditions, transaction costs, leverage options, customer support quality, and overall trading experience. In essence, your chosen broker plays a pivotal role in your trading journey, affecting your success and profitability in the forex market.

Essential Features to Consider When Choosing Forex Brokers

When embarking on your trading journey, ensuring the broker’s Regulation and Licensing by a reputable financial authority like the FCA or ASIC is paramount. This oversight offers traders protection, ensuring ethical practices and financial stability.

Trading Platform usability is crucial. Evaluate for intuitive interfaces, robust tools, and reliable execution speeds. A user-friendly platform enhances trading efficiency and decision-making processes, vital for successful trading strategies.

Comparing Spreads and Commissions between brokers is vital. Low spreads reduce trading costs, influencing profitability. Factor in both fixed and variable spreads along with commission structures to optimize your trading performance.

Evaluate Customer Support responsiveness. A reliable support team is invaluable during technical glitches or account queries. Quick and effective customer service can prevent losses and ensure a smooth trading experience.

Exploring the Different Types of Forex Brokers Tailored to Your Trading Needs

Understanding the Diverse Landscape of Forex Broker Types

When delving into the realm of Forex brokers, traders encounter various categories designed to suit different trading styles and preferences. Among these, ECN Brokers stand out for granting direct access to the interbank market, offering competitive spreads at the expense of higher trading volumes. This setup appeals to traders seeking optimal pricing and transparency in their transactions.

Market Makers, on the other hand, act as counterparties in trades, facilitating quick execution while typically presenting wider spreads. This model caters to traders prioritizing seamless and expedited order fulfillment, especially in fast-moving markets where speed is essential for securing favorable positions.

In the landscape of Forex brokerage, STP Brokers function similarly to ECN brokers by granting access to external liquidity providers. The key distinction lies in their non-pooling of liquidity, directly passing on orders to these providers. This approach appeals to traders valuing quick order execution and an efficient trading process without the consolidation of liquidity.

Diving further into the diverse range of Forex brokers, Hybrid Brokers emerge as a fusion of various broker types, combining features to offer a unique trading experience. These brokers blend characteristics from ECN, Market Makers, and STP models, yielding a balanced mix of advantages and potential drawbacks. Traders exploring hybrid options benefit from a tailored approach that caters to their specific trading preferences and objectives.

In conclusion, understanding the nuances of different Forex broker types is pivotal in aligning your trading strategy with a brokerage that complements your objectives. Whether you value tight spreads, quick execution, direct access to liquidity providers, or a hybrid model combining elements of various types, selecting the right broker tailored to your needs is instrumental in optimizing your trading experience and achieving your financial goals.

This comprehensive exploration of Forex broker types sheds light on the tailored solutions available to traders, guiding them towards informed decisions that align with their unique trading preferences and objectives. By carefully assessing the distinct features and advantages of each broker type, traders can embark on their Forex trading journey equipped with the knowledge needed to navigate the dynamic landscape of the financial markets effectively.

Evaluating Forex Brokers: Key Performance Indicators

When it comes to evaluating forex brokers, understanding key performance indicators is essential for making informed decisions. Execution speed stands out as a critical factor, gauging how swiftly trades are processed. Traders benefit from brokers capable of executing orders promptly, crucial in fast-moving markets like forex. Optimal execution speed ensures timely entries and exits based on trading strategies.

Slippage, another vital indicator, reflects the variance between the intended trade price and the actual execution price. Market fluctuations and broker-related delays can lead to slippage. Traders seek brokers with minimal slippage to ensure trades are executed as closely as possible to the desired price. Low slippage enhances trading precision and minimizes unexpected costs, contributing to overall profitability.

Fill rate, indicating the proportion of orders filled at the requested price without rejection, is pivotal for traders. High fill rates indicate broker reliability in executing trades as intended, essential for strategy accuracy. Traders value brokers with high fill rates, minimizing order rejections that could disrupt trading plans. Consistent fill rates enhance trading confidence and efficiency, aiding traders in achieving their financial goals.

Transparency serves as a cornerstone in evaluating forex brokers, reflecting their honesty in disclosing trading terms, fees, and policies. Transparent brokers provide clarity on all aspects of trading, empowering traders to make well-informed decisions. Clear communication on fees, leverage, and other pertinent information helps traders assess risks and rewards accurately. Transparency fosters trust between traders and brokers, promoting a healthy trading environment focused on honesty and integrity.

Beyond Basics: Additional Considerations for Advanced Traders

Leveraging the Power of Leverage

Advanced traders must comprehend the nuanced dynamics of leverage in forex trading. While leverage can magnify gains, it equally amplifies risks. Understanding proper risk management and the impact of leverage on trading positions is crucial for maximizing potential profits without falling prey to excessive losses in the volatile forex market.

Mastering Hedging Strategies for Risk Management

For seasoned traders, hedging strategies offer a sophisticated approach to mitigating risks and safeguarding against market uncertainties. By strategically using derivatives or other financial instruments to offset potential losses, advanced traders can create a more resilient portfolio and navigate turbulent market conditions with greater confidence and control.

Embracing Automation with Auto Trading Systems

The adoption of auto trading systems represents a paradigm shift for advanced traders seeking efficiency and precision in executing trades. By leveraging algorithms and predefined criteria, automated trading solutions enable traders to execute orders swiftly, capitalize on market opportunities, and remove emotional biases from decision-making processes, enhancing overall trading performance and consistency.

Unleashing the Potential of Social Trading Platforms

Exploring the realm of social trading platforms opens up a world of collaborative opportunities for advanced traders. By engaging with a community of like-minded individuals, traders can share insights, strategies, and performance metrics. By following successful traders and copying their trades, advanced traders can gain valuable insights, improve their own strategies, and cultivate a network of support and knowledge within the forex trading community.

Emerging Trends in the Forex Brokerage Industry

Mobile Trading: Revolutionizing Accessibility

The surge in mobile trading signifies a pivotal shift towards convenience and flexibility in Forex trading. With the rise of user-friendly mobile platforms, traders can execute trades, monitor market movements, and access vital information on-the-go. The mobile revolution has empowered traders by eliminating geographical constraints and enhancing real-time decision-making capabilities, making the Forex market more accessible than ever before.

Cryptocurrency Integration: Diversifying Trading Opportunities

The integration of cryptocurrencies into Forex trading has opened up a new realm of possibilities for traders, offering alternative assets with unique market behaviors. As Forex brokers embrace digital currencies like Bitcoin and Ethereum, traders can now capitalize on the volatility and distinct characteristics of cryptocurrencies, adding a layer of diversification to their trading portfolios and fostering innovation in the financial markets.

Artificial Intelligence: Elevating Trading Efficiency

Artificial Intelligence (AI) has emerged as a game-changer in the Forex brokerage industry, revolutionizing trading platforms through advanced automation and analysis capabilities. By leveraging AI algorithms, brokers can enhance trading experiences with intelligent tools for market prediction, risk assessment, and trade execution. The integration of AI empowers traders with data-driven insights and automated strategies, amplifying efficiency and optimizing decision-making processes.

Regulation Evolution: Ensuring Market Integrity

Amidst the dynamic landscape of Forex trading, regulatory bodies continue to evolve their frameworks to safeguard traders and maintain market transparency. Stringent regulations are being enforced to combat fraudulent practices, protect investor funds, and uphold the integrity of the financial markets. As the industry strives for greater accountability, regulatory evolution plays a critical role in fostering trust among traders, enhancing market stability, and promoting ethical practices within the Forex brokerage sector.