In the realm of global finance, foreign exchange plays a pivotal role in shaping economies and industries worldwide. Understanding the dynamics of foreign exchange is essential for businesses, investors, and policymakers alike. This ultimate guide delves into the significance of foreign exchange, key factors influencing exchange rates, types of transactions, major participants, risks, and rewards of trading, as well as strategies for managing foreign exchange risk. Whether you’re new to the world of foreign exchange or seeking to deepen your knowledge, this comprehensive overview will provide valuable insights into the intricacies of this complex yet fascinating market.

Understanding Foreign Exchange and Its Significance

Foreign exchange, commonly known as forex, facilitates the exchange of currencies among countries, underpinning international trade, tourism, and investment. This market operates around the clock, being the largest globally, ensuring high liquidity for participants. The pricing of currencies, influenced by market forces of supply and demand, holds significant sway over businesses, travelers, and investors, reflecting the economic health of nations. Understanding Foreign Exchange is imperative for navigating the complexities of global finance successfully.

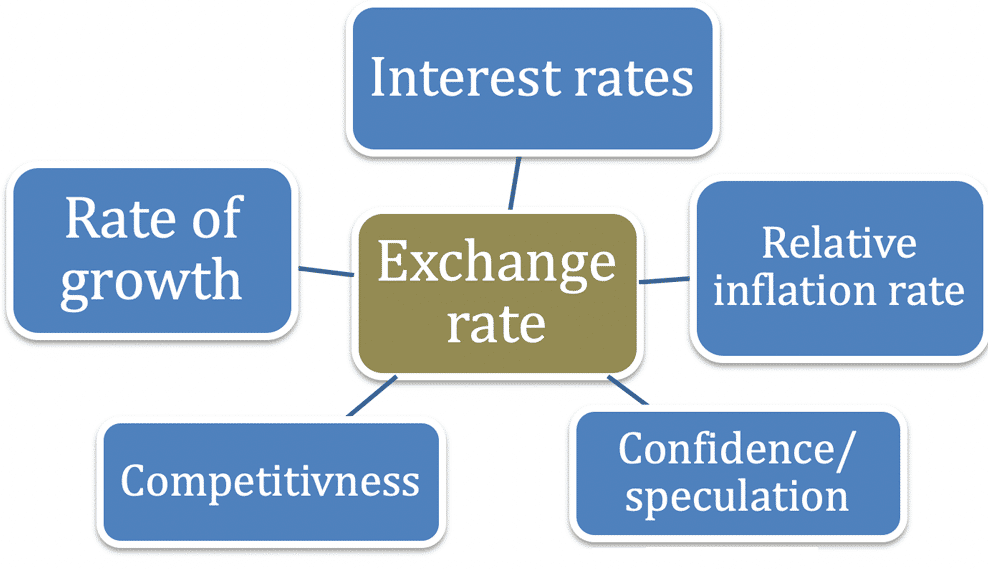

Factors Influencing Foreign Exchange Rates

Economic Conditions and Currency Values

Economic factors like GDP growth, inflation rates, and interest rates directly impact the valuation of currencies. Understanding how these indicators correlate with exchange rates is vital for grasping the complexities of foreign exchange dynamics. Investors keen on mastering the art of forex trading must closely monitor these economic metrics to make informed decisions.

Political Stability and Exchange Rates

Political stability, government policies, and geopolitical events play a pivotal role in determining exchange rates. Sudden political upheavals or policy changes can trigger significant fluctuations in currency values. Astute traders navigate these uncertainties by staying abreast of global political developments, as they can have profound effects on forex markets.

Impacts of Global Economic Events

Global economic events, such as recessions or financial crises, have substantial repercussions on currency exchange rates. These events can trigger market volatility and alter investor confidence, leading to swift currency movements. Being aware of how these events influence forex markets is crucial for mitigating risks and seizing profitable opportunities.

Central Bank Interventions and Market Sentiment

Central banks’ interventions and market sentiment are key determinants of exchange rate movements. Monetary policy decisions, currency interventions, and investors’ sentiment collectively influence the direction of currency values. Traders adept at interpreting central bank actions and market sentiments can capitalize on market trends and position themselves strategically.

By comprehensively understanding the interplay of economic, political, and global factors, investors can navigate the complexities of foreign exchange markets with confidence, making informed decisions to capitalize on opportunities and manage risks effectively. The intricate web of influences shaping exchange rates underscores the importance of staying informed and adapting to the ever-evolving landscape of the forex market.

Major Participants in the Foreign Exchange Market

Commercial Banks

Commercial banks are pivotal participants in the foreign exchange market, serving as intermediaries for businesses and individuals needing currency exchange services. Their role involves conducting transactions, providing liquidity, and offering competitive exchange rates. By leveraging their extensive networks, commercial banks ensure seamless foreign exchange operations for clients worldwide.

Central Banks

Central banks wield significant influence in the foreign exchange market, responsible for setting and maintaining exchange rates through monetary policies. These institutions oversee their countries’ currency reserves, intervening to stabilize their currency values when necessary. Central banks play a crucial role in regulating money supply and inflation, impacting global financial stability and economic conditions.

Hedge Funds

Hedge funds actively engage in currency trading, aiming to capitalize on fluctuations in exchange rates for profit. With substantial resources and expertise, hedge funds speculate on currency movements, utilizing various strategies to maximize returns. Their involvement adds liquidity and depth to the foreign exchange market, contributing to price discovery and market efficiency.

Multinational Corporations

Multinational corporations participate in the foreign exchange market to facilitate international trade transactions. These entities require currency exchange services to conduct cross-border business activities, manage currency exposure risks, and optimize capital allocation. By leveraging foreign exchange mechanisms, multinational corporations mitigate currency fluctuations’ adverse impacts and enhance operational efficiency in global markets.

Navigating the Risks and Rewards of Foreign Exchange Trading

Currency fluctuations are a double-edged sword, offering gains or losses, impacting investors and businesses alike. Exchange rate volatility jeopardizes international investments and trade, necessitating robust risk management strategies. Successful forex trading hinges on understanding market trends and economic factors to navigate risks effectively and capitalize on rewarding opportunities. Mitigating risks through informed decision-making is key to mastering the complexities of foreign exchange trading.

Effective Strategies for Managing Foreign Exchange Risk

Hedging: Mitigating Currency Fluctuations

Hedging involves sophisticated tools like options and futures to minimize losses due to volatile exchange rates. By strategically utilizing these financial instruments, businesses and investors can protect their assets from adverse currency movements, ensuring stability in international transactions.

Diversification: Spreading Risk Across Currencies

Diversification is a powerful strategy to hedge against currency risks. By investing in multiple currencies, individuals and organizations can minimize the impact of a single currency’s fluctuation on their overall portfolio. This approach helps in reducing potential losses and maintaining a more balanced exposure to various currency movements.

Forward Contracts: Securing Future Exchange Rates

Forward contracts enable entities to lock in exchange rates for future transactions, shielding them from unpredictable currency fluctuations. By specifying the exchange rate and settlement date in advance, businesses and investors can safeguard their financial interests and plan ahead with certainty in cross-border dealings.

Currency Futures: Managing Future Exchange Rate Risks

Currency futures provide a standardized way to manage future currency delivery at a predetermined price. These contracts, traded on regulated exchanges, allow participants to hedge against potential losses by fixing exchange rates, providing transparency, and liquidity in the foreign exchange market. It offers a structured approach in mitigating currency risks associated with international transactions.