In the realm of economics, Non-farm Payrolls (NFP) play a pivotal role in shaping market dynamics and influencing investor sentiment. The NFP report, released by the U.S. Bureau of Labor Statistics on a monthly basis, provides crucial insights into the current employment situation excluding farm workers, government employees, and a few other categories. Understanding the key components and significance of NFP is essential for grasping its impact on various industries and the overall economy. This ultimate guide aims to delve into the nuanced aspects of NFP, from its interpretation and forecasting to the ripple effects it generates across different sectors.

Understanding Non-farm Payrolls (NFP)

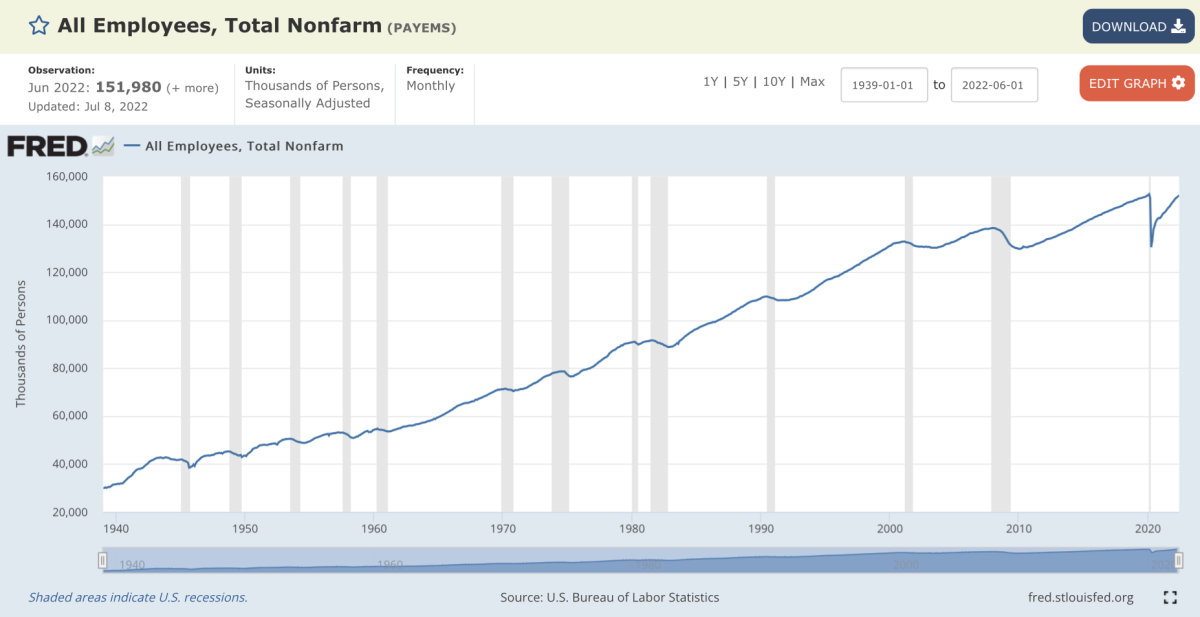

The Non-farm Payrolls (NFP) report, a significant publication by the Bureau of Labor Statistics (BLS), gauges the variance in the number of individuals employed in the US, not encompassing specific sectors like farming, governmental roles, private household laborers, and non-profit organizations. Renowned for providing critical insights into economic well-being and labor market patterns, this report serves as a pivotal benchmark for assessing the country’s economic landscape. Mark your calendars – the NFP findings are unveiled on the first Friday of every month.

Exploring the Key Components of Non-farm Payrolls

Total Non-farm Payroll Employment (Headline Figure)

The headline figure in the NFP report represents the total number of paid workers, excluding certain job types like farm workers and government employees. This primary metric gives a snapshot of the overall health of the labor market, indicating whether employment is rising or falling, serving as a key indicator of economic strength.

Change in Employment by Industry Sector

The NFP report breaks down employment changes by industry sector, revealing which sectors are expanding or contracting. Understanding these shifts helps investors gauge where economic growth is occurring, providing insights into which industries are thriving and which may be facing challenges, guiding investment decisions.

Change in Employment by Job Category

Within the NFP data, the change in employment by job category sheds light on the dynamics of the labor market on a more granular level. It offers valuable insights into trends regarding specific job roles, allowing for a deeper understanding of where job creation or job losses are concentrated, aiding in assessing workforce trends.

Average Hourly Earnings

Apart from employment figures, the average hourly earnings data is a crucial component of the NFP report. It indicates the average amount workers earn per hour, reflecting wage growth trends. Rising wages may signal a strong labor market and potential inflationary pressures, impacting consumer spending habits and overall economic performance significantly.

Significance of Non-farm Payrolls for Investors

Unveiling Labor Market Strength

Understanding Non-farm Payrolls (NFP) unveils the pulse of the labor market, shedding light on employment trends critical for investors. By analyzing NFP data, investors gain valuable insights into job creation, unemployment rates, and wage growth, helping them make informed decisions.

Impact on Financial Markets

NFP data has a profound impact on the stock market and currency exchange rates. Positive NFP reports can lead to stock market rallies, strengthening the dollar, while negative data can trigger market fluctuations, affecting investors’ portfolios and currency trading strategies.

Economic Health Barometer

The NFP report acts as a barometer for investors to assess the overall health of the economy. A robust NFP figure signifies economic growth, encouraging investor confidence, whereas weak NFP figures can signal economic slowdowns, prompting cautious investment strategies.

Central Banks and Interest Rates

Central banks closely monitor NFP reports when formulating monetary policies, especially in deciding interest rates. Strong NFP figures may lead to interest rate hikes to curb inflation, while weak NFP data could prompt rate cuts to stimulate economic activity, impacting investors’ borrowing costs and investment returns.

In conclusion, Understanding Non-farm Payrolls (NFP) is paramount for investors as it provides valuable insights into the labor market, influences financial markets, serves as an economic health indicator, and guides central bank decisions. Investors leveraging NFP data can navigate market volatility, optimize portfolio strategies, and stay ahead in an ever-changing economic landscape.

Interpreting Non-farm Payrolls Data

Understanding Non-farm Payrolls (NFP) growth is crucial; a positive trajectory signifies increased job opportunities, reflecting a robust economy. Conversely, a decline hints at job cuts and economic downturn. Analysts emphasize correlating NFP figures with other economic metrics for a comprehensive assessment. Additionally, seasonal variations and data revisions play a role in understanding the true employment landscape accurately.

Techniques for Forecasting Non-farm Payrolls

Economists and analysts employ diverse models when predicting the Non-farm Payrolls (NFP) report. These models often incorporate historical trends, economic indicators, and mathematical algorithms to estimate upcoming NFP figures accurately. The utilization of these sophisticated models aids in providing more reliable forecasts for market participants.

Forecasting NFP involves considering multiple factors, including prevailing economic data, market sentiment, and geopolitical events. These elements contribute significantly to the volatility and direction of NFP estimates. Analysts meticulously assess these variables to refine their forecasts, recognizing the impact each factor may have on employment numbers and market reactions.

Accurate NFP forecasts empower investors with valuable insights to form strategic decisions. By anticipating NFP outcomes, investors can adjust their portfolios, manage risks proactively, and capitalize on emerging market trends. The ability to interpret and act upon forecasted NFP figures enhances investment strategies and potentially leads to favorable outcomes in volatile market conditions.

It is essential for investors to understand that NFP forecasts serve as informed estimations rather than definitive predictions. While these forecasts offer valuable guidance, unexpected events or revisions can still impact the actual NFP results. Investors should exercise caution and complement forecasted data with ongoing market analysis and risk management strategies for more prudent decision-making.

Impact of Non-farm Payrolls on Industries

Leveraging NFP Growth for Industry Advancement

Strong NFP growth acts as a catalyst for industries linked to job creation, like construction and retail. Robust employment data indicates a healthier economy, boosting consumer confidence and spending, ultimately driving growth in these sectors.

The Ripple Effect of Weak NFP Figures

Conversely, weak NFP growth can spell trouble for industries reliant on consumer spending, such as hospitality and tourism. A downturn in job numbers could lead to decreased discretionary income, impacting these sectors significantly.

Strategic Decision-Making with NFP Insights

Businesses keen on growth harness NFP data for informed choices. By gauging employment trends, companies can fine-tune hiring strategies and make prudent investment decisions aligned with the prevailing job market dynamics. NFP serves as a compass for strategic planning in various industries.