Are you curious about the Carry Trade strategy and its potential as a lucrative approach or a risky bet in trading? In this article, we will delve into the world of Carry Trade to uncover its benefits, risks, historical examples, challenges, and alternative strategies for successful trading. Whether you are a seasoned trader or just starting, understanding the ins and outs of Carry Trade can be crucial for optimizing your trading portfolio. Join us as we explore the advanced strategies and ethical considerations in Carry Trading to enhance your trading knowledge and skills.

Understanding Carry Trade: A Lucrative Strategy or a Risky Gamble?

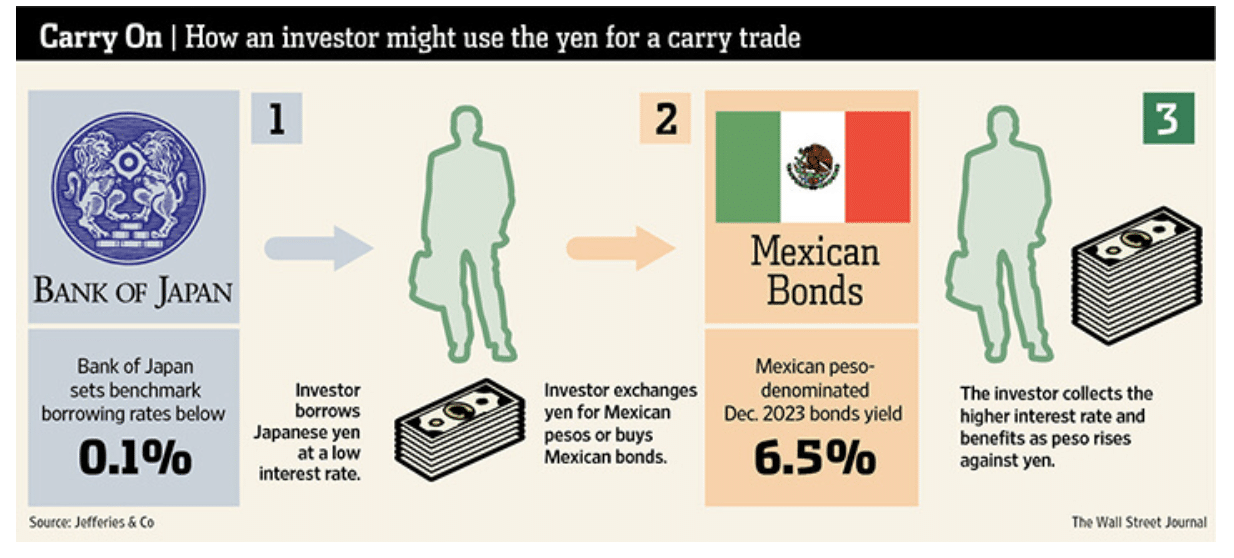

Carry trade is a sophisticated trading strategy where traders borrow funds in a currency with a low-interest rate, aiming to invest in a currency offering higher interest rates. The essence of carry trade lies in profiting from the yield differential between the two currencies, termed as the “carry.” While this approach can yield substantial returns, it also exposes traders to risks associated with currency value fluctuations and sudden changes in interest rates. Thus, thorough risk assessment and strategic evaluation are imperative before executing a carry trade strategy.

Key Considerations for Successful Carry Trading

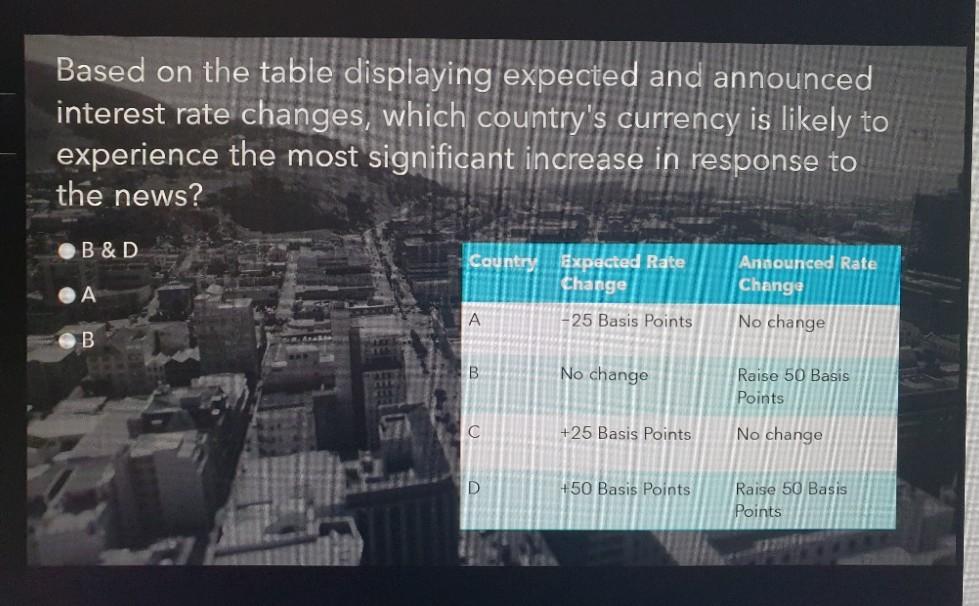

When engaging in Carry Trade Strategy, selecting currency pairs with substantial interest rate gaps is paramount. This difference directly affects potential profits. Additionally, staying vigilant on economic and political developments worldwide is crucial. Factors like inflation rates or geopolitical tensions can swiftly influence exchange rates.

To safeguard investments, efficient risk management is vital. Diversification across multiple currencies can help mitigate potential losses. Implementing hedging mechanisms, such as options or futures contracts, adds an extra layer of protection. These strategies aim to cushion against unexpected market fluctuations.

Consistent monitoring of your carry trade position is essential for sustained success. Markets are dynamic, and adjustments may be needed to align with changing economic conditions. By staying proactive and adaptable, traders can capitalize on opportunities and shield themselves from potential risks. Regular reviews ensure you can capitalize on favorable conditions and shield against adverse market movements.

Historical Examples of Successful Carry Trades

In the 1980s and 1990s, the Japanese yen carry trade was a standout success story in the Forex market, yielding substantial profits for savvy traders who leveraged the interest rate differentials to their advantage. This strategic approach garnered significant returns for those who timed their trades effectively, showcasing the potential profitability inherent in well-executed carry trade strategies.

Moving into the early 2000s, the Swiss franc carry trade emerged as another notable example of successful carry trading. Traders took advantage of Switzerland’s low interest rates, capitalizing on the interest rate differentials between the Swiss franc and other currencies to generate profitable trading opportunities. This period demonstrated how careful consideration of interest rate differentials could lead to successful outcomes in the carry trade strategy.

During the mid-2000s, the Australian dollar carry trade gained traction as traders tapped into the high commodity prices that boosted the Australian economy. By exploiting the interest rate differentials and the flourishing commodity market, traders were able to seize profitable opportunities within the carry trade strategy. These instances underscore the importance of adapting to prevailing market conditions to maximize the potential gains in carry trading.

While these historical examples showcase the potential profitability of carry trades, they also emphasize the significance of prudent timing and effective risk management in mitigating potential downsides. Successful carry trades require a thorough understanding of market dynamics, interest rate differentials, and global economic factors to navigate the inherent risks effectively. By learning from these historical successes and failures, traders can better position themselves to capitalize on favorable market conditions while managing risks proactively.

Diversified Alternatives for Risk-Averse Investors

Exploring Safer Investment Options

In the world of finance, risk-averse investors seeking alternatives to the Carry Trade Strategy often turn to fixed income investments like bonds. Although yielding lower returns, bonds offer a more stable investment avenue with reduced risk exposure, making them a preferred choice for those prioritizing capital preservation over high returns.

Embracing Stability with Dividend-Paying Stocks

For investors inclined towards consistent income flow alongside the potential for capital appreciation, dividend-paying stocks present a compelling option. These stocks offer a steady stream of dividends, making them attractive for risk-averse individuals looking for a balance between income generation and growth potential in their portfolios.

Realizing Real Estate Exposure through REITs

Real estate investment trusts (REITs) emerge as a lucrative alternative for those interested in real estate without venturing into direct property ownership. REITs provide investors with exposure to the real estate sector while offering liquidity and professional management, making them an appealing choice for risk-averse individuals seeking diversification.

Harnessing Diversification with Exchange-Traded Funds (ETFs)

Seeking diversification and access to a broad range of asset classes without the complexities of managing individual securities? Exchange-traded funds (ETFs) offer a convenient solution for risk-averse investors. Through ETFs, investors can access diversified portfolios while benefiting from liquidity, cost-effectiveness, and flexibility in their investment strategies.

By exploring these diverse alternatives, risk-averse investors can tailor their investment portfolios to align with their risk tolerance and financial goals while mitigating the inherent risks associated with more aggressive strategies like the Carry Trade.

Advanced Strategies for Experienced Carry Traders

Experienced carry traders often utilize leverage to boost returns, although this can heighten risks significantly. By carefully managing leverage ratios, traders can amplify profits while keeping risk exposure in check, crucial in the volatile forex market.

Hedging plays a pivotal role for seasoned carry traders by utilizing instruments like currency forwards and options to hedge against adverse currency movements. This strategic approach helps mitigate potential losses, safeguarding profits and overall portfolio stability.

Quantitative analysis serves as a cornerstone for advanced carry traders, enabling them to pinpoint lucrative trade opportunities with precision. By leveraging sophisticated tools and data analysis, traders can optimize entry and exit points, enhancing overall profitability and risk management.

Diversification is a key strategy for experienced carry traders, involving spreading investments across various currency pairs and asset classes. This approach helps mitigate concentration risk and exposure to a single currency or market, providing a more balanced and resilient portfolio in the face of market fluctuations.

Ethical Considerations in Carry Trading

Carry trade strategies can impact currency stability in developing nations due to large capital flows. This can lead to exchange rate fluctuations affecting local economies negatively. Ethical carry trading involves assessing these impacts and acting responsibly. Investors must conduct thorough research to comprehend the broader consequences of their trades, promoting ethical decision-making in the financial markets. By considering the ethical implications, traders can contribute to more sustainable and socially responsible trading practices.