Central banks play a crucial role in the global financial system, serving as the backbone of monetary policy and economic stability. Understanding Central Banks and their functions is essential to grasp how these institutions impact the economy. From regulating monetary systems to influencing interest rates, central banks wield significant power in shaping economic outcomes. In this article, we will delve into the purpose and functions of central banks, shedding light on their role in ensuring financial stability and managing key economic indicators such as inflation and employment levels.

Unveiling the Core Functions of Central Banks

Central banks stand as pivotal financial institutions tasked with overseeing and regulating a nation’s monetary system. Their fundamental roles encompass the pivotal tasks of curbing inflation, steering interest rates, and upholding the bedrock of financial stability within the economy. By serving as the ultimate financial backstop for commercial banks, these institutions wield substantial influence in shaping economic policies and safeguarding the economic landscape from tumultuous shifts.

In essence, central banks function as the guardians of economic health, influencing critical aspects such as economic growth trajectories, employment dynamics, and the delicate intricacies of price stability. Their strategic decisions reverberate throughout the economy, charting the course for sustainable development, fostering employment opportunities, and carefully calibrating price levels to maintain a balanced economic equilibrium. Through their multifaceted functions, central banks are indispensable pillars of financial resilience and prosperity, playing an indispensable role in steering nations towards economic progress and stability.

By intricately weaving together their functions of regulating monetary systems, managing inflation, and providing critical financial support to banking entities, central banks pave the way for economic vitality and resilience. Through their meticulous control over interest rates and strategic interventions in financial markets, these institutions uphold the fragile balance of economic stability, ensuring that nations navigate financial turbulences with prudence and foresight. In essence, central banks play a pivotal role in sculpting the economic landscape, safeguarding against instability, and steering economies towards a path of sustainable growth and prosperity.

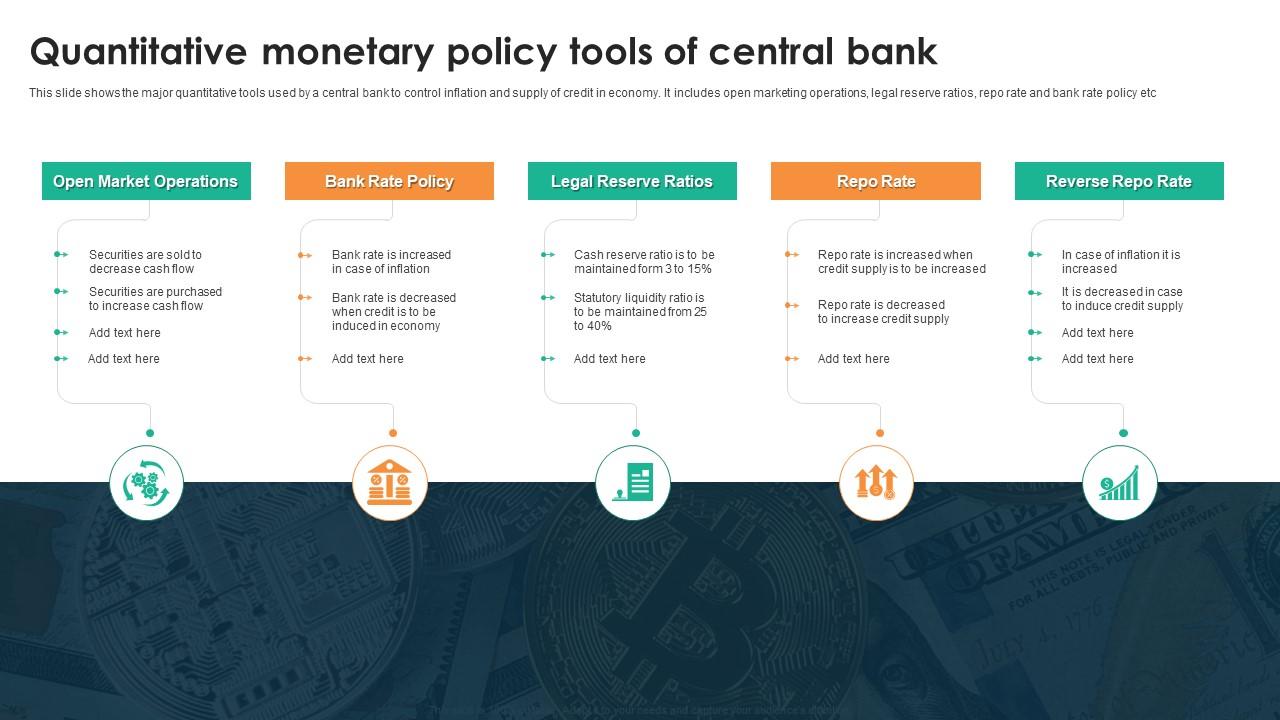

Exploring Monetary Policy Tools Utilized by Central Banks

Central banks employ a diverse array of tools to execute monetary policy effectively, aiming to regulate economic conditions. One key mechanism is open market operations, where central banks trade government securities to manage the money supply’s circulation, impacting interest rates and inflation levels significantly.

Reserve requirements form another pivotal tool in central banks’ arsenal, mandating commercial banks to maintain a certain level of reserves. By adjusting these requirements, central banks can directly influence the liquidity available for lending, thereby affecting credit expansion and money circulation in the economy.

Moreover, interest rate adjustments stand out as a fundamental instrument wielded by central banks to steer the economic environment. By manipulating key interest rates, central banks can modulate the cost of borrowing, steering investment decisions, consumer spending patterns, and overall economic vitality. The nuanced calibration of these rates plays a vital role in shaping economic growth trajectories and managing inflation dynamics.

In essence, the strategic deployment of these monetary policy tools by central banks signifies their proactive approach in steering economic performance and stability. By judiciously utilizing open market operations, reserve requirements, and interest rate adjustments, central banks can effectively regulate key economic indicators, foster sustainable growth, and navigate fluctuations in the financial landscape with precision and impact.

Central Banks and Inflation Management

Central banks prioritize controlling inflation as it safeguards purchasing power and economic stability. Monitoring inflation rates enables central banks to deploy monetary policy tools effectively, aiming to maintain inflation within set thresholds. The adoption of inflation targeting frameworks by central banks globally showcases a commitment to preserving price stability while considering broader economic objectives like growth and employment. This delicate balance underscores the multifaceted role central banks play in managing inflation and promoting overall economic well-being.

The Impact of Central Bank Policies on Economic Growth

Central bank policies play a pivotal role in shaping economic growth dynamics. By influencing investment, consumption patterns, and business sentiment, they can either spur or dampen economic activity. Low interest rates, a common tool, fuel growth by incentivizing borrowing and investment, thus boosting overall economic activity. Nonetheless, excessive easing of monetary policy may trigger inflation and asset bubbles, underscoring the delicate balance central banks must maintain between controlling inflation and fostering growth.

The Future of Central Banks: Adapting to Change and Addressing Challenges

Central banks are at the forefront of adapting to changing economic landscapes and embracing technological advancements. The exploration of digital currencies and blockchain technology represents a shift towards more efficient and secure financial infrastructures, potentially revolutionizing traditional banking systems.

Moreover, central banks are confronted with significant challenges like climate change, rising inequality, and geopolitical uncertainties. These issues necessitate innovative policy responses to mitigate risks and promote sustainable economic development while maintaining financial stability.

As the economic landscape evolves, the role of central banks is anticipated to transform further. Adapting to new economic realities will require central banks to be proactive in addressing emerging challenges and leveraging opportunities to enhance their effectiveness in ensuring monetary stability and fostering economic growth.