Currency markets play a crucial role in shaping the global economy, influencing trade, exchange rates, and investment decisions worldwide. Understanding the intricate workings of currency markets is essential for individuals and businesses alike. From major currency pairs to the diverse types of currency markets, a comprehensive grasp of this dynamic field is key to navigating the complexities of the financial world. In this article, we delve into the dynamics of Currency Markets, shedding light on key market participants, market forecasting tools, and the various opportunities they present for traders and investors seeking to capitalize on market fluctuations.

Exploring Currency Markets Globally

Currency markets, the backbone of international finance, enable countries to exchange currencies, fueling global trade and investment. These markets wield enormous influence, dictating exchange rates that impact prices of goods and services globally. Economic indicators, political developments, and monetary policies by central banks are key factors shaping the intricate movements within currency markets, making them dynamic and responsive to the ever-changing global landscape.

Major Currency Pairs: The Cornerstone of Forex Trading

In the realm of forex trading, currency pairs like EUR/USD and GBP/JPY serve as the foundation, dictating exchange rates globally. Major pairs, such as EUR/USD, boast substantial trading activity and liquidity, offering traders accessibility and smoother transactions within the market. Delving deeper into the intricacies of major currency pairs is paramount for navigating the complexities and seizing profitable opportunities in the dynamic world of forex trading.

Exploring the Diversity of Currency Markets: Spot, Forward, and Futures

Spot Markets:

Spot markets are the heartbeat of currency trading, where transactions occur instantly at the prevailing exchange rate. This real-time nature caters to immediate needs, making it popular among businesses and investors seeking quick exchanges or trade settlements. The agility of spot markets reflects the dynamic nature of global trade, offering instant liquidity and price discovery for currencies.

Forward Markets:

In the realm of forward markets, traders secure exchange rates for future deals, mitigating risks associated with fluctuating currency values. This strategic approach allows businesses to plan ahead, ensuring price stability and budget certainty in international transactions. Forward contracts provide a valuable tool for managing exposure to currency volatility, enhancing financial predictability in global ventures.

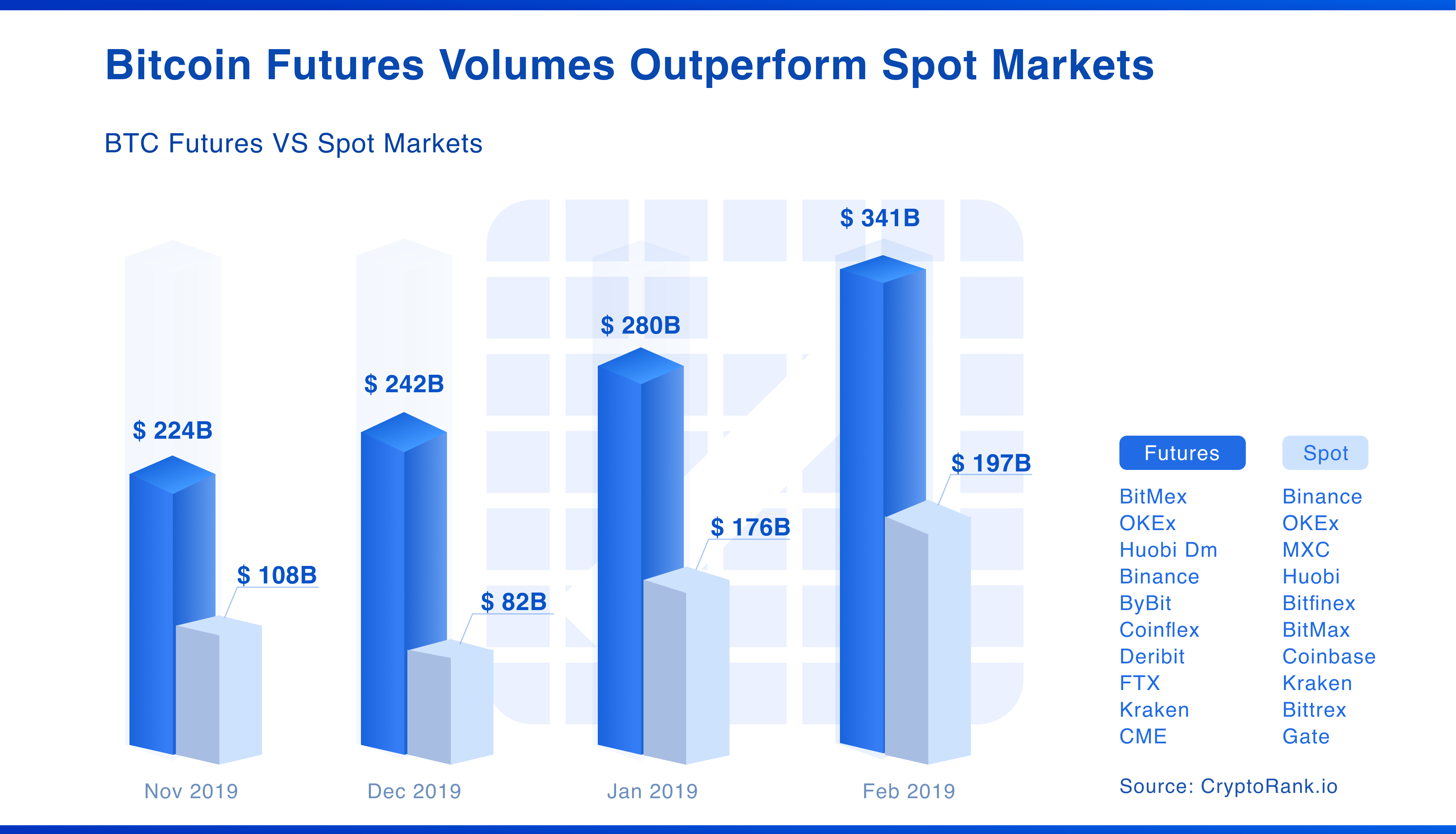

Futures Markets:

Futures markets stand as pillars of standardized currency trading, offering contracts detailing fixed prices and future delivery dates. By enabling participants to speculate on currency values, futures markets foster a transparent and regulated arena for currency exchange. These contracts provide flexibility for hedging, speculation, and investment, catering to a diverse range of financial objectives in the ever-evolving currency landscape.

Key Market Participants: Central Banks, Commercial Banks, and Speculators

Central banks, like the Federal Reserve in the United States or the European Central Bank, wield immense influence in currency markets. They use monetary policies, such as interest rate adjustments, to stabilize economies and impact exchange rates. Central bank interventions can significantly affect currency valuations, making them vital players in the global forex arena, shaping the “currency markets global perspective.”

Commercial banks act as intermediaries in currency trading, catering to businesses and individuals exchanging currencies for various purposes. Their role in providing liquidity and executing foreign exchange transactions is crucial for ensuring smooth market operations. Commercial banks bridge the gap between market participants, facilitating seamless currency transactions and contributing to the overall efficiency of the forex market.

Speculators, often portrayed as risk-takers, play a pivotal role in currency markets by actively trading currencies to capitalize on price movements. These market participants aim to profit from fluctuations in exchange rates by buying low and selling high or vice versa. Speculators add depth and liquidity to currency markets while also intensifying price volatility, offering opportunities for traders to benefit from market movements. Speculators bring dynamism to the ever-evolving landscape of forex trading, enriching the “currency markets global perspective.”

Analyzing Currency Markets: The Power of Technical and Fundamental Analysis

Understanding the Essence of Technical Analysis

Technical analysis delves into historical price data to unveil trends, support, and resistance levels influencing currency movements. By recognizing patterns like head and shoulders or triangles, traders can anticipate potential price directions, aiding in strategic decision-making in the volatile currency markets.

Embracing the Depth of Fundamental Analysis

Fundamental analysis delves deeper, scrutinizing economic indicators, political events, and market sentiment to gauge the fundamental value of currencies. Factors like GDP growth, interest rates, and geopolitical stability play a pivotal role in determining currency strength, offering invaluable insights for traders navigating global currency fluctuations.

Uniting Forces: The Power of Combined Analysis

Convergence of technical and fundamental analysis equips traders with a comprehensive toolkit to comprehend market dynamics. By merging insights from both disciplines, traders can develop a holistic view of the currency markets, increasing the precision and confidence in their trading decisions to capitalize on the global perspective.

Mitigating Risks in Currency Markets: Essential Strategies

Currency markets, characterized by volatility and unforeseeable events, pose inherent risks to traders and investors. Implementing robust risk management approaches like stop-loss orders and hedging tools is vital to safeguard capital. By comprehensively assessing risk tolerance and prudently managing positions, individuals can effectively mitigate potential losses and navigate the uncertainties inherent in the global currency markets.

Unveiling Lucrative Opportunities in Currency Markets

Seizing Profitable Speculation Paths

Currency markets, with their high liquidity and volatility, present traders with abundant prospects for speculation. Engaging in currency trading enables traders to capitalize on price movements and fluctuations, potentially yielding substantial profits. Analyzing market trends and leveraging appropriate trading strategies are paramount in navigating the ever-changing landscape of currency markets.

Diversification Through Currency Investments

Currency investments, including currency ETFs and mutual funds, offer investors avenues for diversification outside traditional asset classes. These instruments provide exposure to foreign currencies, mitigating risks associated with a single currency. Strategic allocation and monitoring of currency investments can enhance portfolio resilience and potentially deliver attractive returns in the long run.

Research and Trend Awareness: The Cornerstones of Success

To excel in currency markets, research and trend analysis stand as critical pillars. Staying informed about global economic developments, geopolitical events, and central bank policies is essential for making informed trading and investment decisions. Utilizing fundamental and technical analysis tools equips market participants with the insights needed to anticipate market movements and seize profitable opportunities.