Understanding Derivatives Trading: Types, Benefits, and Risks

Are you curious about derivatives trading and how it works? In this article, we will delve into the world of derivatives, exploring the different types available, the benefits they offer, as well as the risks associated with trading in them. Whether you are a seasoned investor or just starting out, understanding derivatives is essential in today’s financial landscape. Let’s explore how derivatives work and the regulations that govern them to help you make informed investment decisions.

Exploring the World of Derivatives

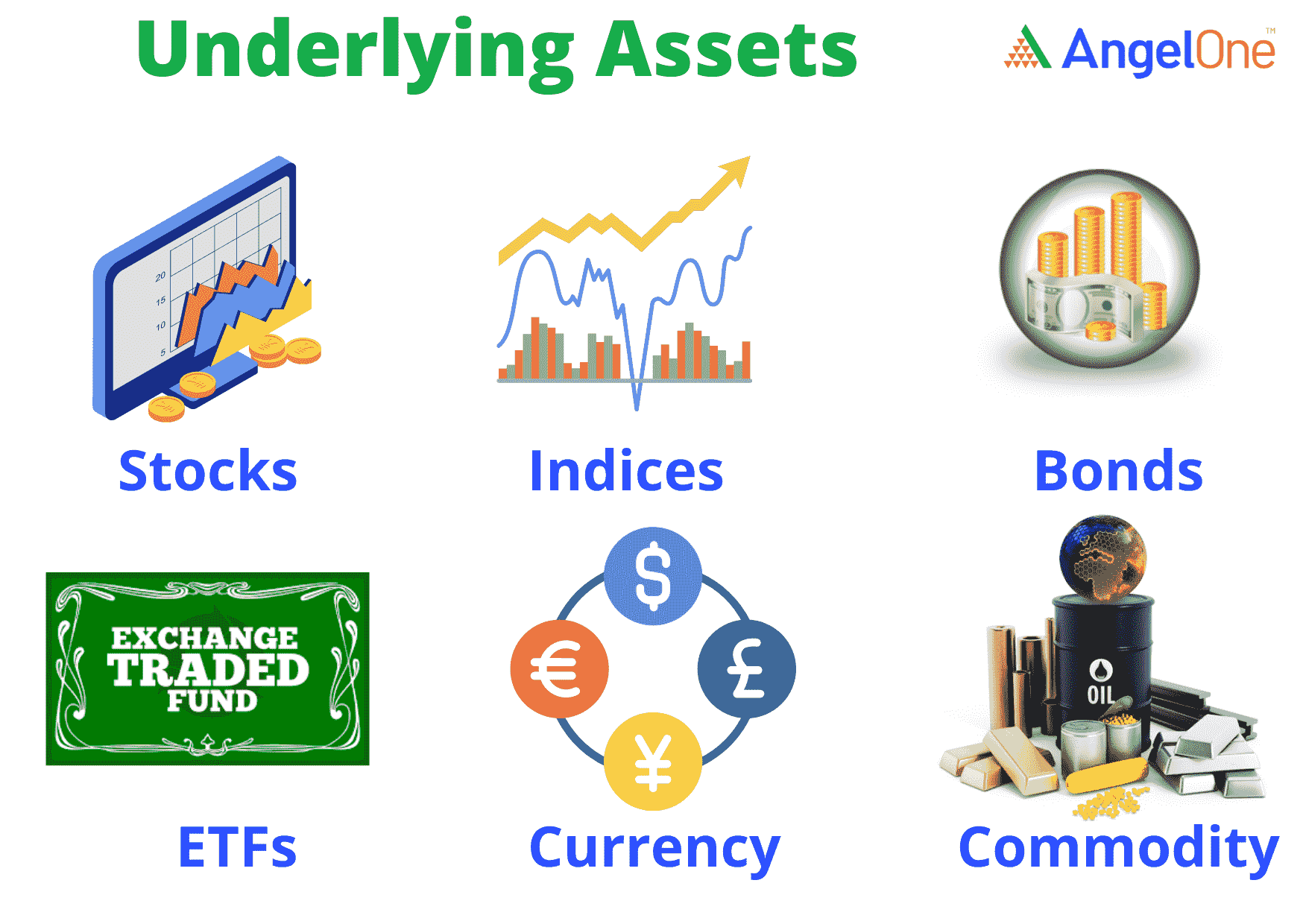

Derivatives serve as financial tools whose worth is linked to an underlying asset like stocks, bonds, commodities, or currencies. They grant investors the ability to forecast future asset prices without the need for direct ownership. This flexibility allows for diverse applications, including hedging against risks, engaging in speculative endeavors, and generating income streams from market movements. The dynamic nature of derivatives offers a broad spectrum of investing opportunities.

Exploring the Diverse World of Derivatives

Derivatives trading offers a spectrum of instruments catering to various risk appetites. Among the most prevalent types are futures, options, forwards, and swaps. Futures and forwards lock in the price for buying or selling an asset at a predetermined future time, providing a hedge against price fluctuations. Options grant the holder the choice to trade an asset at a specified price within a set timeframe, offering versatility in risk management. Swaps, on the other hand, facilitate cash flow exchanges linked to distinct interest rates or currencies, enabling a strategic approach to managing financial variables. Each derivative type serves distinct purposes, empowering investors with tools to navigate market uncertainties effectively. Understanding the nuances of these derivative categories is key to harnessing their potential within your investment strategy.

Understanding How Derivatives Work

Derivatives are actively traded on exchanges or over-the-counter platforms, offering diverse investment opportunities. When purchasing a derivative, you effectively engage in a contractual agreement with a counterparty. Within this agreement, crucial elements such as the underlying asset, strike price, expiration date, and monetary value are clearly defined. These components collectively shape the potential profitability and risk associated with the derivative transaction. Understanding these details is fundamental to successful derivatives trading.

:max_bytes(150000):strip_icc()/derivative.finalJPEG-5c8982d646e0fb00010f11c9.jpg)

Unveiling the Advantages of Derivatives in Investment

Derivatives present a dual-edged sword, offering investors the potential for amplified gains or losses through leverage. While this amplification can intensify profits, prudent risk management is crucial to mitigate the heightened exposure to losses. Notably, derivatives serve as effective hedging tools, enabling investors to protect their portfolios from adverse market movements by offsetting risks in other asset classes.

Moreover, the beauty of derivatives lies in their ability to unlock doors to diverse markets that might otherwise be inaccessible. Through derivatives, investors can venture into markets beyond their conventional reach, diversifying their investment portfolios and seizing opportunities in various sectors. This expanded market access broadens investment horizons and potentially enhances overall returns, offering a compelling allure for astute investors seeking growth and diversification.

Understanding the Risks of Derivatives

Complex Nature of Derivatives

Derivatives, being intricate financial instruments, can pose challenges for investors due to their complex structures and varied pricing mechanisms. Understanding Derivatives Trading requires in-depth knowledge to navigate through the intricacies and potential risks associated with these instruments effectively.

Volatility and Potential Losses

One of the primary risks of derivatives trading is their inherent volatility, which can result in substantial losses if market conditions move against the investor’s position. Traders must be prepared for sudden price fluctuations that can lead to significant financial implications, emphasizing the need for risk management strategies.

Leveraged Positions and Risk Amplification

Derivatives often involve leverage, allowing traders to control a larger position with a relatively small amount of capital. While leverage can enhance profits, it also magnifies the potential losses, making risk management crucial in derivative trading to mitigate adverse outcomes. Understanding the leverage factor is essential for managing risk effectively in derivative transactions.

By delving into the risks associated with derivatives, investors can make informed decisions and implement risk management strategies to navigate the complexities of derivative trading successfully. Remember, educating oneself about the risks involved is fundamental to becoming a knowledgeable and prudent participant in the derivative market landscape.

Understanding Derivatives Trading: Who Should Invest?

Derivatives are not suitable for all investors

Derivatives trading requires a certain level of financial sophistication and risk tolerance. Novice investors should proceed cautiously due to the complex nature of derivative products. Understanding the intricacies of derivatives is crucial before venturing into this advanced form of investment.

Investors should only invest in derivatives if they understand the risks involved

Potential high returns in derivatives trading come hand in hand with significant risks. Those considering derivatives should have a thorough grasp of market volatility, leverage, and the potential for rapid losses. Education and awareness of risks are paramount in making informed investment decisions.

Investors should consult with a financial advisor before investing in derivatives

Given the complexities and risks of derivatives, seeking guidance from a qualified financial advisor is advisable. Professional advice can help investors assess their risk tolerance, financial goals, and suitability for derivatives trading. A financial advisor can provide tailored recommendations based on individual circumstances.

Regulation of Derivatives

Derivatives, intricate financial instruments, fall under stringent regulation by various government bodies to ensure market integrity and investor protection. The Commodity Futures Trading Commission (CFTC) plays a pivotal role in overseeing futures and options markets, safeguarding against manipulation and fraud. Conversely, the Securities and Exchange Commission (SEC) takes charge of supervising swaps and other over-the-counter derivatives, promoting transparency and mitigating systemic risks in these areas. The collaborative efforts of these regulatory bodies establish a robust framework to govern derivatives trading, maintaining a fair and orderly financial environment for investors.