Understanding global currencies is essential in today’s interconnected world. From the US dollar to the Euro, the Japanese Yen to the British Pound, currencies play a pivotal role in shaping the global economy. With exchange rates fluctuating daily and central banks influencing monetary policies, the dynamics of global currencies are constantly shifting. In this article, we will delve into the intricate world of global currencies, exploring their impact on economies, market structures, and investment opportunities. Understanding the complexities of global currencies is crucial for navigating the ever-changing landscape of international trade and finance.

In the fast-paced world of finance, keeping abreast of the latest trends and developments in global currencies is paramount. Whether you are a seasoned investor or a novice in the realm of forex trading, grasping the nuances of global currencies can provide valuable insights into economic landscapes worldwide. From the rise of digital currencies to the challenges faced by traditional fiat money, the global currency market is ripe with opportunities and risks. This comprehensive guide aims to shed light on the importance of global currencies in driving economic growth, fostering international trade, and shaping the future of financial markets. Explore the intricate world of global currencies with us and uncover the potential for growth and prosperity in this ever-evolving landscape.

Major Global Currencies and Their Importance

The Dominance of the US Dollar

The US dollar reigns as the primary global reserve currency, driving international trade and financial transactions. Its stability and widespread use offer liquidity and confidence in global markets, impacting exchange rates worldwide. The dollar’s strength influences commodity prices, interest rates, and geopolitical dynamics, underscoring its pivotal role in the global economy.

The Euro’s Role in European Economies

Within the Eurozone, the euro plays a central role, fostering economic integration and trade among member countries. As the second most traded currency globally, the euro enhances financial stability in the region while promoting cross-border investments and reducing currency risks. The Eurozone’s economic performance often mirrors the euro’s strength, impacting global markets.

The Emergence of the Chinese Yuan

With China’s economic growth, the Chinese yuan is increasingly challenging traditional currencies. As China expands its global presence, the yuan’s internationalization accelerates, shaping economic policies and trade relationships. The yuan’s potential to become a leading reserve currency signifies China’s ascent as a key player in the global financial landscape, influencing investment decisions and market dynamics.

Significance of Other Major Currencies

The Japanese yen, British pound, and Swiss franc, as major currencies, hold unique positions in global finance. The yen’s safe-haven status, pound’s historical significance, and franc’s stability contribute to their roles in international trade and investments. Understanding the dynamics of these currencies is vital for assessing global economic trends and diversifying investment portfolios effectively.

In essence, the interactions and importance of major global currencies like the US dollar, euro, Chinese yuan, Japanese yen, British pound, and Swiss franc are critical in shaping the international financial landscape. Each currency’s unique characteristics, market influences, and geopolitical implications underscore the intricate role they play in driving economic growth, trade dynamics, and investment opportunities worldwide. It is imperative for financial analysts, economists, and traders to grasp the nuances of these currencies to make informed decisions in the dynamic global market environment.

Unraveling Currency Exchange Rates: Insights and Implications

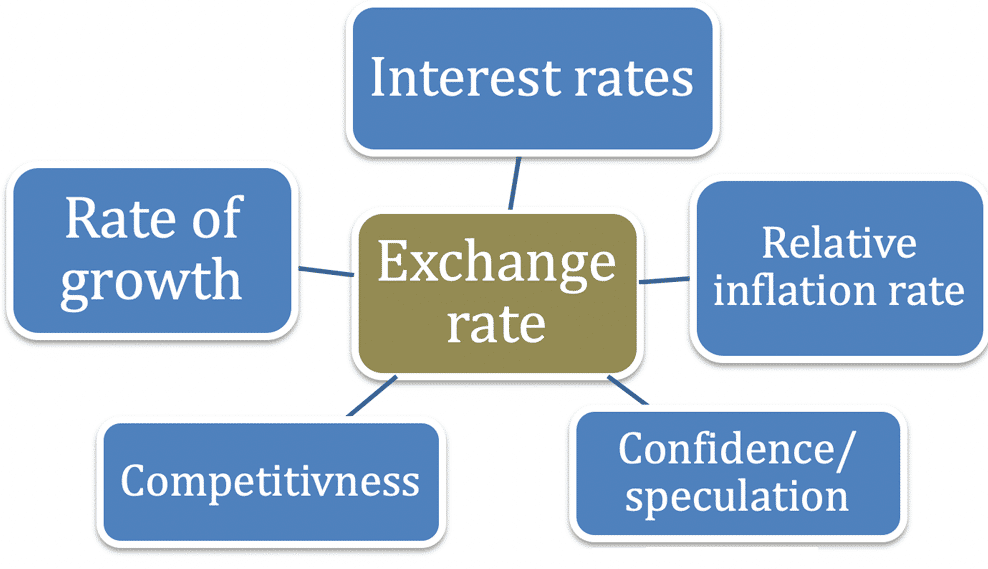

Exploring the Dynamics of Currency Exchange Rates

Currency exchange rates are influenced by a myriad of factors, including interest rates, inflation, geopolitical events, and market speculation. Understanding these intricate mechanisms is key to navigating the complexities of the global currency landscape. The fluctuations in exchange rates reflect the constantly evolving dynamics of the global economy, presenting both challenges and opportunities for investors and businesses alike.

Impact of Economic, Political, and Social Factors on Exchange Rates

Economic indicators, such as GDP growth, trade balances, and employment data, can significantly impact currency valuations. Political stability, governmental policies, and social unrest also play a pivotal role in determining exchange rates. Investors and analysts keen on predicting currency movements closely monitor these factors to make informed decisions in the volatile currency markets.

Role of Arbitrage and Speculation in Currency Markets

Arbitrage involves exploiting price differentials of the same currency in different markets to make profits, ultimately contributing to market efficiency. Speculation, on the other hand, involves forecasting currency movements based on analysis and intuition. Both practices shape currency prices and liquidity, influencing exchange rates and market behaviors.

Strategies for Managing Currency Risk in International Business

Businesses engaged in international trade often face currency risk due to exchange rate fluctuations. Hedging strategies, such as forward contracts, options, and currency swaps, are deployed to mitigate these risks. By managing currency exposure effectively, companies can safeguard their financial performance and enhance their competitiveness in the global marketplace.

Global Currency Markets: Structure and Participants

Understanding the Organization and Structure of Global Currency Markets

Global currency markets operate 24/7 across different financial centers worldwide, with major hubs in London, New York, Tokyo, and Singapore. This decentralized structure allows for continuous trading and significant liquidity. Participants engage in currency trading through over-the-counter (OTC) transactions facilitated by electronic trading platforms, ensuring seamless market functioning and efficient price discovery.

Key Players in Currency Trading

The currency market consists of various participants, including commercial banks, central banks, investment banks, hedge funds, institutional investors, retail traders, and foreign exchange brokers. These entities contribute to high trading volumes, influencing exchange rates based on their trading strategies, market insights, and risk management practices. Their combined actions shape the dynamics of global currency markets, impacting economic conditions and financial stability.

Types of Currency Transactions and Markets

Currency transactions occur in different forms, including spot transactions, forward contracts, options, and swaps. The spot market, where currencies are bought and sold for immediate delivery, is the largest segment. Additionally, the derivatives market offers instruments for hedging and speculation, providing flexibility and risk management tools for market participants. Understanding these various markets is vital for navigating currency exposures and investment decisions effectively.

Regulatory Framework in Global Currency Markets

Regulatory oversight plays a crucial role in maintaining the integrity and stability of global currency markets. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK and the Commodity Futures Trading Commission (CFTC) in the US oversee market participants, ensure compliance with trading rules, and address financial misconduct. Transparent and well-regulated markets foster confidence among participants, contributing to market efficiency and investor protection.

Emerging Trends in Global Currencies

Rise of Digital Currencies

Digital currencies like Bitcoin are reshaping the landscape, challenging traditional financial systems. Their decentralized nature and blockchain technology offer increased transactional security and efficiency. As these currencies gain wider acceptance, they pose both opportunities and threats to the established norms of global currencies.

Influence of Blockchain Technology

Blockchain technology, the backbone of digital currencies, is revolutionizing currency markets. Its transparent and secure ledger system enhances transaction speed and reduces costs. As blockchain applications expand, they are poised to reshape how global currencies are exchanged and tracked, influencing market dynamics significantly.

Implications of Geopolitical Events

Geopolitical events wield significant influence over currency dynamics. Factors like trade wars, political instability, and global conflicts can trigger currency fluctuations. Understanding these interconnected relationships is crucial for investors and policymakers to navigate the unpredictable terrain of global currencies effectively.

Future of Global Currencies

The future of global currencies is dynamic, with the potential for new reserve currencies to emerge. Shifts in economic power, technological advancements, and evolving trade patterns may pave the way for alternative reserve currencies to challenge the dominance of existing ones. Adapting to these changing trends is vital for stakeholders in the global currency landscape.

Investing in Global Currencies

Exploring Investment Opportunities and Risks

Investing in global currencies offers opportunities for portfolio diversification and potential high returns but comes with risks due to market volatility. Understanding market trends and geopolitical events is crucial for informed investment decisions.

Diverse Investment Strategies in Currency Markets

Forex trading allows investors to speculate on currency price movements, while currency ETFs provide exposure to currency markets through diversified portfolios. Choosing the right strategy depends on risk tolerance and investment goals.

Factors to Consider in Currency Investments

When investing in global currencies, factors like economic indicators, political stability, central bank policies, and market sentiment significantly impact currency values. Conducting thorough research and analysis is key to successful currency investments.

Potential Returns and Risks in Currency Markets

Currency investments can yield substantial profits through leverage but carry inherent risks like exchange rate fluctuations and geopolitical uncertainties. Risk management strategies and staying informed are essential for navigating the complexities of currency markets.

Navigating Currency Volatility and Market Fluctuations

Currency volatility and exchange rate fluctuations pose significant challenges in the global currency landscape. Investors must contend with unpredictable shifts impacting investment values and foreign exchange transactions. Understanding risk management strategies becomes pivotal to navigate these challenges effectively, ensuring financial stability amid volatile market conditions. Adapting to these fluctuations demands a comprehensive understanding of market dynamics and economic indicators to make informed decisions in the face of currency uncertainties.

Seizing Opportunities in Emerging Markets and Developing Economies

Despite challenges, emerging markets and developing economies offer lucrative opportunities for currency investors. These regions exhibit rapid economic growth, increasing trade volumes, and evolving financial infrastructures. Investors can capitalize on these expanding markets by diversifying portfolios and leveraging the potential for higher returns. Embracing these opportunities entails thorough market research, assessing geopolitical risks, and staying attuned to regulatory changes to optimize investment decisions in dynamic environments.

Navigating Regulatory and Legal Landscape in Global Currency Transactions

Navigating the regulatory and legal considerations in global currency transactions is paramount. Compliance with international regulations, anti-money laundering laws, and taxation policies is critical to ensure transparency and legitimacy in cross-border financial dealings. Engaging in thorough due diligence, partnering with reputable financial institutions, and staying abreast of regulatory updates are essential steps to mitigate risks and uphold ethical standards in global currency transactions.

Future Outlook and Prospects in the Global Currency Market

The future outlook for global currencies presents a spectrum of opportunities for discerning investors. Technological advancements, geopolitical developments, and economic shifts are reshaping the currency landscape. Innovations like blockchain technology, digital currencies, and sustainable finance are paving the way for new investment avenues. The evolving global economy offers prospects for innovation, collaboration, and diversification, creating a dynamic environment for investors to explore novel opportunities in the ever-changing global currency market.