Understanding Quantitative Easing Policy: A Comprehensive Guide

Quantitative easing, commonly known as QE, is a monetary policy employed by central banks to stimulate the economy during periods of economic downturn. This policy involves the purchasing of government securities to increase the money supply and lower interest rates. In this article, we will delve into the intricate details of quantitative easing, including its benefits, risks, usage scenarios, real-world examples, and alternative measures available to policymakers. By exploring how central banks utilize QE to foster economic growth, we can gain a deeper understanding of its significance in the financial landscape.

Understanding Quantitative Easing

Quantitative Easing Policy is a strategic monetary tool wielded by central banks to bolster economic expansion by augmenting the money supply. This approach entails the acquisition of government bonds and financial assets from institutions, facilitating a surge in liquidity. By executing QE, central banks target reduced interest rates, driving up spending and encouraging investment, vital for fostering economic vitality.

The Mechanism Behind Quantitative Easing Policy

Central banks, like the Federal Reserve, initiate Quantitative Easing Policy by injecting freshly created money into the economy through purchasing assets, predominantly government securities. This infusion escalates the money supply, fostering liquidity in the financial system. Consequently, the reduced interest rates incentivize borrowing, empowering businesses and individuals to engage in spending and investment, propelling economic growth. Moreover, the augmented liquidity eases lending conditions for banks, facilitating enhanced credit flow to businesses and consumers, thereby amplifying economic vitality.

Potential Risks of Quantitative Easing

Inflation Concerns:

Quantitative Easing Policy, if not executed prudently, poses the risk of fueling inflation. The injection of excess money into the economy can drive up prices, impacting consumers’ purchasing power and eroding savings, ultimately affecting overall economic stability.

Asset Bubble Formation:

An inherent risk of QE lies in the potential creation of asset bubbles and financial instability. Excess liquidity can artificially inflate asset values, leading to unsustainable market conditions and increasing the likelihood of a market crash or correction.

Currency Devaluation and Exchange Rates:

Another risk associated with QE is the devaluation of the domestic currency, impacting exchange rates. A weakened currency affects international trade competitiveness, potentially leading to trade imbalances and economic uncertainties on a global scale.

:max_bytes(150000):strip_icc()/Quantitative-Easing-a5017c79cf824f1390b0374700f45c60.png)

The Timing of Quantitative Easing Deployment

Understanding the Strategic Employment of Quantitative Easing Policy

Quantitative Easing Policy is strategically utilized during economic downturns or recessions when traditional monetary policy tools, like adjusting interest rates, are deemed ineffective. Central banks deploy QE to inject liquidity into the economy by purchasing financial assets to lower long-term interest rates and encourage borrowing and investment. This unconventional tool can be employed to support government spending, boost economic activity, and mitigate financial crises by stabilizing markets and increasing confidence in the economy.

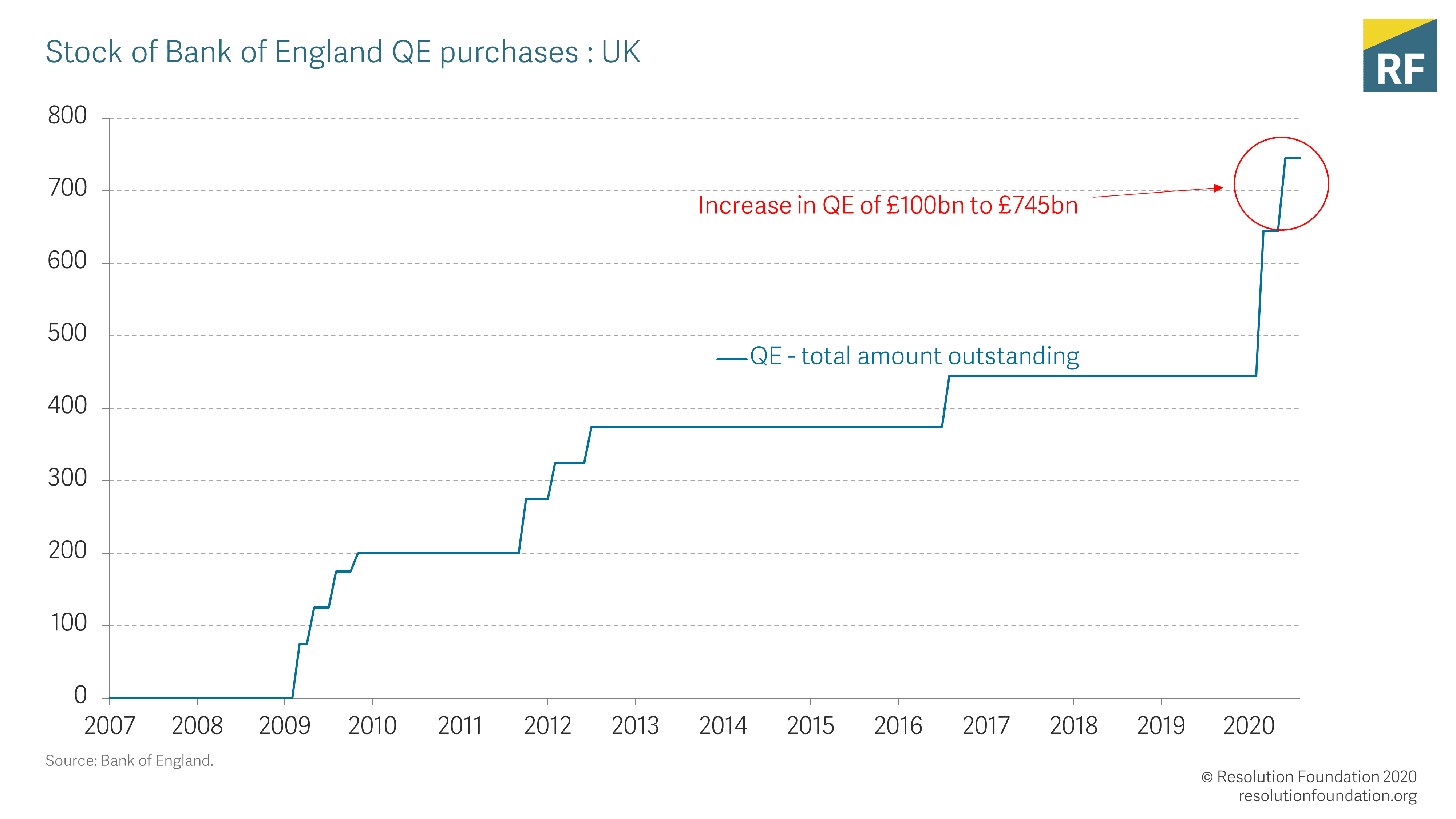

Illustrative Cases of Quantitative Easing

The Federal Reserve’s Response to the 2008 Financial Crisis

In the aftermath of the 2008 financial crisis, the Federal Reserve embarked on an unprecedented quantitative easing program. By purchasing mortgage-backed securities and treasury bonds, the Fed injected liquidity into the financial system, aiming to stabilize markets and reduce long-term interest rates.

Japan’s Battle with Deflation through Quantitative Easing

Struggling with persistent deflation, the Bank of Japan turned to quantitative easing as a tool to rejuvenate economic growth. Through large-scale asset purchases, Japan aimed to increase the money supply, prop up prices, and kickstart lending, all essential components in combating deflationary pressures.

European Central Bank’s Stride to Support the Eurozone Economy

Facing economic challenges within the Eurozone, the European Central Bank (ECB) resorted to quantitative easing to bolster the region’s financial stability. By acquiring government bonds and other securities, the ECB aimed to ease credit conditions, promote investment, and boost overall economic activity within member countries.

Exploring Alternatives to Quantitative Easing

Fiscal Policy: A Powerful Tool in Economic Stimulation

Fiscal policy, unlike QE, involves government actions like increasing spending or cutting taxes to boost economic activity. With the potential to directly influence demand, fiscal policy can address specific sectors or groups, supplementing central bank efforts without expanding the balance sheet. This approach empowers policymakers to tailor interventions for optimal economic impact.

Leveraging Monetary Policy Tools for Stability

In lieu of QE, central banks can utilize monetary policy tools like adjusting interest rates to manage inflation and economic growth. By influencing borrowing costs, central banks can stimulate or cool down spending, fostering stability and controlling inflationary pressures. Flexible and swift, interest rate adjustments offer targeted support to the economy in varying market conditions.

Embracing Structural Reforms for Sustainable Growth

Implementing structural reforms aimed at enhancing economic competitiveness and productivity presents a long-term alternative to QE. By improving regulatory frameworks, labor markets, and infrastructure, governments can lay the foundation for sustained economic growth. These reforms foster efficiency, innovation, and adaptability, ensuring robust economic performance beyond the short-term stimulus provided by QE.