Understanding RSI: A Comprehensive Guide

Are you curious about Relative Strength Index (RSI) and its significance in the world of trading and investing? In this guide, we will delve into the RSI’s formula, interpretation, trading strategies, limitations, advanced techniques, and its application across various markets. Whether you are a seasoned trader or a novice investor, mastering RSI can be a game-changer in your decision-making process. Let’s explore the intricacies of RSI and how it can enhance your market analysis skills.

The Intricacies of RSI Calculation

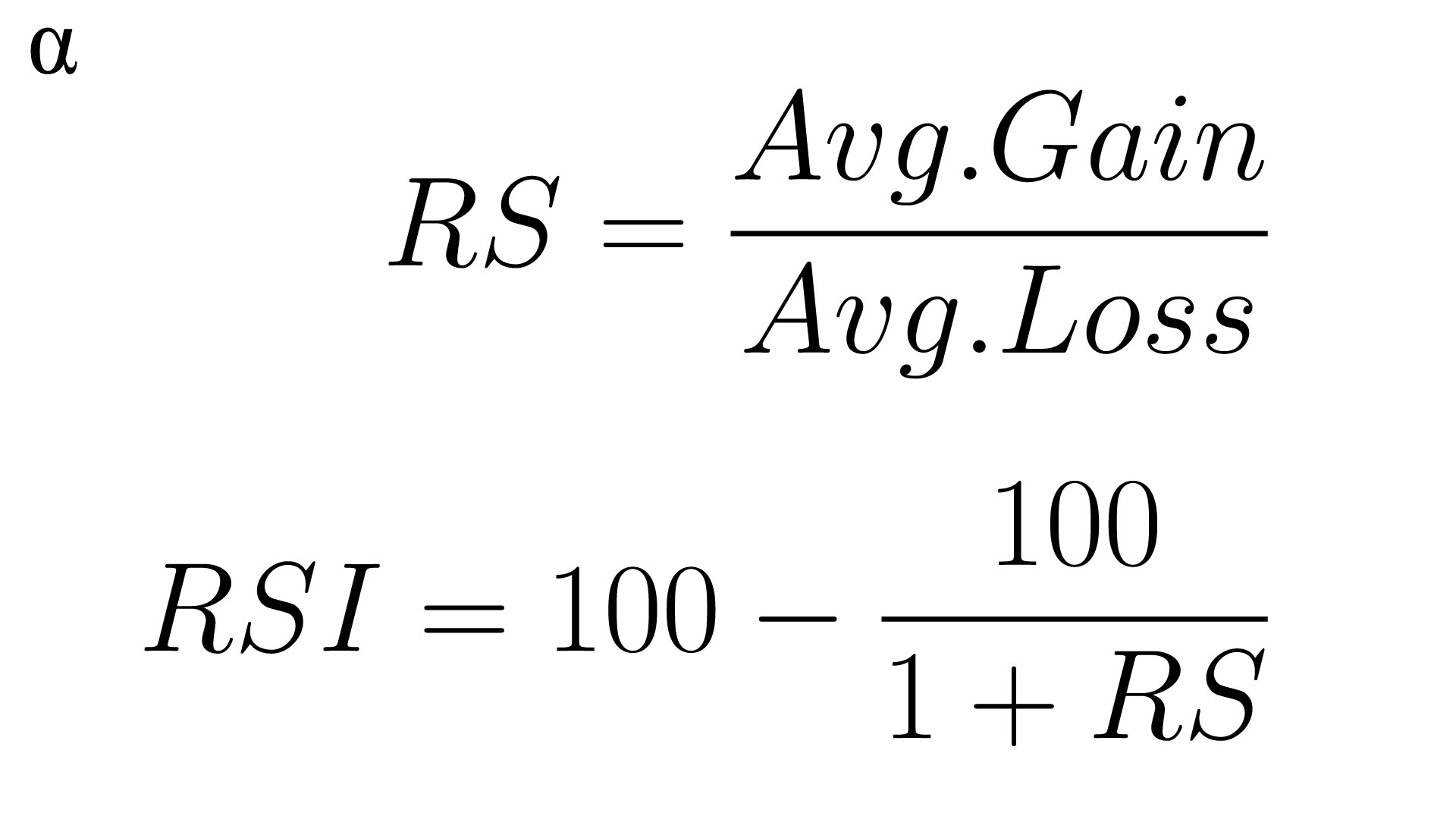

Relative Strength Index (RSI) intricately measures market momentum. Calculated using the average gain and loss over a chosen timeframe, usually 14 days, this indicator balances the market’s bullish and bearish aspects. The RSI formula’s essence lies in normalizing the gains and losses, offering traders a numeric representation of a security’s strength and potential reversal points.

The average gain, derived by totaling positive price changes over the defined period and dividing by the number of periods, signifies buying momentum. Conversely, the average loss, obtained by summing negative price changes and dividing by the same period count, reveals selling pressure within the market. These components form the foundation for RSI’s insightful calculation.

In essence, the RSI formula encapsulates the essence of market movements by harmonizing gains and losses. By dividing the average gain by the sum of the average gain and average loss, the resultant value is converted into a scale of 0 to 100, illustrating the security’s overbought or oversold conditions. This numeric representation empowers traders with valuable insights for informed decision-making.

RSI’s calculation methodology offers traders a quantitative perspective on price momentum and strength. By leveraging the average gain and loss metrics over a specific period, RSI aids in identifying potential price reversals and trend shifts. This formulaic approach provides a structured framework for evaluating a security’s price behavior, enhancing the precision and effectiveness of trading strategies.

Advanced RSI Techniques

Traders harness RSI across various time frames to pinpoint both short-term fluctuations and long-term market trends. By adjusting the period settings, traders can adapt RSI to suit specific trading styles and investment horizons effectively, enhancing decision-making processes.

RSI unveils hidden divergences, signaling potential market reversals ahead of time. Detecting these subtle shifts via RSI can serve as a valuable tool for traders, offering a competitive edge in anticipating trend changes and making informed trading decisions promptly.

Crafting custom trading strategies around distinctive RSI patterns or their combinations can elevate trading precision. Advanced traders leverage RSI’s versatility by developing intricate strategies that align with their unique risk appetite, trading objectives, and market conditions, fostering a more tailored and strategic approach to trading.

To master advanced RSI techniques, traders must delve deep into technical analysis principles and market dynamics. This advanced knowledge equips traders with a profound understanding of RSI’s behaviors in different market scenarios, facilitating more accurate predictions and nuanced trading decisions in the dynamic world of finance.