Discover the advantages of incorporating take profit orders into your trading arsenal. By understanding how to strategically place these orders, traders can optimize their profit potential while managing risks effectively. Whether you are a novice or experienced trader, mastering the art of utilizing take profit orders can significantly enhance your trading outcomes.

Advantages of Utilizing Take Profit Orders

Enhancing Profit Security and Loss Limitation

Implementing take profit orders allows traders to lock in profits at predefined levels, safeguarding gains even if market conditions fluctuate. Simultaneously, these orders establish thresholds to cap potential losses, promoting a disciplined trading approach.

Reducing Emotional Trading Risks

By setting take profit orders, traders can sidestep emotional decision-making during volatile market movements. This automation enforces rational trading strategies and prevents impulsive actions driven by fear or greed, fostering consistent and objective trading behavior.

Streamlining Trading Strategies with Automation

Take profit orders enable traders to automate their exit points, seamlessly executing predefined profit-taking levels without constant monitoring. This feature not only enhances efficiency but also supports a systematic and structured trading approach.

Saving Time and Effort

Utilizing take profit orders frees traders from the need to continually monitor market movements, allowing for a more hands-off approach to trading. This time-saving benefit empowers traders to focus on analysis, strategy development, and overall portfolio management tasks more effectively.

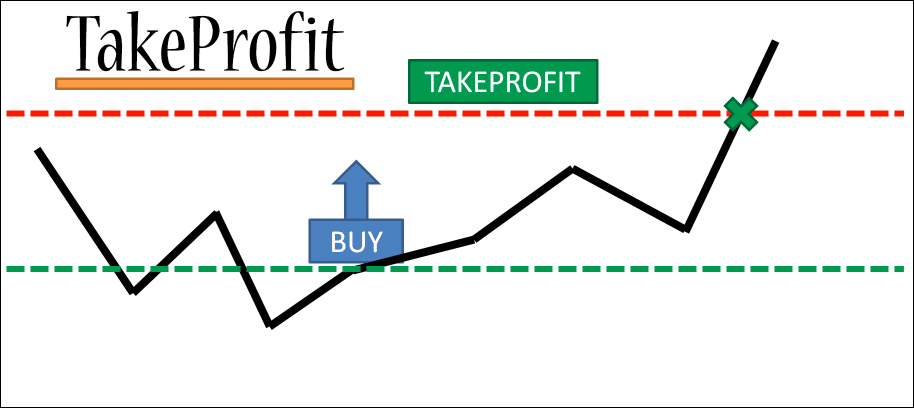

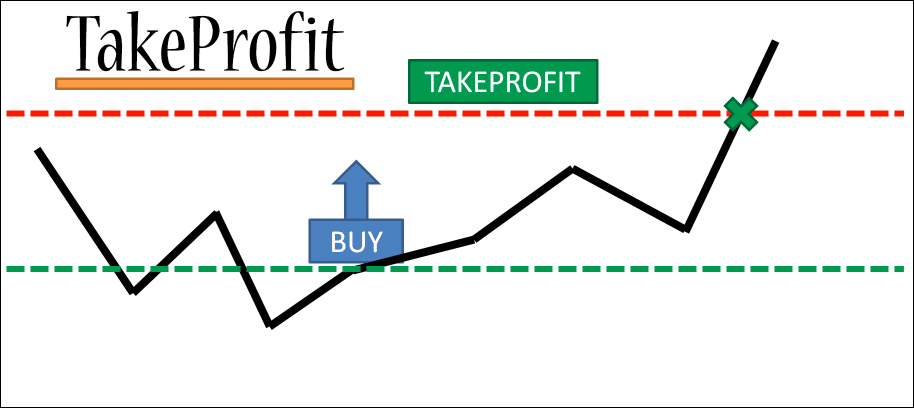

Placing a Take Profit Order: Mastering the Art of Strategic Trading

When placing a take profit order, precision is key. Start by defining the price at which you want the order to activate, ensuring you lock in your desired profit level. Opt for either a market order for immediate execution or a limit order for price control. Remember, take profit orders persist until triggered or manually revoked, giving you flexibility and control over your trading strategy. Cancelling the order is simple and can be done at any time, allowing for quick adjustments based on market conditions.

Common Mistakes to Avoid When Using Take Profit Orders

Placing a take profit order too close to the current price is a common error. Traders should avoid setting it too tight as it may trigger prematurely, causing missed profit opportunities. Conversely, setting a take profit order too far from the current price can lead to it never being executed, resulting in potential losses for the trader. Strike a balance for optimal results.

Mastering Advanced Strategies for Enhancing Your Trading Success

Implementing trailing stop orders is a sophisticated technique in maximizing profits with Take Profit Orders. This dynamic order type tailors the exit point as the market progresses positively, shielding gains and minimizing losses effectively.

Moreover, diversifying your approach by utilizing multiple take profit orders is a smart move. By setting various profit-taking levels, you mitigate the chance of early triggering and secure profits at different price points, enhancing risk management.