The Federal Reserve, often referred to as the Fed, is the central banking system of the United States. Established in 1913, the Federal Reserve plays a crucial role in regulating the country’s monetary policy, supervising and regulating banks, and maintaining financial stability. As a key player in the nation’s economy, the Federal Reserve wields significant influence over interest rates, inflation, and overall economic growth. Understanding the Federal Reserve’s functions and impact is essential for grasping the complexities of the U.S. financial system and its interconnected global implications. Explore the intricacies of the Federal Reserve, a pivotal monetary authority shaping the economic landscape.

Overview of the Federal Reserve as a Monetary Authority

The Federal Reserve System, commonly known as the Fed, stands as the cornerstone of the United States’ financial infrastructure. Tasked with overseeing the nation’s monetary framework, it meticulously administers the money supply, steering economic stability. With a core mission of ensuring price stability, fostering optimal employment levels, and maintaining moderate long-term interest rates, the Fed operates as a pivotal monetary authority shaping the economic landscape.

Exploring the Structure and Governance of the Federal Reserve

The Federal Reserve operates through a decentralized structure comprising 12 regional Federal Reserve Banks strategically located across the U.S. These banks play a pivotal role in understanding local economic conditions and feeding into the national monetary policy decisions set by the Board of Governors in Washington, D.C. This decentralized setup ensures a nuanced approach to policymaking that considers regional dynamics.

The Board of Governors, located in Washington, D.C., serves as the core governing body responsible for setting the overall direction of monetary policy. Consisting of seven members appointed by the U.S. President and confirmed by the Senate, the Board oversees key decisions impacting the nation’s economy. Its role is crucial in steering policies that affect interest rates, inflation, and employment, shaping the Federal Reserve’s function as a monetary authority.

Within the Federal Reserve system, the Federal Open Market Committee (FOMC) stands out as a vital decision-making body in determining the direction of monetary policy, especially concerning interest rates. Comprising the seven members of the Board of Governors along with five Reserve Bank presidents, the FOMC convenes regularly to assess economic conditions and make informed choices regarding interest rates. These decisions significantly influence borrowing costs, economic activity, and financial market dynamics, showcasing the Federal Reserve’s weight as a monetary authority.

Exploring the Monetary Policy Tools of the Federal Reserve

Open Market Operations:

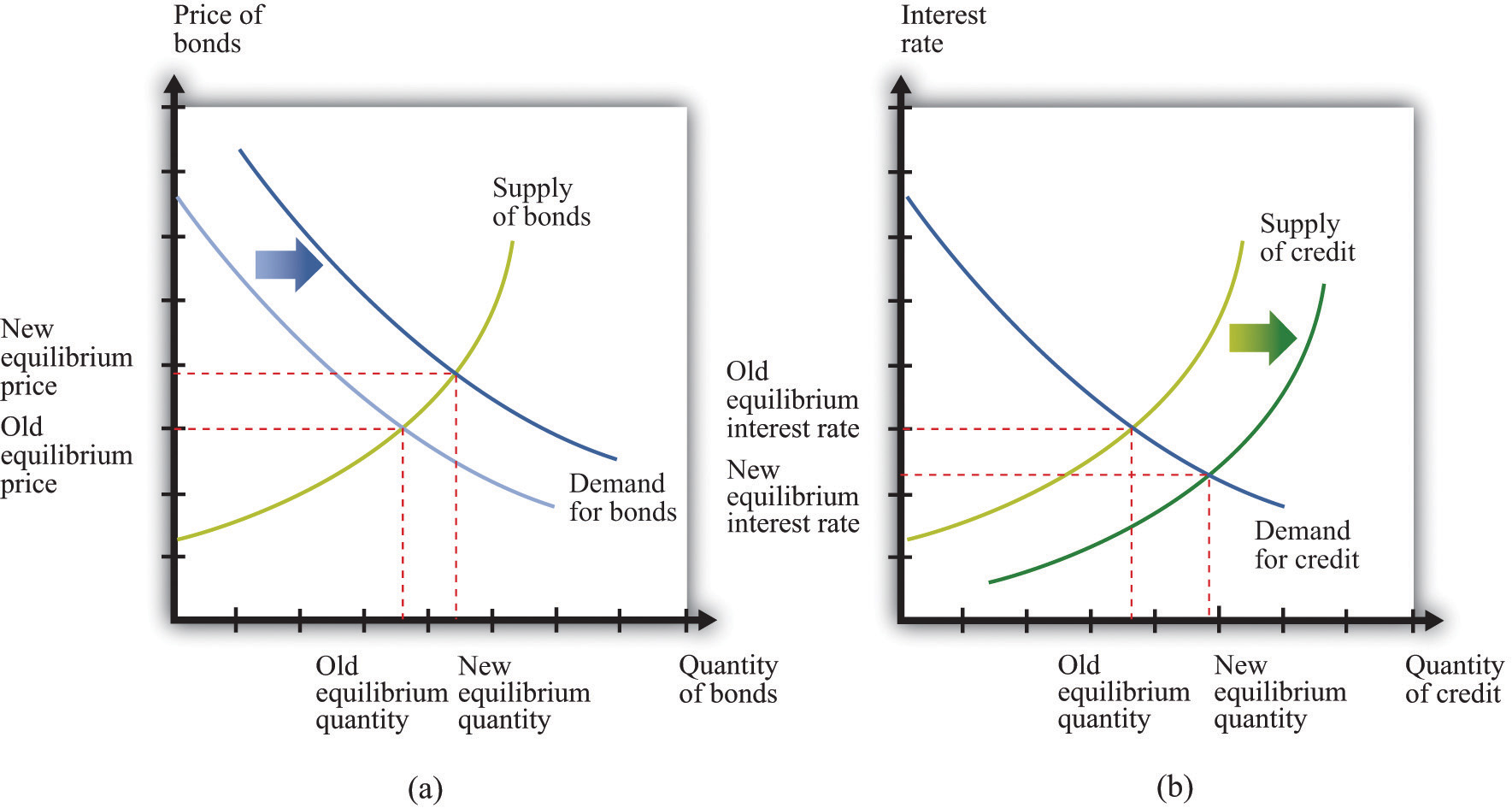

Open Market Operations are a significant tool utilized by the Federal Reserve monetary authority to control the money supply. Through buying and selling government securities in the open market, the Fed can adjust the reserves that banks hold, influencing interest rates, credit availability, and ultimately, economic activity.

Discount Rate:

The Discount Rate, set by the Federal Reserve, is the interest rate at which commercial banks can borrow funds directly from the Fed. This rate plays a crucial role in encouraging or discouraging banks from borrowing, consequently affecting their lending behavior and the overall money supply in the economy.

Reserve Requirements:

Reserve Requirements dictate the minimum amount of funds that banks must hold in reserve against certain liabilities. By adjusting these requirements, the Federal Reserve can impact the ability of banks to lend and thereby influence the overall money supply in the economy, a key aspect of monetary policy implementation.

The Federal Reserve’s Crucial Role in Economic Stability

Managing Inflation Through Monetary Policy

The Federal Reserve acts as the main entity controlling inflation by adjusting the money supply through mechanisms like open market operations and reserve requirements. This regulation helps maintain stable prices, ensuring that the economy doesn’t experience rapid and erratic price changes. Thus, the Federal Reserve plays a pivotal role in safeguarding the purchasing power of the currency, contributing to overall economic stability.

Fostering Economic Growth via Interest Rate Management

By setting key interest rates, such as the federal funds rate, the Federal Reserve influences borrowing costs for businesses and consumers. Lower interest rates encourage borrowing, spending, and investment, stimulating economic activity. Conversely, higher rates can curb inflationary pressures. This capacity to modulate economic growth underscores the Federal Reserve’s significance as a driver of economic stability.

Serving as a Lender of Last Resort

During financial crises or bank panics, the Federal Reserve steps in as a lender of last resort to provide liquidity to distressed financial institutions. By extending credit when necessary, the Federal Reserve helps to avert systemic financial disruptions and instills confidence in the banking system. This crucial function contributes to overall economic stability and confidence in the financial markets.

The Impact of the Federal Reserve on Financial Markets

Interest Rate Influence on Stock and Bond Prices

The Federal Reserve’s monetary authority extends to interest rate decisions that have a profound effect on stock and bond prices. By altering interest rates, the Fed can either stimulate or constrain borrowing and investment activities, ultimately impacting the performance of financial markets.

Monetary Policy’s Effect on Currency Exchange Rates

Through its monetary policy tools, the Federal Reserve plays a critical role in shaping currency exchange rates. Changes in interest rates and money supply can influence the value of the U.S. dollar relative to other currencies, impacting trade balances and global competitiveness.

Influence on Consumer Spending and Business Investment

The Federal Reserve’s actions hold sway over consumer spending and business investment through the adjustment of interest rates. Lower rates can incentivize borrowing for purchases, boosting consumer spending, while affecting businesses’ decisions on capital investment and expansion.

Challenges Facing the Federal Reserve

Balancing Inflation Control with Economic Growth

Achieving the delicate balance between controlling inflation and fostering economic growth poses a perpetual challenge for the Federal Reserve monetary authority. Striking the right equilibrium is essential to prevent overheating the economy while ensuring sustainable growth. The Fed employs various tools like interest rate adjustments to navigate this intricate task effectively.

Managing Financial Market Volatility

Navigating the choppy waters of financial market volatility stands as a significant challenge for the Federal Reserve. Sudden market fluctuations can disrupt economic stability, requiring swift and precise actions from the Fed. Through strategic interventions and communication strategies, the Federal Reserve aims to mitigate the adverse effects of market turbulence for sustained financial health.

Maintaining Public Trust and Credibility

Maintaining public trust and credibility is paramount for the Federal Reserve’s effectiveness as a monetary authority. Transparency, clear communication, and consistent policy decisions are vital in earning and upholding public confidence. Any perception of bias or deviation from mandate can undermine the Fed’s ability to implement effective monetary policies and maintain economic stability.

The Future of the Federal Reserve: Embracing Innovation and Global Influence

Embracing Digital Currencies and CBDC

The Federal Reserve faces the evolving landscape of digital currencies. Exploring Central Bank Digital Currency (CBDC) becomes vital to adapt to modern payment systems and mitigate risks in an increasingly digitized economy. The Fed’s stance on CBDC will shape the future of monetary policy and financial stability, marking a significant shift in the traditional banking paradigm.

Adapting to Technological Advancements

As technology reshapes financial markets, the Federal Reserve must embrace innovations like blockchain and AI. Leveraging these tools can enhance efficiency in monetary transactions, bolster cybersecurity measures, and streamline regulatory processes. Adapting swiftly to technological advancements ensures the Fed remains agile in addressing emerging challenges and opportunities in the financial landscape.

Global Influence and Economic Stability

The Federal Reserve’s role transcends domestic boundaries, impacting the global economy. As a key player in international finance, the Fed’s policies reverberate worldwide, affecting exchange rates and capital flows. Upholding economic stability domestically and contributing to global financial equilibrium solidifies the Federal Reserve’s position as a cornerstone of the international monetary system, ensuring its continued significance and influence.