Understanding the Volatility Index, commonly referred to as VIX, is essential for anyone involved in the financial market. The VIX is a key measure that reflects the market’s expectation of future volatility, helping traders and investors assess the level of risk and uncertainty. In this comprehensive guide, we will delve into the importance of interpreting VIX values, explore the various factors that influence the index, discuss effective trading strategies based on VIX movements, and enlighten readers on how to utilize VIX as a powerful risk management tool. Whether you are a seasoned trader or a novice investor, understanding the dynamics of the Volatility Index is crucial in navigating the complexities of the market landscape.

Comprehensive Overview of the Volatility Index

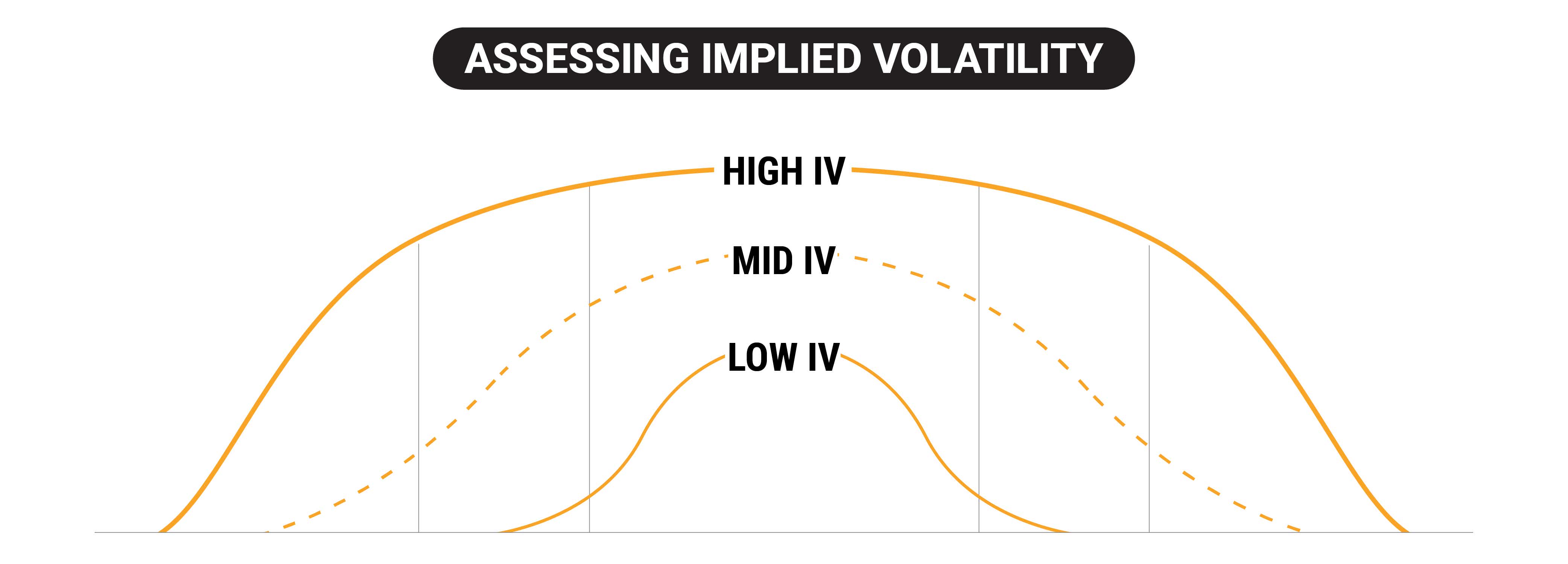

The Volatility Index (VIX) stands as a crucial barometer in the financial realm, capturing the implied volatility of S&P 500 index options in real-time. Esteemed for its predictive insights, the VIX reflects market sentiment and foretells potential tumult. When the VIX surges, signaling elevated apprehension and unpredictability, investors brace for stormy market conditions. Conversely, a subdued VIX hints at tranquility and reduced perceived risks, prompting a different investment approach.

Leveraging VIX for Trading: Strategies, Risks, and Rewards

Trading Strategies with VIX Derivatives

Utilizing VIX futures or options can be a strategic move for traders aiming to capitalize on anticipated volatility shifts. Long positions signal confidence in increased market turbulence, while short positions signal a belief in calmer waters ahead. However, engaging in VIX derivatives demands a profound understanding of market dynamics and a readiness to withstand potential risks.

Risk and Return Dynamics

Trading VIX derivatives offers opportunities for substantial gains but also exposes traders to heightened risks due to the inherent volatility in the market. Those venturing into this arena must carefully balance the allure of potential returns with the stark reality of market unpredictability. Understanding the nuances of VIX movements is paramount to navigating the risks effectively.

Market Knowledge and Risk Management

Successful VIX trading necessitates a comprehensive grasp of market intricacies and a disciplined approach to risk management. Traders must be adept at analyzing volatility patterns, interpreting market signals, and swiftly adapting their strategies in response to changing conditions. Implementing robust risk management practices is crucial to mitigate potential downsides and safeguard investments.

Strategic Decision-making

Making informed decisions when trading VIX derivatives hinges on a blend of technical analysis, fundamental understanding, and risk assessment. Traders must assess market sentiment, economic indicators, and geopolitical factors that can sway volatility levels. The art lies in accurately gauging these variables to craft effective trading strategies that align with one’s risk appetite and investment goals.

Embracing Volatility for Profits

While volatility can instigate fear in some investors, adept traders recognize it as a source of profit-generating opportunities. By embracing volatility, traders can harness its fluctuations to their advantage, employing sophisticated trading techniques to capitalize on market volatility. This proactive approach enables traders to leverage the VIX as a potent tool for maximizing returns in dynamic market conditions.

Psychological Preparedness

Beyond technical skills, psychological readiness is vital for traders engaging in VIX-related trading. The nature of volatile markets demands emotional resilience, disciplined decision-making, and the ability to maintain calm under pressure. Developing a sound psychological approach is as crucial as mastering technical analysis when navigating the complexities of VIX trading.

VIX as a Risk Management Tool: Gauging Market Uncertainty

Understanding Market Risk with VIX

Investors leverage the VIX to evaluate market risk and fine-tune their investment strategies. By monitoring VIX fluctuations, traders can gauge the market’s sentiment and adjust their portfolios proactively to mitigate potential losses effectively.

Adjusting Risk Exposure

A high VIX reading signals increased market uncertainty, prompting investors to adopt a more conservative asset allocation strategy to safeguard their investments. Conversely, a low VIX suggests a calmer market environment, allowing for a more aggressive risk-taking approach to capitalize on opportunities.

Anticipating Market Swings

The VIX serves as a valuable tool for predicting market inflection points. When the VIX spikes, it indicates heightened market volatility and potential downturns, alerting investors to brace for turbulent times. Conversely, a declining VIX may signal a period of stability, prompting investors to prepare for potential shifts in market dynamics.

Limitations and Considerations: Understanding VIX

Implied vs. Realized Volatility:

One key consideration when interpreting the VIX is that it measures implied volatility, reflecting market expectations, which may not always align perfectly with realized volatility. Traders need to be cautious as actual market volatility can deviate from these implied estimates, impacting trading decisions.

Forward-Looking Indicator:

The VIX is a forward-looking indicator, providing insights into market expectations of volatility. However, it’s crucial to note that it cannot definitively predict future volatility levels. Investors must exercise prudence and not solely rely on VIX readings for forecasting market behavior.

Holistic Analysis:

To maximize the utility of the VIX, traders should incorporate it as part of a holistic approach to market analysis. Utilizing VIX in conjunction with other key market indicators offers a more comprehensive view, enhancing decision-making processes and risk management strategies.

In the realm of financial markets, understanding the limitations and considerations surrounding the Volatility Index is paramount for making informed investment decisions. By recognizing the nuances of VIX as an implied, forward-looking indicator and integrating it effectively with other market metrics, investors can navigate market uncertainties more effectively. Balancing the insights from VIX with a broader analysis framework enhances risk management practices and overall trading strategies.

Evolution of VIX Over Time: Unveiling Market Secrets

Understanding Market Dynamics Through VIX Analysis

The VIX exhibits a tendency to surge during market downturns, signaling increased fear and uncertainty among investors. Conversely, it typically recedes in bull markets, indicating a calmer market environment. By tracking these fluctuations, investors can gauge sentiment shifts and potential turning points in the market.

Identifying Major Market Events with VIX Spikes

Significant VIX spikes frequently align with pivotal moments in the financial landscape, such as economic recessions, geopolitical tensions, or unexpected global events. These spikes serve as crucial markers, highlighting periods of heightened market volatility and potential investment challenges or opportunities.

Extracting Insights from Long-Term VIX Trends

Analyzing VIX data over extended periods unveils historical volatility patterns and market trends. By studying these long-term trends, investors can gain a deeper understanding of market behavior, identify recurring patterns, and make informed decisions based on past market performance. The historical trends in VIX offer valuable insights into market dynamics and potential future movements.