Are you looking to delve into the world of trading strategies and enhance your trading performance? In this comprehensive guide on trading strategies, we will explore various types, technical analysis, risk management, personalized approaches, trading psychology, and automated methods. Understanding the intricacies of trading strategies is essential for traders seeking to make informed decisions and optimize their trading outcomes. Trading Strategies will be the focal point of our discussion, providing you with valuable insights to elevate your trading game.

Comprehensive Overview of Trading Strategies Guide

Trading strategies encompass structured methodologies used to guide trading decisions in financial markets, aiding traders in navigating the complexities of the trading landscape. By deciphering market patterns, analyzing data, and projecting future price movements, traders make informed choices crucial for success. These strategies, incorporating risk tolerance, investment objectives, and market dynamics, form the cornerstone of profitable trading endeavors.

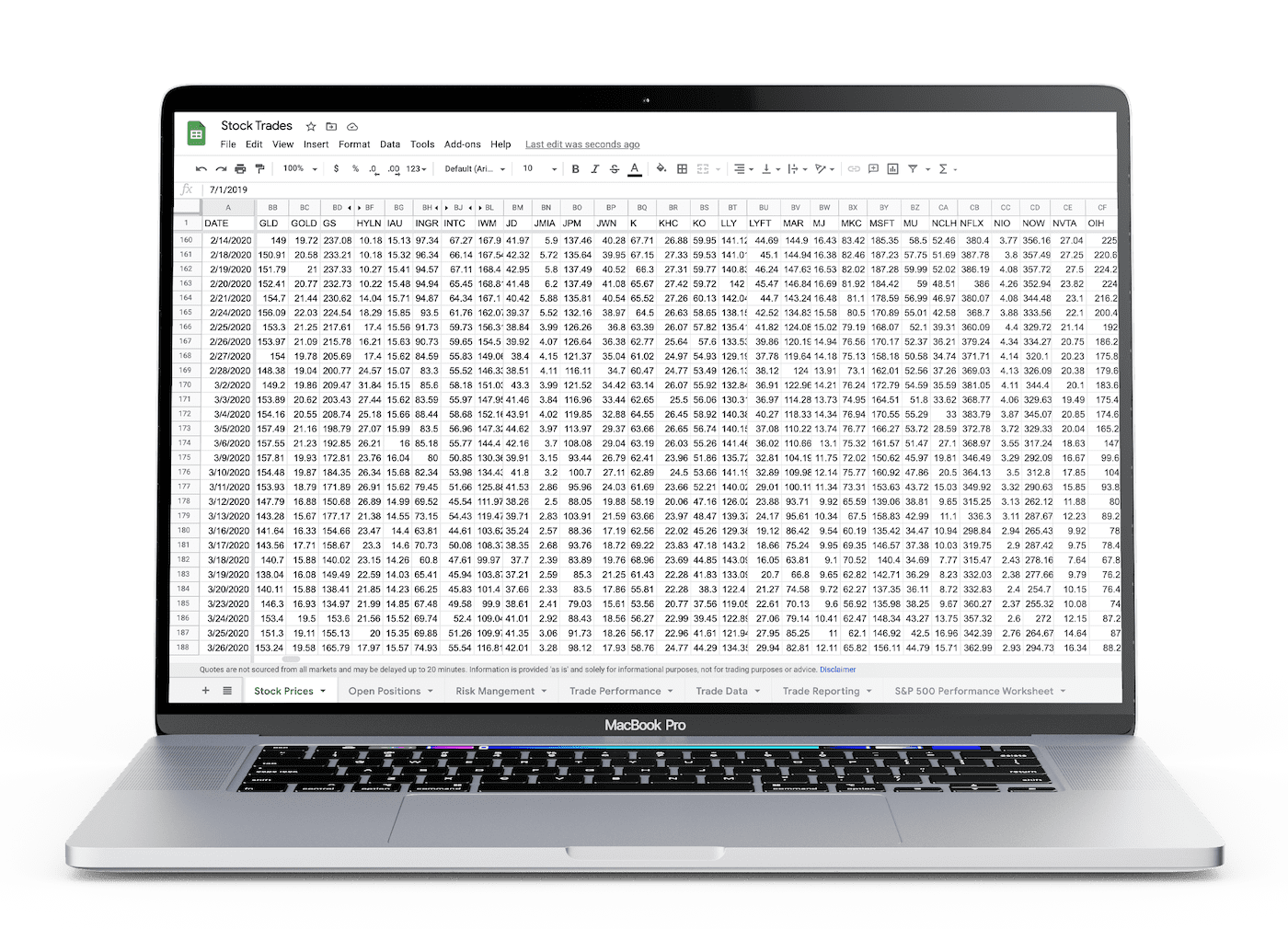

Crafting a robust trading strategy entails meticulous research, data analysis, and continuous adaptation to market changes. Traders refine their strategies through backtesting, optimizing entry and exit points, and adjusting risk management techniques. Success hinges on aligning the strategy with personal preferences while staying attuned to evolving market conditions. An evolutionary process, refining a strategy requires dedication, flexibility, and a keen eye for market nuances.

Constant evaluation of trading patterns, risk exposure, and performance metrics is essential for refining and optimizing strategies. Traders must remain vigilant, staying updated on market trends, economic indicators, and geopolitical events that could impact their strategies. Through a data-driven approach, traders can enhance their decision-making process, mitigate risks, and capitalize on profitable opportunities. A systematic and disciplined strategy implementation is key to sustainability and long-term profitability in trading endeavors.

By integrating cutting-edge tools, technology, and analytics, traders can amplify the effectiveness of their strategies. Utilizing automation, algorithmic trading, and machine learning algorithms can streamline trading processes, enhance efficiency, and execute trades with precision. Harnessing technology not only augments trading strategies but also reduces human errors, emotional biases, and enhances overall trading performance. Embracing innovation ensures traders maintain a competitive edge in dynamic markets.

In conclusion, mastering trading strategies is a continuous journey of learning, adaptation, and refinement. By embracing a comprehensive guide to trading strategies and leveraging diverse techniques and tools, traders can optimize their decision-making process, manage risks effectively, and achieve consistent profitability in financial markets. With a strategic blend of analysis, innovation, and discipline, traders can navigate the markets with confidence and sharpen their competitive edge in the ever-evolving trading landscape.

Unveiling Market Trends through Technical Analysis

Technical analysis in trading strategies is a powerful tool that involves delving into historical price data to uncover patterns and trends within the market. By utilizing common technical indicators such as moving averages, support and resistance levels, and candlestick patterns, traders gain valuable insights into potential market movements. This analysis aids in making informed decisions by leveraging historical market behavior to predict future price movements accurately.

Understanding the limitations and potential biases of technical analysis is crucial for traders looking to effectively interpret market trends. While technical analysis provides valuable insights, it is essential to acknowledge that historical patterns may not always dictate future market behavior with absolute certainty. Traders must approach technical analysis with a critical mindset, considering both its strengths and weaknesses to make well-rounded trading decisions. By understanding these nuances, traders can navigate the market more effectively and enhance their trading performance.

Crafting Your Unique Trading Approach

When embarking on creating your personalized trading strategy, it’s vital to factor in elements like risk tolerance, investment objectives, and your understanding of the market landscape. By aligning these aspects, you can tailor a strategy that resonates with your individual needs and goals, enhancing its effectiveness. Understanding your comfort level with risk and aligning it with your investment aspirations forms the bedrock of a sturdy trading strategy.

One crucial step in honing your customized approach is to backtest it using historical market data. This analysis allows you to gauge the performance of your strategy, identify its strengths and weaknesses, and refine it accordingly. By learning from past market behavior, you can fine-tune your strategy to enhance its profitability and resilience in different market scenarios. Backtesting becomes a cornerstone in ensuring your strategy is well-equipped to navigate the complexities of trading.

To ensure the relevance and efficiency of your strategy, regular monitoring and adjustments are paramount. Markets are dynamic and ever-changing; hence, staying attuned to the evolving landscape helps in adapting your strategy to current conditions. By closely tracking its performance and making necessary tweaks, you can optimize your strategy to align with market trends and capitalize on profitable opportunities. Flexibility and adaptability are key components in maintaining a successful trading strategy amidst market fluctuations.

While developing your personalized trading strategy, don’t hesitate to seek professional guidance and expertise. Consulting with experienced traders or financial advisors can offer fresh perspectives, valuable insights, and advanced techniques to refine your strategy further. Drawing from the knowledge and expertise of professionals can elevate your trading acumen, providing you with a competitive edge and enhancing the overall effectiveness of your strategy. Collaboration and mentorship can significantly augment your trading journey and optimize your strategy for success.

In conclusion, developing a personalized trading strategy tailored to your unique needs is a process that demands careful consideration, constant evaluation, and a willingness to adapt. By integrating your risk profile, investment goals, and market awareness into your strategy, backtesting it rigorously, making timely adjustments, and leveraging professional guidance, you equip yourself with a robust framework to navigate the intricate world of trading successfully. Embrace the iterative nature of strategy development, stay informed, and remain open to continuous improvement to maximize your trading performance and achieve your financial goals.

Mastering the Mental Game in Trading Psychology

Trading psychology is the cornerstone of successful trading. It revolves around managing emotions amidst market volatility. Emotions like fear, greed, and overconfidence can cloud judgment, leading to costly mistakes. To excel, traders must cultivate discipline, mastering their emotions for rational decision-making.

Achieving a disciplined mindset is paramount for navigating the complexities of trading. By staying mindful and employing stress management techniques, traders can enhance focus and clarity. These practices enable traders to approach trading with a clear and rational perspective, detaching from emotional impulses that can sway decisions.

In the fast-paced world of trading, emotional intelligence plays a pivotal role. Traders who can recognize and regulate emotions effectively are better equipped to handle market fluctuations. Harnessing emotional awareness allows traders to make informed choices, mitigating the impact of impulsive actions driven by unchecked emotions.

Moreover, understanding one’s psychological tendencies and biases is crucial. By acknowledging and addressing these biases, traders can work towards developing a more objective and strategic approach to trading. This self-awareness empowers traders to make well-informed decisions based on analysis rather than emotional reactions.

In essence, mastering the mental game in trading psychology involves a continual commitment to self-improvement. By honing emotional resilience, fostering discipline, and embracing mindfulness techniques, traders can sharpen their decision-making skills and optimize their trading strategies effectively. Maintaining a balanced psychological state is key to achieving long-term success in the dynamic world of trading.

By prioritizing psychological well-being and adopting strategies to enhance mental resilience, traders can take control of their trading journey. Embracing a proactive approach to trading psychology not only fosters better decision-making but also cultivates a sustainable trading mindset. Remember, mastering the mental game is not just about reacting to market movements but about proactively shaping your trading destiny.

Leveraging Technology for Automated Trading Strategies

Automated trading strategies revolutionize trading by employing algorithms to execute trades following preset rules. By eliminating emotional influences, algorithmic trading enhances efficiency, crucial in fast-paced markets. Despite its benefits, understanding the risks and limitations of automated trading is paramount to mitigate potential downsides. Integrating hybrid strategies that blend manual intervention with automation can offer flexibility and improve overall trading performance significantly.